Start Business Paperwork Requirements

Starting a Business: Understanding Paperwork Requirements

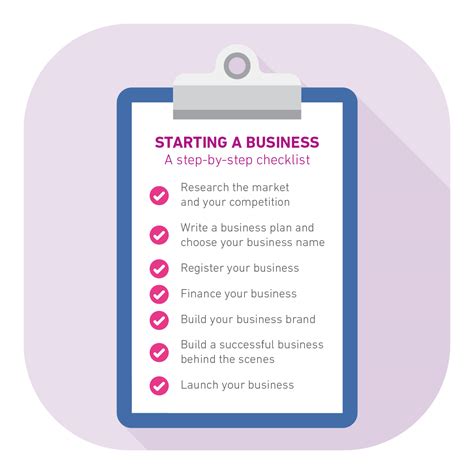

When it comes to starting a business, one of the most crucial steps is navigating the complex world of paperwork requirements. From licenses and permits to tax registrations and employee documentation, the list of necessary documents can seem overwhelming. However, understanding what is required and how to obtain the necessary paperwork is essential for establishing a legitimate and successful business.

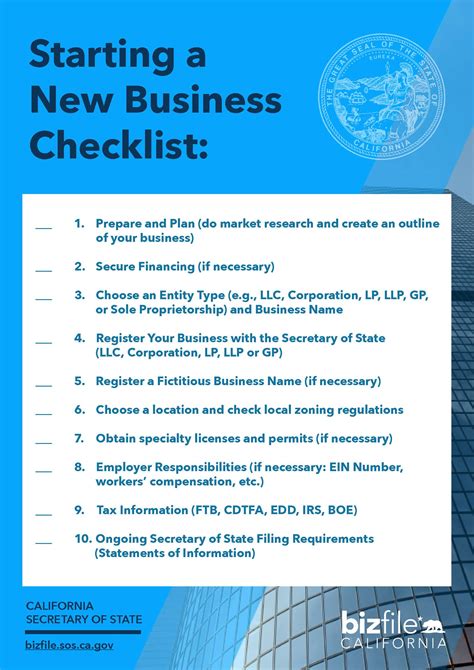

Business Structure and Registration

The first step in meeting paperwork requirements is to register the business. This involves choosing a business structure, such as a sole proprietorship, partnership, limited liability company (LLC), or corporation. Each structure has its own set of requirements and benefits, and choosing the right one is critical for tax purposes and liability protection. Once the business structure is determined, the next step is to register the business with the state and obtain any necessary licenses and permits.

Licenses and Permits

Licenses and permits are required for various types of businesses, and the specific requirements vary depending on the industry, location, and type of business. Some common licenses and permits include: * Business license: required for most businesses and typically issued by the state or local government * Professional license: required for certain professions, such as law, medicine, or engineering * Environmental permit: required for businesses that may have an impact on the environment * Food service permit: required for businesses that handle or serve food * Zoning permit: required for businesses that operate in a specific location

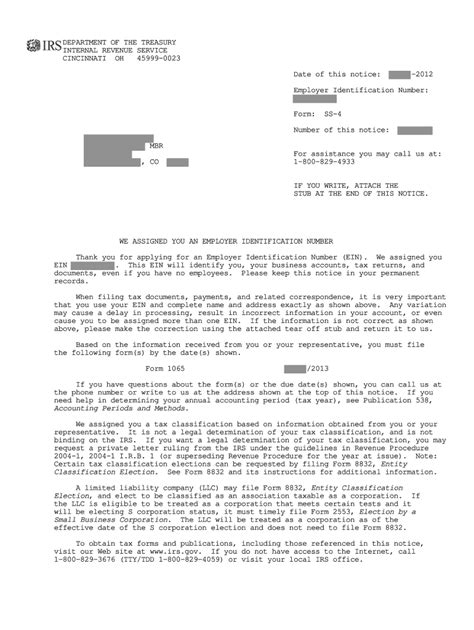

Tax Registrations

In addition to licenses and permits, businesses must also register for taxes. This includes: * Employer Identification Number (EIN): required for most businesses and used to identify the business for tax purposes * State tax registration: required for businesses that operate in a specific state * Local tax registration: required for businesses that operate in a specific location * Sales tax permit: required for businesses that sell taxable goods or services

