5 Tax Papers Needed

Understanding the Importance of Tax Papers

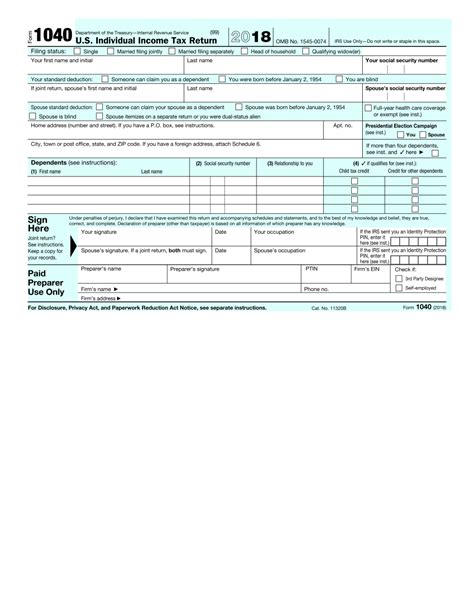

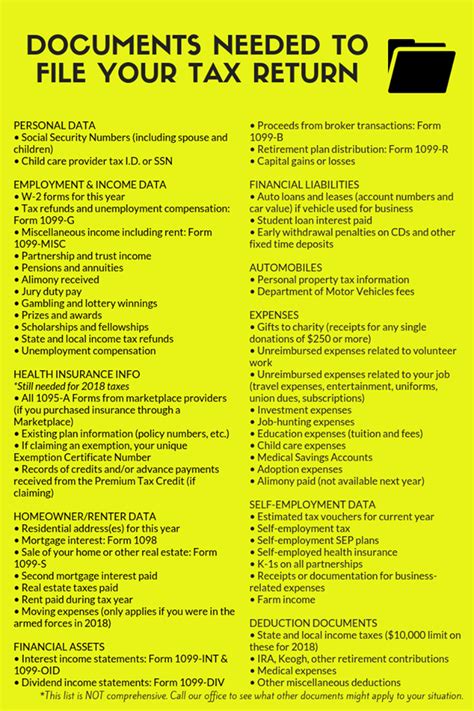

When it comes to managing your finances, one of the most critical aspects is ensuring you have all the necessary tax papers in order. These documents are essential for filing your taxes, claiming deductions, and avoiding any potential issues with the tax authorities. In this article, we will delve into the 5 key tax papers you need to have, their significance, and how they can impact your financial situation.

