Get Estate Paperwork in Pennsylvania

Understanding the Importance of Estate Paperwork in Pennsylvania

Estate planning is a crucial aspect of ensuring that an individual’s assets are distributed according to their wishes after their passing. In Pennsylvania, having the right estate paperwork in place can make a significant difference in how smoothly the probate process unfolds. Estate planning documents such as wills, trusts, and powers of attorney are essential for avoiding unnecessary legal complications and ensuring that the deceased person’s intentions are respected.

Types of Estate Paperwork in Pennsylvania

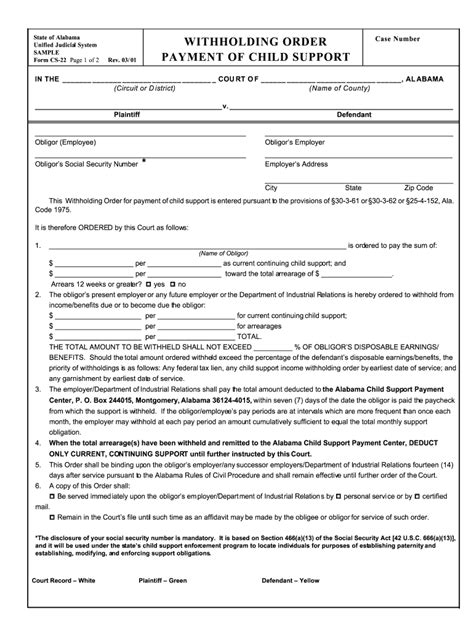

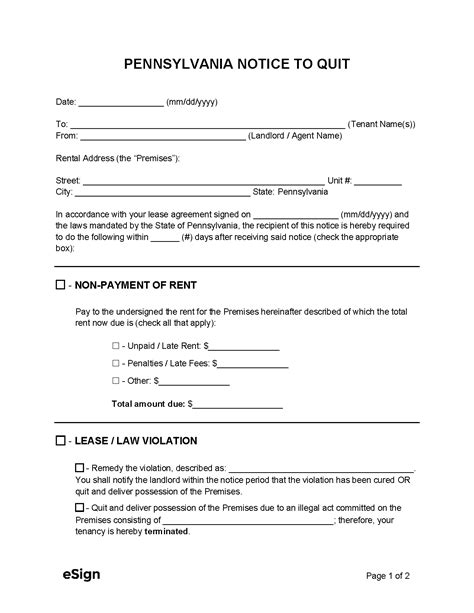

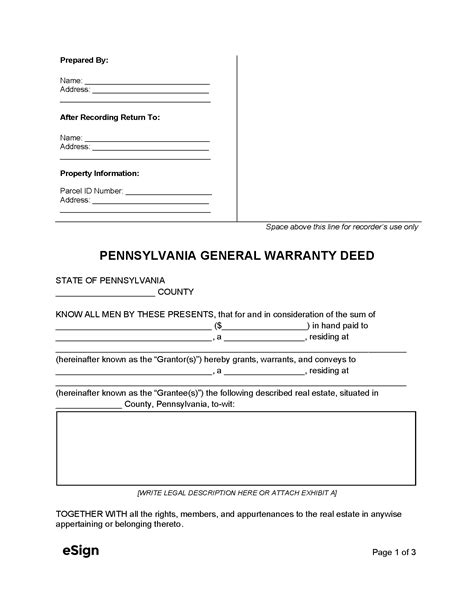

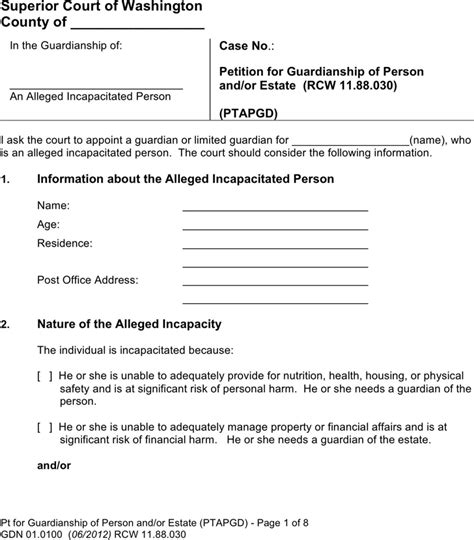

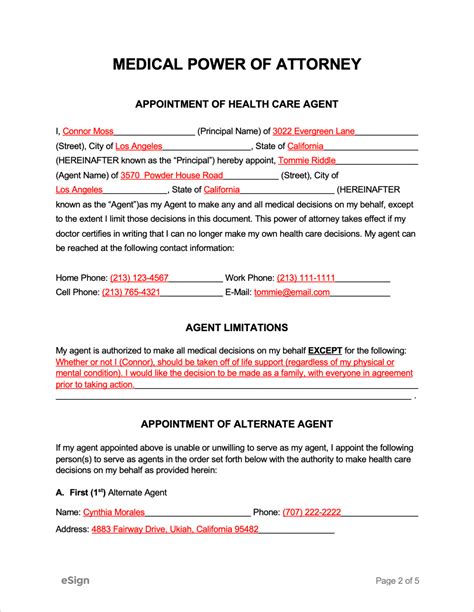

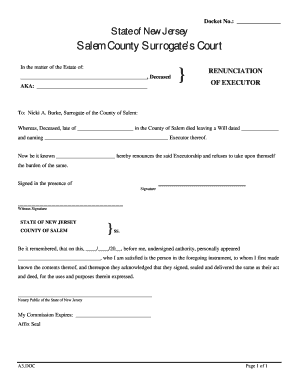

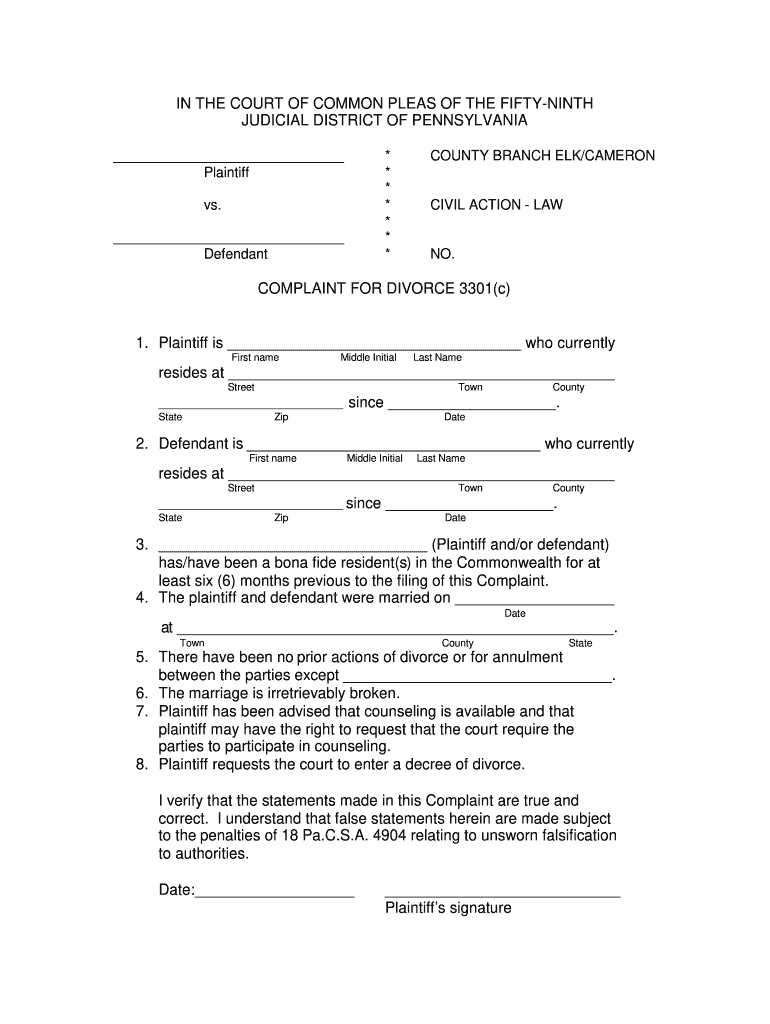

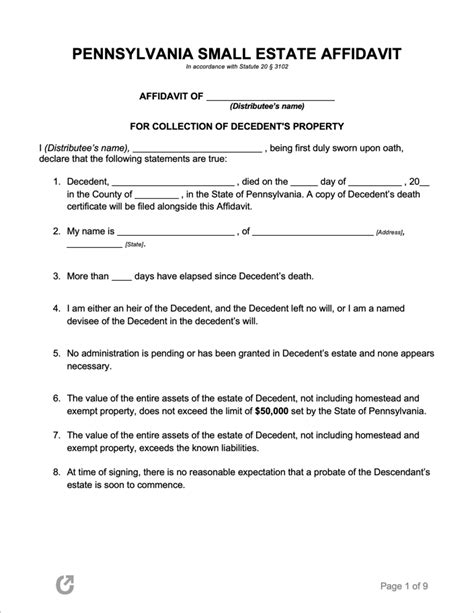

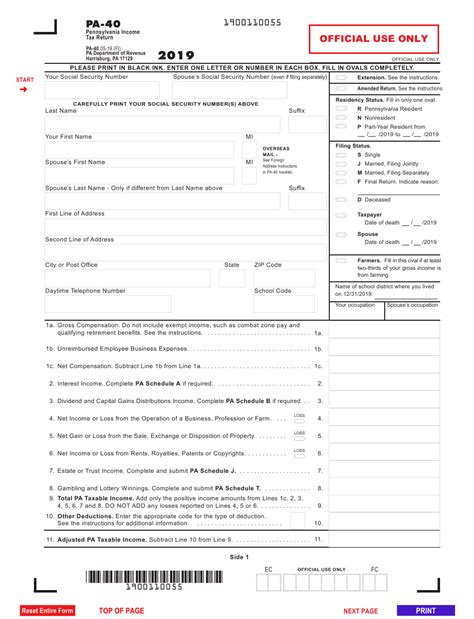

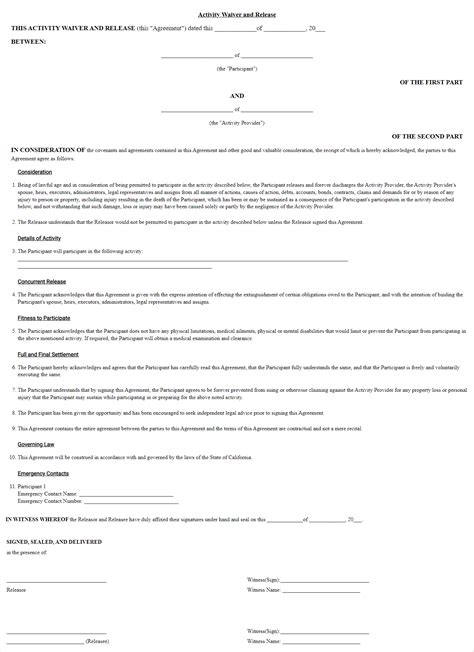

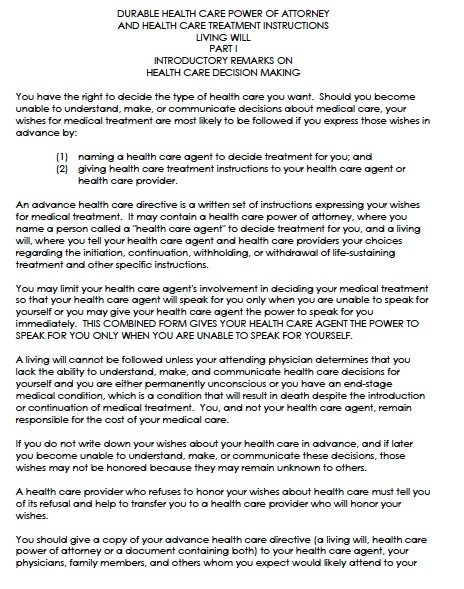

There are several types of estate paperwork that individuals in Pennsylvania should consider as part of their estate planning strategy. These include: * Last Will and Testament: This document outlines how a person’s assets should be distributed after their death. It also names an executor who will be responsible for carrying out the deceased person’s