5 Mortgage Paper Tips

Understanding the Basics of Mortgage Papers

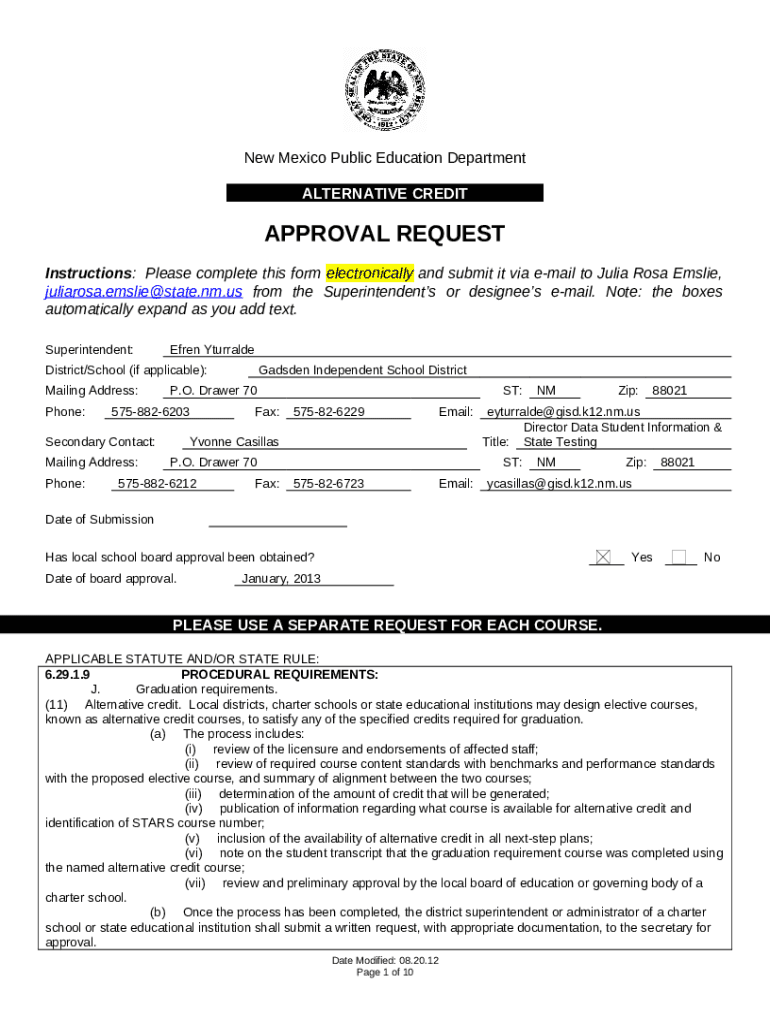

When it comes to purchasing a home, one of the most critical aspects of the process is dealing with the mortgage papers. These documents are legally binding and outline the terms of your loan, including the interest rate, repayment schedule, and other essential details. It is crucial to understand what you are signing to avoid any potential pitfalls or surprises down the line. In this article, we will delve into five mortgage paper tips that can help you navigate this complex process with confidence.

Tip 1: Read and Understand the Fine Print

The first and most crucial tip is to read the fine print. Mortgage documents are often lengthy and filled with legal jargon, but it is essential to take the time to read through them carefully. Do not hesitate to ask questions if you are unsure about any part of the agreement. Understanding the terms of your loan will help you avoid any unexpected costs or penalties. Some key things to look out for include: * The interest rate and how it may change over time * The repayment schedule, including the amount and frequency of payments * Any fees associated with the loan, such as origination fees or late payment fees * The terms of the loan, including the length of the loan and any prepayment penalties

Tip 2: Check for Errors and Discrepancies

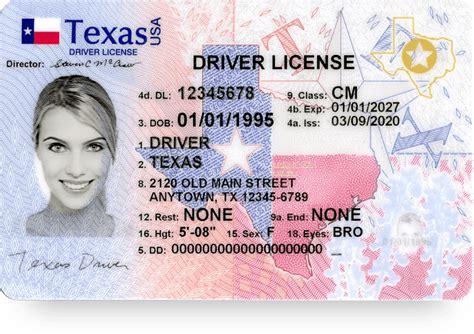

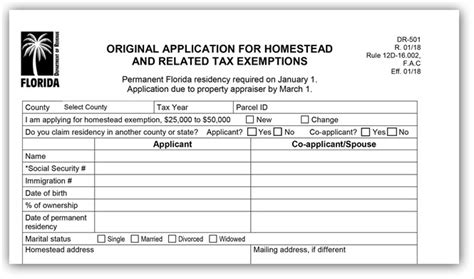

Once you have read through the documents, it is essential to check for errors and discrepancies. This includes verifying your personal information, such as your name and address, as well as the details of the loan. Some common mistakes to look out for include: * Incorrect interest rates or repayment schedules * Missing or incorrect signatures * Errors in the calculation of fees or charges * Inconsistent information throughout the documents

