Paperwork

Max Tax Refund Without Paperwork

Introduction to Tax Refunds

When it comes to filing taxes, one of the most exciting aspects is receiving a refund. A tax refund is the amount of money that the government owes you after you’ve paid more in taxes than you actually owe. The process of claiming a refund can be complex and often involves a significant amount of paperwork. However, with the advancement of technology and the introduction of electronic filing systems, it’s now possible to claim your maximum tax refund without the hassle of paperwork.

Understanding Tax Refund Eligibility

To be eligible for a tax refund, you must have paid more in taxes throughout the year than you actually owe. This can happen for a variety of reasons, such as having too much tax withheld from your paycheck or overpaying your quarterly estimated taxes. The amount of your refund will depend on the difference between the amount of taxes you’ve paid and the amount of taxes you actually owe. It’s essential to understand the tax laws and regulations in your area to ensure you’re eligible for a refund.

Electronic Filing for a Paperless Refund

Electronic filing, also known as e-filing, is a convenient and efficient way to file your taxes and claim your refund without the need for paperwork. With e-filing, you can submit your tax return electronically and receive your refund via direct deposit. This method is not only faster but also more secure than traditional paper filing. By using tax preparation software or consulting a tax professional, you can ensure that your return is accurate and complete, maximizing your refund.

Maximizing Your Refund with Tax Preparation Software

Tax preparation software is designed to help you navigate the tax filing process and ensure that you’re taking advantage of all the deductions and credits you’re eligible for. These programs will guide you through a series of questions and prompts to help you prepare your return. They’ll also perform calculations and checks to ensure that your return is accurate and complete. Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct. By using one of these programs, you can maximize your refund and avoid the hassle of paperwork.

Tax Credits and Deductions

Tax credits and deductions can significantly impact the amount of your refund. A tax credit is a dollar-for-dollar reduction in the amount of taxes you owe, while a deduction reduces your taxable income. Common tax credits include the Earned Income Tax Credit (EITC) and the Child Tax Credit. Deductions can include things like charitable donations, mortgage interest, and medical expenses. By taking advantage of these credits and deductions, you can reduce your tax liability and increase your refund.

Importance of Accurate Tax Reporting

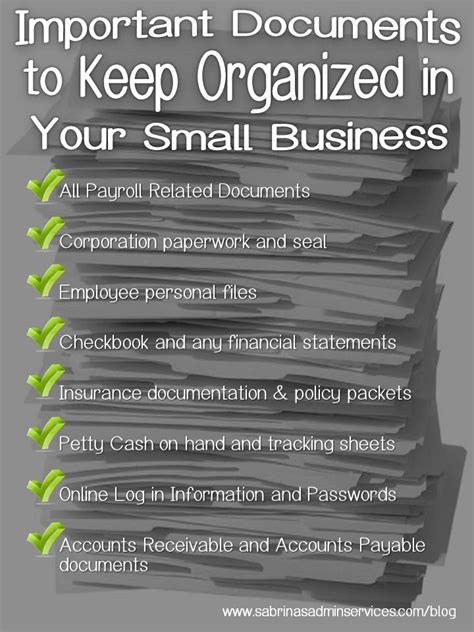

Accurate tax reporting is crucial when it comes to claiming your refund. You must ensure that all the information on your return is accurate and complete. This includes reporting all your income, claiming the correct deductions and credits, and ensuring that your return is signed and dated. Inaccurate or incomplete returns can delay your refund or even result in an audit.

📝 Note: It's essential to keep accurate records and supporting documentation for all your income, deductions, and credits in case of an audit.

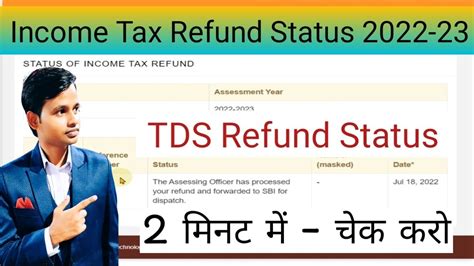

Direct Deposit for Faster Refunds

Direct deposit is a convenient and fast way to receive your refund. By providing your bank account information, you can have your refund deposited directly into your account. This method is not only faster but also more secure than receiving a paper check. Direct deposit can get you your refund in as little as 8-14 days, compared to 6-8 weeks for a paper check.

Conclusion and Final Thoughts

In summary, claiming your maximum tax refund without paperwork is possible with electronic filing and tax preparation software. By understanding tax refund eligibility, taking advantage of tax credits and deductions, and ensuring accurate tax reporting, you can maximize your refund. With direct deposit, you can receive your refund quickly and securely. Remember to always keep accurate records and seek professional help if you’re unsure about any aspect of the tax filing process.

What is the difference between a tax credit and a tax deduction?

+

A tax credit is a dollar-for-dollar reduction in the amount of taxes you owe, while a deduction reduces your taxable income.

How long does it take to receive a tax refund with direct deposit?

+

With direct deposit, you can receive your refund in as little as 8-14 days, compared to 6-8 weeks for a paper check.

What is the Earned Income Tax Credit (EITC), and how does it affect my refund?

+

The EITC is a tax credit for low-to-moderate-income working individuals and families. It can significantly increase your refund, as it’s a refundable credit.