wishes. * Trusts: Trusts are legal arrangements that allow a person to transfer assets to a trust, which is then managed by a trustee for the benefit of the trust’s beneficiaries. * Powers of Attorney: Powers of attorney grant a person the authority to make decisions on behalf of another person if they become incapacitated. * Advance Directives: Advance directives, such as living wills and do-not-resuscitate orders, outline a person’s wishes regarding end-of-life care.

The Process of Obtaining Estate Paperwork in Pennsylvania

Obtaining estate paperwork in Pennsylvania involves several steps: * Consulting with an Attorney: It is recommended that individuals consult with an attorney who specializes in estate planning to ensure that their paperwork is in order. * Gathering Information: The attorney will need information about the individual’s assets, debts, and wishes regarding the distribution of their estate. * Preparing the Documents: The attorney will prepare the necessary estate planning documents, which the individual will then sign in the presence of witnesses. * Storing the Documents: The original documents should be stored in a safe place, such as a fireproof safe or a safe deposit box.

📝 Note: It is essential to keep estate paperwork up to date to ensure that it reflects any changes in an individual's circumstances or wishes.

Benefits of Having Estate Paperwork in Pennsylvania

Having estate paperwork in place can provide several benefits, including: * Avoiding Probate: In some cases, having a trust or other estate planning documents can help avoid the probate process, which can be time-consuming and expensive. * Reducing Taxes: Estate planning documents can help minimize taxes and ensure that the deceased person’s assets are distributed in a tax-efficient manner. * Protecting Beneficiaries: Estate planning documents can help protect beneficiaries from creditors and ensure that they receive the assets intended for them. * Providing Peace of Mind: Having estate paperwork in place can provide peace of mind for individuals and their loved ones, knowing that their wishes will be respected after their passing.

| Type of Document | Purpose |

|---|---|

| Last Will and Testament | Outlines the distribution of assets after death |

| Trusts | Transfers assets to a trust for the benefit of beneficiaries |

| Powers of Attorney | Grants authority to make decisions on behalf of another person |

| Advance Directives | Outlines wishes regarding end-of-life care |

Common Mistakes to Avoid in Estate Planning

There are several common mistakes that individuals should avoid when it comes to estate planning in Pennsylvania, including: * Failing to Update Documents: Failing to update estate planning documents can lead to outdated information and unintended consequences. * Not Having a Will: Not having a will can lead to the state determining how assets are distributed, which may not align with the deceased person’s wishes. * Not Naming Beneficiaries: Not naming beneficiaries can lead to confusion and disputes over who should inherit certain assets. * Not Considering Taxes: Not considering taxes can lead to unnecessary tax liabilities and reduced inheritances for beneficiaries.

In the end, having estate paperwork in place is essential for ensuring that an individual’s wishes are respected after their passing. By understanding the importance of estate planning and avoiding common mistakes, individuals in Pennsylvania can provide peace of mind for themselves and their loved ones.

What is the purpose of a last will and testament in Pennsylvania?

+

The purpose of a last will and testament in Pennsylvania is to outline how a person’s assets should be distributed after their death.

Do I need an attorney to prepare my estate planning documents in Pennsylvania?

+

While it is possible to prepare estate planning documents without an attorney, it is highly recommended that individuals consult with an attorney who specializes in estate planning to ensure that their documents are valid and effective.

How often should I review and update my estate planning documents in Pennsylvania?

+

It is recommended that individuals review and update their estate planning documents every 5-10 years, or as needed, to ensure that they reflect any changes in their circumstances or wishes.