Maryland LLC Amendment Filing

Maryland LLC Amendment Filing: A Comprehensive Guide

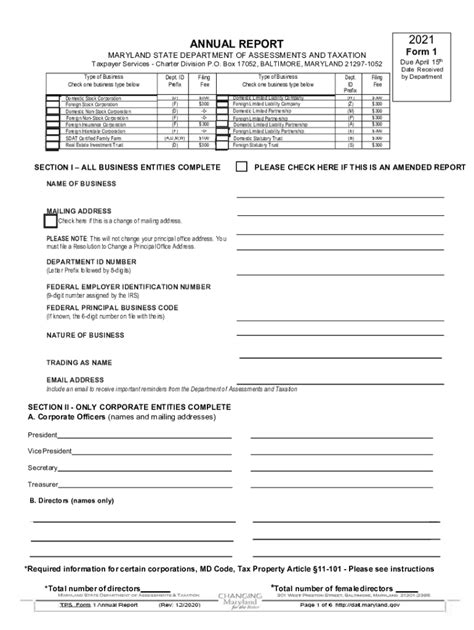

In the state of Maryland, limited liability companies (LLCs) are required to file amendments with the state when certain changes occur. These changes can include updates to the company’s name, address, purpose, or management structure. Filing an amendment is essential to ensure that the state’s records are up-to-date and accurate. In this article, we will delve into the process of Maryland LLC amendment filing, including the necessary steps, required documents, and potential consequences of failing to file.

Why File an Amendment?

There are several reasons why an LLC in Maryland may need to file an amendment. Some of the most common reasons include: * Change of name: If the LLC decides to change its name, it must file an amendment with the state to reflect the new name. * Change of address: If the LLC’s principal address or mailing address changes, it must file an amendment to update the state’s records. * Change of purpose: If the LLC’s purpose or business activities change, it may need to file an amendment to reflect the new purpose. * Change of management structure: If the LLC’s management structure changes, such as a change from member-managed to manager-managed, it must file an amendment to update the state’s records.

