5 Tips I9

Introduction to I-9 Compliance

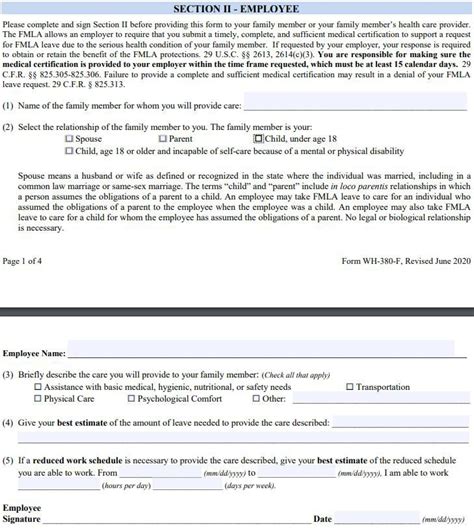

The I-9 form is a crucial document for employers in the United States, as it verifies the identity and employment authorization of newly hired employees. The form is used by U.S. Citizenship and Immigration Services (USCIS) to ensure that employers are hiring eligible workers. Completing the I-9 form correctly is essential to avoid penalties and fines. In this article, we will discuss 5 tips to help employers navigate the I-9 compliance process.

Tip 1: Understand the I-9 Form Requirements

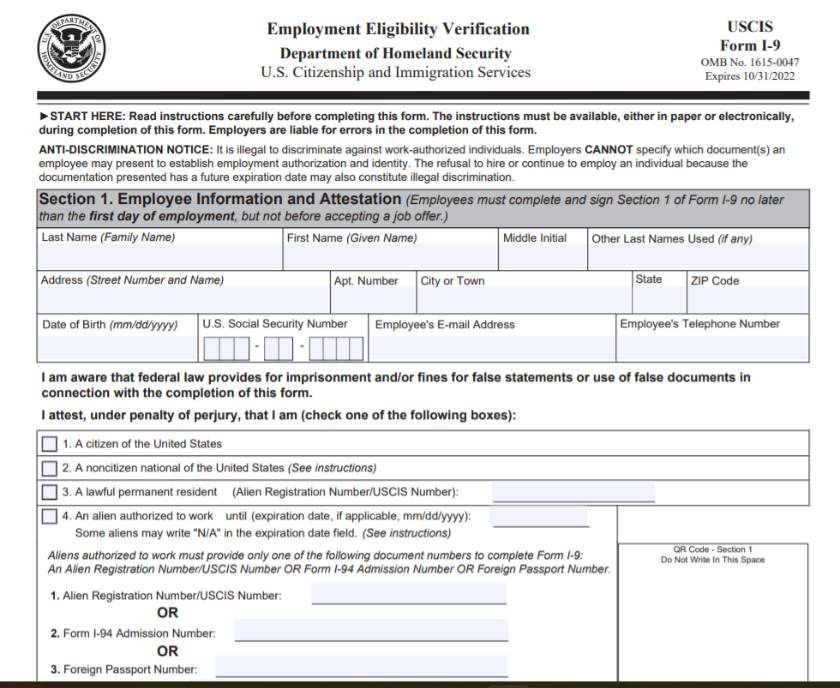

The I-9 form has several sections that must be completed accurately. Employers must ensure that Section 1 is completed by the employee on the first day of work, while Section 2 must be completed by the employer within three business days of the employee’s first day of work. It is essential to review the form carefully and ensure that all required fields are completed. The form requires employees to provide documentation to establish their identity and employment authorization.

Tip 2: Choose the Correct Documentation

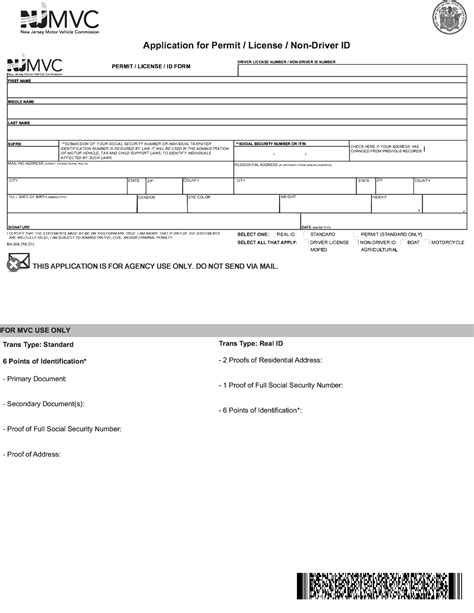

Employees must provide unexpired documents that establish their identity and employment authorization. The most common documents used for I-9 verification are: * U.S. passport * Driver’s license * Social Security card * Permanent Resident Card * Employment Authorization Document (EAD) Employers must accept only valid documents and ensure that the documents are unexpired. It is also important to note that employees may choose which documents to present, as long as they meet the I-9 requirements.

