Return Paperwork Deadline for Employees

Introduction to Return Paperwork Deadline for Employees

As an employer, it is essential to understand the importance of return paperwork deadline for employees. This process involves the completion and submission of various documents by employees, which are necessary for the administration of payroll, benefits, and other employment-related matters. In this blog post, we will delve into the world of return paperwork deadline for employees, exploring its significance, the types of documents required, and the consequences of missing deadlines.

Significance of Return Paperwork Deadline

The return paperwork deadline is crucial for both employees and employers. For employees, it ensures that their personal and financial information is up-to-date, and they receive their salaries and benefits on time. For employers, it helps in maintaining accurate records, complying with regulatory requirements, and avoiding penalties. Timely submission of paperwork is vital to avoid delays in payroll processing, which can lead to dissatisfaction among employees and damage to the company’s reputation.

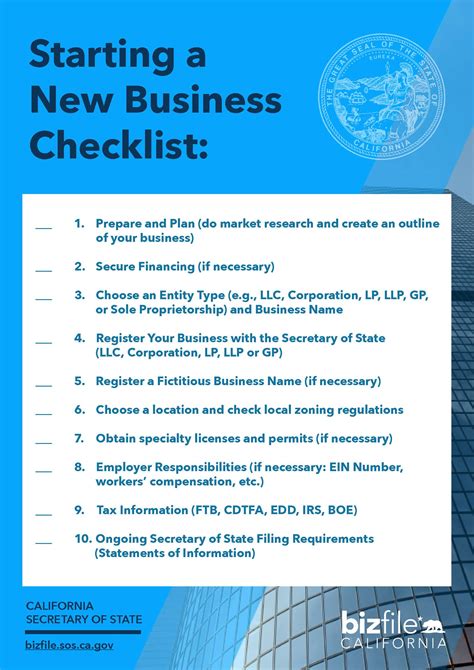

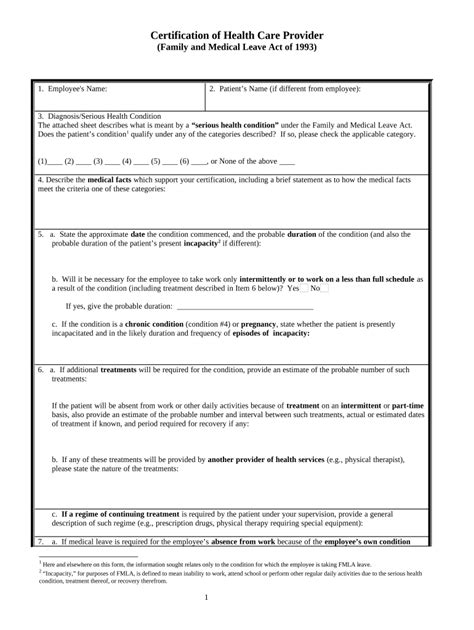

Types of Documents Required

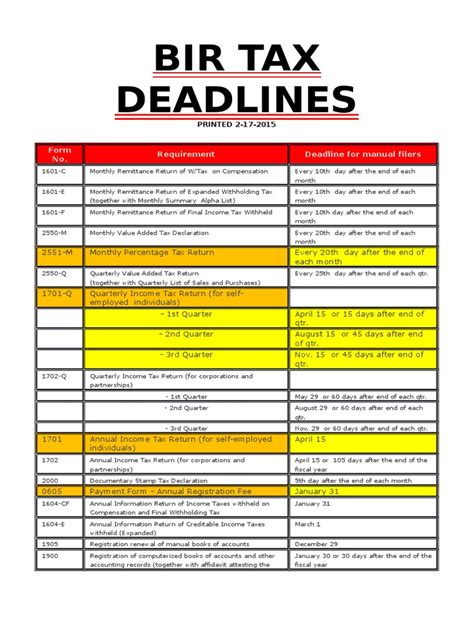

The types of documents required for return paperwork deadline may vary depending on the company and the country’s laws. However, some common documents include: * Employee information forms * Tax forms (e.g., W-4 or W-9) * Benefits enrollment forms * Direct deposit authorization forms * Emergency contact information forms * Insurance forms (e.g., health, life, or disability insurance)

These documents are typically provided to new employees during the onboarding process, and existing employees may be required to update their information periodically.

