Paperwork

FEIN Paperwork IRS Wait Time

Understanding FEIN Paperwork and IRS Wait Time

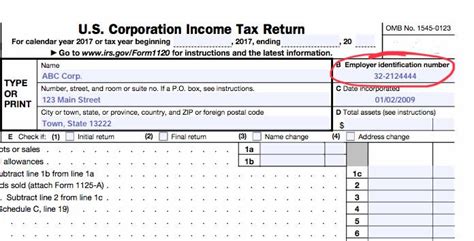

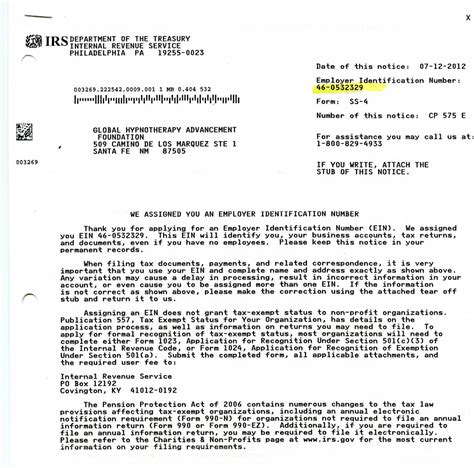

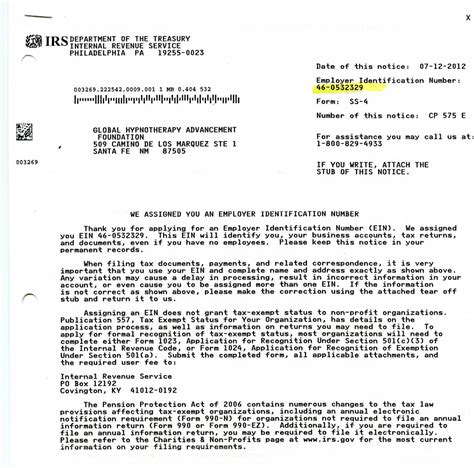

When starting a new business, one of the most critical steps is obtaining an Employer Identification Number (EIN), also known as a Federal Employer Identification Number (FEIN). This unique nine-digit number is assigned by the Internal Revenue Service (IRS) and is used to identify a business entity for tax purposes. However, the process of obtaining an EIN and dealing with the associated paperwork can be complex and time-consuming, especially when it comes to navigating the IRS wait time. In this article, we will delve into the world of FEIN paperwork and explore the factors that contribute to IRS wait time.

The Importance of FEIN for Businesses

A FEIN is essential for any business, as it is required for various purposes, including: * Filing tax returns: A FEIN is necessary for filing tax returns, including income tax, employment tax, and excise tax. * Opening a business bank account: Most banks require a FEIN to open a business bank account. * Applying for credit: A FEIN is often required when applying for business credit or loans. * Hiring employees: A FEIN is necessary for reporting employment taxes and withholding income taxes from employee wages.

Applying for a FEIN

To obtain a FEIN, businesses must submit an application to the IRS. The application can be submitted online, by phone, or by mail. The online application is the fastest way to obtain a FEIN, as it can be processed immediately. However, the online application is only available for businesses with a principal place of business located in the United States. Businesses with a principal place of business located outside the United States must apply by phone or mail.

FEIN Paperwork Requirements

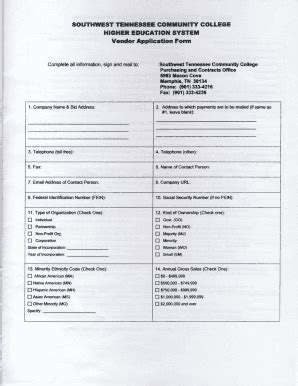

To apply for a FEIN, businesses must provide certain information, including: * Business name and address: The business name and address must be provided, including the principal place of business. * Business type: The type of business, such as corporation, partnership, or sole proprietorship, must be identified. * Responsible party: The responsible party, such as the owner or CEO, must be identified. * SSN or ITIN: The social security number (SSN) or individual taxpayer identification number (ITIN) of the responsible party must be provided.

IRS Wait Time

The IRS wait time for processing FEIN applications can vary depending on the method of application and the time of year. The online application is typically processed immediately, while applications submitted by phone or mail can take several weeks to process. The IRS recommends allowing 4-6 weeks for processing FEIN applications submitted by mail.

| Method of Application | Processing Time |

|---|---|

| Online | Immediate |

| Phone | 1-2 weeks |

| 4-6 weeks |

Factors Contributing to IRS Wait Time

Several factors can contribute to IRS wait time, including: * Volume of applications: The IRS receives a high volume of FEIN applications, particularly during peak periods, such as January and February. * Complexity of application: Applications that require additional documentation or verification can take longer to process. * Staffing and resources: The IRS has limited staffing and resources, which can impact processing times.

📝 Note: Businesses can check the status of their FEIN application by calling the IRS Business and Specialty Tax Line at (800) 829-4933.

Best Practices for Minimizing IRS Wait Time

To minimize IRS wait time, businesses can follow these best practices: * Apply online: The online application is the fastest way to obtain a FEIN. * Ensure accurate information: Make sure all information provided is accurate and complete. * Submit application during off-peak periods: Submitting an application during off-peak periods, such as July or August, can help minimize wait time.

Conclusion and Final Thoughts

Obtaining a FEIN is a critical step for any business, and navigating the associated paperwork and IRS wait time can be challenging. By understanding the importance of FEIN, the application process, and the factors that contribute to IRS wait time, businesses can take steps to minimize delays and ensure a smooth startup process. Whether you’re a seasoned entrepreneur or just starting out, it’s essential to prioritize the FEIN application process and plan accordingly to avoid unnecessary delays.

What is the fastest way to obtain a FEIN?

+

The fastest way to obtain a FEIN is by submitting an online application, which can be processed immediately.

How long does it take to process a FEIN application submitted by mail?

+

The IRS recommends allowing 4-6 weeks for processing FEIN applications submitted by mail.

What information is required to apply for a FEIN?

+

To apply for a FEIN, businesses must provide certain information, including business name and address, business type, responsible party, and SSN or ITIN.