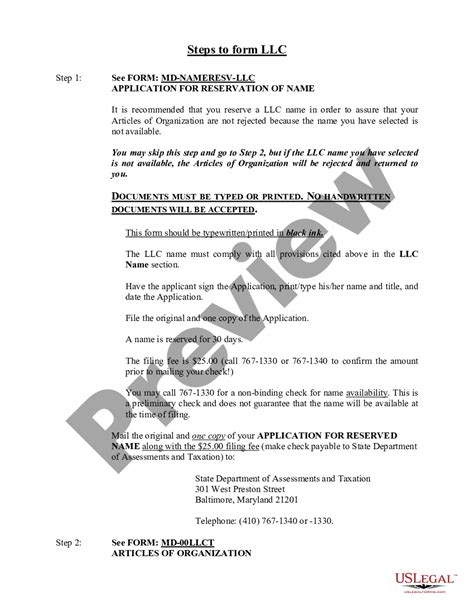

Steps to File an Amendment

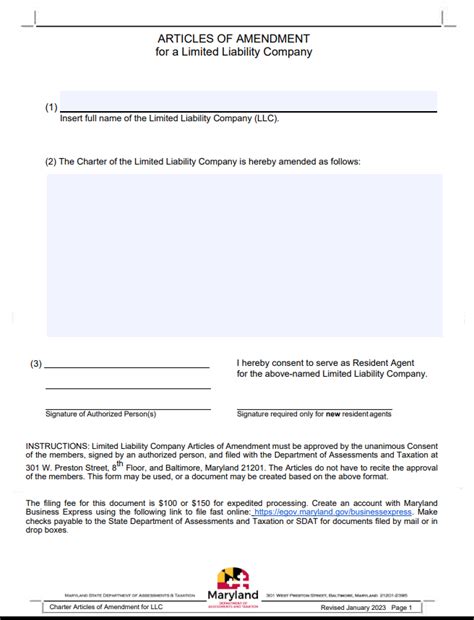

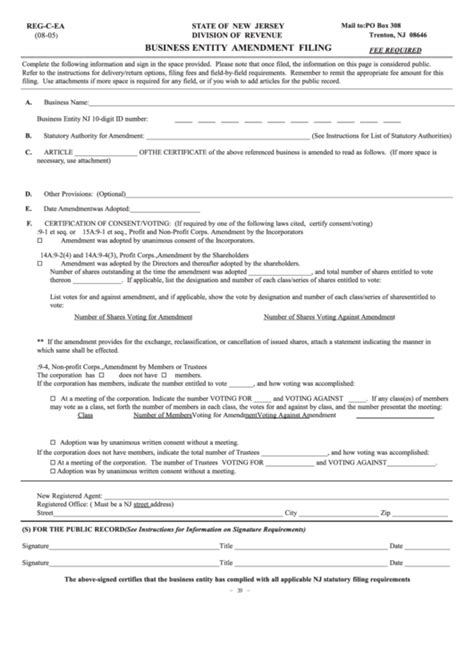

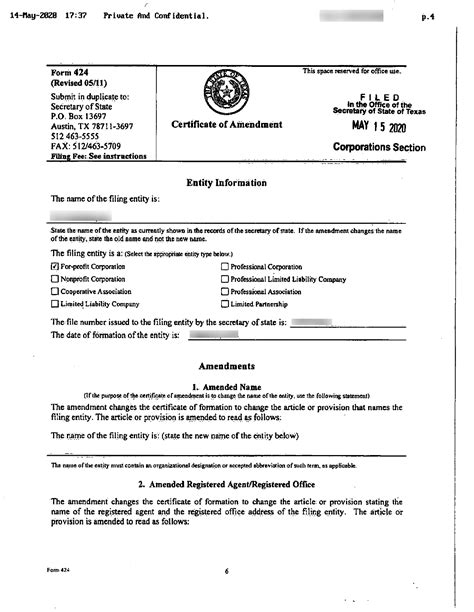

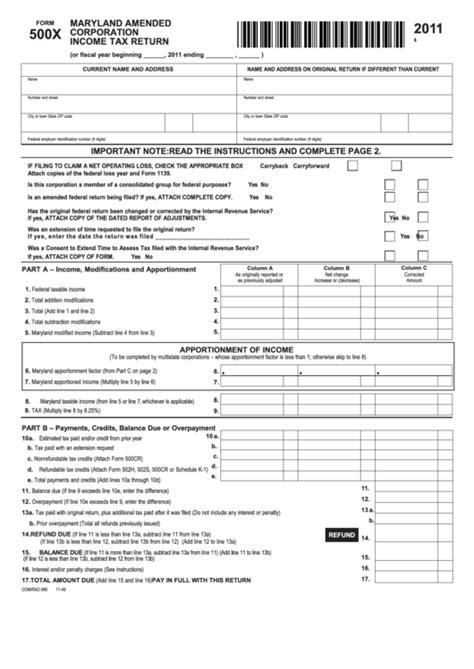

To file an amendment in Maryland, the following steps must be taken: * Obtain the necessary forms: The Maryland State Department of Assessments and Taxation (SDAT) provides the necessary forms for filing an amendment. The forms can be downloaded from the SDAT website or obtained by contacting the SDAT office. * Complete the forms: The forms must be completed accurately and thoroughly. The LLC must provide all required information, including the company’s name, address, and purpose. * Attach required documents: Depending on the nature of the amendment, additional documents may be required. For example, if the LLC is changing its name, it must attach a certified copy of the resolution adopting the new name. * File the amendment: The completed forms and required documents must be filed with the SDAT. The filing can be done online or by mail. * Pay the filing fee: A filing fee is required to file an amendment in Maryland. The fee is currently $100, but it is subject to change.

