Legal Gift Deed Paperwork

Introduction to Legal Gift Deed Paperwork

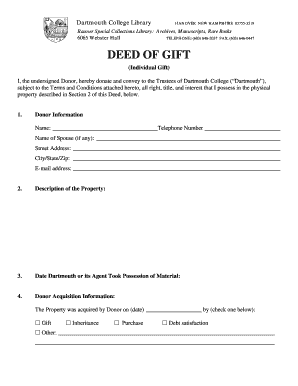

When it comes to transferring ownership of a property or any other valuable asset, it is essential to have the right legal documents in place. A gift deed is a type of legal document that is used to transfer ownership of a property from one person to another without any exchange of money or other compensation. In this blog post, we will delve into the world of legal gift deed paperwork, exploring the importance of having the right documents, the key elements that should be included, and the steps involved in creating a valid gift deed.

Understanding the Importance of Gift Deed Paperwork

A gift deed is a legally binding document that serves as proof of the transfer of ownership of a property. It is essential to have a gift deed in place to avoid any potential disputes or legal issues that may arise in the future. A well-drafted gift deed can help to prevent misunderstandings and ensure that the transfer of ownership is smooth and hassle-free. Moreover, a gift deed can also help to minimize the risk of tax implications and other financial consequences that may arise from the transfer of ownership.