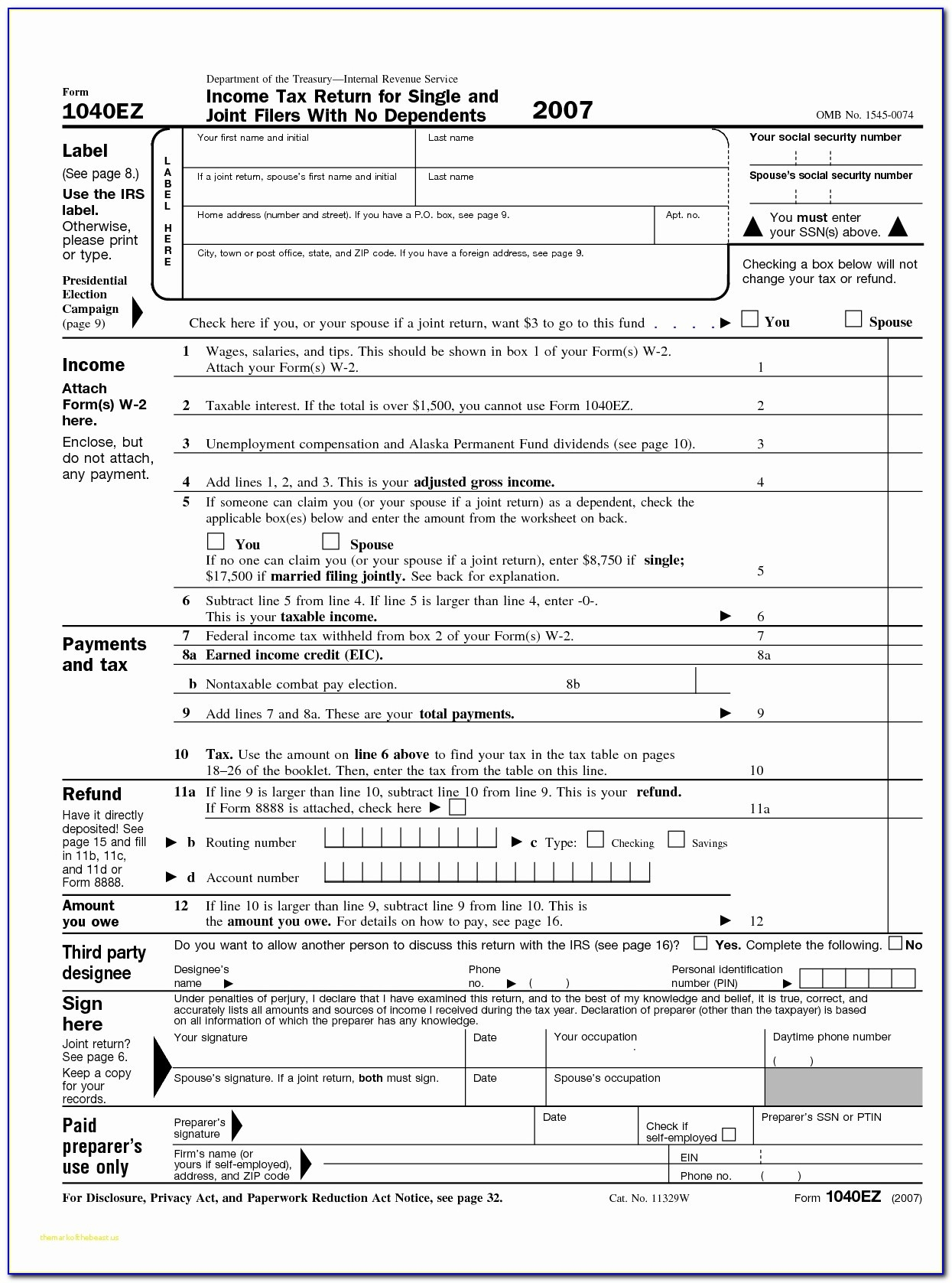

1. W-2 Form: Understanding Your Income

The W-2 form is one of the most critical tax papers you will receive. It outlines your income and the taxes withheld by your employer. This form is usually provided by your employer by January 31st of each year and is essential for filing your tax return. The W-2 form includes details such as: - Your name and address - Your employer’s name and address - Your Social Security number - The amount of wages you earned - The amount of federal and state income taxes withheld

