Paperwork

7 Tax Paper Tips

Introduction to Tax Papers

When it comes to managing finances, understanding and preparing tax papers is a crucial aspect for individuals and businesses alike. Tax papers, which include forms, returns, and other documentation related to taxation, can be overwhelming due to their complexity and the legal implications of inaccuracies. However, with the right approach and knowledge, navigating through tax papers can become more manageable. This article aims to provide insights and tips on how to handle tax papers effectively, ensuring compliance with tax laws and maximizing benefits.

Understanding Tax Obligations

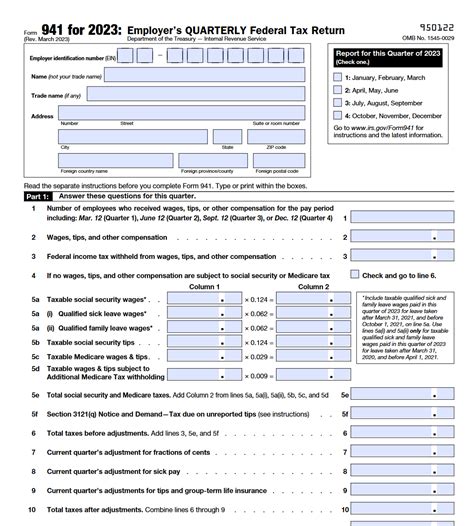

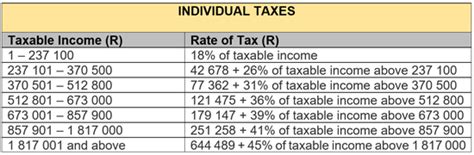

Before diving into the preparation of tax papers, it’s essential to understand one’s tax obligations. This involves knowing the types of taxes one is liable for, the deadlines for filing tax returns, and the consequences of late or incorrect filings. Tax obligations can vary significantly based on factors such as income level, business type, and geographical location. For instance, self-employed individuals and businesses may have different tax filing requirements compared to employed individuals. Familiarizing oneself with these specifics can help in avoiding penalties and ensuring timely compliance.

Organizing Financial Records

Effective management of tax papers begins with the organization of financial records. This includes maintaining accurate and detailed records of income, expenses, deductions, and credits. For businesses, this might involve keeping track of invoices, receipts, bank statements, and payroll records. Individuals should also keep records of their income, charitable donations, medical expenses, and any other items that could qualify as deductions or credits on their tax return. Using digital tools or accounting software can simplify this process and reduce the risk of errors or lost documents.

Choosing the Right Filing Status

Selecting the appropriate filing status is critical when preparing tax papers. The filing status (such as single, married filing jointly, married filing separately, head of household, or qualifying widow(er)) affects the tax rates and deductions one is eligible for. Understanding the different filing statuses and choosing the one that best fits one’s situation can lead to significant savings. It’s also important to note that life changes, such as marriage, divorce, or the death of a spouse, can impact one’s filing status and should be reflected accordingly in tax papers.

Claiming Deductions and Credits

Deductions and credits can substantially reduce one’s tax liability, making it essential to claim all eligible ones. Deductions lower taxable income, while credits directly reduce the amount of tax owed. Common deductions include mortgage interest, state and local taxes, and business expenses. Credits might include the Earned Income Tax Credit (EITC), Child Tax Credit, and education credits. Keeping detailed records and consulting with a tax professional can help ensure that all possible deductions and credits are claimed.

Deadline Compliance

Meeting tax filing deadlines is crucial to avoid penalties and interest on unpaid taxes. The deadline for filing individual tax returns is typically April 15th, but this can vary for businesses or in cases where an extension is filed. Filing electronically can expedite the process and provide immediate confirmation of receipt, reducing the risk of missing deadlines.

Tips for Efficient Tax Paper Management

Here are some additional tips for managing tax papers efficiently: - Keep digital copies of tax papers for easy access and to reduce physical storage needs. - Consult a tax professional for complex tax situations or to ensure all deductions and credits are maximized. - Stay informed about tax law changes that could affect one’s tax obligations or benefits. - Review tax papers carefully before submission to catch any errors or omissions.

| Type of Tax Paper | Description |

|---|---|

| W-2 | Reports income and taxes withheld from employment |

| 1099 | Reports income from self-employment, freelance work, or investments |

| Form 1040 | The standard form for personal income tax returns |

📝 Note: Keeping abreast of the latest tax forms and their purposes can simplify the tax preparation process and ensure compliance with tax laws.

In the end, managing tax papers effectively is about being informed, organized, and proactive. By understanding one’s tax obligations, maintaining accurate financial records, choosing the right filing status, claiming all eligible deductions and credits, and meeting deadlines, individuals and businesses can navigate the complex world of taxation with confidence. This approach not only helps in avoiding legal and financial repercussions but also in maximizing tax benefits, ultimately contributing to financial stability and growth.