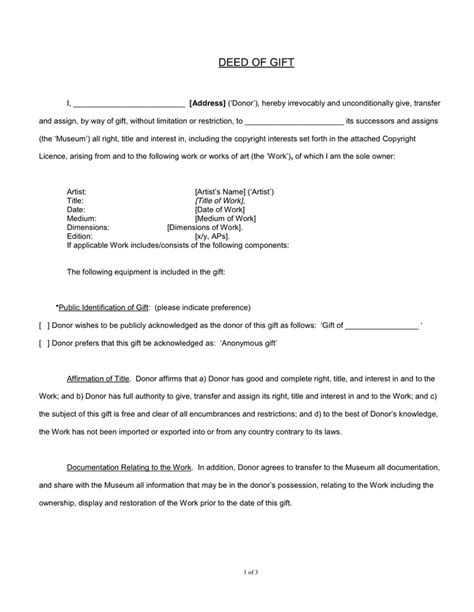

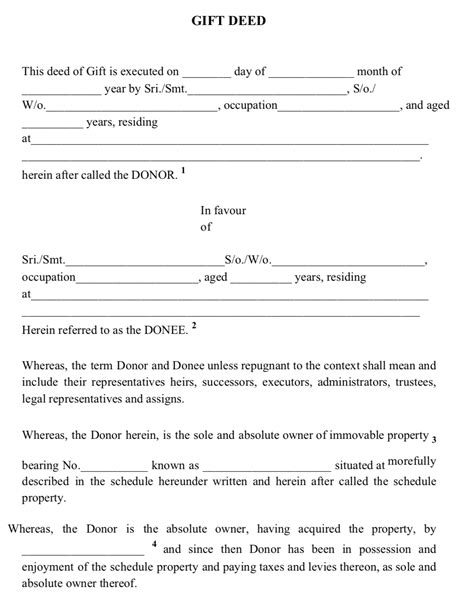

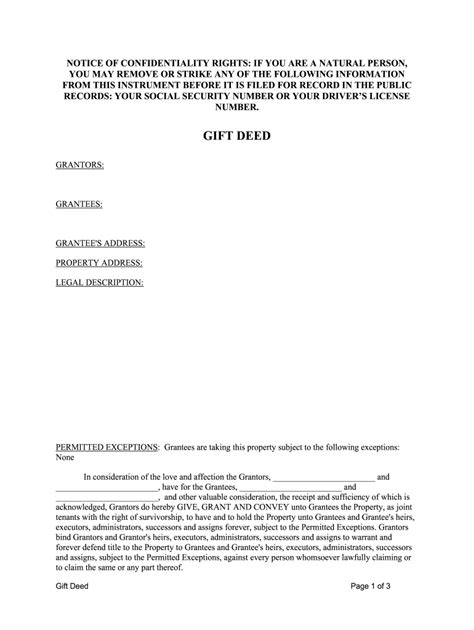

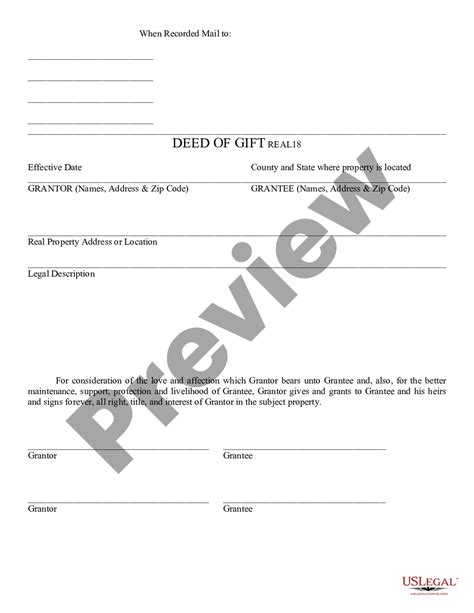

Key Elements of a Gift Deed

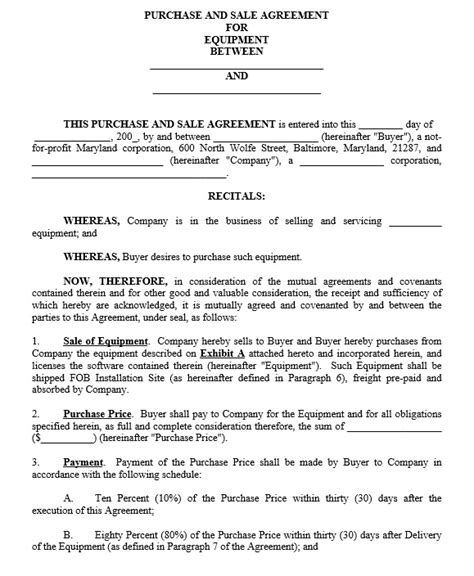

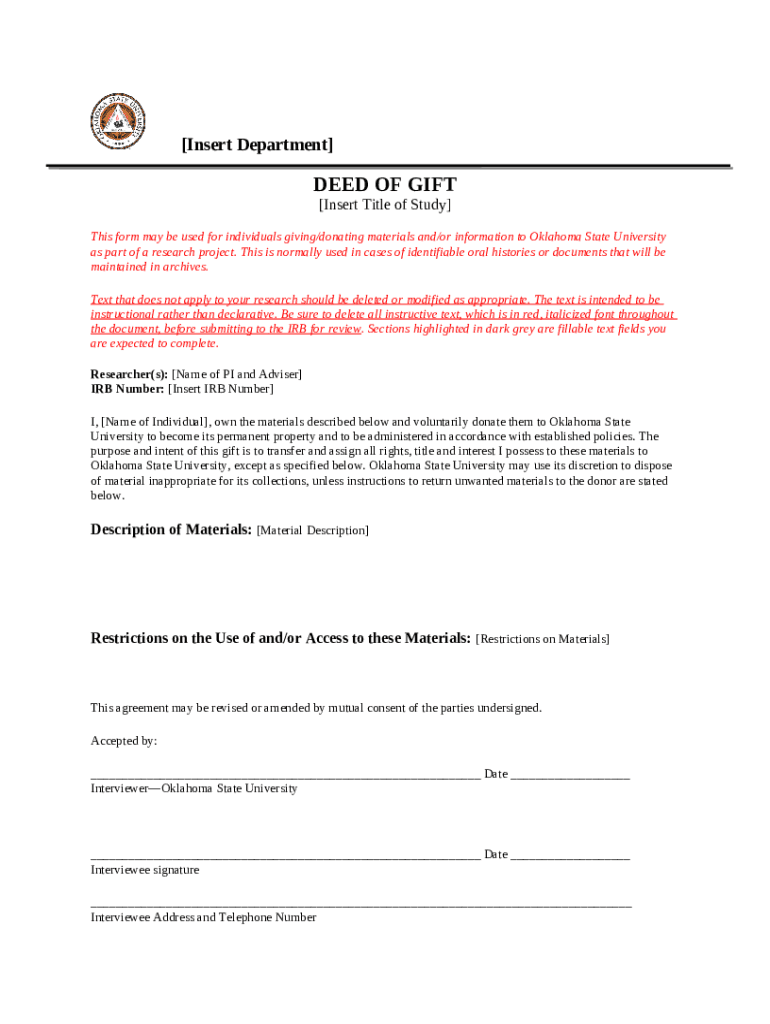

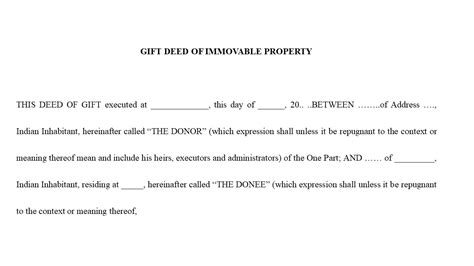

A gift deed typically includes the following key elements: * The names and addresses of the donor (the person giving the gift) and the donee (the person receiving the gift) * A detailed description of the property being transferred, including its location and any relevant identifying features * A statement indicating that the transfer of ownership is being made as a gift, without any expectation of payment or other compensation * The signature of the donor, acknowledging that they are making the gift voluntarily and without any coercion or duress * The signature of the donee, acknowledging that they accept the gift and agree to the terms of the transfer

Steps Involved in Creating a Valid Gift Deed

Creating a valid gift deed involves several steps, including: * Drafting the deed: The first step is to draft the gift deed, using a template or working with a lawyer to ensure that all the necessary elements are included. * Signing the deed: Once the deed has been drafted, it must be signed by the donor and the donee. The signatures should be witnessed by at least two independent witnesses. * Notarizing the deed: In some jurisdictions, it may be necessary to have the deed notarized, which involves having a notary public witness the signatures and verify the identities of the parties involved. * Recording the deed: Finally, the deed should be recorded with the relevant authorities, such as the county recorder’s office, to provide public notice of the transfer of ownership.

