5 Tips HMRC

Introduction to HMRC

HMRC, or Her Majesty’s Revenue and Customs, is a non-ministerial department of the UK Government responsible for the collection of taxes, the payment of some forms of state support, and the administration of other regulatory regimes including the national minimum wage. Dealing with HMRC can be a daunting task, especially for individuals and small businesses. However, with the right guidance, it is possible to navigate the system efficiently. Here are 5 tips to help you deal with HMRC.

Understanding Your Tax Obligations

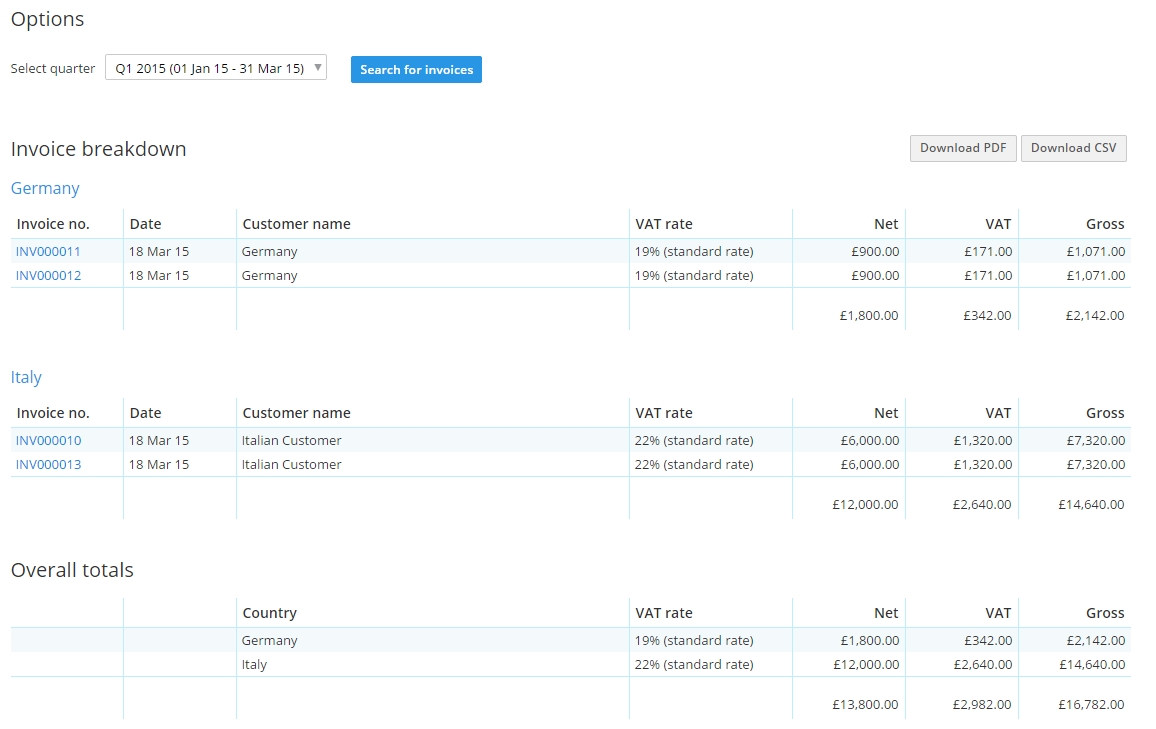

The first step in dealing with HMRC is to understand your tax obligations. This includes knowing what taxes you need to pay, when you need to pay them, and how much you need to pay. Income tax, corporation tax, VAT, and National Insurance contributions are some of the common taxes that individuals and businesses need to pay. You can find information on your tax obligations on the HMRC website or by consulting with a tax advisor.

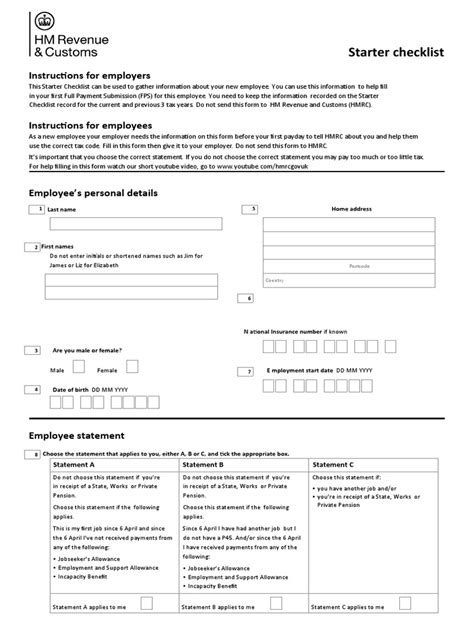

Keeping Accurate Records

Keeping accurate records is crucial when dealing with HMRC. This includes records of your income, expenses, and tax payments. You will need to provide these records to HMRC if you are selected for a tax audit or if you need to claim a tax refund. It is a good idea to keep both physical and digital copies of your records, and to make sure they are up to date and easily accessible. Some of the key records you should keep include: * Income statements * Expense receipts * Tax returns * Bank statements

