5 Tips 501c3

Understanding the Basics of 501c3 Organizations

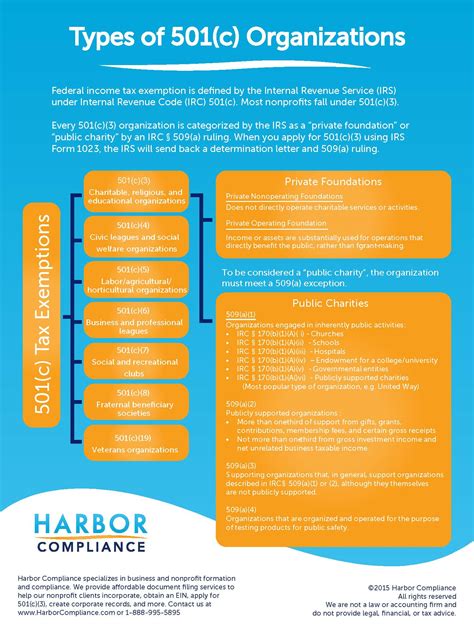

When it comes to nonprofit organizations, one of the most crucial aspects to understand is the 501c3 designation. This status, granted by the Internal Revenue Service (IRS), signifies that an organization is exempt from federal income tax and is eligible to receive tax-deductible donations. In this article, we will delve into the world of 501c3 organizations, exploring what they are, their benefits, and providing essential tips for those looking to establish or manage a 501c3 nonprofit.

What is a 501c3 Organization?

A 501c3 organization is a type of nonprofit organization that has been granted tax-exempt status by the IRS. The name “501c3” comes from the relevant section of the IRS tax code. To qualify for this designation, an organization must meet specific criteria, including being organized and operated exclusively for one or more of the following purposes: charitable, educational, scientific, religious, or literary. Additionally, no part of the organization’s net earnings can benefit private individuals, and the organization cannot engage in political campaigns or substantial lobbying activities.

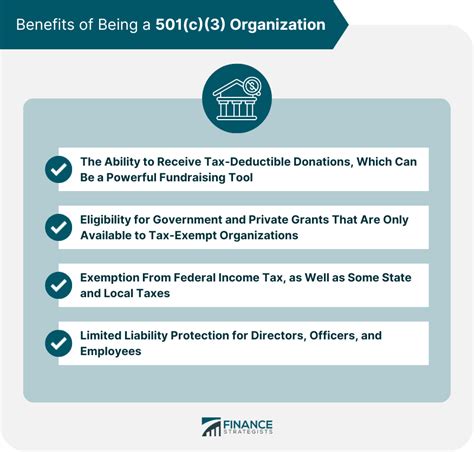

Benefits of Being a 501c3 Organization

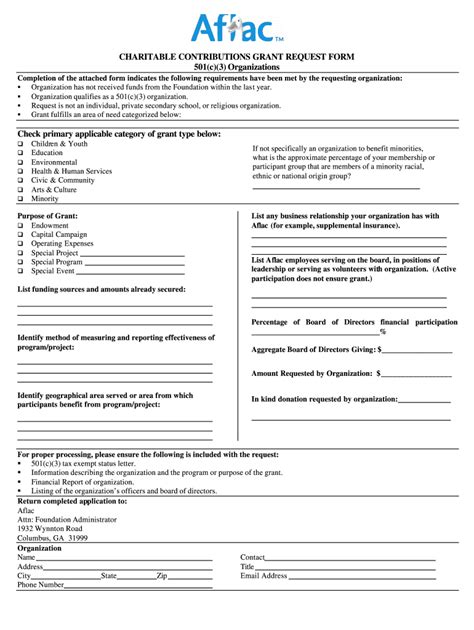

There are numerous benefits associated with being a 501c3 organization. One of the most significant advantages is the ability to receive tax-deductible donations. This can greatly enhance an organization’s fundraising capabilities, as donors can claim deductions on their contributions. Other benefits include: - Exemption from federal income tax: This means the organization does not have to pay taxes on its income, allowing it to allocate more resources towards its mission. - Eligibility for grants: Many foundations and corporate giving programs provide grants only to 501c3 organizations. - Credibility and trust: The 501c3 status can enhance an organization’s reputation and credibility with the public and donors, as it signifies compliance with IRS regulations.