Employee Documentation

If the business plans to hire employees, there are additional paperwork requirements to consider. This includes: * Employee contracts: required for most employees and outline the terms of employment * W-4 forms: required for most employees and used to determine tax withholding * I-9 forms: required for most employees and used to verify employment eligibility * Worker’s compensation insurance: required for most businesses with employees and provides insurance coverage in case of work-related injuries

💡 Note: It's essential to consult with an attorney or accountant to ensure that all necessary paperwork requirements are met, as failure to comply can result in fines, penalties, and even business closure.

Other Paperwork Requirements

In addition to the above requirements, there may be other paperwork requirements to consider, such as: * Insurance policies: required for most businesses and provide protection against various types of risks * Contracts and agreements: required for most businesses and outline the terms of relationships with customers, suppliers, and partners * Trademarks and copyrights: required for businesses that want to protect their intellectual property * Financial statements: required for most businesses and provide a snapshot of the business’s financial performance

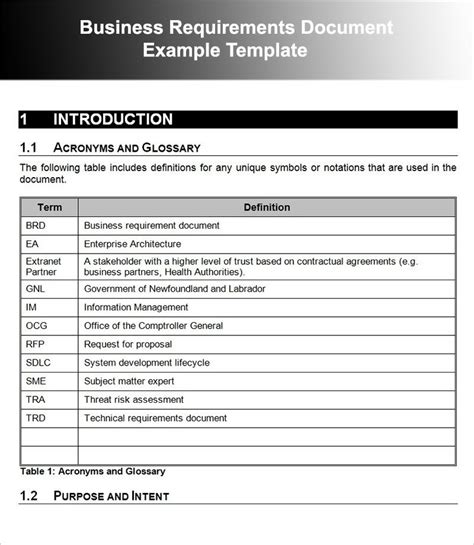

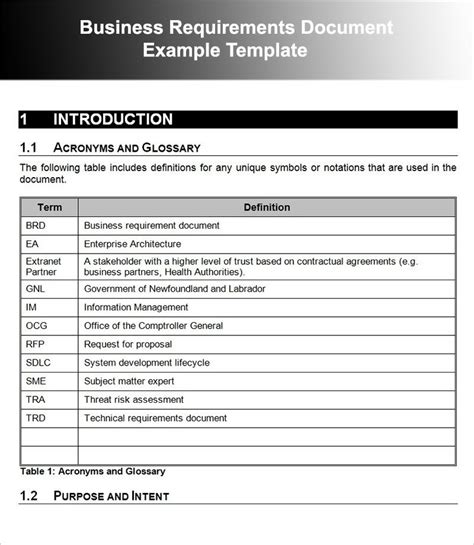

| Business Structure | Licenses and Permits | Tax Registrations | Employee Documentation |

|---|---|---|---|

| Sole Proprietorship | Business license, professional license | EIN, state tax registration | None |

| Partnership | Business license, professional license | EIN, state tax registration | Employee contracts, W-4 forms, I-9 forms |

| LLC | Business license, professional license | EIN, state tax registration | Employee contracts, W-4 forms, I-9 forms |

| Corporation | Business license, professional license | EIN, state tax registration | Employee contracts, W-4 forms, I-9 forms |

In summary, starting a business requires navigating a complex world of paperwork requirements. From licenses and permits to tax registrations and employee documentation, it’s essential to understand what is required and how to obtain the necessary paperwork. By consulting with an attorney or accountant and staying organized, businesses can ensure compliance and set themselves up for success.

What is the first step in meeting paperwork requirements for starting a business?

+

The first step is to register the business and choose a business structure, such as a sole proprietorship, partnership, LLC, or corporation.

What are some common licenses and permits required for businesses?

+

Some common licenses and permits include business licenses, professional licenses, environmental permits, food service permits, and zoning permits.

What is an Employer Identification Number (EIN) and why is it required?

+

An EIN is a unique number assigned to a business by the IRS and is used to identify the business for tax purposes. It is required for most businesses and is used to open a business bank account, file tax returns, and hire employees.