Probing Probate Paperwork Retention Period

Introduction to Probate Paperwork Retention

When dealing with the estate of a deceased person, probate is the legal process that involves verifying the will, identifying and inventorying the deceased person’s assets, paying off debts and taxes, and distributing the remaining assets to the beneficiaries. This process generates a significant amount of paperwork, including wills, trusts, deeds, tax returns, and court documents. Understanding the probate paperwork retention period is crucial for estate administrators, executors, and beneficiaries to ensure compliance with legal requirements and to maintain a clear record of the estate’s administration.

Understanding Probate Paperwork

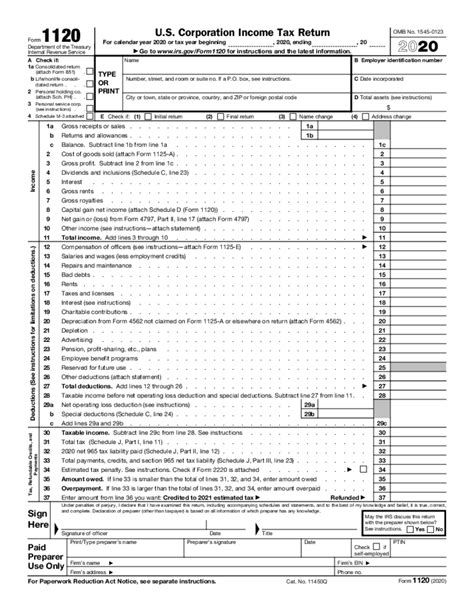

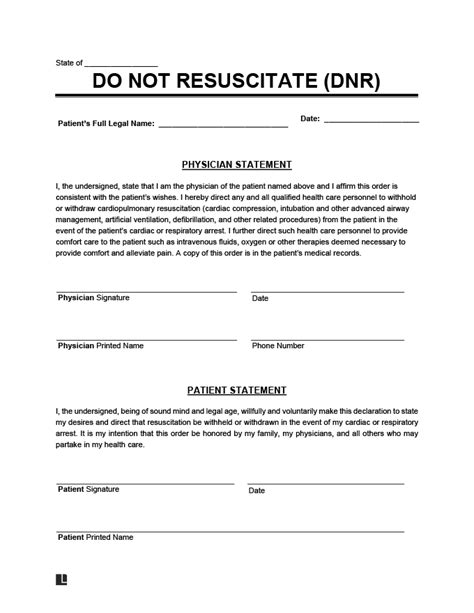

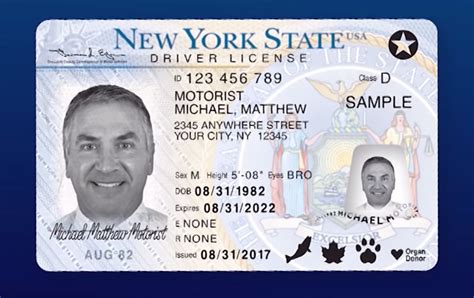

Probate paperwork encompasses a wide range of documents, each serving a unique purpose in the probate process. These documents include: - Wills and Codicils: The last will and testament of the deceased, along with any amendments (codicils). - Trust Documents: If the deceased had established trusts, the trust agreements and any amendments. - Deeds and Property Records: Documents related to real estate and other properties. - Tax Returns: Income tax returns filed by the estate during the probate period. - Court Documents: Petitions, orders, and other documents filed with the court during probate. - Inventory and Appraisals: Lists and valuations of the estate’s assets. - Accountings: Financial reports detailing the income, expenses, and distributions of the estate.

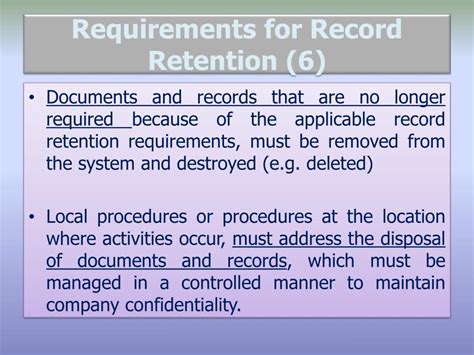

Importance of Retaining Probate Paperwork

Retaining probate paperwork is essential for several reasons: - Compliance with Legal Requirements: Many jurisdictions require that certain documents be kept for a specified period. - Audit and Tax Purposes: In case of an audit, these documents can serve as proof of the estate’s income, expenses, and tax payments. - Dispute Resolution: In the event of disputes among beneficiaries or with creditors, these documents can provide crucial evidence. - Historical and Genealogical Research: For family historians, these documents can offer valuable insights into family history and lineage.

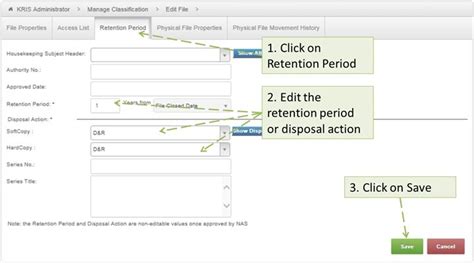

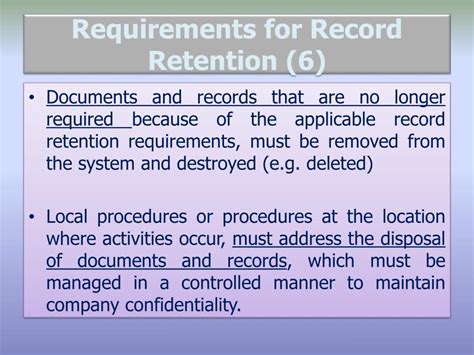

Determining the Retention Period

The retention period for probate paperwork can vary significantly depending on the jurisdiction and the type of document. Generally, it is recommended to retain documents related to the estate’s tax filings for at least three to six years after the filing date, as this is the typical statute of limitations for tax audits. However, wills, trusts, and deeds should be kept permanently, as they are essential for proving ownership and the deceased’s intentions. Court documents and accountings should also be retained for an extended period, often until the statute of limitations expires for any potential legal claims.

