Paperwork

5 Tips Fast Auto Loans

Introduction to Fast Auto Loans

When it comes to purchasing a vehicle, financing options are often a crucial consideration. For many, the process of obtaining a car loan can be daunting, especially for those with less-than-ideal credit scores. However, with the rise of fast auto loans, individuals can now access the funds they need quickly and efficiently. In this article, we will explore five key tips for securing fast auto loans, helping you navigate the process with confidence.

Understanding Fast Auto Loans

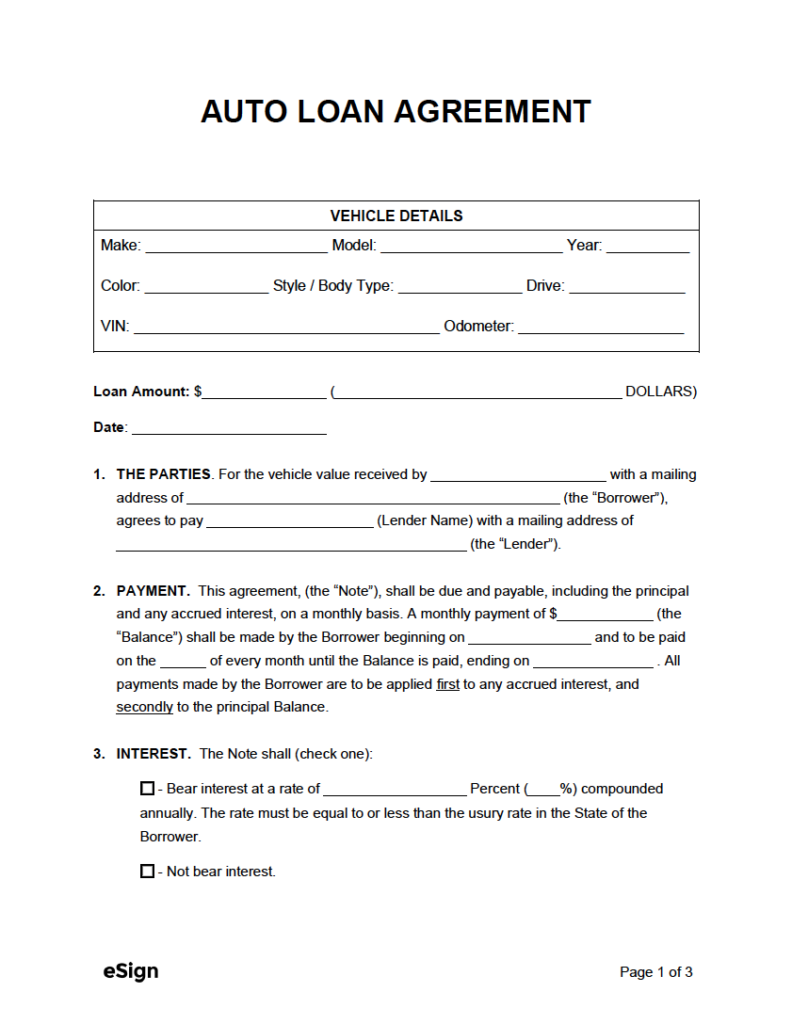

Before diving into the tips, it’s essential to understand what fast auto loans are. Unlike traditional bank loans, which can take days or even weeks to process, fast auto loans are designed to provide rapid financing solutions. These loans are often offered by online lenders or specialized financing companies that use advanced technology to streamline the application and approval process. This means that borrowers can receive the funds they need in as little as 24 hours, making it possible to drive away in their new vehicle sooner.

Tips for Securing Fast Auto Loans

Here are five valuable tips to help you secure fast auto loans:

- Check your credit score: While fast auto loans are available to individuals with various credit scores, having a good credit score can significantly improve your chances of approval and help you qualify for better interest rates.