5 Essential Tips for 501c3 Organizations

For those looking to establish or successfully manage a 501c3 organization, here are five essential tips:

- Ensure Compliance with IRS Regulations: Maintaining tax-exempt status requires adherence to IRS rules and regulations. This includes filing the annual Form 990 and ensuring that all activities align with the organization’s exempt purpose.

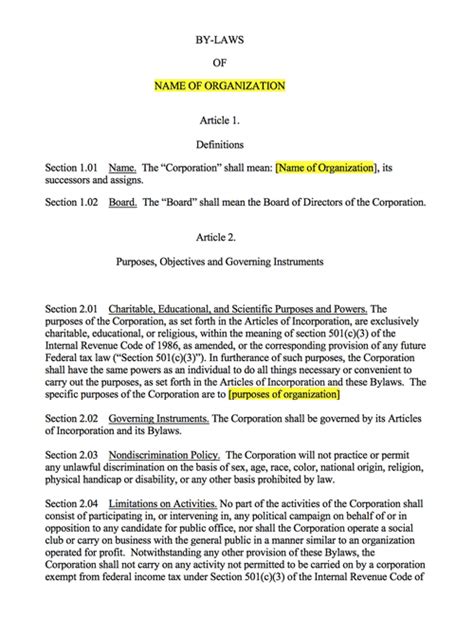

- Develop a Strong Governance Structure: A well-defined governance structure, including a board of directors, is crucial for the success and accountability of a 501c3 organization. The board should oversee financial management, ensure compliance with laws and regulations, and guide strategic decisions.

- Focus on Transparency and Accountability: Transparency in financial dealings and operational activities can build trust among donors and the public. Regular audits, clear financial reporting, and an open communication policy can help maintain this transparency.

- Build a Diverse and Engaged Board of Directors: A diverse board with a range of skills and experiences can provide valuable insights and guidance. Ensuring that board members are engaged and committed to the organization’s mission is key to effective governance and strategic decision-making.

- Stay Informed About Legal and Regulatory Changes: The legal and regulatory landscape for nonprofits is continually evolving. Staying updated on changes in tax laws, fundraising regulations, and other relevant areas can help a 501c3 organization navigate challenges and opportunities effectively.

Additional Considerations

In addition to these tips, it’s essential for 501c3 organizations to understand the importance of community engagement and strategic planning. Building strong relationships with the community and other stakeholders can enhance an organization’s impact and support base. A strategic plan that outlines the organization’s mission, goals, and objectives can serve as a roadmap for success, helping to guide decision-making and resource allocation.

💡 Note: Establishing and managing a 501c3 organization requires careful planning, adherence to regulations, and a deep commitment to the organization's mission. By following these tips and staying informed, nonprofits can navigate the complexities of the 501c3 landscape and achieve their goals.

Conclusion and Final Thoughts

In conclusion, the 501c3 designation is a vital aspect of the nonprofit sector, offering numerous benefits that can enhance an organization’s ability to fulfill its mission. By understanding the basics of 501c3 organizations, following essential tips for compliance and management, and staying committed to transparency, accountability, and community engagement, nonprofits can thrive and make a lasting impact. As the nonprofit sector continues to evolve, the importance of informed leadership and strategic planning will only continue to grow, ensuring that 501c3 organizations remain at the forefront of charitable, educational, and community-driven initiatives.

What are the primary purposes of a 501c3 organization?

+

A 501c3 organization must be organized and operated exclusively for charitable, educational, scientific, religious, or literary purposes.

How does a nonprofit apply for 501c3 status?

+

To apply for 501c3 status, a nonprofit must file Form 1023 with the IRS, providing detailed information about its mission, structure, and financial plans.

Can a 501c3 organization engage in political activities?

+

No, a 501c3 organization is prohibited from engaging in political campaigns or substantial lobbying activities. Limited lobbying is permissible, but the organization must ensure it does not become a substantial part of its activities.