Tax Paperwork Needed

Introduction to Tax Paperwork

When it comes to managing your finances, one of the most critical aspects is dealing with tax paperwork. This can be a daunting task, especially for those who are not familiar with the process. Tax returns and other related documents are essential for individuals and businesses to comply with tax laws and regulations. In this article, we will delve into the world of tax paperwork, exploring the necessary documents, the process of filing, and providing valuable tips to make the experience less overwhelming.

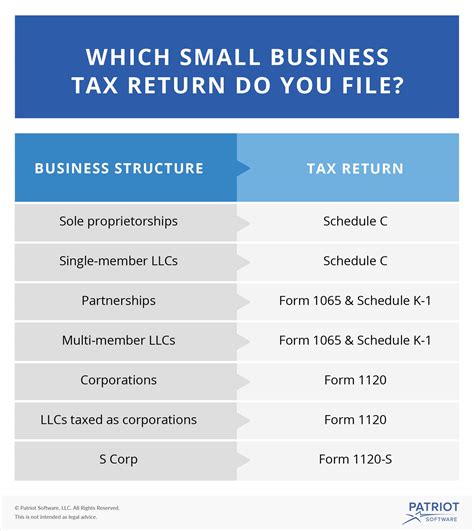

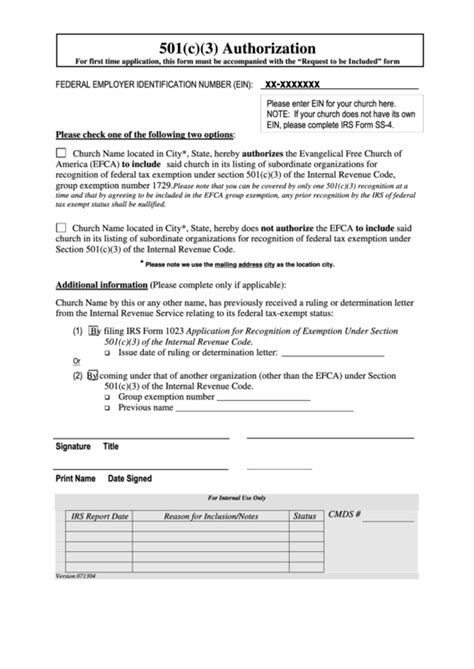

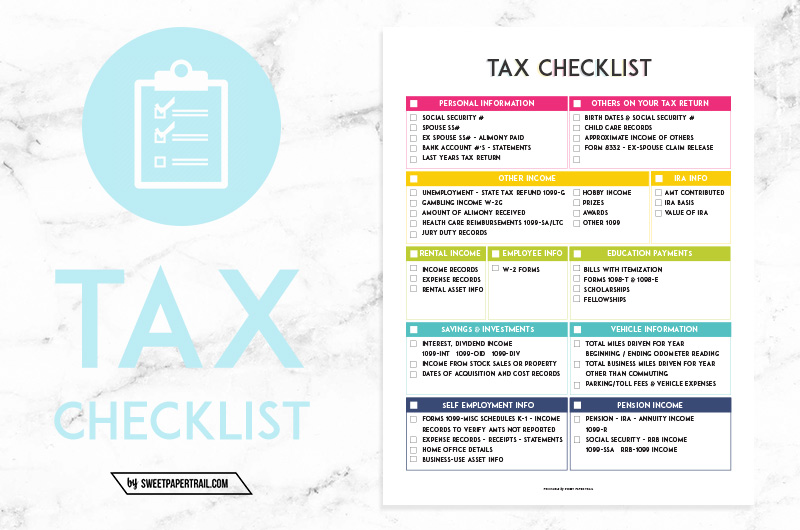

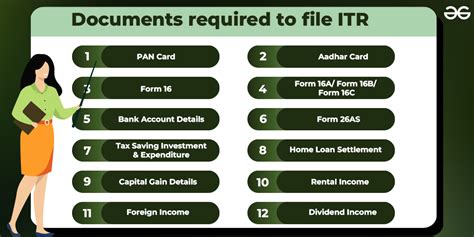

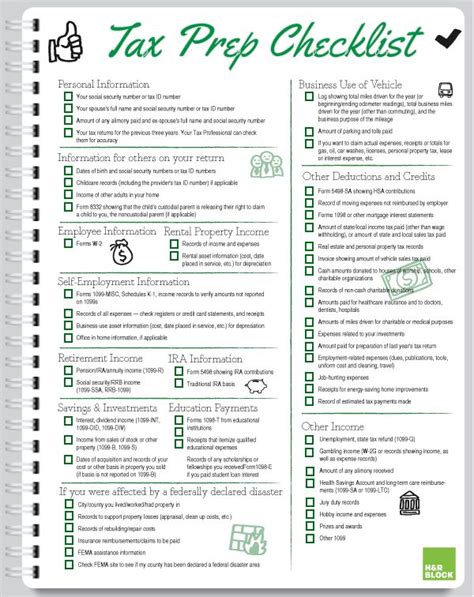