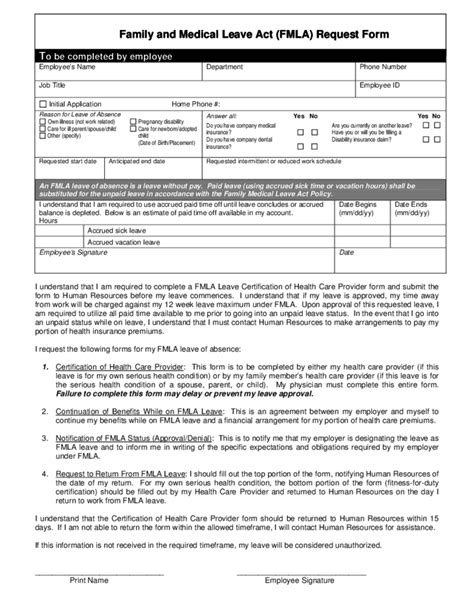

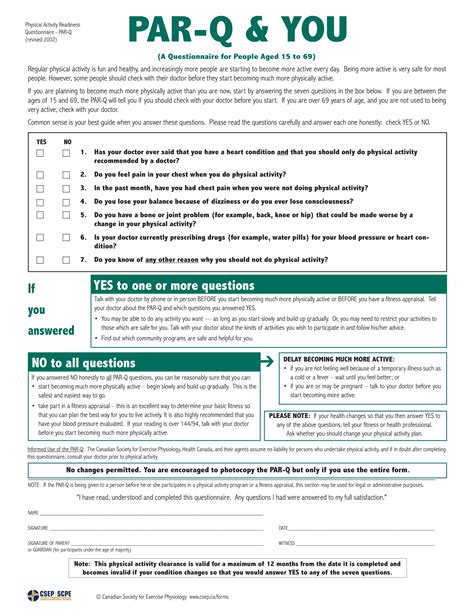

- Gather necessary documents: To expedite the loan process, make sure you have all the required documents ready, including proof of income, employment, and insurance.

- Research and compare lenders: With numerous lenders offering fast auto loans, it’s crucial to research and compare their terms, interest rates, and repayment conditions to find the best option for your needs.

- Consider a co-signer: If you have a less-than-ideal credit score, having a co-signer with good credit can increase your chances of approval and help you secure a more favorable interest rate.

- Read reviews and ask questions: Before committing to a lender, read reviews from other customers and ask questions about their process, fees, and repayment terms to ensure you’re making an informed decision.

Benefits of Fast Auto Loans

The benefits of fast auto loans are numerous. Some of the most significant advantages include: - Quick funding: Receive the funds you need in as little as 24 hours, allowing you to purchase your vehicle sooner. - Convenience: Apply online or over the phone, eliminating the need for lengthy in-person applications. - Flexibility: Fast auto loans often offer more flexible repayment terms, including the option to repay the loan early without penalties. - Accessibility: Fast auto loans can be an excellent option for individuals with less-than-ideal credit scores, as they may be more willing to work with borrowers who have been turned down by traditional lenders.

Common Mistakes to Avoid

When applying for fast auto loans, there are several common mistakes to avoid:

| Mistake | Explanation |

|---|---|

| Not researching lenders | Failing to research and compare lenders can lead to unfavorable terms and higher interest rates. |

| Not reading reviews | Not reading reviews from other customers can leave you unaware of potential issues with the lender. |

| Not asking questions | Not asking questions about the loan process, fees, and repayment terms can lead to unexpected surprises down the line. |

🚨 Note: Be cautious of lenders that charge exorbitant interest rates or fees, as these can quickly add up and make the loan more expensive than necessary.

Conclusion and Final Thoughts

In conclusion, fast auto loans can be a valuable financing option for individuals looking to purchase a vehicle quickly and efficiently. By following the five tips outlined in this article, you can increase your chances of securing a fast auto loan that meets your needs. Remember to research and compare lenders, gather necessary documents, and read reviews from other customers to ensure you’re making an informed decision. With the right lender and loan terms, you can drive away in your new vehicle sooner and enjoy the freedom and convenience that comes with it.

What is the typical interest rate for fast auto loans?

+

The typical interest rate for fast auto loans varies depending on the lender, your credit score, and other factors. However, you can expect to pay an interest rate ranging from 6% to 36% APR.

Can I get a fast auto loan with bad credit?

+

Yes, it is possible to get a fast auto loan with bad credit. However, you may need to pay a higher interest rate or provide a co-signer to secure the loan.

How long does it take to get approved for a fast auto loan?

+

The approval process for fast auto loans typically takes between 24 to 48 hours. However, some lenders may offer same-day approval or even instant approval in some cases.