5 Ways Check PPI

Introduction to PPI Checks

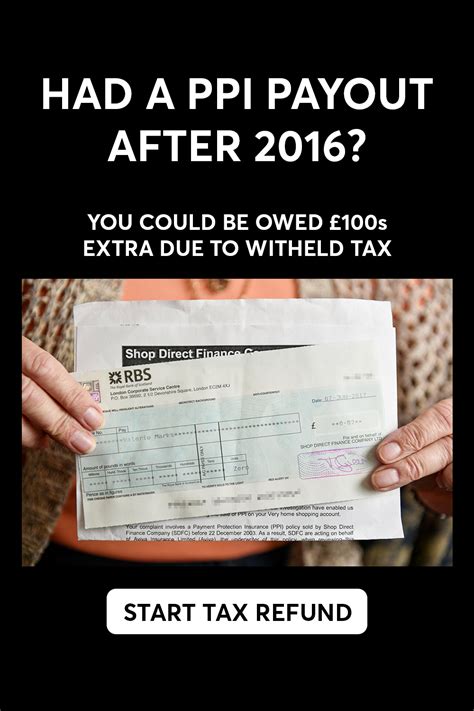

Payment Protection Insurance (PPI) was a type of insurance policy sold alongside loans, credit cards, and other financial products. Its purpose was to cover repayments if the policyholder became unable to work due to illness, injury, or redundancy. However, PPI was often mis-sold, leading to a major scandal in the financial industry. As a result, many people are now checking if they had PPI and if they are eligible for a refund. Here are five ways to check for PPI:

Understanding the Mis-Selling of PPI

Before diving into the methods of checking for PPI, it’s essential to understand how PPI was mis-sold. Mis-selling occurred when PPI was added to financial products without the customer’s knowledge or consent. It was also mis-sold to people who were not eligible to claim, such as the self-employed or those with pre-existing medical conditions. The widespread mis-selling of PPI led to a significant number of complaints and claims for refunds.

Method 1: Check Old Financial Documents

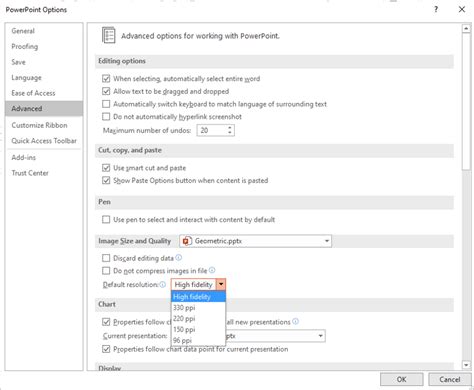

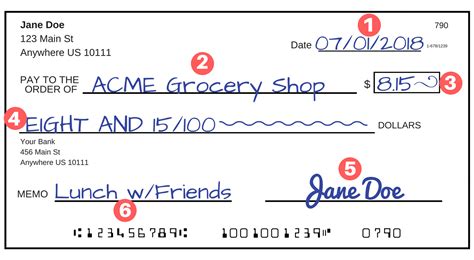

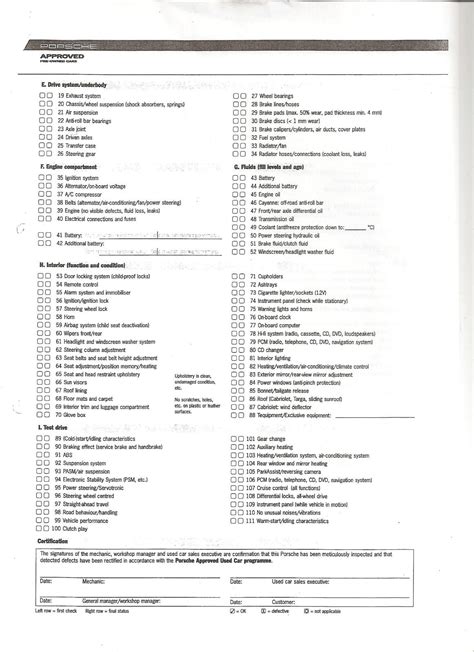

The first step in checking for PPI is to review old financial documents, including loan and credit card statements. Look for any mention of PPI or similar insurance products. Check for the following: * PPI premiums paid * Policy numbers or references * The name of the insurance provider * The date the policy was sold

