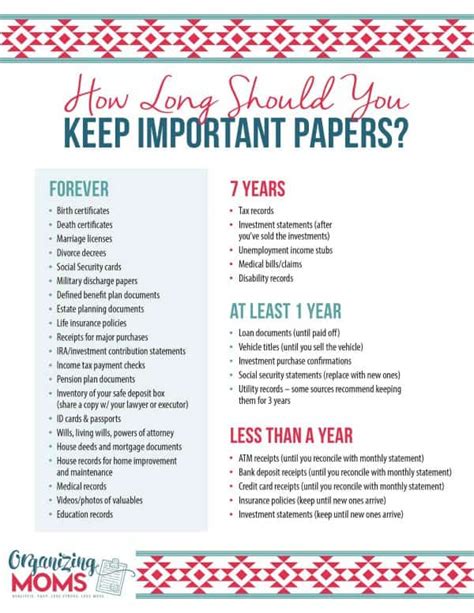

7 Years to Keep

Introduction to Data Retention

In the digital age, data retention has become a critical aspect of personal and professional life. With the increasing amount of data being generated, it’s essential to have a strategy in place for managing and retaining this data. One common guideline for data retention is to keep records for 7 years, but what does this mean, and why is it important? In this article, we’ll delve into the world of data retention, exploring its significance, benefits, and best practices.

Understanding Data Retention

Data retention refers to the practice of storing and maintaining data for a specified period. This can include documents, emails, financial records, and other types of digital information. The goal of data retention is to ensure that important information is available when needed, while also complying with regulatory requirements and minimizing storage costs. Effective data retention involves striking a balance between keeping relevant data and eliminating unnecessary information.

Benefits of Data Retention

There are several benefits to retaining data for an extended period, including: * Compliance with regulations: Many industries are subject to regulations that require the retention of specific data for a certain period. * Audit and financial purposes: Keeping financial records and other data can help with audits, tax returns, and financial planning. * Historical reference: Retained data can provide valuable insights into past trends, decisions, and outcomes. * Dispute resolution: In the event of a dispute, retained data can serve as evidence or support for claims.

Why 7 Years?

The 7-year rule is a common guideline for data retention, particularly in the context of financial and tax-related records. This timeframe is often recommended because: * Tax audits: In many countries, tax authorities have the right to audit returns for a period of 7 years. * Statute of limitations: The statute of limitations for various types of claims and disputes often expires after 7 years. * Business cycles: Retaining data for 7 years can help businesses identify patterns and trends that may not be immediately apparent.

Best Practices for Data Retention

To ensure effective data retention, consider the following best practices: * Develop a data retention policy: Establish clear guidelines for what data to retain, for how long, and in what format. * Use secure storage: Store retained data in a secure, access-controlled environment to protect against unauthorized access or data breaches. * Implement data backup and recovery procedures: Regularly back up retained data and have a plan in place for recovering data in case of loss or corruption. * Monitor and review retained data: Regularly review retained data to ensure it remains relevant and compliant with regulatory requirements.

| Data Type | Retention Period |

|---|---|

| Financial records | 7 years |

| Employment records | 4-7 years |

| Emails and communications | 1-3 years |

📝 Note: The retention periods listed in the table are general guidelines and may vary depending on the specific industry, regulation, or jurisdiction.

As we conclude our discussion on data retention, it’s essential to remember that effective data management is crucial for both personal and professional success. By understanding the importance of data retention, following best practices, and complying with regulatory requirements, individuals and organizations can ensure that their data is secure, accessible, and useful when needed. The 7-year rule serves as a guideline, but it’s essential to tailor data retention strategies to specific needs and requirements. By doing so, we can unlock the full potential of our data and make informed decisions that drive growth and success.

What is data retention, and why is it important?

+

Data retention refers to the practice of storing and maintaining data for a specified period. It’s essential for compliance with regulations, audit and financial purposes, historical reference, and dispute resolution.

How long should I retain financial records?

+

It’s generally recommended to retain financial records for 7 years, as this allows for compliance with tax regulations and provides a sufficient timeframe for audits and financial planning.

What are some best practices for data retention?

+

Best practices for data retention include developing a data retention policy, using secure storage, implementing data backup and recovery procedures, and regularly monitoring and reviewing retained data.