7 IRS Paperwork Tips

Introduction to IRS Paperwork

Dealing with IRS paperwork can be a daunting task for many individuals and businesses. The complexity of tax laws and the sheer volume of paperwork required can be overwhelming. However, with the right approach and understanding, navigating IRS paperwork can be made easier. In this article, we will explore seven valuable tips to help simplify the process and ensure compliance with IRS regulations.

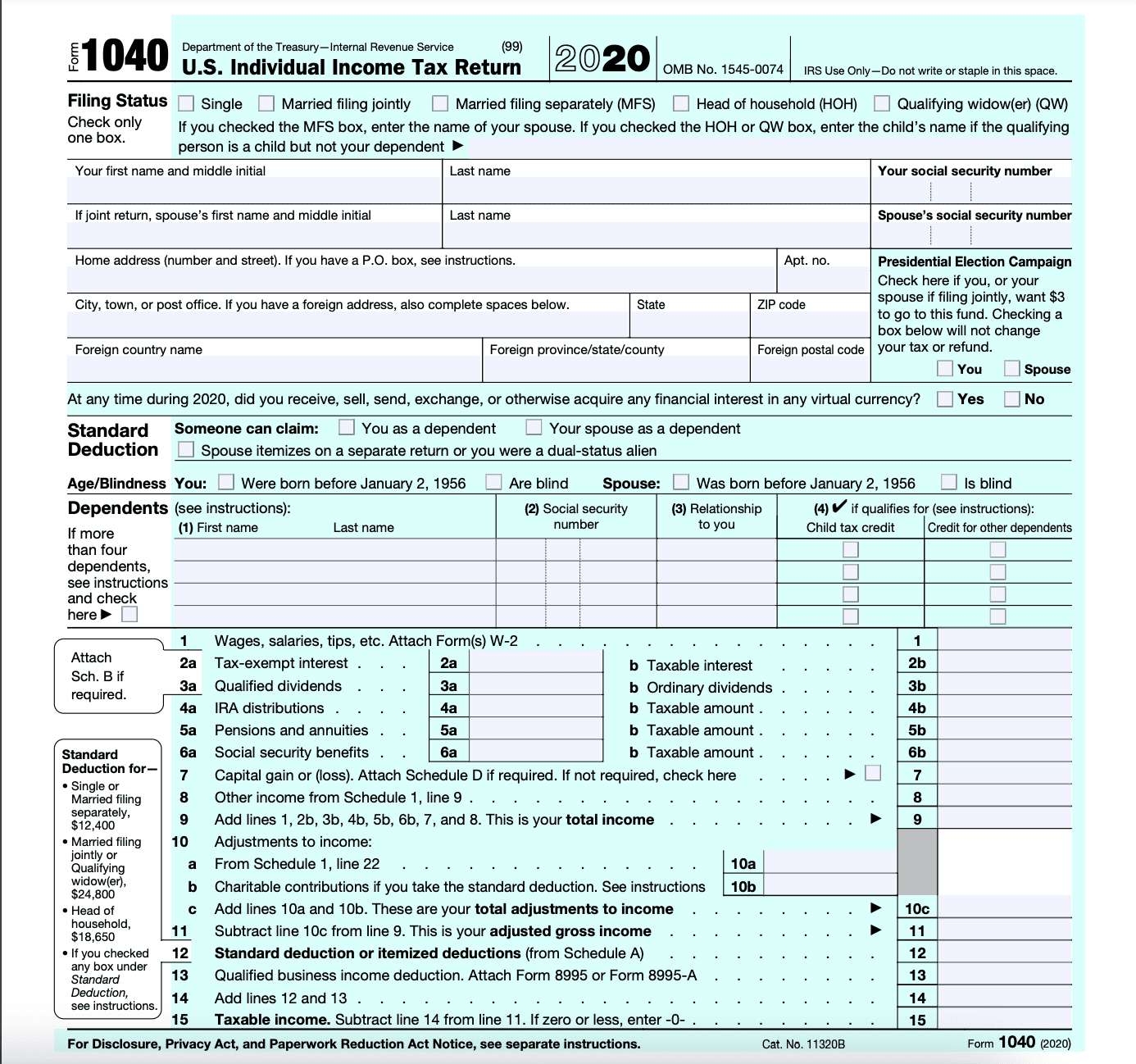

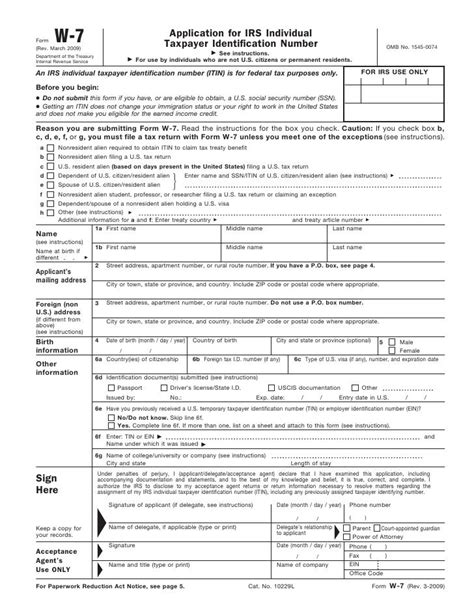

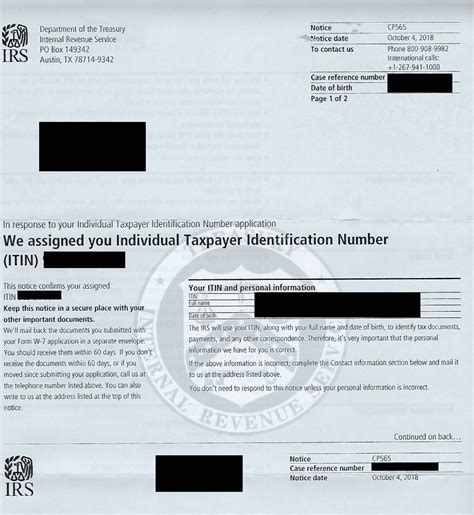

Understanding IRS Forms and Schedules

The first step in tackling IRS paperwork is to understand the various forms and schedules required. The IRS uses a plethora of forms to collect information from taxpayers, including the Form 1040 for personal income tax, Form 1120 for corporate income tax, and Form 941 for employment tax. Each form has its own set of instructions and requirements, making it essential to carefully review and complete them accurately.

Tip 1: Keep Accurate Records

Maintaining accurate and detailed records is crucial for completing IRS paperwork correctly. This includes keeping track of income, expenses, deductions, and credits. Records should be organized and easily accessible to ensure that all necessary information is available when needed. This can be achieved by using a combination of physical and digital storage methods, such as filing cabinets and cloud-based storage services.

Tip 2: Familiarize Yourself with IRS Deadlines

The IRS has strict deadlines for filing various forms and schedules. Missing these deadlines can result in penalties and fines, making it essential to stay on top of IRS deadlines. Key deadlines include April 15th for personal income tax returns, March 15th for corporate income tax returns, and April 30th for employment tax returns.

Tip 3: Take Advantage of IRS Resources

The IRS provides a range of resources to help taxpayers navigate the paperwork process. These resources include IRS.gov, the IRS Taxpayer Assistance Centers, and the IRS phone hotline. Taxpayers can access forms, instructions, and guidance on various tax topics, as well as receive personalized assistance from IRS representatives.

Tip 4: Consider Hiring a Tax Professional

