Keep Tax Paperwork

Introduction to Tax Paperwork

Keeping track of tax paperwork is an essential aspect of managing one’s financial records. It involves maintaining accurate and detailed records of all financial transactions, including income, expenses, and tax-related documents. This practice not only helps individuals and businesses stay organized but also ensures compliance with tax laws and regulations. In this article, we will delve into the importance of keeping tax paperwork, the types of documents that should be kept, and provide tips on how to manage these records effectively.

Importance of Keeping Tax Paperwork

Keeping tax paperwork is crucial for several reasons:

- Compliance with Tax Laws: Accurate records help individuals and businesses comply with tax laws and regulations, reducing the risk of audits and penalties.

- Support for Tax Returns: Detailed records provide the necessary support for tax returns, ensuring that all deductions and credits are claimed correctly.

- Financial Planning: Tax paperwork helps in financial planning by providing insights into income, expenses, and tax liabilities.

- Dispute Resolution: In case of disputes or audits, having detailed tax paperwork can serve as evidence to support one’s claims.

Types of Tax Paperwork to Keep

There are several types of tax paperwork that individuals and businesses should keep, including:

- Income Statements: Records of all income earned, including wages, salaries, and investment income.

- Expense Records: Detailed records of all expenses, including receipts, invoices, and bank statements.

- Tax Returns: Copies of all tax returns filed, including federal, state, and local returns.

- Receipts and Invoices: Records of all receipts and invoices related to business expenses or charitable donations.

- W-2 and 1099 Forms: Copies of all W-2 and 1099 forms received, which report income earned from employment or freelance work.

Managing Tax Paperwork

Managing tax paperwork can be overwhelming, but there are several strategies that can help:

- Use a Filing System: Create a filing system that categorizes documents by type and year, making it easier to locate specific records.

- Digitize Records: Consider digitizing paper records to free up physical storage space and reduce the risk of document loss or damage.

- Set Reminders: Set reminders for tax-related deadlines, such as the deadline for filing tax returns or making estimated tax payments.

- Consult a Tax Professional: Consider consulting a tax professional to ensure that all tax paperwork is in order and to receive guidance on tax planning and compliance.

Best Practices for Keeping Tax Paperwork

To ensure that tax paperwork is kept accurately and efficiently, follow these best practices:

- Keep Records for the Right Amount of Time: Keep tax records for at least three years from the date of filing, but consider keeping them for longer if necessary.

- Use Accurate and Consistent Record-Keeping: Use accurate and consistent record-keeping methods to ensure that all documents are properly categorized and easily accessible.

- Protect Sensitive Information: Protect sensitive information, such as Social Security numbers and financial account numbers, by storing them securely and limiting access to authorized individuals.

- Review and Update Records Regularly: Review and update tax records regularly to ensure that they are accurate and complete.

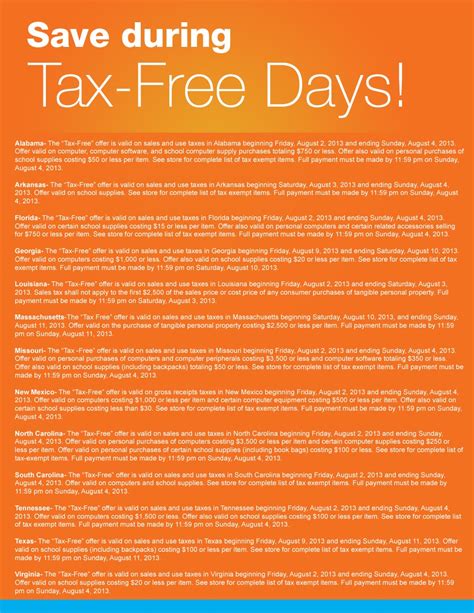

| Type of Document | Retention Period |

|---|---|

| Income Tax Returns | At least 3 years from the date of filing |

| W-2 and 1099 Forms | At least 3 years from the date of filing |

| Expense Records | At least 3 years from the date of filing |

| Bank Statements | At least 1 year from the date of the statement |

💡 Note: The retention period for tax documents may vary depending on the type of document and the specific tax laws and regulations in your jurisdiction.

In summary, keeping tax paperwork is essential for managing one’s financial records, ensuring compliance with tax laws, and supporting tax returns. By understanding the importance of keeping tax paperwork, the types of documents to keep, and how to manage these records effectively, individuals and businesses can ensure that they are well-prepared for tax season and beyond. The key is to stay organized, use accurate and consistent record-keeping methods, and protect sensitive information. By following these best practices and tips, individuals and businesses can ensure that their tax paperwork is in order and that they are in compliance with all tax laws and regulations.

What types of tax paperwork should I keep?

+

You should keep income statements, expense records, tax returns, receipts and invoices, and W-2 and 1099 forms.

How long should I keep tax paperwork?

+

You should keep tax paperwork for at least three years from the date of filing, but consider keeping it for longer if necessary.

What are the benefits of keeping tax paperwork?

+

The benefits of keeping tax paperwork include ensuring compliance with tax laws, supporting tax returns, and providing insights into income, expenses, and tax liabilities.