5 Ways Update 501c3 Contact Info

Updating Your 501c3 Contact Information: A Step-by-Step Guide

As a nonprofit organization with a 501c3 status, it is crucial to keep your contact information up to date with the Internal Revenue Service (IRS) and other relevant entities. This ensures that you receive important correspondence, such as tax returns and compliance notices, in a timely manner. In this article, we will explore the different ways to update your 501c3 contact information, including online and offline methods.

Why Update Your 501c3 Contact Information?

Before we dive into the ways to update your contact information, let’s discuss the importance of doing so. Outdated contact information can lead to missed deadlines, lost correspondence, and even revocation of your 501c3 status. Additionally, updating your contact information helps the IRS and other organizations to reach you with important notifications, such as changes in tax laws or compliance requirements.

Method 1: Update Online through the IRS Website

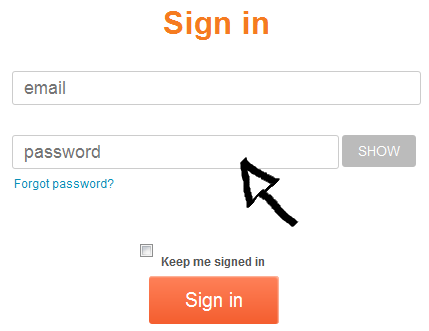

The IRS provides an online platform for nonprofits to update their contact information. To do this, follow these steps: * Visit the IRS website at www.irs.gov * Click on the “Charities and Nonprofits” tab * Select “Update Your Organization’s Information” * Log in to your account or create a new one * Fill out the required fields with your updated contact information

