File Nonprofit Tax Illinois

Understanding Nonprofit Taxation in Illinois

In the state of Illinois, nonprofit organizations play a crucial role in addressing various social, cultural, and economic issues. These organizations, which are typically exempt from paying federal income taxes, are also subject to specific state regulations and tax requirements. Understanding the nuances of nonprofit taxation in Illinois is essential for these organizations to maintain their tax-exempt status and ensure compliance with state laws.

Types of Nonprofit Organizations in Illinois

There are several types of nonprofit organizations in Illinois, including: * 501©(3) organizations: These are charitable organizations that are exempt from federal income taxes and are eligible to receive tax-deductible donations. * 501©(4) organizations: These are social welfare organizations that are exempt from federal income taxes but are not eligible to receive tax-deductible donations. * 501©(6) organizations: These are trade associations that are exempt from federal income taxes but are not eligible to receive tax-deductible donations. * 501©(7) organizations: These are social clubs that are exempt from federal income taxes but are not eligible to receive tax-deductible donations.

Illinois State Tax Requirements

Nonprofit organizations in Illinois are required to file certain tax returns and reports with the state. These include: * Annual Report: Nonprofit organizations are required to file an annual report with the Illinois Secretary of State’s office, which includes information about the organization’s purpose, activities, and financial condition. * Form IL-990-T: Nonprofit organizations are required to file Form IL-990-T with the Illinois Department of Revenue, which reports the organization’s income, expenses, and tax liabilities. * Form IL-1120: Nonprofit organizations that are subject to the Illinois income tax are required to file Form IL-1120 with the Illinois Department of Revenue, which reports the organization’s income, expenses, and tax liabilities.

Exemptions and Deductions

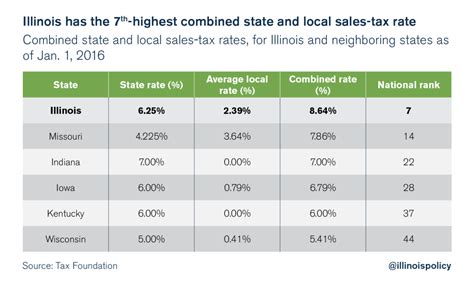

Nonprofit organizations in Illinois may be eligible for certain exemptions and deductions, including: * Sales Tax Exemption: Nonprofit organizations may be exempt from paying sales tax on certain purchases, such as office supplies and equipment. * Property Tax Exemption: Nonprofit organizations may be exempt from paying property taxes on certain properties, such as those used for charitable or educational purposes. * Income Tax Deduction: Donors to nonprofit organizations may be eligible to deduct their contributions from their taxable income.

| Type of Exemption | Requirements | Benefits |

|---|---|---|

| Sales Tax Exemption | Must be a qualified nonprofit organization | Exemption from sales tax on certain purchases |

| Property Tax Exemption | Must be a qualified nonprofit organization and use the property for charitable or educational purposes | Exemption from property taxes on certain properties |

| Income Tax Deduction | Must be a qualified charitable organization and the donor must itemize their deductions | Deduction from taxable income for donations to qualified charitable organizations |

📝 Note: Nonprofit organizations in Illinois must carefully review the state's tax laws and regulations to ensure compliance and take advantage of available exemptions and deductions.

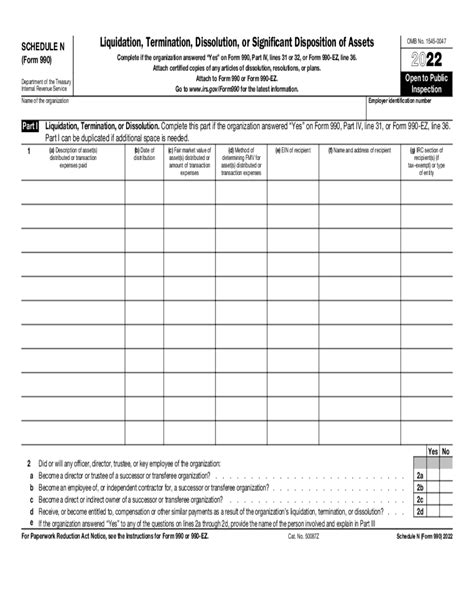

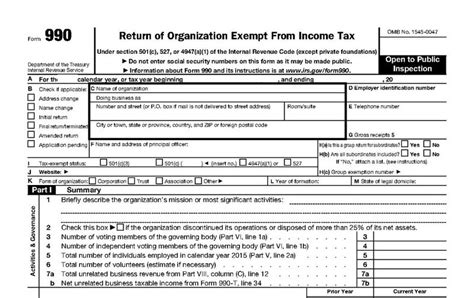

Compliance and Reporting Requirements

Nonprofit organizations in Illinois must comply with certain reporting requirements, including: * Annual Audit: Nonprofit organizations with annual revenues over $500,000 are required to undergo an annual audit by an independent certified public accountant. * Form 990: Nonprofit organizations are required to file Form 990 with the Internal Revenue Service, which reports the organization’s income, expenses, and activities. * Illinois Charitable Trust Act: Nonprofit organizations that solicit donations in Illinois must comply with the Illinois Charitable Trust Act, which requires registration and reporting with the Illinois Attorney General’s office.

In summary, nonprofit organizations in Illinois must navigate a complex web of state and federal tax laws and regulations to maintain their tax-exempt status and ensure compliance. By understanding the nuances of nonprofit taxation in Illinois, these organizations can take advantage of available exemptions and deductions, while also fulfilling their reporting and compliance requirements.

What is the purpose of the Illinois Charitable Trust Act?

+

The Illinois Charitable Trust Act requires nonprofit organizations that solicit donations in Illinois to register and report with the Illinois Attorney General's office, in order to protect donors and ensure transparency and accountability in charitable fundraising.

What is the difference between a 501(c)(3) and a 501(c)(4) organization?

+

A 501(c)(3) organization is a charitable organization that is exempt from federal income taxes and is eligible to receive tax-deductible donations, while a 501(c)(4) organization is a social welfare organization that is exempt from federal income taxes but is not eligible to receive tax-deductible donations.

What are the reporting requirements for nonprofit organizations in Illinois?

+

Nonprofit organizations in Illinois must file an annual report with the Illinois Secretary of State's office, as well as Form IL-990-T and Form IL-1120 with the Illinois Department of Revenue, and may also be required to file Form 990 with the Internal Revenue Service.

Ultimately, nonprofit organizations in Illinois must prioritize compliance and transparency in their financial reporting and tax practices, in order to maintain the trust and confidence of their donors, stakeholders, and the broader community. By understanding and navigating the complex landscape of nonprofit taxation in Illinois, these organizations can focus on their core missions and activities, while also ensuring long-term sustainability and success.