7 Tax Tips

Introduction to Tax Planning

When it comes to managing your finances, understanding how to navigate the complex world of taxes is crucial. Tax planning is not just about compliance; it’s a strategic process that can help you save money, reduce your tax liability, and achieve your long-term financial goals. In this article, we will delve into 7 key tax tips that can make a significant difference in your financial landscape.

Understanding Your Tax Bracket

One of the first steps in effective tax planning is understanding your tax bracket. Your tax bracket, also known as your marginal tax rate, is the rate at which your last dollar of income is taxed. It’s essential to note that your tax bracket is not the rate at which your entire income is taxed, but rather the rate applied to the amount you earn within that bracket. Being aware of your tax bracket can help you make informed decisions about income timing and deductions.

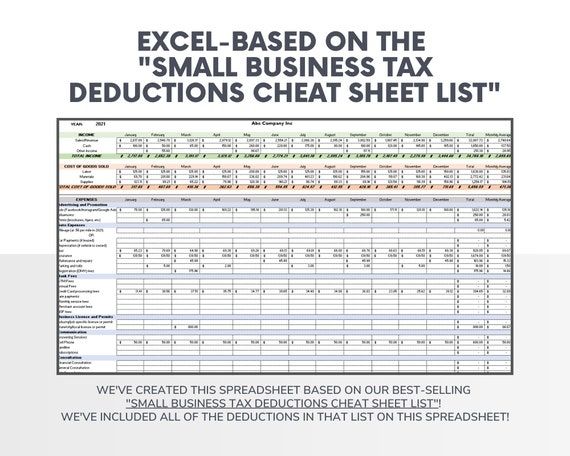

Maximizing Deductions

Maximizing your deductions is a key strategy in reducing your taxable income. There are two primary types of deductions: itemized deductions and the standard deduction. Itemized deductions allow you to deduct specific expenses such as mortgage interest, charitable donations, and medical expenses, provided you have receipts and records to support these claims. On the other hand, the standard deduction is a fixed amount that you can deduct from your income without needing to itemize. Choosing between itemizing deductions and taking the standard deduction depends on which method yields the greater deduction.

Leveraging Tax Credits

Unlike deductions, which reduce your taxable income, tax credits directly reduce the amount of tax you owe. There are various types of tax credits available, including credits for education expenses, child care, and energy-efficient home improvements. Tax credits can be particularly beneficial because they reduce your tax bill dollar for dollar. For example, if you qualify for a 1,000 tax credit, you can subtract 1,000 directly from your tax liability.

Utilizing Tax-Advantaged Retirement Accounts

Saving for retirement through tax-advantaged accounts such as 401(k), IRA, or Roth IRA can provide significant tax benefits. Contributions to these accounts may be tax-deductible, and the funds grow tax-deferred or tax-free, depending on the account type. Contributing to these accounts not only helps you build a nest egg for retirement but can also reduce your taxable income for the year.

Investment Tax Strategies

Investments, such as stocks, bonds, and real estate, can generate taxable income. Understanding the tax implications of your investments can help you minimize your tax liability. For instance, long-term capital gains (gains from assets held for more than one year) are often taxed at a lower rate than short-term capital gains. Holding onto investments for at least a year can significantly reduce the tax you owe on the gains.

Tax Planning for Businesses

For business owners, tax planning involves not just personal tax considerations but also understanding the tax implications of business operations. Choosing the right business structure (sole proprietorship, partnership, S corporation, or C corporation) can have significant tax implications. Additionally, businesses can deduct a wide range of expenses, from operational costs to certain types of insurance premiums. Keeping detailed records and consulting with a tax professional can help ensure you are taking full advantage of business deductions and credits.

Staying Informed and Seeking Professional Advice

Tax laws and regulations are subject to change, making it essential to stay informed about updates that could affect your tax situation. Furthermore, tax planning can be complex, and seeking advice from a tax professional can provide personalized strategies tailored to your financial situation and goals. A tax professional can help navigate the intricacies of tax law, identify opportunities for savings, and ensure compliance with all tax requirements.

📝 Note: Always consult with a tax professional or financial advisor to get advice tailored to your specific situation, as tax laws and individual circumstances can vary widely.

In summary, effective tax planning involves a combination of understanding your tax bracket, maximizing deductions and credits, leveraging tax-advantaged savings vehicles, employing wise investment strategies, and staying abreast of tax law changes. By implementing these strategies and seeking professional advice when needed, you can optimize your financial plan, reduce your tax liability, and work towards achieving your long-term financial objectives.

What is the difference between a tax deduction and a tax credit?

+

A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe. For example, if you have a 1,000 tax deduction and you're in a 24% tax bracket, you'll save 240 in taxes. In contrast, a 1,000 tax credit would save you 1,000 in taxes directly.

How do I know if I should itemize deductions or take the standard deduction?

+

To decide, calculate your total itemized deductions and compare them to the standard deduction. If your itemized deductions are greater than the standard deduction, it’s beneficial to itemize. Otherwise, taking the standard deduction might be the better choice. It’s a good idea to consult with a tax professional to make an informed decision based on your specific situation.

What are some common tax deductions that people often overlook?

+

Commonly overlooked deductions include home office expenses for those who work from home, mileage logs for business use of a personal vehicle, and certain medical expenses. Keeping detailed records and consulting with a tax professional can help ensure you’re taking advantage of all the deductions you’re eligible for.