Best Practices for Document Retention

To ensure that probate paperwork is properly retained, consider the following best practices: - Digital and Physical Storage: Store documents both digitally (using secure, password-protected cloud storage) and physically (in a safe or fireproof box) to protect against loss or destruction. - Organization: Keep documents well-organized, using clear labels and categories, to facilitate easy access and retrieval. - Accessibility: Ensure that key individuals, such as the executor or beneficiaries, know where the documents are stored and how to access them. - Security: Protect sensitive information by limiting access to authorized individuals and using encryption for digital storage.

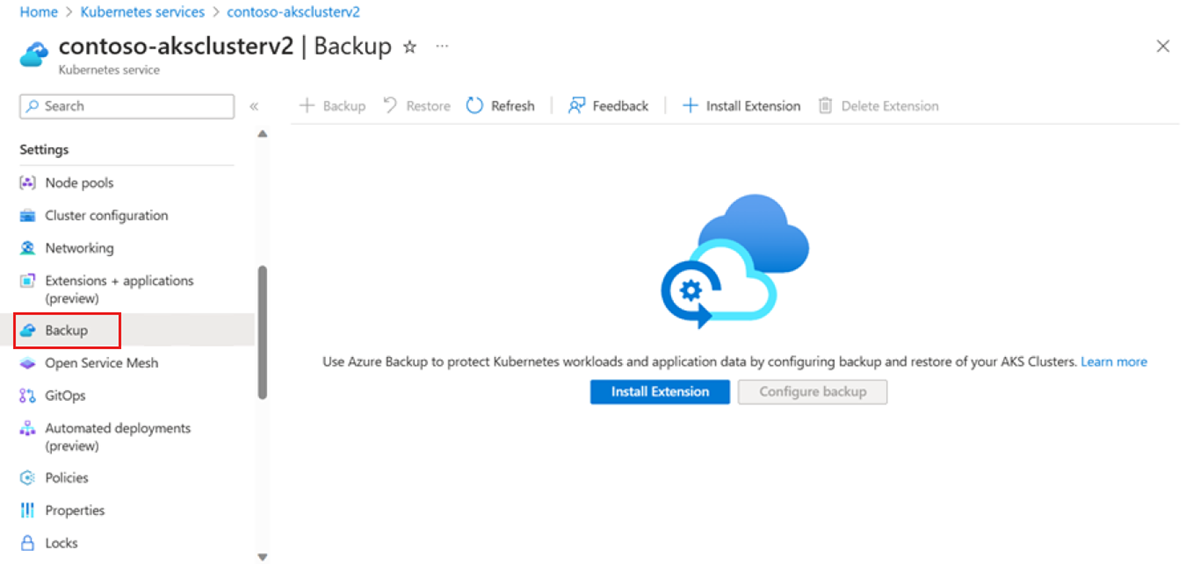

Considerations for Digital Storage

Given the increasing reliance on digital solutions, it’s essential to consider the following when storing probate paperwork digitally: - Security Measures: Implement robust security measures, including encryption, two-factor authentication, and secure passwords. - Cloud Services: Choose reputable cloud storage services that offer high levels of security, redundancy, and customer support. - Backup Systems: Regularly backup digital files to prevent loss in case of a technical failure or cyberattack.

| Document Type | Recommended Retention Period |

|---|---|

| Wills and Trusts | Permanently |

| Tax Returns | 3 to 6 years |

| Court Documents | Until the statute of limitations expires |

| Deeds and Property Records | Permanently |

📝 Note: The retention periods mentioned are general guidelines and may vary based on specific legal requirements in your jurisdiction. It's always advisable to consult with a legal professional to determine the appropriate retention period for your situation.

In summary, understanding and adhering to the probate paperwork retention period is vital for ensuring compliance with legal requirements, resolving potential disputes, and maintaining a clear record of the estate’s administration. By implementing best practices for document retention and considering the unique aspects of digital storage, individuals can effectively manage the complex process of probate paperwork retention.

To finalize, the management and retention of probate paperwork are intricate processes that require careful consideration of legal, practical, and security aspects. By following the guidelines and best practices outlined, individuals involved in the probate process can navigate these complexities with greater ease and ensure that all necessary documents are retained for the appropriate amount of time. This not only aids in the efficient administration of the estate but also provides a safeguard against potential legal issues and ensures the preservation of important family documents for generations to come.

What is the typical retention period for tax returns related to an estate?

+

The typical retention period for tax returns related to an estate is at least 3 to 6 years after the filing date, as this is the standard statute of limitations for tax audits.

Why is it important to retain probate paperwork?

+

Retaining probate paperwork is essential for compliance with legal requirements, potential audits, dispute resolution, and historical preservation. These documents serve as proof of the estate’s administration, tax payments, and the deceased’s intentions.

How should probate documents be stored to ensure their safety and accessibility?

+

Probate documents should be stored both digitally and physically. Digital storage should be secure, using cloud services with high security measures, and physical documents should be kept in a safe or fireproof box. It’s also important to ensure that key individuals know where the documents are stored and how to access them.