Meeting Deadlines

Meeting deadlines is essential when dealing with HMRC. This includes deadlines for filing tax returns, paying taxes, and responding to HMRC queries. Missing a deadline can result in penalties and fines, so it is essential to stay on top of your tax obligations. You can use the HMRC website or a tax calendar to keep track of upcoming deadlines. Some of the key deadlines you should be aware of include: * Self-assessment tax return deadline: January 31st * Corporation tax return deadline: 12 months after the end of the accounting period * VAT return deadline: 1 month and 7 days after the end of the VAT quarter

Seeking Help When Needed

If you are having trouble dealing with HMRC, do not hesitate to seek help. This can include consulting with a tax advisor, contacting HMRC directly, or seeking guidance from a professional organization. Some of the ways you can seek help include: * HMRC helpline: You can contact the HMRC helpline for general queries and advice * Tax advisors: You can consult with a tax advisor for personalized advice and guidance * Professional organizations: You can seek guidance from professional organizations such as the Institute of Chartered Accountants in England and Wales (ICAEW)

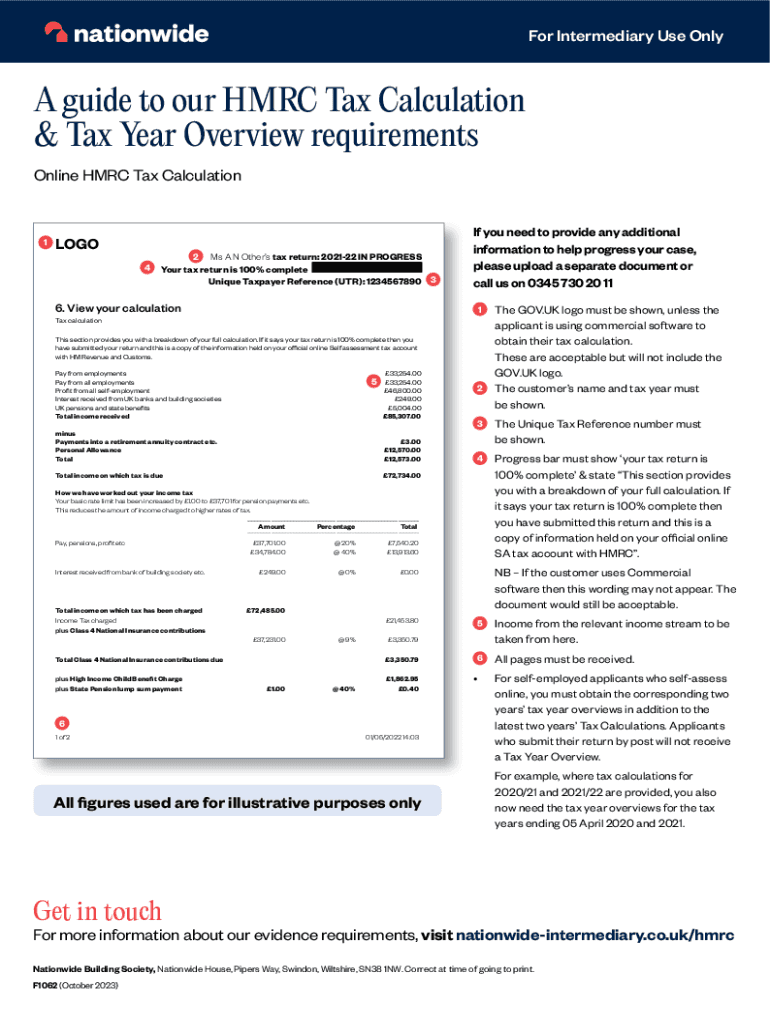

Using HMRC Online Services

HMRC offers a range of online services that can make it easier to deal with your tax obligations. These services include: * Self-assessment online: You can file your self-assessment tax return online * Corporation tax online: You can file your corporation tax return online * VAT online: You can file your VAT return online * Paye online: You can pay your taxes online Using these services can save you time and reduce the risk of errors.

📝 Note: It is essential to keep your online account details secure to prevent unauthorized access to your tax information.

To summarize, dealing with HMRC requires understanding your tax obligations, keeping accurate records, meeting deadlines, seeking help when needed, and using HMRC online services. By following these tips, you can navigate the HMRC system efficiently and minimize the risk of errors and penalties.

What is the deadline for filing a self-assessment tax return?

+

The deadline for filing a self-assessment tax return is January 31st.

How can I contact HMRC for help?

+

You can contact HMRC by phone, email, or post. You can also use the HMRC website to find answers to common questions and access online services.

What records do I need to keep for tax purposes?

+

You should keep records of your income, expenses, and tax payments. This includes income statements, expense receipts, tax returns, and bank statements.