2. 1099 Forms: Reporting Miscellaneous Income

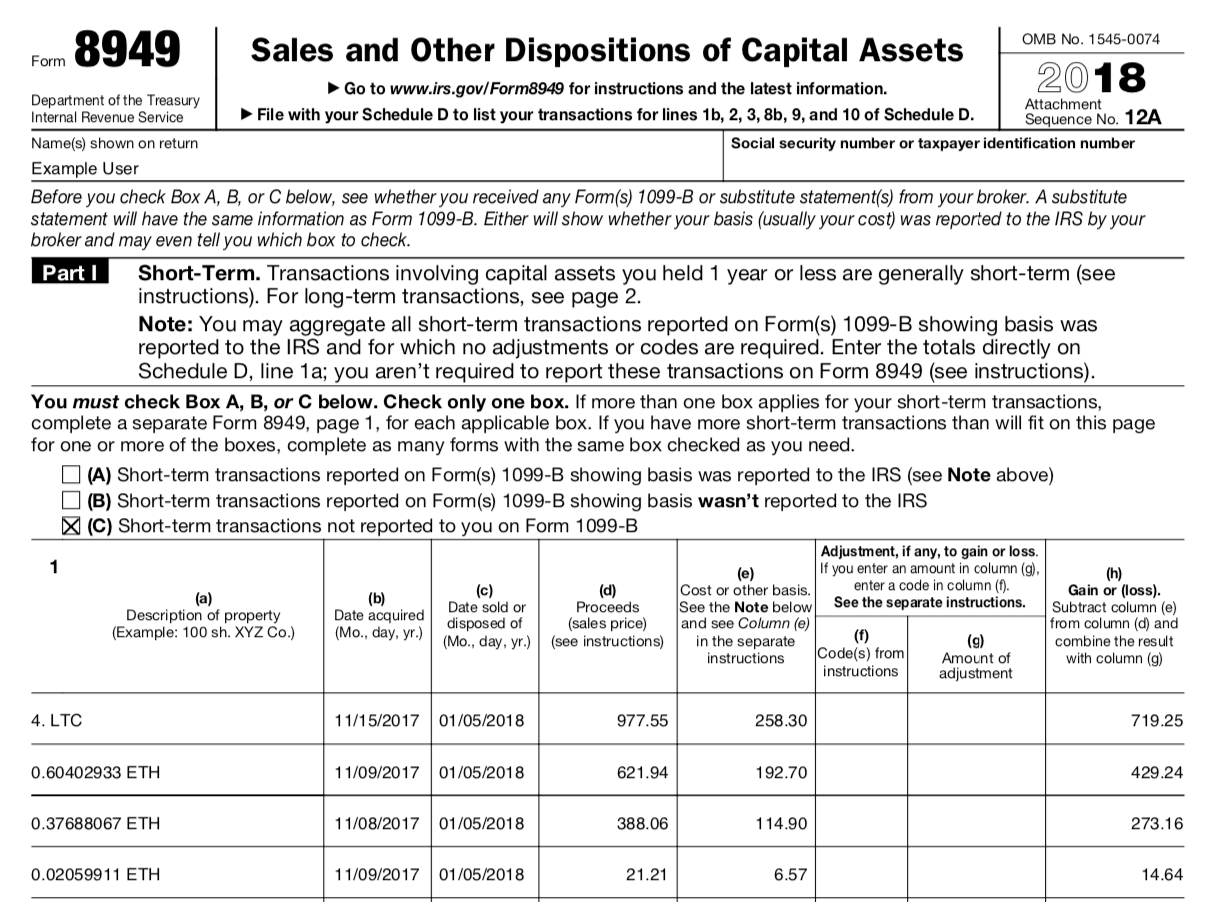

If you are self-employed, freelance, or have investments, you will receive 1099 forms. These forms report miscellaneous income that is not subject to withholding, such as: - Freelance work - Rent - Dividends - Interest - Capital gains It is essential to report this income accurately to avoid any discrepancies in your tax return.

3. Interest Statements (1098 and 1099-INT): Tracking Your Investments

Interest statements, such as the 1098 and 1099-INT forms, report the interest earned on your investments, including: - Savings accounts - Certificates of deposit (CDs) - Bonds - Stocks These statements are crucial for reporting your investment income and claiming any deductions you may be eligible for.

4. Charitable Donation Receipts: Claiming Deductions

If you have made charitable donations, you will need to obtain receipts from the organizations you donated to. These receipts are essential for claiming deductions on your tax return. Make sure to keep accurate records of your donations, including: - The date of the donation - The amount donated - The name and address of the charitable organization

5. Medical Expense Receipts: Claiming Medical Deductions

Medical expense receipts are necessary for claiming deductions on medical expenses, such as: - Doctor visits - Hospital stays - Prescription medications - Medical equipment Keep detailed records of your medical expenses, including receipts, invoices, and statements from your healthcare providers.

📝 Note: It is essential to keep all your tax papers organized and easily accessible in case of an audit or if you need to refer to them in the future.

To ensure you have all the necessary tax papers, consider the following tips: - Set up a filing system for your tax documents - Keep accurate records of your income, expenses, and investments - Review your tax papers carefully before filing your tax return - Consult a tax professional if you are unsure about any aspect of your tax papers

| Tax Paper | Description |

|---|---|

| W-2 Form | Reports income and taxes withheld by your employer |

| 1099 Forms | Reports miscellaneous income, such as freelance work and investments |

| Interest Statements (1098 and 1099-INT) | Reports interest earned on investments, such as savings accounts and bonds |

| Charitable Donation Receipts | Supports deductions for charitable donations |

| Medical Expense Receipts | Supports deductions for medical expenses, such as doctor visits and prescription medications |

In summary, having the right tax papers is crucial for filing your taxes accurately and avoiding any potential issues. By understanding the importance of each tax paper and keeping accurate records, you can ensure a smooth and stress-free tax filing experience. Remember to stay organized, review your tax papers carefully, and consult a tax professional if you need guidance.

What is the deadline for receiving my W-2 form?

+

Your employer is required to provide you with your W-2 form by January 31st of each year.

Can I file my tax return without all the necessary tax papers?

+

No, it is not recommended to file your tax return without all the necessary tax papers. Missing documents can lead to delays, audits, or even penalties.

How long should I keep my tax papers?

+

It is recommended to keep your tax papers for at least three years in case of an audit or if you need to refer to them in the future.