Paperwork

Cobra Paperwork Deadline

Understanding the Cobra Paperwork Deadline

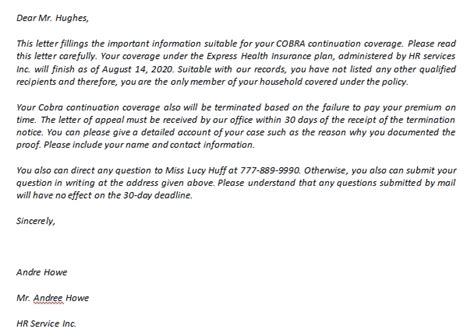

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that requires employers to offer continued health coverage to employees and their families after a qualifying event, such as job loss, divorce, or death. One of the critical aspects of COBRA is the paperwork deadline, which can be confusing for both employers and employees. In this article, we will delve into the details of the COBRA paperwork deadline, its importance, and the consequences of missing it.

What is the COBRA Paperwork Deadline?

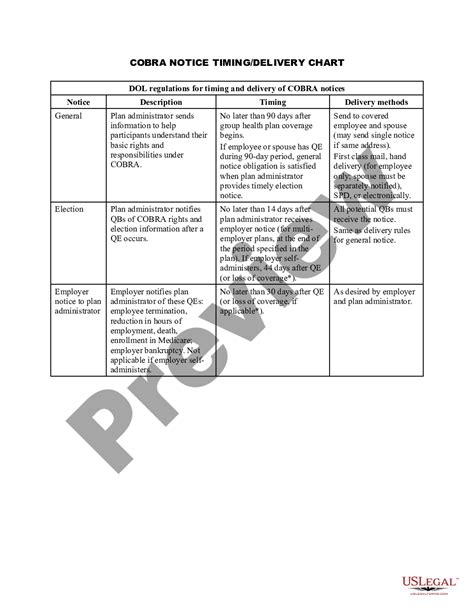

The COBRA paperwork deadline refers to the timeframe within which employers must provide certain documents to employees and their families after a qualifying event. The deadline is typically 44 days from the date of the qualifying event. During this period, employers must provide the following documents:

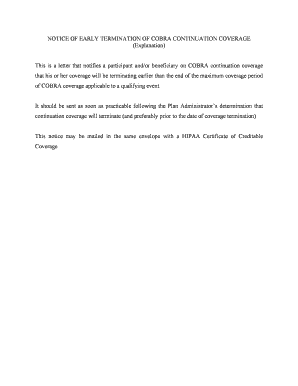

- COBRA Notice: This notice informs the employee and their family members about their rights to continue health coverage under COBRA.

- Election Notice: This notice provides instructions on how to elect COBRA coverage and the deadline for doing so.

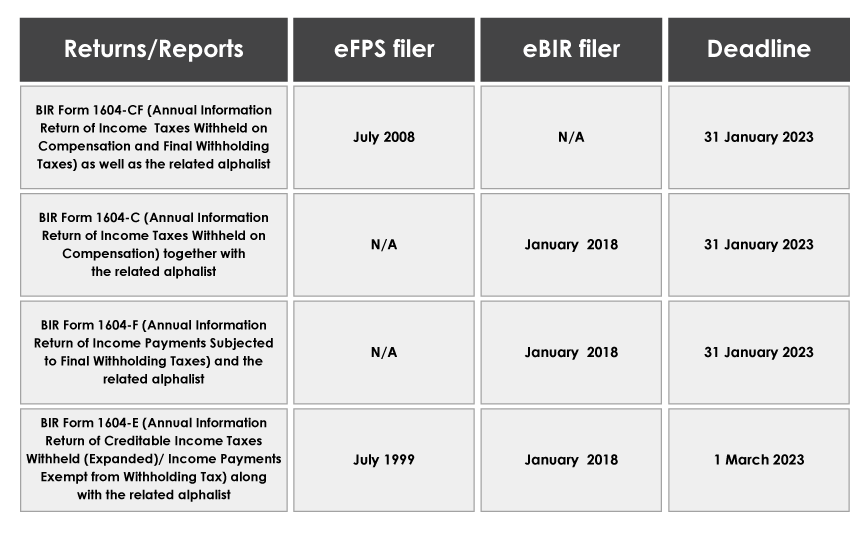

- Payment Information: Employers must provide information on the cost of COBRA coverage and the payment schedule.

Importance of Meeting the COBRA Paperwork Deadline

Meeting the COBRA paperwork deadline is crucial for both employers and employees. Failure to provide the required documents within the specified timeframe can result in severe consequences, including:

- Penalties: Employers may face penalties and fines for non-compliance with COBRA regulations.

- Lawsuits: Employees may file lawsuits against employers for failing to provide COBRA notices, resulting in costly legal battles.

- Loss of Coverage: Employees and their families may lose their right to continue health coverage under COBRA if the paperwork deadline is missed.

Consequences of Missing the COBRA Paperwork Deadline

Missing the COBRA paperwork deadline can have serious consequences for employers. Some of the potential consequences include:

- Excise Tax: Employers may be subject to an excise tax of up to $100 per day for non-compliance with COBRA regulations.

- Legal Fees: Employers may incur significant legal fees to defend against lawsuits related to COBRA non-compliance.

- Reputation Damage: Employers who fail to comply with COBRA regulations may suffer damage to their reputation, which can impact their ability to attract and retain employees.

Best Practices for Meeting the COBRA Paperwork Deadline

To avoid the consequences of missing the COBRA paperwork deadline, employers should follow these best practices:

- Designate a COBRA Administrator: Appoint a qualified individual to oversee COBRA administration and ensure compliance with regulations.

- Use COBRA Software: Utilize COBRA software to streamline the notification process and ensure timely delivery of required documents.

- Review and Update COBRA Policies: Regularly review and update COBRA policies to ensure compliance with changing regulations and laws.

📝 Note: Employers should consult with a qualified benefits attorney or COBRA expert to ensure compliance with all COBRA regulations and deadlines.

Conclusion and Final Thoughts

In conclusion, meeting the COBRA paperwork deadline is crucial for employers to avoid penalties, lawsuits, and damage to their reputation. By understanding the importance of the deadline and following best practices, employers can ensure compliance with COBRA regulations and provide their employees with the necessary information to make informed decisions about their health coverage. It is essential for employers to stay up-to-date with changing regulations and laws to avoid any potential consequences.

What is the COBRA paperwork deadline?

+

The COBRA paperwork deadline is typically 44 days from the date of the qualifying event.

What happens if an employer misses the COBRA paperwork deadline?

+

Employers who miss the COBRA paperwork deadline may face penalties, lawsuits, and damage to their reputation.

How can employers ensure compliance with COBRA regulations?

+

Employers can ensure compliance with COBRA regulations by designating a COBRA administrator, using COBRA software, and reviewing and updating COBRA policies regularly.