Consequences of Missing Deadlines

Missing the return paperwork deadline can have severe consequences for both employees and employers. For employees, it may result in: * Delayed payment of salaries or benefits * Ineligibility for certain benefits or perks * Incorrect tax withholding or reporting * Negative impact on credit scores (in cases where employee information is used for credit checks)

For employers, missing deadlines can lead to: * Non-compliance with regulatory requirements, resulting in fines or penalties * Inaccurate payroll processing, leading to errors in salary payments or benefits administration * Damage to the company’s reputation and employee trust * Potential lawsuits or disputes with employees or regulatory agencies

Best Practices for Managing Return Paperwork Deadline

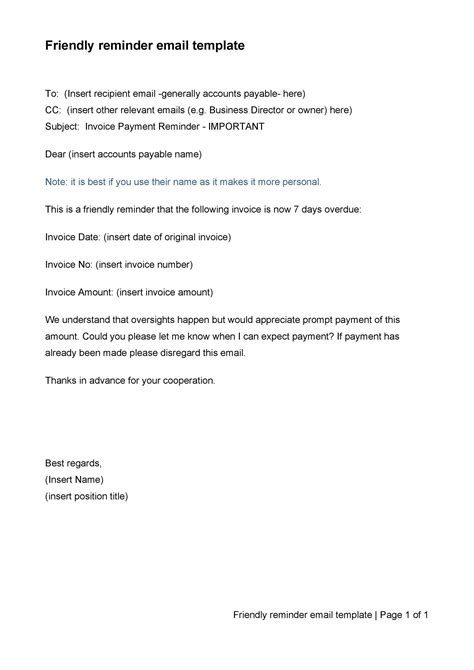

To avoid the consequences of missing deadlines, employers can implement the following best practices: * Clear communication: Inform employees about the importance of return paperwork deadline and the consequences of missing it. * Simplified processes: Streamline the paperwork process by using online platforms or digital forms to reduce errors and increase efficiency. * Regular reminders: Send reminders to employees about upcoming deadlines to ensure they submit their paperwork on time. * Training and support: Provide training and support to employees who may need assistance with completing paperwork. * Tracking and follow-up: Establish a system to track the status of paperwork and follow up with employees who have not submitted their documents.

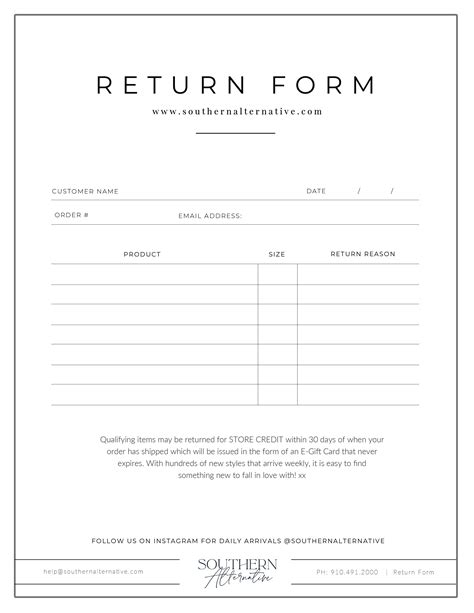

| Document Type | Description | Deadline |

|---|---|---|

| Employee Information Form | Personal and contact information | First day of employment |

| Tax Form (W-4) | Tax withholding information | First day of employment |

| Benefits Enrollment Form | Benefits selection and enrollment | Within 30 days of employment |

📝 Note: Employers should review and update their paperwork processes regularly to ensure compliance with changing regulatory requirements and to improve efficiency.

In summary, the return paperwork deadline is a critical aspect of employee administration, and both employees and employers must take it seriously. By understanding the significance of return paperwork deadline, the types of documents required, and the consequences of missing deadlines, employers can implement best practices to manage the process efficiently and avoid potential issues. As we move forward in this digital age, it is essential to adapt and improve our processes to ensure a smooth and compliant employee administration experience.

What is the purpose of return paperwork deadline for employees?

+

The purpose of return paperwork deadline is to ensure that employees complete and submit necessary documents on time, which helps in maintaining accurate records, complying with regulatory requirements, and avoiding penalties.

What are the consequences of missing the return paperwork deadline for employees?

+

Missing the return paperwork deadline can result in delayed payment of salaries or benefits, ineligibility for certain benefits or perks, incorrect tax withholding or reporting, and negative impact on credit scores.

How can employers manage the return paperwork deadline efficiently?

+

Employers can manage the return paperwork deadline efficiently by implementing clear communication, simplified processes, regular reminders, training and support, and tracking and follow-up.