Types of Tax Paperwork

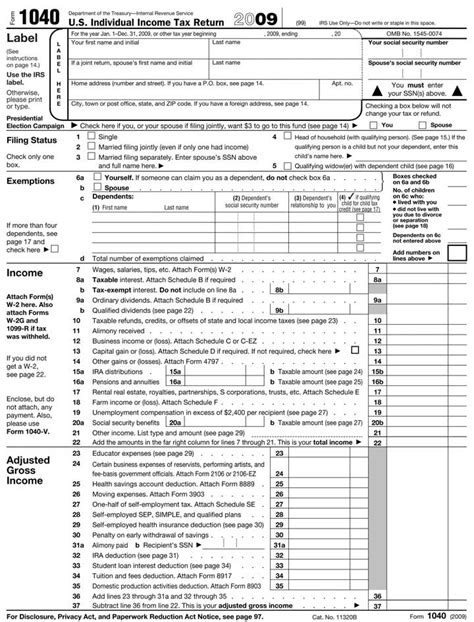

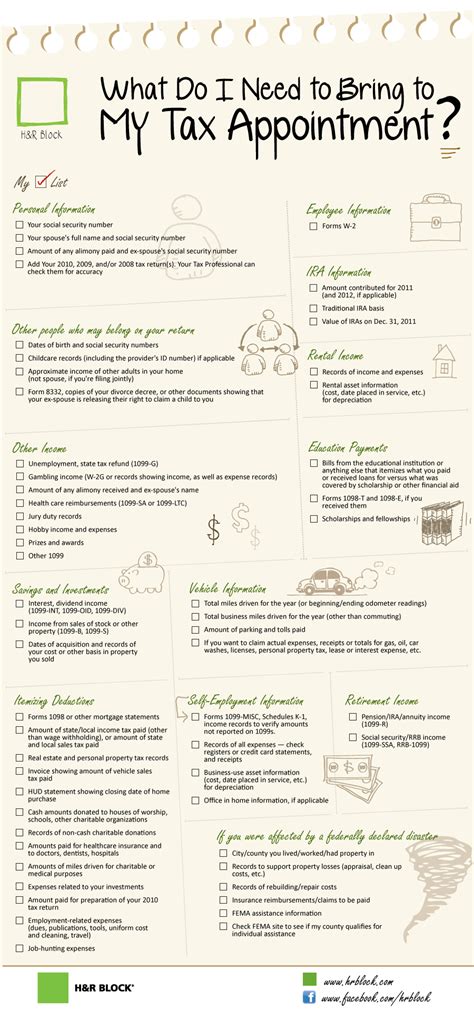

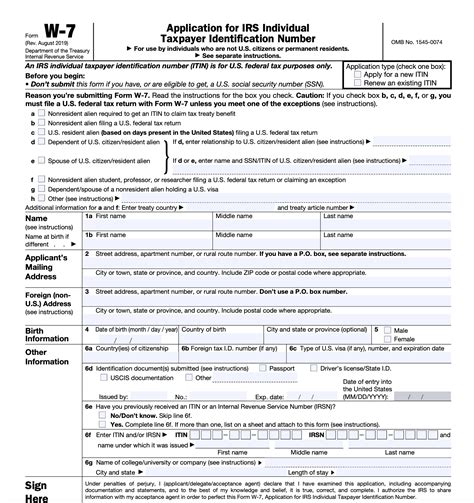

There are various types of tax paperwork that individuals and businesses need to be aware of. These include: * W-2 forms: Provided by employers to employees, detailing their income and taxes withheld. * 1099 forms: Used to report income from freelance work, dividends, and other sources. * Tax returns: The primary document filed with the tax authority, such as the IRS in the United States, to report income and claim deductions. * Schedule C: A form used by self-employed individuals to report business income and expenses. * W-4 forms: Completed by employees to determine their tax withholding.

