Find Bank on Car Insurance Paperwork

Understanding Car Insurance Paperwork

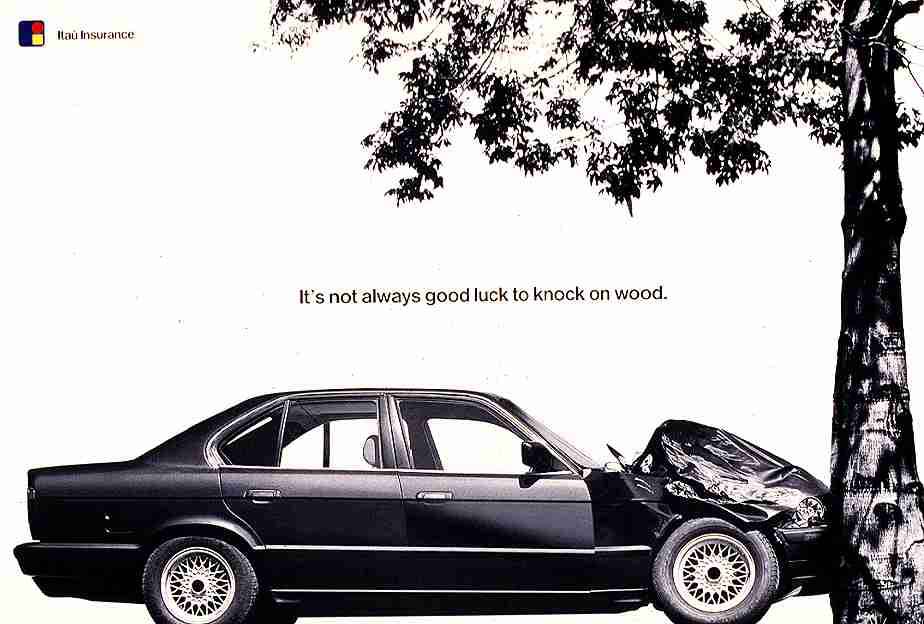

When dealing with car insurance, it’s essential to understand the various documents involved in the process. One crucial aspect of car insurance paperwork is finding the bank information, which is typically required for premium payments or when filing a claim. In this article, we will delve into the world of car insurance paperwork, exploring the different types of documents, where to find bank information, and tips for managing your car insurance documents efficiently.

