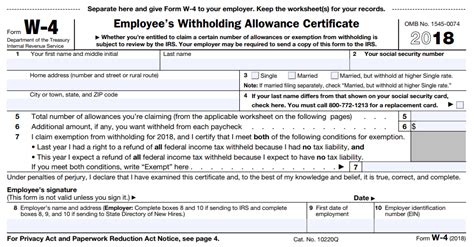

5 Ways Check IRS Paperwork Status

Introduction to Checking IRS Paperwork Status

When dealing with the Internal Revenue Service (IRS), it’s essential to stay on top of your paperwork status, especially if you’re waiting for a refund, responding to an audit, or dealing with any other tax-related issue. The IRS provides several methods to check the status of your paperwork, ensuring you can plan and manage your finances effectively. In this article, we’ll explore five ways to check your IRS paperwork status, making it easier for you to navigate the system.

Understanding the Importance of Checking IRS Paperwork Status

Checking the status of your IRS paperwork is crucial for several reasons. It helps you track the progress of your tax return, refund, or any pending issues. This information can also be vital for financial planning, as knowing when to expect your refund or the resolution of an issue can significantly impact your budgeting and savings. Moreover, staying informed about the status of your paperwork can help you identify and address any potential problems early on, reducing the risk of delays or complications.

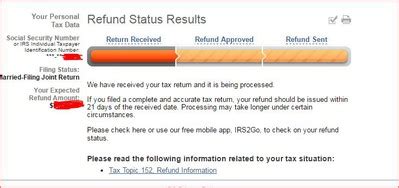

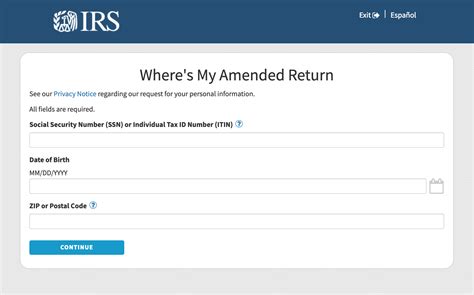

Method 1: Using the IRS Website

The IRS website is a convenient and accessible way to check the status of your paperwork. By visiting irs.gov, you can use the “Where’s My Refund?” tool or the “IRS Account” tool to get updates on your tax return, refund, or account information. To use these tools, you’ll need to provide some personal and tax-related information to verify your identity. The website is available 24⁄7, making it easy to check your status at any time.

Method 2: Calling the IRS

Another way to check the status of your IRS paperwork is by calling the IRS directly. The IRS provides a phone number that you can call to speak with a representative who can help you with your inquiry. It’s essential to have your tax-related information ready, such as your Social Security number or Individual Taxpayer Identification Number (ITIN), to verify your identity. Be prepared for potential wait times, especially during peak tax seasons.

Method 3: Visiting a Local IRS Office

For those who prefer in-person assistance or have complex issues that require face-to-face interaction, visiting a local IRS office can be a viable option. IRS offices are located throughout the country, and you can find the nearest one by using the IRS website or calling the IRS. Before visiting, it’s a good idea to call ahead and confirm their hours of operation and the services they offer. This method can be particularly helpful for individuals who need assistance with filling out forms or have questions that require detailed explanations.

Method 4: Using the IRS2Go App

The IRS2Go app is a mobile application that allows you to check the status of your refund, make payments, and find free tax preparation assistance, among other services. This app is available for both Android and iOS devices and provides a convenient way to access your tax information on the go. By downloading and installing the app, you can stay connected with the IRS and manage your tax affairs more efficiently.

Method 5: Checking Your Mail

Lastly, the IRS often sends notifications by mail regarding the status of your paperwork. It’s essential to regularly check your mail for any correspondence from the IRS, as these letters can provide critical updates on your tax return, refund, or any issues that require your attention. If you’ve moved recently, ensure that the IRS has your current address to avoid missing important communications.

📝 Note: Always keep your tax-related documents and information secure to protect your identity and financial data.

In summary, checking the status of your IRS paperwork is a straightforward process that can be done through various methods, including the IRS website, phone, local offices, the IRS2Go app, and by checking your mail. Each method has its advantages, and choosing the right one depends on your personal preferences and the nature of your inquiry. By staying informed about your paperwork status, you can better manage your financial affairs and ensure a smoother interaction with the IRS.

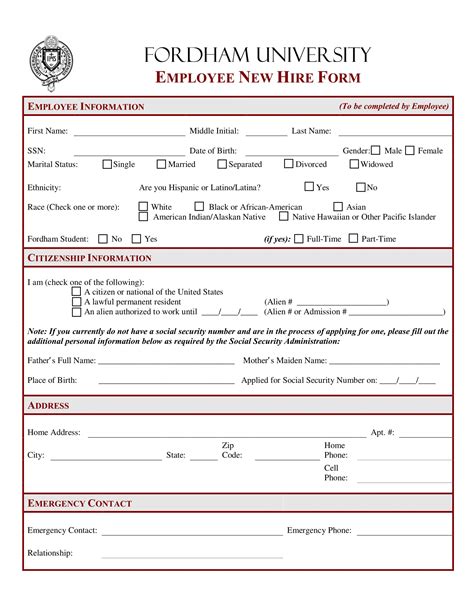

What information do I need to check my IRS paperwork status online?

+

To check your IRS paperwork status online, you’ll need to provide your Social Security number or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact amount of your refund.

How long does it take for the IRS to process a tax return?

+

The time it takes for the IRS to process a tax return can vary, but generally, it takes around 2-3 weeks for electronic returns and 6-8 weeks for paper returns.

What if I haven’t received my refund yet?

+

If you haven’t received your refund yet, you can check the status using the IRS website or by calling the IRS. Ensure you have your tax return information ready to verify your identity and track your refund.