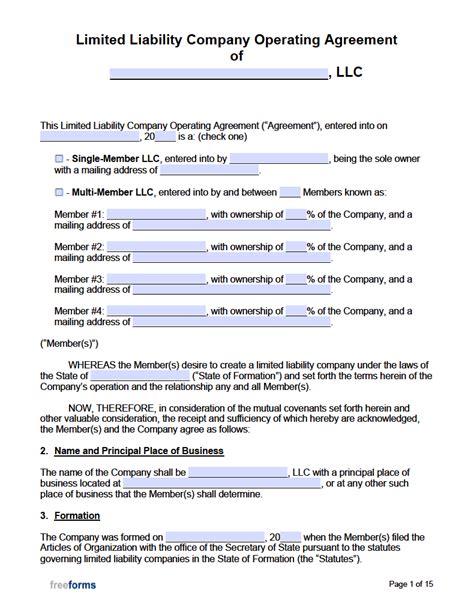

Required Documents

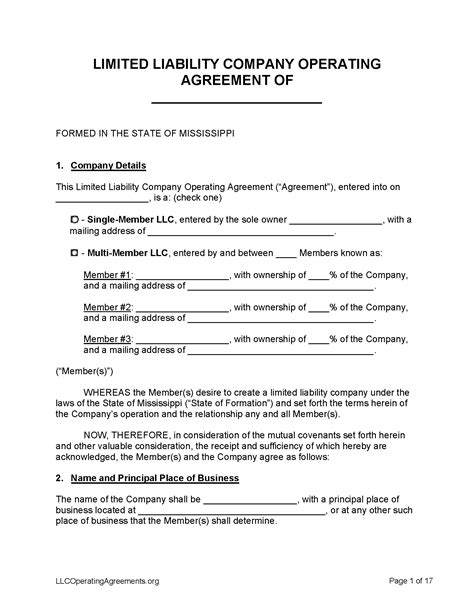

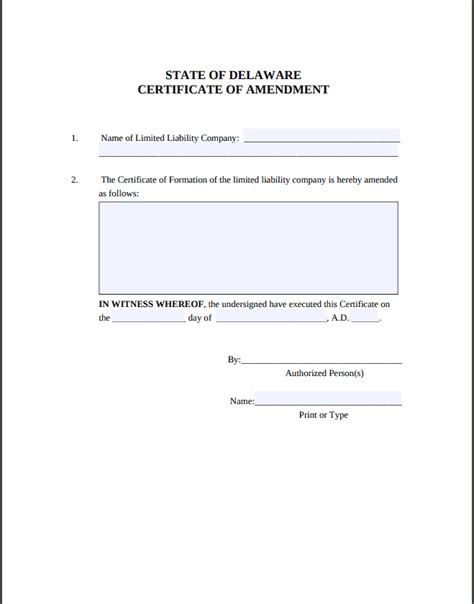

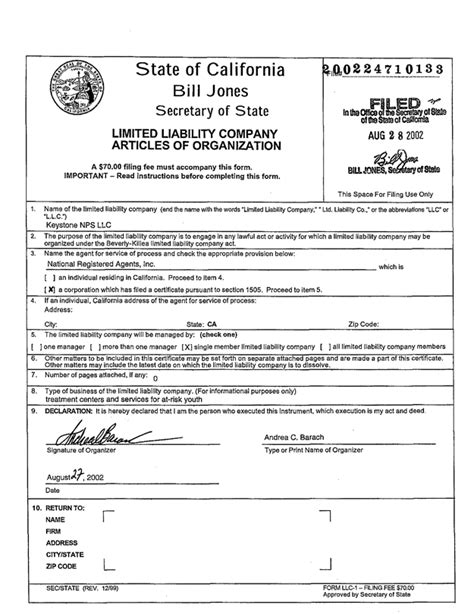

The following documents are required to file an amendment in Maryland: * Articles of Amendment: This form is used to make changes to the LLC’s articles of organization. * Certificate of Amendment: This form is used to certify that the amendment has been adopted by the LLC. * Resolution: A resolution is required to adopt the amendment. The resolution must be certified by the LLC’s authorized representative. * Other documents: Depending on the nature of the amendment, other documents may be required. For example, if the LLC is changing its name, it must attach a certified copy of the resolution adopting the new name.

| Document | Description |

|---|---|

| Articles of Amendment | Used to make changes to the LLC's articles of organization |

| Certificate of Amendment | Used to certify that the amendment has been adopted by the LLC |

| Resolution | Required to adopt the amendment |

💡 Note: It is essential to review the SDAT website or consult with an attorney to ensure that all required documents are obtained and completed accurately.

Potential Consequences of Failing to File

Failing to file an amendment in Maryland can have serious consequences, including: * Loss of good standing: If the LLC fails to file an amendment, it may lose its good standing with the state. * Penalties and fines: The LLC may be subject to penalties and fines for failing to file an amendment. * Delay in business activities: Failing to file an amendment can delay the LLC’s business activities, including the ability to enter into contracts and conduct business with the state.

In summary, filing an amendment is a crucial step in maintaining the accuracy of an LLC’s records with the state of Maryland. By following the necessary steps and obtaining the required documents, an LLC can ensure that its records are up-to-date and accurate. Failing to file an amendment can have serious consequences, including loss of good standing, penalties, and fines.

What is the purpose of filing an amendment in Maryland?

+

The purpose of filing an amendment in Maryland is to update the state's records to reflect changes to the LLC's name, address, purpose, or management structure.

What are the required documents for filing an amendment in Maryland?

+

The required documents for filing an amendment in Maryland include the Articles of Amendment, Certificate of Amendment, and Resolution, among others.

What are the potential consequences of failing to file an amendment in Maryland?

+

The potential consequences of failing to file an amendment in Maryland include loss of good standing, penalties, and fines, as well as delays in business activities.

In final consideration, the process of Maryland LLC amendment filing is a crucial aspect of maintaining the accuracy of an LLC’s records with the state. By understanding the necessary steps and required documents, an LLC can ensure that its records are up-to-date and accurate, avoiding potential consequences and delays in business activities.