Types of Car Insurance Documents

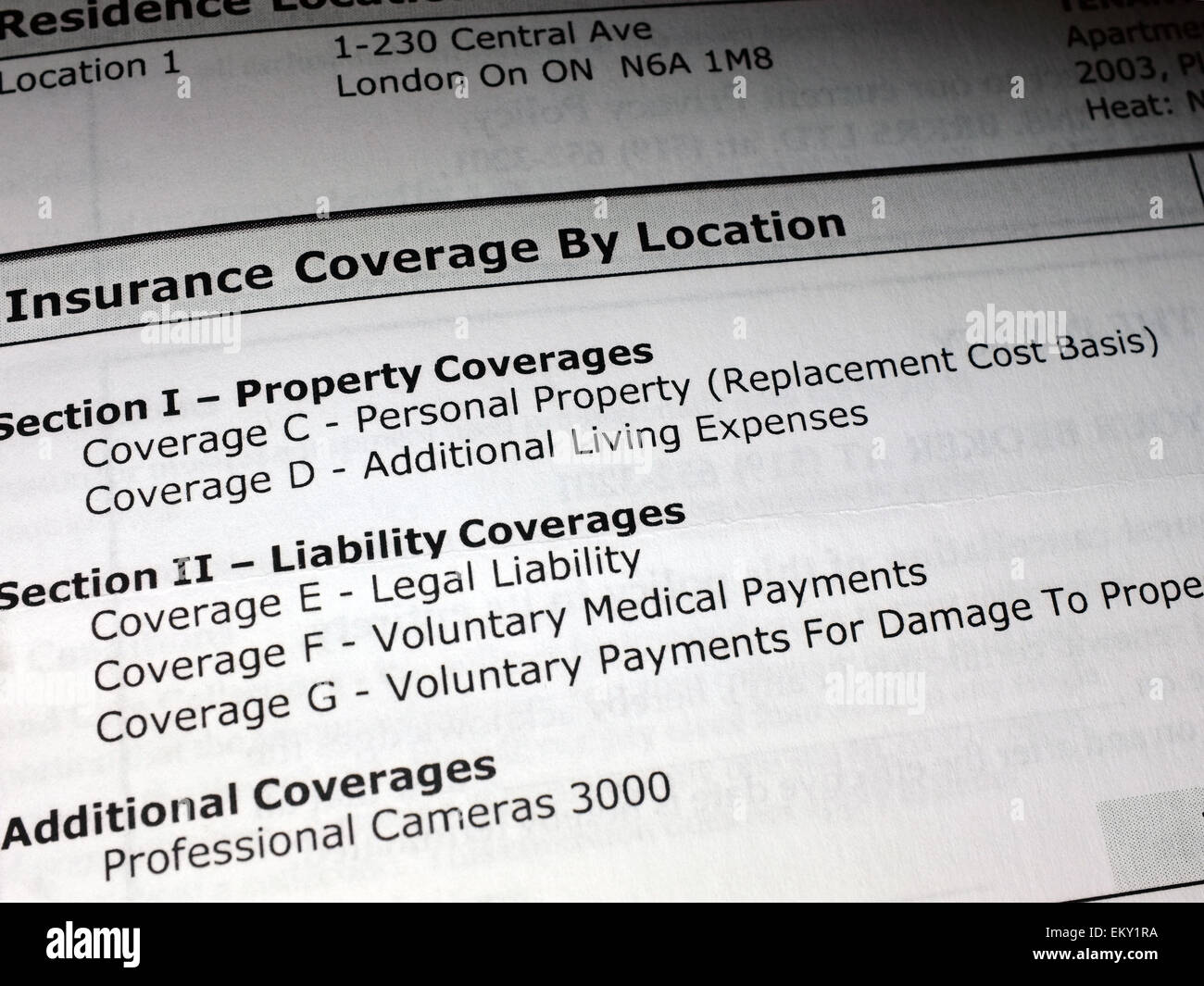

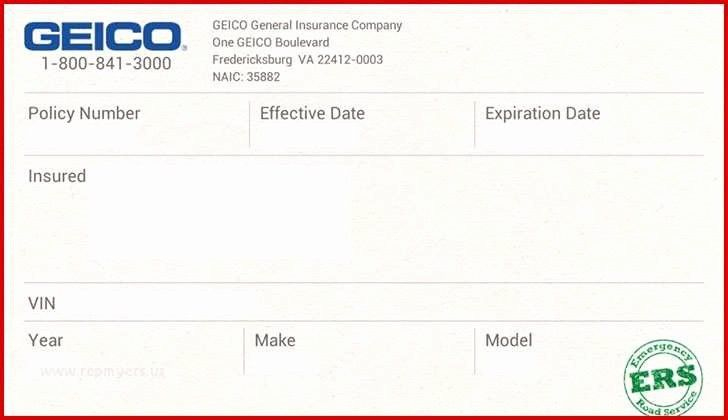

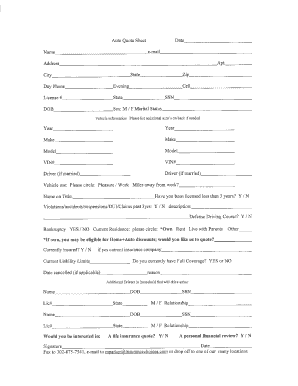

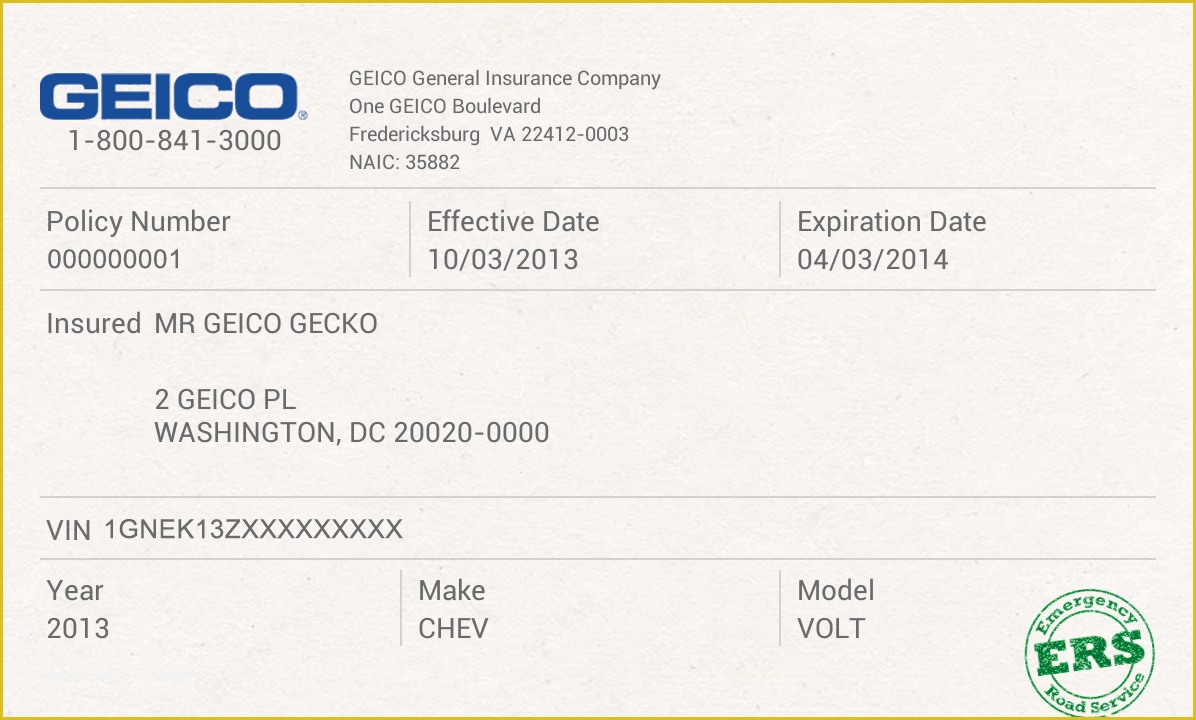

Car insurance documents can be overwhelming, especially for those who are new to the process. Here are some of the most common types of car insurance documents: * Policy documents: These documents outline the terms and conditions of your car insurance policy, including the coverage, deductibles, and premium payments. * Insurance cards: These cards provide proof of insurance and typically include the policy number, vehicle information, and insurance company details. * Claims forms: These forms are used to file a claim with the insurance company in the event of an accident or damage to your vehicle. * Payment receipts: These receipts confirm payment of premiums and can be used as proof of payment.

Locating Bank Information on Car Insurance Paperwork

Finding bank information on car insurance paperwork can be a challenge, especially if you’re not sure where to look. Here are some tips to help you locate the bank information: * Check the policy documents: The policy documents usually include the bank details, such as the account number and routing number, which are required for premium payments. * Look for the payment section: The payment section of the policy documents or insurance cards typically includes the bank information, such as the bank name, account number, and payment instructions. * Review the claims forms: If you’re filing a claim, the claims forms may require bank information, such as the account number and routing number, to facilitate payment of the claim settlement.

| Document Type | Location of Bank Information |

|---|---|

| Policy documents | Payment section or policy terms and conditions |

| Insurance cards | Payment section or back of the card |

| Claims forms | Payment section or claim settlement instructions |

