Paperwork

Keep Insurance Claim Paperwork

Understanding the Importance of Keeping Insurance Claim Paperwork

When dealing with insurance claims, it’s essential to keep accurate and detailed records of all related paperwork. This includes documents such as police reports, medical records, and correspondence with the insurance company. Organizing and maintaining these records can help ensure a smooth claims process and prevent potential disputes or delays. In this article, we’ll discuss the importance of keeping insurance claim paperwork and provide tips on how to manage these documents effectively.

Why Keep Insurance Claim Paperwork?

There are several reasons why it’s crucial to keep insurance claim paperwork: * Supports your claim: Detailed records can help support your claim and provide evidence of the incident or damage. * Prevents disputes: Keeping accurate records can help prevent disputes with the insurance company and ensure that your claim is processed fairly. * Simplifies the process: Organized records can make it easier to navigate the claims process and reduce the risk of errors or delays. * Provides a paper trail: A complete record of correspondence and documentation can provide a paper trail in case of any issues or disagreements.

What Documents Should You Keep?

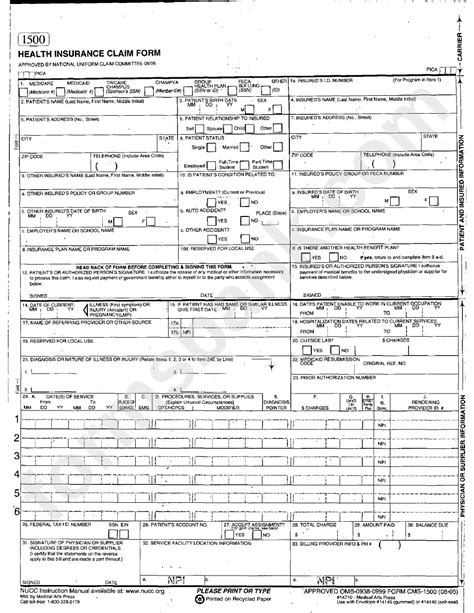

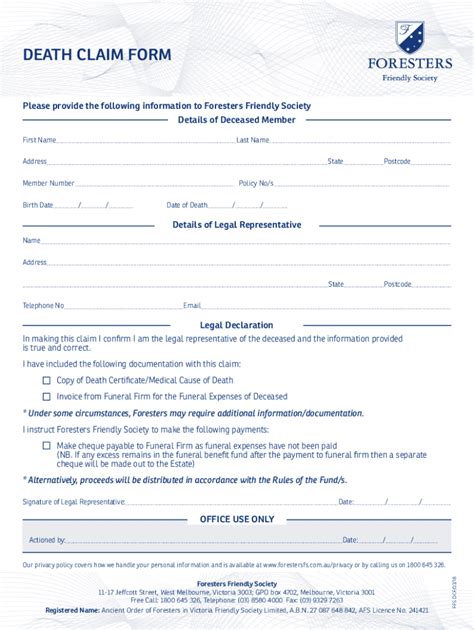

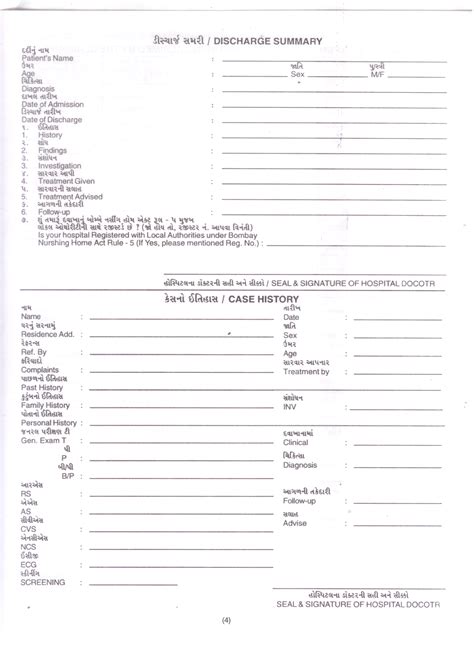

When it comes to insurance claim paperwork, it’s essential to keep a wide range of documents, including: * Police reports: If your claim involves a crime or accident, keep a copy of the police report. * Medical records: If you’ve been injured, keep detailed records of your medical treatment, including doctor’s notes, test results, and medication lists. * Correspondence: Keep a record of all correspondence with the insurance company, including emails, letters, and phone calls. * Repair estimates: If your claim involves property damage, keep estimates from contractors or repair services. * Receipts: Keep receipts for any expenses related to the claim, such as rental cars or temporary accommodation.

| Document Type | Importance |

|---|---|

| Police reports | Provides evidence of the incident |

| Medical records | Supports injury claims |

| Correspondence | Provides a paper trail |

| Repair estimates | Supports property damage claims |

| Receipts | Verifies expenses |

How to Organize Your Insurance Claim Paperwork

To keep your insurance claim paperwork organized, consider the following tips: * Create a dedicated folder: Keep all related documents in a dedicated folder or file. * Use a binder or notebook: Use a binder or notebook to keep track of correspondence and records. * Scan documents: Scan paper documents and save them digitally to prevent loss or damage. * Keep a record of phone calls: Keep a record of phone calls with the insurance company, including dates, times, and details of conversations. * Review and update regularly: Regularly review and update your records to ensure they are accurate and complete.

💡 Note: It's essential to keep your insurance claim paperwork organized and easily accessible to ensure a smooth claims process.

Conclusion and Final Thoughts

In summary, keeping insurance claim paperwork is crucial for a smooth and successful claims process. By understanding the importance of keeping these documents, knowing what to keep, and organizing your records effectively, you can ensure that your claim is supported and processed fairly. Remember to stay organized, keep detailed records, and review and update your paperwork regularly to avoid any potential disputes or delays. By following these tips, you can navigate the insurance claims process with confidence and ensure that you receive the compensation you deserve.

What documents should I keep for an insurance claim?

+

You should keep a wide range of documents, including police reports, medical records, correspondence with the insurance company, repair estimates, and receipts.

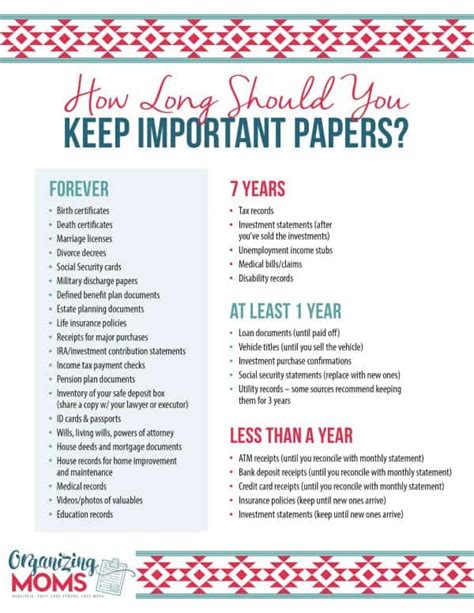

How long should I keep insurance claim paperwork?

+

You should keep insurance claim paperwork for at least 5-7 years, or as long as the statute of limitations for your claim allows.

Can I keep digital copies of my insurance claim paperwork?

+