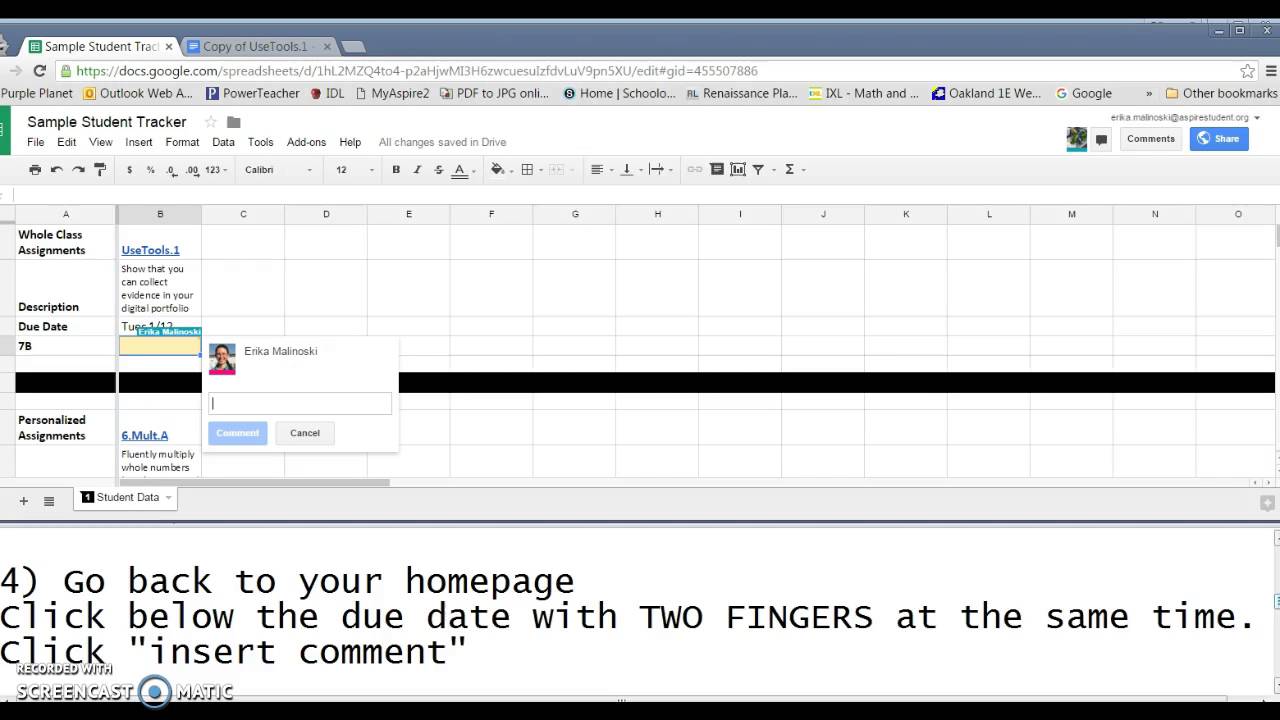

Tip 3: Complete Section 2 Correctly

Section 2 of the I-9 form requires employers to examine the employee’s documents and complete the section based on the documents presented. It is crucial to ensure that the documents are genuine and relate to the employee. Employers must also record the document information accurately, including the document title, issuing authority, and expiration date (if applicable).

Tip 4: Maintain Accurate Records

Employers must retain the I-9 form for each employee, either in paper or electronic format. It is essential to store the forms in a secure location, such as a locked cabinet or a password-protected electronic folder. Employers must also maintain accurate records of the I-9 verification process, including the date of hire, date of I-9 completion, and any updates or corrections made to the form.

Tip 5: Conduct Regular Audits

Regular audits are crucial to ensuring I-9 compliance. Employers should conduct internal audits to review their I-9 forms and processes, identify any errors or discrepancies, and make corrections as needed. It is also essential to be prepared for external audits by USCIS or other government agencies. Employers should maintain a record of their audit findings and any corrective actions taken.

📝 Note: Employers should consult the USCIS website for the most up-to-date information on I-9 compliance and any changes to the form or regulations.

As we summarize the key points, it is clear that I-9 compliance is a critical aspect of hiring and employing workers in the United States. By following these 5 tips, employers can ensure that they are completing the I-9 form correctly, maintaining accurate records, and conducting regular audits to ensure compliance. Remember, I-9 compliance is an ongoing process that requires attention to detail and a commitment to following the regulations.

What is the purpose of the I-9 form?

+

The I-9 form is used to verify the identity and employment authorization of newly hired employees in the United States.

What documents can employees use to establish their identity and employment authorization?

+

Employees can use a variety of documents, including a U.S. passport, driver’s license, Social Security card, Permanent Resident Card, and Employment Authorization Document (EAD).

How long must employers retain the I-9 form for each employee?

+

Employers must retain the I-9 form for each employee for at least three years after the date of hire or one year after the date of termination, whichever is later.