For individuals and businesses with complex tax situations, hiring a tax professional can be a wise decision. Tax professionals, such as certified public accountants (CPAs) and enrolled agents (EAs), have extensive knowledge of tax laws and regulations, ensuring that IRS paperwork is completed accurately and efficiently.

Tip 5: Utilize Tax Software

Tax software, such as TurboTax and H&R Block, can simplify the IRS paperwork process by guiding users through the preparation and filing of tax returns. These programs provide step-by-step instructions, error checking, and audit support, making it easier to ensure accuracy and compliance with IRS regulations.

Tip 6: Stay Organized with a Tax Calendar

Creating a tax calendar can help individuals and businesses stay on top of IRS deadlines and requirements. A tax calendar should include key dates, such as IRS deadline dates, estimated tax payment due dates, and record-keeping reminders.

Tip 7: Review and Double-Check

Finally, it is essential to review and double-check all IRS paperwork before submission. This includes verifying personal information, income, deductions, and credits. A single mistake can lead to delays, penalties, or even an IRS audit.

📝 Note: It is crucial to stay up-to-date with changes in tax laws and regulations, as these can impact IRS paperwork requirements.

To further illustrate the importance of accurate record-keeping, consider the following table:

| Record Type | Retention Period |

|---|---|

| Income statements | 3 years |

| Expense receipts | 3 years |

| Tax returns | 7 years |

In summary, navigating IRS paperwork requires a combination of understanding, organization, and attention to detail. By following these seven tips, individuals and businesses can simplify the process, ensure compliance with IRS regulations, and avoid costly penalties and fines.

What is the deadline for filing personal income tax returns?

+

The deadline for filing personal income tax returns is typically April 15th.

Can I file for an extension on my tax return?

+

Yes, you can file for an extension on your tax return by submitting Form 4868 by the original deadline.

What are the consequences of missing an IRS deadline?

+

Missing an IRS deadline can result in penalties, fines, and interest on the amount owed.