Tip 3: Understand the Different Types of Mortgages

There are several types of mortgages available, each with its own set of benefits and drawbacks. Understanding the different types of mortgages can help you choose the one that best suits your needs. Some common types of mortgages include: * Fixed-rate mortgages, which offer a fixed interest rate for the life of the loan * Adjustable-rate mortgages, which offer a lower initial interest rate that may increase over time * Government-backed mortgages, such as FHA or VA loans, which offer more lenient credit requirements and lower down payments * Jumbo mortgages, which are used to finance larger, more expensive homes

Tip 4: Consider Working with a Mortgage Broker

A mortgage broker can be a valuable resource when navigating the complex world of mortgage papers. These professionals have extensive knowledge of the mortgage industry and can help you find the best loan for your situation. Some benefits of working with a mortgage broker include: * Access to a wide range of lenders and loan products * Expert guidance and advice throughout the application process * Help with navigating the often-confusing world of mortgage paperwork * Potential savings on interest rates and fees

Tip 5: Keep Detailed Records

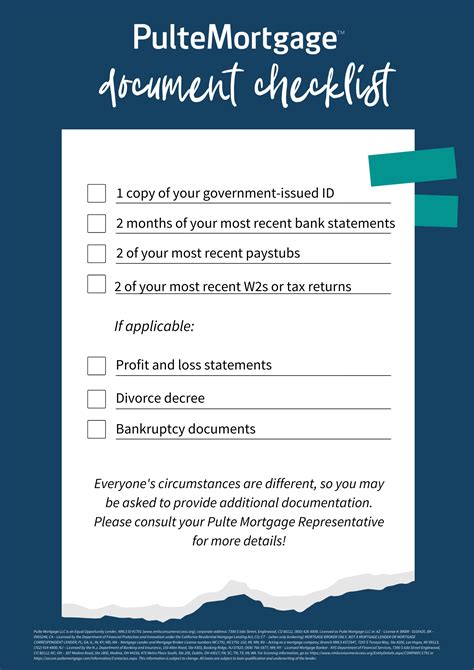

Finally, it is essential to keep detailed records of all your mortgage paperwork. This includes copies of the loan agreement, payment schedules, and any other relevant documents. Keeping these records organized and easily accessible can help you stay on top of your payments and avoid any potential issues. Some tips for keeping detailed records include: * Using a file folder or digital storage system to keep all your documents in one place * Making copies of important documents, such as the loan agreement and payment schedule * Setting reminders for upcoming payments and deadlines * Reviewing your records regularly to ensure everything is up to date and accurate

📝 Note: Keeping detailed records can help you avoid potential pitfalls, such as missed payments or incorrect charges.

Additional Tips and Considerations

In addition to the five tips outlined above, there are several other factors to consider when dealing with mortgage papers. These include: * Shopping around for the best interest rates and terms * Carefully reviewing the loan agreement and other documents before signing * Asking questions if you are unsure about any part of the process * Seeking professional advice from a financial advisor or attorney if necessary

| Mortgage Type | Benefits | Drawbacks |

|---|---|---|

| Fixed-Rate Mortgage | Predictable payments, protection from rising interest rates | May have higher interest rates than adjustable-rate mortgages |

| Adjustable-Rate Mortgage | Lower initial interest rates, potential for lower payments | Interest rates may increase over time, making payments less predictable |

| Government-Backed Mortgage | More lenient credit requirements, lower down payments | May have stricter eligibility requirements, higher fees |

In the end, navigating the world of mortgage papers requires patience, attention to detail, and a willingness to ask questions. By following these five tips and considering the additional factors outlined above, you can ensure a smooth and successful mortgage application process. With the right knowledge and preparation, you can find the perfect loan for your needs and enjoy the benefits of homeownership for years to come.

What is the difference between a fixed-rate and adjustable-rate mortgage?

+

A fixed-rate mortgage offers a fixed interest rate for the life of the loan, while an adjustable-rate mortgage has a lower initial interest rate that may increase over time.

How do I know which type of mortgage is right for me?

+

The right type of mortgage for you will depend on your individual financial situation and goals. Consider factors such as your credit score, income, and debt-to-income ratio when choosing a mortgage.

Can I negotiate the terms of my mortgage?

+

In some cases, it may be possible to negotiate the terms of your mortgage, such as the interest rate or fees. However, this will depend on the lender and the specific loan product.