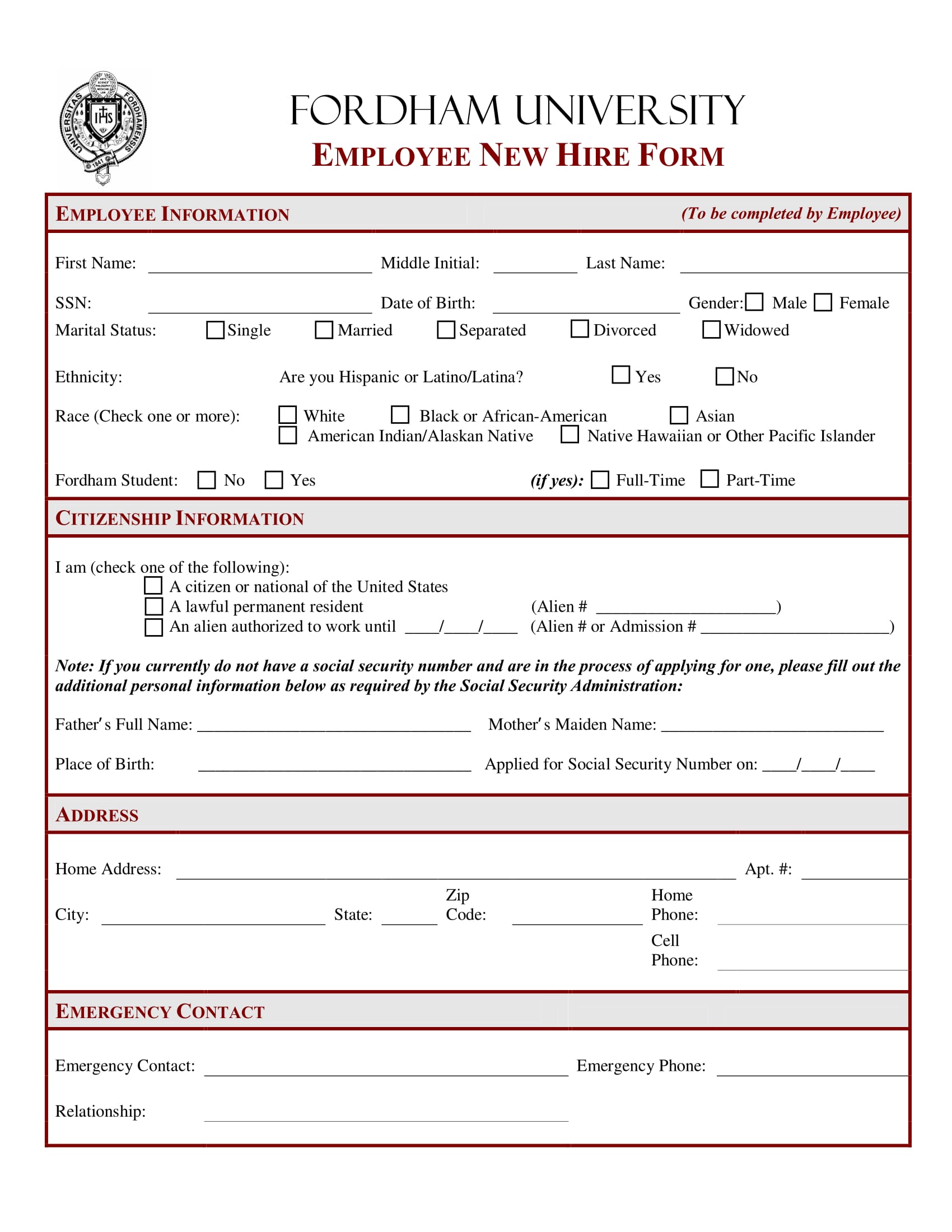

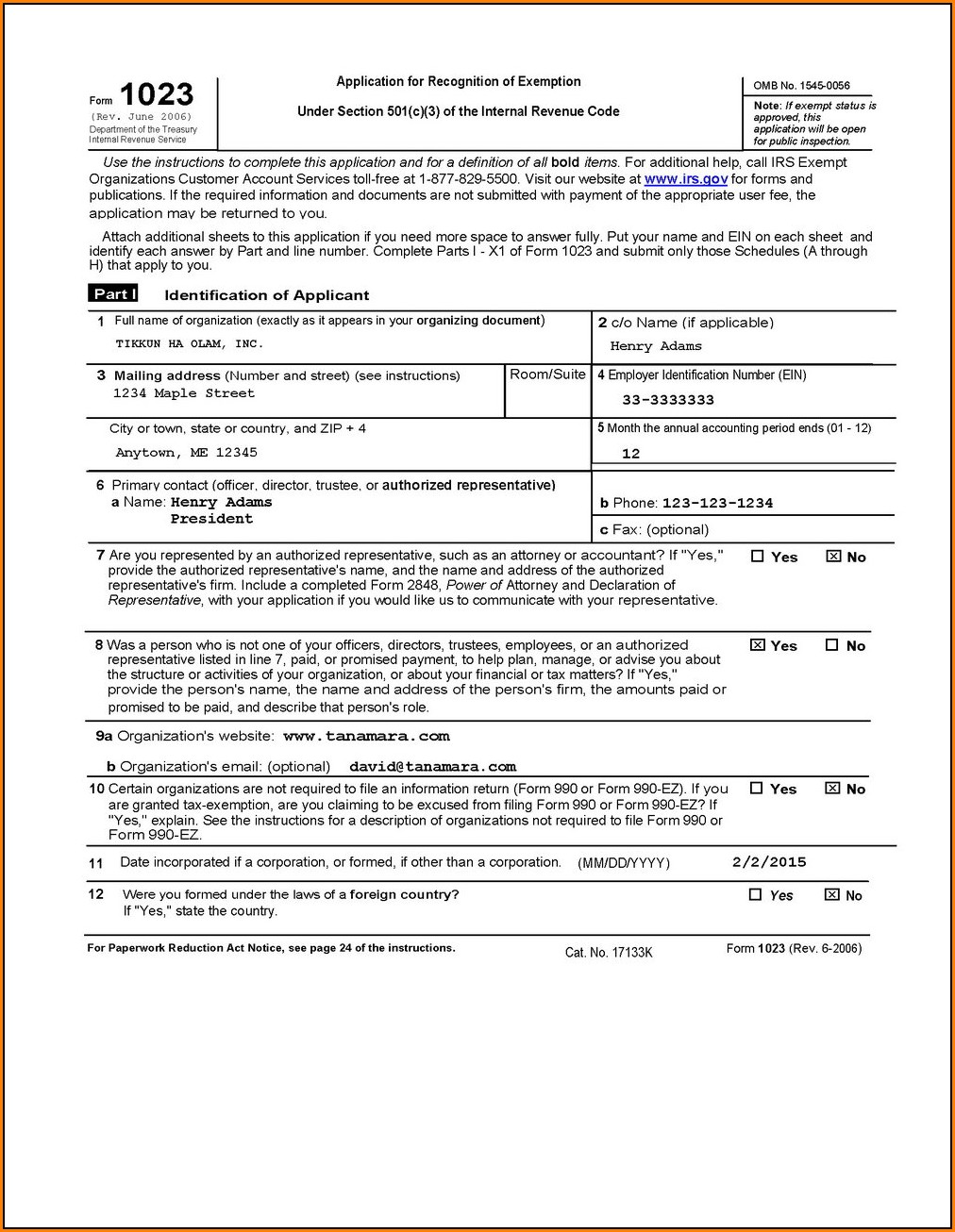

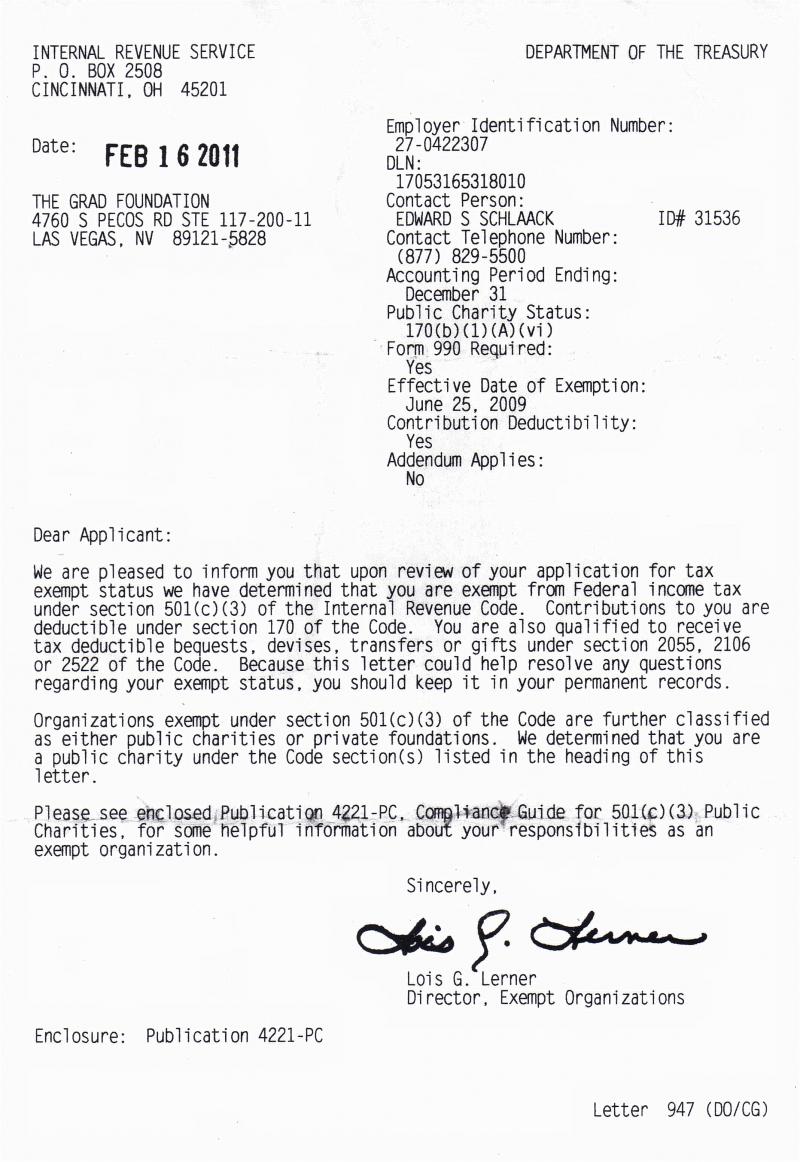

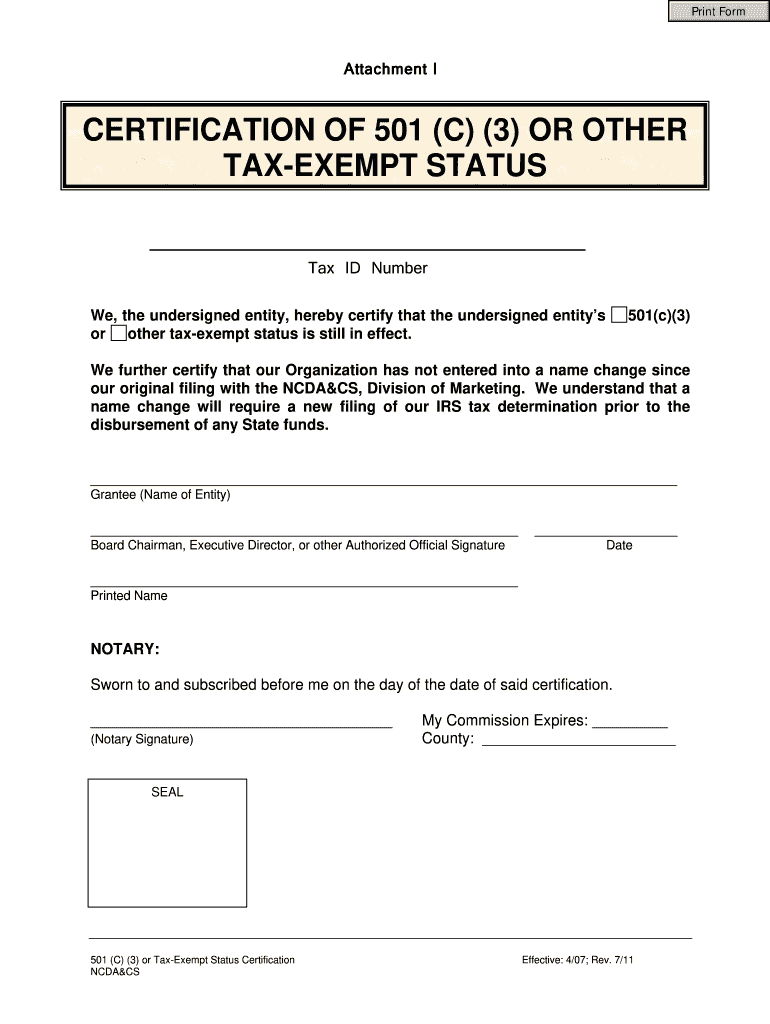

Method 2: File Form 8822-B

Another way to update your 501c3 contact information is by filing Form 8822-B, “Change of Address or Responsible Person - Business”. This form can be downloaded from the IRS website or obtained by calling the IRS Business and Specialty Tax Line at (800) 829-4933. To file Form 8822-B, follow these steps: * Download and complete Form 8822-B * Attach the required documentation, such as a copy of your organization’s articles of incorporation or bylaws * Mail the form to the IRS address listed on the form