Importance of Accurate Tax Paperwork

Accurate and complete tax paperwork is crucial to avoid any issues with the tax authorities. Inaccurate reporting can lead to delays in processing, penalties, and even audits. It is essential to ensure that all documents are filled out correctly, and all necessary information is included. This includes: * Social Security numbers: Correctly reporting Social Security numbers for all individuals involved. * Income reporting: Accurately reporting all sources of income, including employment, investments, and self-employment. * Deductions and credits: Claiming all eligible deductions and credits to minimize tax liability.

Process of Filing Tax Paperwork

The process of filing tax paperwork involves several steps: 1. Gathering documents: Collecting all necessary documents, including W-2 forms, 1099 forms, and receipts for deductions. 2. Choosing a filing method: Deciding whether to file manually or use tax software. 3. Filing the tax return: Submitting the completed tax return to the tax authority. 4. Paying any tax due: Paying any outstanding tax balance or arranging for payment plans.

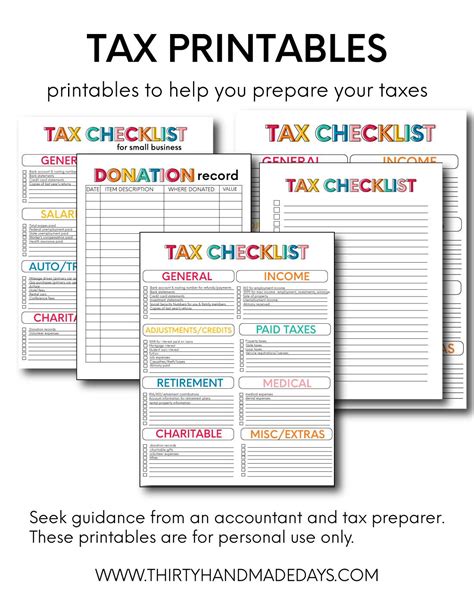

Tips for Managing Tax Paperwork

To make the tax paperwork process more manageable, consider the following tips: * Keep accurate records: Maintaining organized and accurate records throughout the year. * Use tax software: Utilizing tax software to simplify the filing process and reduce errors. * Seek professional help: Consulting with a tax professional if unsure about any aspect of the process. * Stay informed: Staying up-to-date with changes in tax laws and regulations.

📝 Note: It is essential to keep all tax-related documents for at least three years in case of an audit or other issues.

Common Mistakes to Avoid

When dealing with tax paperwork, there are common mistakes to avoid: * Inaccurate reporting: Failing to report all income or claiming incorrect deductions. * Missing deadlines: Failing to file tax returns or pay taxes on time. * Insufficient records: Not maintaining adequate records to support deductions and credits.

| Document | Purpose |

|---|---|

| W-2 form | Reports income and taxes withheld |

| 1099 form | Reports income from freelance work, dividends, and other sources |

| Tax return | Reports income and claims deductions |

In summary, tax paperwork is a critical aspect of managing your finances, and it is essential to be aware of the necessary documents, the process of filing, and tips to make the experience less overwhelming. By following the guidelines outlined in this article and avoiding common mistakes, individuals and businesses can ensure a smooth and stress-free tax season.

What is the purpose of a W-2 form?

+

A W-2 form is used to report income and taxes withheld by an employer.

What is the deadline for filing tax returns?

+

The deadline for filing tax returns varies by country and region, but in the United States, it is typically April 15th.

Can I file my tax return manually or do I need to use tax software?

+

You can file your tax return manually or use tax software, depending on your preference and the complexity of your tax situation.