Paperwork

Form 4 Paperwork Requirements

Introduction to Form 4 Paperwork Requirements

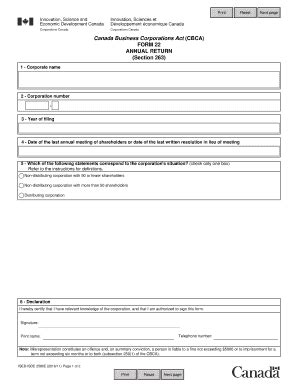

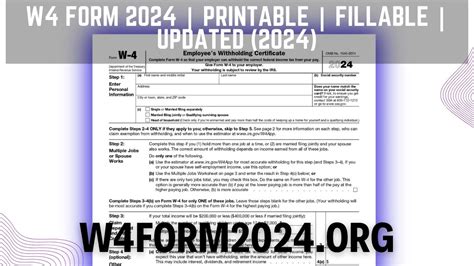

When it comes to filing Form 4 paperwork, individuals must understand the requirements and procedures involved. Form 4 is a document used to report changes in beneficial ownership of securities by corporate insiders. The process can be complex, and accurate completion of the form is crucial to avoid any potential issues. In this article, we will delve into the paperwork requirements for Form 4 and provide guidance on how to navigate the process.

Understanding Form 4

Before we dive into the paperwork requirements, it’s essential to understand what Form 4 is and who needs to file it. Form 4 is a Securities and Exchange Commission (SEC) document that must be filed by corporate insiders, such as officers, directors, and significant shareholders, to report changes in their beneficial ownership of securities. This includes purchases, sales, and other transactions that affect their ownership stakes.

Key Components of Form 4

The Form 4 document consists of several key components, including: * Issuer information: The name and address of the issuer, as well as the Commission File Number and the CIK number. * Reporting person information: The name, address, and relationship of the reporting person to the issuer. * Transaction information: Details of the transaction, including the date, type, and number of securities involved. * Security information: Information about the securities being reported, including the CUSIP number and the number of shares. * Ownership information: The reporting person’s ownership percentage and the number of shares owned after the transaction.

Paperwork Requirements for Form 4

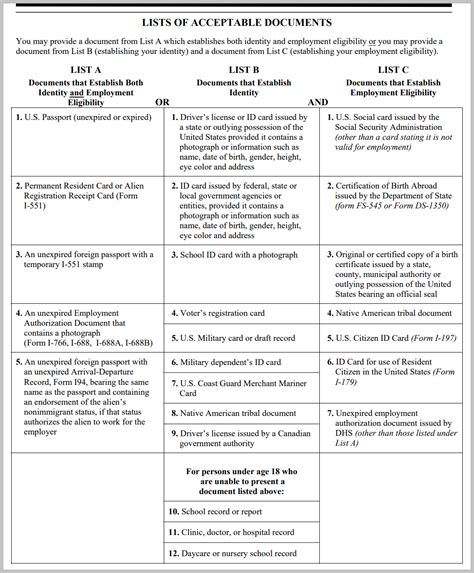

To file Form 4, individuals must meet specific paperwork requirements. These include: * Electronic filing: Form 4 must be filed electronically through the SEC’s EDGAR system. * Signature requirements: The reporting person must sign the form electronically. * Attachments: Certain attachments, such as exhibits or appendices, may be required depending on the specific transaction. * Filing deadlines: Form 4 must be filed within two business days of the transaction date.

Table: Form 4 Filing Requirements

| Component | Requirement |

|---|---|

| Issuer information | Must include name, address, and Commission File Number |

| Reporting person information | Must include name, address, and relationship to issuer |

| Transaction information | Must include date, type, and number of securities involved |

| Security information | Must include CUSIP number and number of shares |

| Ownership information | Must include ownership percentage and number of shares owned after transaction |

Best Practices for Filing Form 4

To ensure accurate and timely filing of Form 4, individuals should follow best practices, including: * Verify information: Double-check all information for accuracy and completeness. * Use correct codes: Use the correct codes and formatting when reporting transactions. * File on time: File Form 4 within the required two business days of the transaction date. * Keep records: Maintain accurate and complete records of all transactions and filings.

📝 Note: It's essential to carefully review the Form 4 instructions and requirements to ensure accurate and complete filing.

Conclusion and Final Thoughts

In conclusion, filing Form 4 paperwork requires careful attention to detail and adherence to specific requirements. By understanding the key components of Form 4 and following best practices, individuals can ensure accurate and timely filing. It’s crucial to remember that Form 4 is a critical document that helps maintain transparency and accountability in the securities market.

What is the purpose of Form 4?

+

Form 4 is a document used to report changes in beneficial ownership of securities by corporate insiders.

Who needs to file Form 4?

+

Corporate insiders, such as officers, directors, and significant shareholders, must file Form 4 to report changes in their beneficial ownership of securities.

What is the filing deadline for Form 4?

+

Form 4 must be filed within two business days of the transaction date.