Managing Car Insurance Documents

Managing car insurance documents can be a daunting task, especially if you have multiple policies or vehicles. Here are some tips to help you stay organized: * Keep all documents in a safe place: Store your car insurance documents in a secure location, such as a file cabinet or digital storage device, to prevent loss or damage. * Make digital copies: Scan or photocopy your car insurance documents and store them digitally to ensure you have access to them in case of an emergency. * Review and update documents regularly: Regularly review your car insurance documents to ensure they are up-to-date and accurate, and update them as necessary.

📝 Note: It's essential to keep your car insurance documents organized and easily accessible to avoid delays or complications when filing a claim or making premium payments.

To summarize, car insurance paperwork can be complex, but understanding the different types of documents and where to find bank information can make the process more manageable. By following the tips outlined in this article, you can stay organized and ensure that your car insurance documents are in order.

What types of car insurance documents should I keep?

+

You should keep policy documents, insurance cards, claims forms, and payment receipts.

Where can I find bank information on my car insurance paperwork?

+

You can find bank information on your policy documents, insurance cards, or claims forms, typically in the payment section.

How can I manage my car insurance documents effectively?

+

You can manage your car insurance documents by keeping them in a safe place, making digital copies, and reviewing and updating them regularly.

In the end, understanding car insurance paperwork and managing your documents effectively can save you time and hassle in the long run. By staying organized and informed, you can ensure that you have the necessary documents and information to navigate the car insurance process with confidence.