Keep Tax Paperwork Years

Understanding the Importance of Keeping Tax Paperwork for Years

When it comes to managing personal or business finances, one of the most critical aspects is tax compliance. This involves not only filing taxes on time but also maintaining accurate and detailed records of all tax-related documents. The question of how long to keep tax paperwork is a common one, and the answer can vary depending on several factors, including the type of tax return, the presence of deductions or credits, and potential audits.

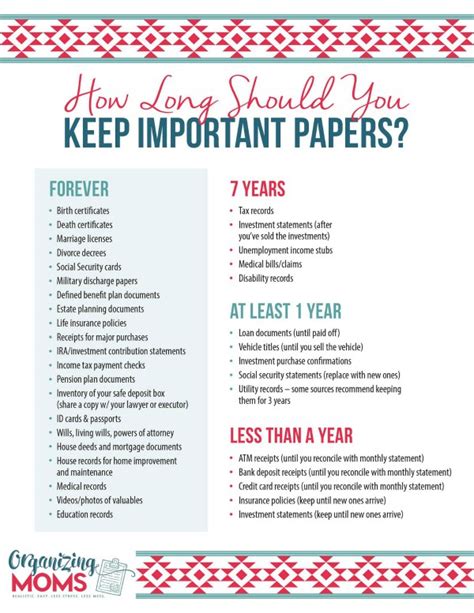

In general, it is recommended to keep tax records for at least three years from the date the tax return was filed. This timeframe is based on the statute of limitations for the IRS to initiate an audit. However, this period can extend under certain circumstances, such as if there is suspicion of fraud or if a substantial error is identified in the return.

Why Keeping Tax Records is Crucial

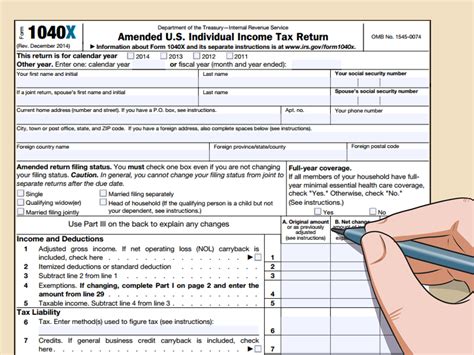

Keeping tax records for an extended period is crucial for several reasons: - Audit Protection: In the event of an audit, having detailed records can help support the information reported on the tax return, reducing the risk of penalties or additional taxes owed. - Amended Returns: If there is a need to file an amended return, having the original records can facilitate the process, ensuring accuracy and completeness. - Future Reference: Tax records can serve as a reference for future tax planning, helping in identifying trends, deductions, and credits that can be beneficial in subsequent years.

Types of Tax Records to Keep

It is essential to maintain a wide range of tax-related documents, including but not limited to: * Income statements (W-2s, 1099s) * Deduction receipts (charitable donations, medical expenses) * Business expense records (if self-employed) * Investment statements (interest, dividends, capital gains) * Real estate documents (property taxes, mortgage interest statements) * Education expense records (for education credits)

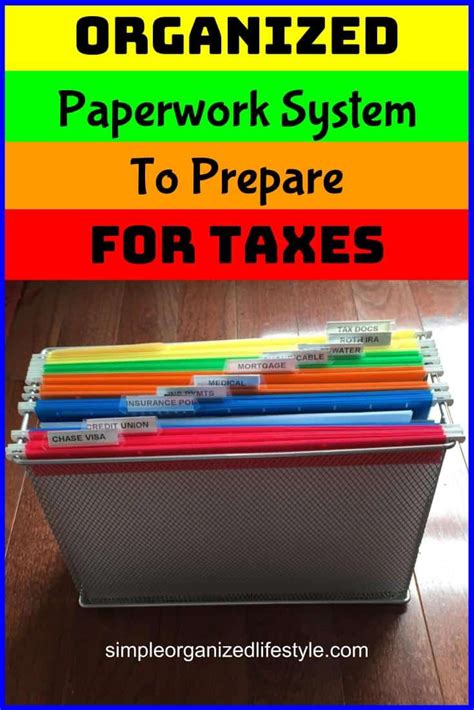

Best Practices for Storing Tax Records

With the advancement in technology, storing tax records can be efficiently managed through: * Digital Storage: Scanning documents and storing them digitally. This method is space-saving and allows for easy access and retrieval of information. * Cloud Storage: Utilizing cloud services provides an added layer of security and accessibility from anywhere. * Physical Storage: For those who prefer tangible records, using a fireproof safe or a secure file cabinet can protect documents from damage or loss.

Extended Record Keeping Scenarios

There are situations where it is advisable to keep tax records for more than the standard three years: * Business Use of Home: If claiming a home office deduction, it is recommended to keep records for as long as the deduction is claimed, plus the statute of limitations period, as this can impact future tax filings. * Retirement Account Contributions: Records of contributions to retirement accounts, such as IRAs, should be kept until retirement to ensure accurate reporting of distributions. * Loss Carryforwards: In cases where there are loss carryforwards (e.g., net operating losses), records should be maintained until the losses are fully utilized.

📝 Note: The specific record-keeping requirements can vary based on individual circumstances. It is always a good idea to consult with a tax professional to ensure compliance with all tax regulations and to optimize tax strategies.

Record Keeping for Specific Tax Credits and Deductions

Certain tax credits and deductions require meticulous record keeping to support claims: * Earned Income Tax Credit (EITC): Records of income, family size, and filing status should be maintained. * Child Tax Credit: Proof of child dependency, including birth certificates and social security numbers, should be kept. * Education Credits: Records of tuition payments, enrollment status, and student loans should be maintained.

| Type of Record | Recommended Keeping Period |

|---|---|

| Income Tax Returns | At least 3 years from the filing date |

| Business Records | At least 3 years from the filing date, longer if business use of home is claimed |

| Real Estate Documents | As long as the property is owned, plus the statute of limitations period |

In summary, keeping tax paperwork for years is not just a matter of compliance; it is a strategy for financial management and protection. By understanding what records to keep, how long to keep them, and the best practices for storage, individuals and businesses can ensure they are well-prepared for audits, amended returns, and future tax planning.

As we reflect on the importance of tax record keeping, it becomes clear that this practice is foundational to maintaining financial health and avoiding potential legal and financial repercussions. By adopting a diligent approach to tax record management, individuals and businesses can navigate the complexities of tax law with greater confidence and security.

How long should I keep my tax returns?

+

It is generally recommended to keep tax returns for at least three years from the date the return was filed. However, this period can extend under certain circumstances.

What types of records should I keep for tax purposes?

+

You should keep a variety of records, including income statements, deduction receipts, business expense records, investment statements, and real estate documents, among others.

Can I store my tax records digitally?

+