Keep Paperwork After Selling House

Introduction to Keeping Paperwork After Selling a House

When you sell your house, it’s essential to keep certain documents for future reference, tax purposes, and to protect yourself from potential disputes. The paperwork involved in a house sale can be overwhelming, but it’s crucial to understand what documents you should keep and for how long. In this article, we’ll guide you through the process of what paperwork to keep after selling a house and why it’s essential to maintain these records.

Types of Paperwork to Keep

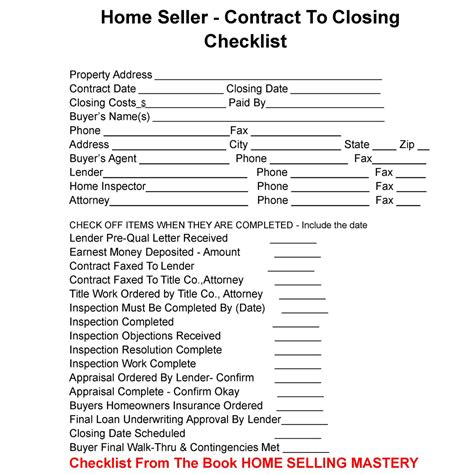

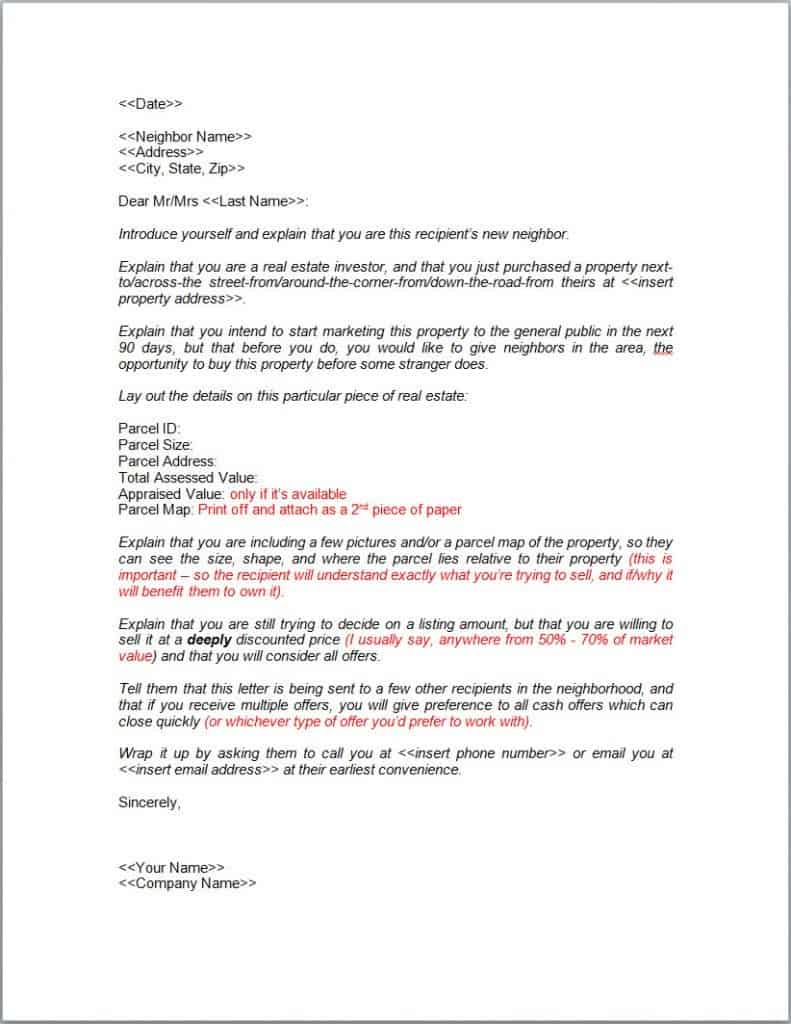

After selling your house, you should keep the following documents: * Sale agreement: This document outlines the terms and conditions of the sale, including the price, payment method, and any contingencies. * Title deeds: These documents prove your ownership of the property and should be kept safe, even after the sale. * Mortgage documents: If you had a mortgage on the property, keep the documents related to the loan, including the repayment schedule and any correspondence with the lender. * Tax documents: Keep records of any tax-related documents, such as capital gains tax calculations and receipts for tax payments. * Inspection reports: If you had any inspections done on the property, keep the reports and any corresponding documents. * Warranties and guarantees: If you provided any warranties or guarantees to the buyer, keep the documents related to these.

Why Keep Paperwork?

Keeping paperwork after selling a house is essential for several reasons: * Tax purposes: You may need to provide documentation to support your tax returns or to claim deductions. * Dispute resolution: If a dispute arises with the buyer, having the necessary documents can help resolve the issue quickly and efficiently. * Future reference: You may need to refer to the documents in the future, for example, if you’re audited or need to prove ownership.

How Long to Keep Paperwork

The length of time you should keep paperwork after selling a house varies depending on the document and the relevant laws in your area. As a general rule, keep documents for at least: * 3-5 years: For tax-related documents and sale agreements. * 6-7 years: For mortgage documents and inspection reports. * Permanently: For title deeds and any other documents that prove ownership.

📝 Note: The exact time frame for keeping paperwork may vary depending on your location and the specific laws in your area. It's always best to consult with a professional, such as a lawyer or accountant, for personalized advice.

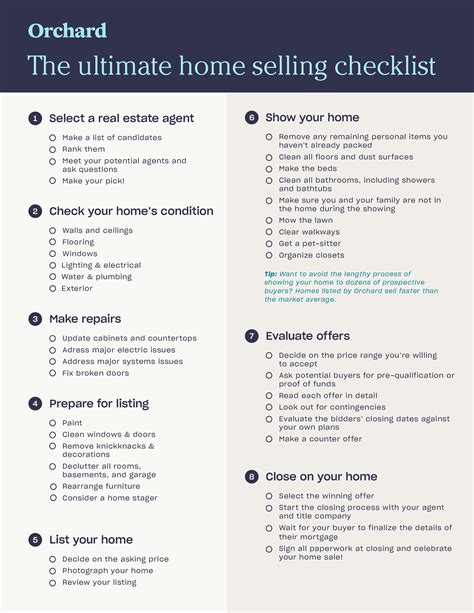

Organizing and Storing Paperwork

To keep your paperwork organized and easily accessible, consider the following tips: * Use a filing system: Create a filing system that allows you to easily categorize and retrieve documents. * Scan documents: Scan your documents and save them electronically, in case the physical copies are lost or damaged. * Store documents securely: Keep your documents in a safe and secure location, such as a fireproof safe or a secure online storage service.

Conclusion

In summary, keeping paperwork after selling a house is crucial for tax purposes, dispute resolution, and future reference. By understanding what documents to keep and for how long, you can ensure you’re well-prepared for any situation that may arise. Remember to organize and store your paperwork securely, and don’t hesitate to seek professional advice if you’re unsure about any aspect of the process.

What documents should I keep after selling my house?

+

You should keep documents such as the sale agreement, title deeds, mortgage documents, tax documents, inspection reports, and warranties and guarantees.

How long should I keep paperwork after selling my house?

+

The length of time you should keep paperwork varies depending on the document and the relevant laws in your area. As a general rule, keep documents for at least 3-5 years for tax-related documents and sale agreements, and 6-7 years for mortgage documents and inspection reports.

Why is it essential to keep paperwork after selling my house?

+

Keeping paperwork after selling your house is essential for tax purposes, dispute resolution, and future reference. It can help you resolve any issues that may arise and provide proof of ownership and sale.