Method 2: Contact Your Bank or Lender

If you’re unsure about PPI or can’t find any information in your documents, contact your bank or lender directly. They should be able to tell you if you had PPI and provide details about the policy. You can: * Call their customer service number * Visit their website and use their online contact form * Write to their customer service address

Method 3: Use a PPI Checker Tool

Some websites offer PPI checker tools that can help you determine if you had PPI. These tools typically ask for your personal and financial information, then check their databases for any records of PPI policies. However, be cautious when using these tools, as some may charge a fee or sell your information to third parties.

Method 4: Check with the Financial Ombudsman Service

The Financial Ombudsman Service (FOS) is an independent organization that resolves disputes between consumers and financial businesses. You can contact the FOS to see if they have any records of PPI complaints or claims related to your financial products. They may be able to provide guidance on how to proceed with a claim.

Method 5: Use a Claims Management Company

If you’re unsure about how to check for PPI or need help with the claims process, consider using a claims management company. These companies specialize in helping people claim back mis-sold PPI. However, be aware that they will typically charge a fee for their services, and you should carefully research the company before using their services.

📝 Note: When using a claims management company, make sure to check their fees and terms of service before proceeding.

In summary, checking for PPI requires a combination of reviewing old financial documents, contacting your bank or lender, and using online tools or services. By following these methods, you can determine if you had PPI and if you’re eligible for a refund.

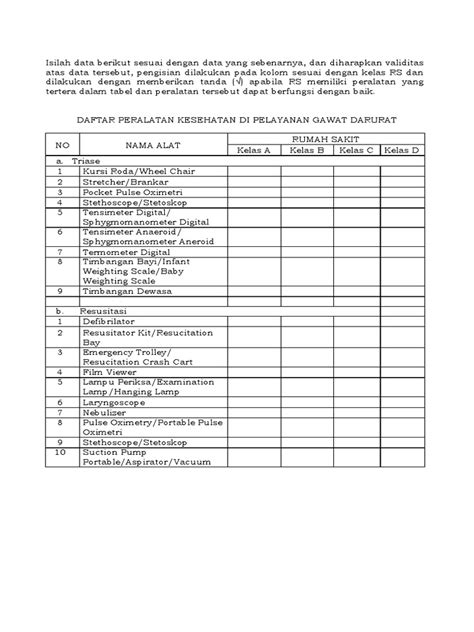

To further illustrate the process, here is a table summarizing the key steps:

| Method | Description |

|---|---|

| Check Old Financial Documents | Review loan and credit card statements for PPI premiums or policy details |

| Contact Your Bank or Lender | Ask your bank or lender about PPI policies and refunds |

| Use a PPI Checker Tool | Utilize online tools to check for PPI policies, but be cautious of fees and data selling |

| Check with the Financial Ombudsman Service | Contact the FOS for guidance on PPI complaints and claims |

| Use a Claims Management Company | Consider hiring a professional to help with the PPI claims process, but research their fees and services |

Looking back on the process, it’s clear that checking for PPI requires patience, persistence, and attention to detail. By following these steps and being mindful of potential pitfalls, you can successfully navigate the process and potentially receive a refund for mis-sold PPI.

What is PPI, and why was it mis-sold?

+

PPI, or Payment Protection Insurance, was a type of insurance policy sold alongside loans, credit cards, and other financial products. It was mis-sold when added to financial products without the customer’s knowledge or consent, or when sold to people who were not eligible to claim.

How do I know if I had PPI?

+

You can check old financial documents, contact your bank or lender, or use online tools to determine if you had PPI. Look for mentions of PPI premiums, policy numbers, or insurance providers in your documents.

Can I claim a refund for mis-sold PPI?

+

Yes, if you were mis-sold PPI, you may be eligible for a refund. Contact your bank or lender, or use a claims management company to help with the process. Be aware of any fees associated with using a claims management company.