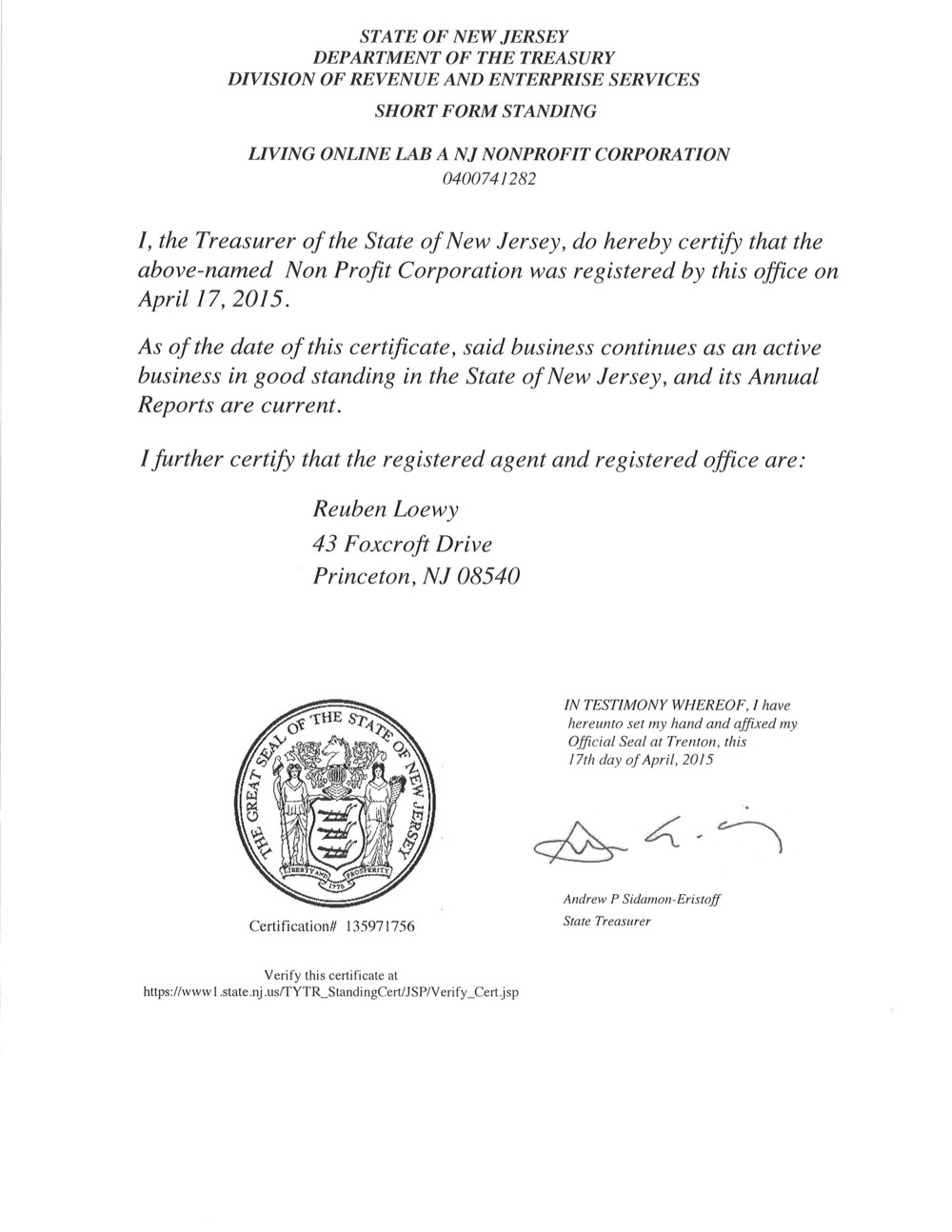

Method 3: Update with the State Charity Registry

In addition to updating your contact information with the IRS, you may also need to update it with your state charity registry. This is typically done through the state’s website or by filing a paper form. To update your contact information with the state charity registry, follow these steps: * Visit your state’s charity registry website * Search for your organization’s name and click on the “Update” or “Amend” button * Fill out the required fields with your updated contact information

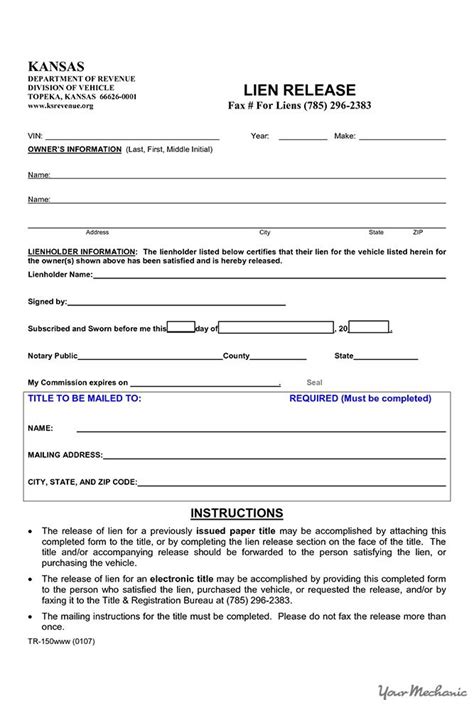

Method 4: Notify the Post Office and Other Relevant Entities

It is also important to update your contact information with the post office and other relevant entities, such as your bank and vendors. This ensures that you receive mail and other important correspondence at your new address. To update your contact information with the post office, follow these steps: * Visit the United States Postal Service (USPS) website at www.usps.com * Click on the “Change of Address” tab * Fill out the required fields with your updated contact information

Method 5: Update Your Organization’s Records

Finally, it is essential to update your organization’s internal records to reflect the new contact information. This includes updating your: * Articles of incorporation or bylaws * Board meeting minutes * Financial records * Website and social media profiles

| Method | Description |

|---|---|

| Update Online through the IRS Website | Visit the IRS website and update your contact information online |

| File Form 8822-B | Download and complete Form 8822-B to update your contact information with the IRS |

| Update with the State Charity Registry | Visit your state's charity registry website and update your contact information |

| Notify the Post Office and Other Relevant Entities | Update your contact information with the post office and other relevant entities |

| Update Your Organization's Records | Update your organization's internal records to reflect the new contact information |

📝 Note: It is essential to keep a record of your updated contact information, including the date and method used to update it.

To summarize, updating your 501c3 contact information is a crucial step in maintaining compliance with the IRS and other relevant entities. By following the methods outlined in this article, you can ensure that your organization’s contact information is up to date and accurate. Remember to update your contact information with the IRS, state charity registry, post office, and other relevant entities, as well as your organization’s internal records.

What is the purpose of updating my 501c3 contact information?

+

The purpose of updating your 501c3 contact information is to ensure that you receive important correspondence, such as tax returns and compliance notices, in a timely manner.

How often should I update my 501c3 contact information?

+

You should update your 501c3 contact information whenever it changes, such as when you move to a new address or change your phone number or email address.

What are the consequences of not updating my 501c3 contact information?

+

The consequences of not updating your 501c3 contact information can include missed deadlines, lost correspondence, and even revocation of your 501c3 status.