5 Tax Record Tips

Introduction to Tax Record Management

Maintaining accurate and detailed tax records is a crucial aspect of personal and business finance. Proper record-keeping helps individuals and companies navigate the complexities of tax law, ensuring compliance with regulations and maximizing eligible deductions. In this article, we will explore five essential tips for managing tax records effectively, highlighting the importance of organization, digital tools, and professional advice.

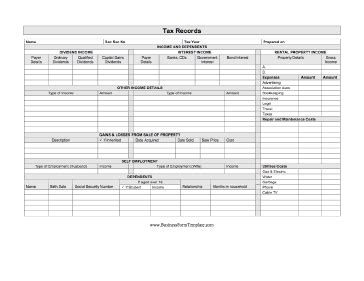

Tip 1: Understand What to Keep

When it comes to tax records, it’s essential to know what documents to keep and for how long. Tax-related documents include income statements, receipts for deductible expenses, charitable donation records, and any correspondence with tax authorities. A good rule of thumb is to keep records for at least three years from the date of filing, but some documents, like property records, should be kept indefinitely.

Tip 2: Organize Your Records

Organization is key to efficient tax record management. Using file folders or digital storage solutions, categorize documents by type and year. This makes it easier to find specific records when needed. Consider using cloud storage services for digital documents, ensuring they are accessible from anywhere and automatically backed up.

Tip 3: Utilize Digital Tools

Digital tools and software can significantly streamline tax record management. Tax preparation software often includes features for tracking deductions and storing receipts. Additionally, apps designed for receipt scanning and expense tracking can help maintain accurate and up-to-date records. These tools can also provide reminders for tax deadlines and offer guidance on what expenses are deductible.

Tip 4: Seek Professional Advice

Tax laws and regulations are complex and frequently updated. Consulting a tax professional can provide valuable insights into what records are necessary and how to best organize them. Professionals can also help identify often-overlooked deductions and ensure compliance with all tax requirements, potentially saving money and avoiding legal issues.

Tip 5: Review and Update Records Annually

Regular review of tax records is crucial for maintaining their accuracy and relevance. Annual reviews should include updating records to reflect changes in income, deductions, and tax law. This process also helps in identifying any missing documents or discrepancies that need to be addressed. By staying on top of tax records, individuals and businesses can ensure they are well-prepared for tax season and any potential audits.

📝 Note: Regularly backing up digital tax records is essential to prevent data loss in case of technical issues or cyberattacks.

To further illustrate the importance of each tip, consider the following benefits: - Improved Compliance: Accurate and detailed records help ensure compliance with tax laws, reducing the risk of audits and penalties. - Maximized Deductions: Well-organized records make it easier to identify and claim all eligible deductions, potentially lowering tax liability. - Efficiency: Digital tools and organized systems save time and effort when preparing for tax season. - Professional Guidance: Consulting with tax professionals can provide peace of mind and expert advice tailored to individual or business needs. - Adaptability: Regular reviews and updates help tax records remain relevant and effective, even as tax laws and personal circumstances change.

In summary, effective tax record management is about more than just storing documents; it’s about creating a system that is organized, accessible, and compliant with tax regulations. By understanding what to keep, organizing records, utilizing digital tools, seeking professional advice, and reviewing records annually, individuals and businesses can navigate the complexities of tax season with confidence and efficiency.

What are the most important tax records to keep?

+

The most important tax records to keep include income statements, receipts for deductible expenses, charitable donation records, and any correspondence with tax authorities.

How long should I keep tax records?

+

It’s generally recommended to keep tax records for at least three years from the date of filing, but some documents, like property records, should be kept indefinitely.

What are the benefits of using digital tools for tax record management?

+

Digital tools can help streamline tax record management by providing features for tracking deductions, storing receipts, and offering reminders and guidance. They also make it easier to access and share records with tax professionals.