Types of Gift Deeds

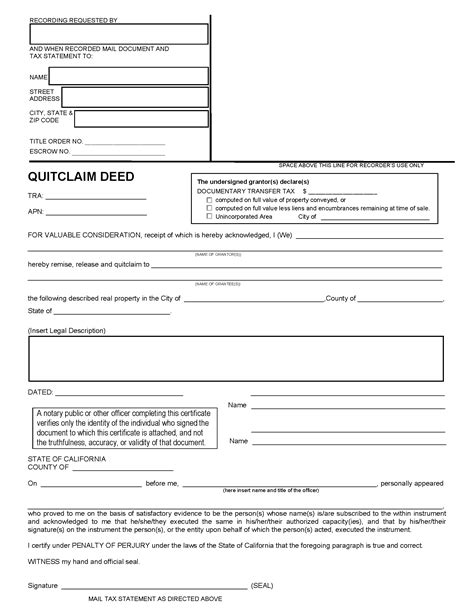

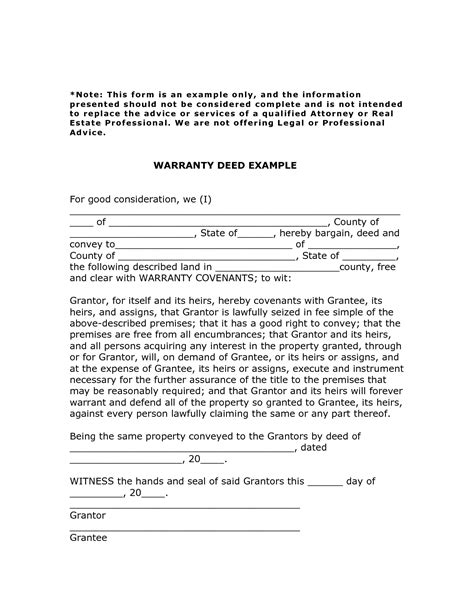

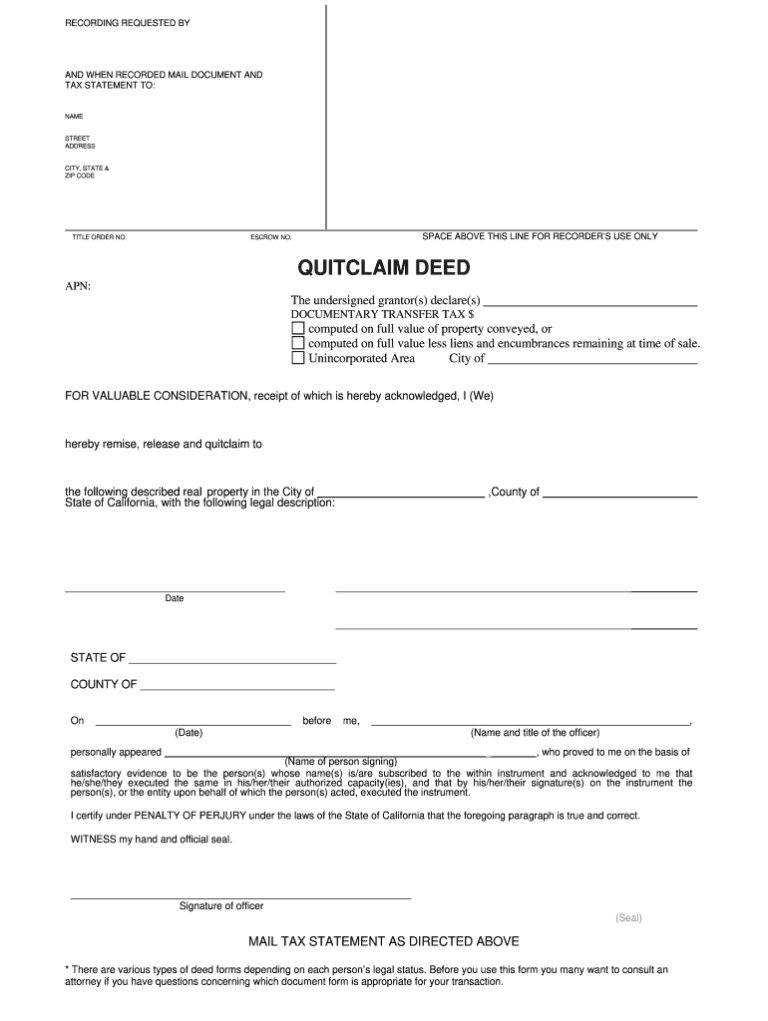

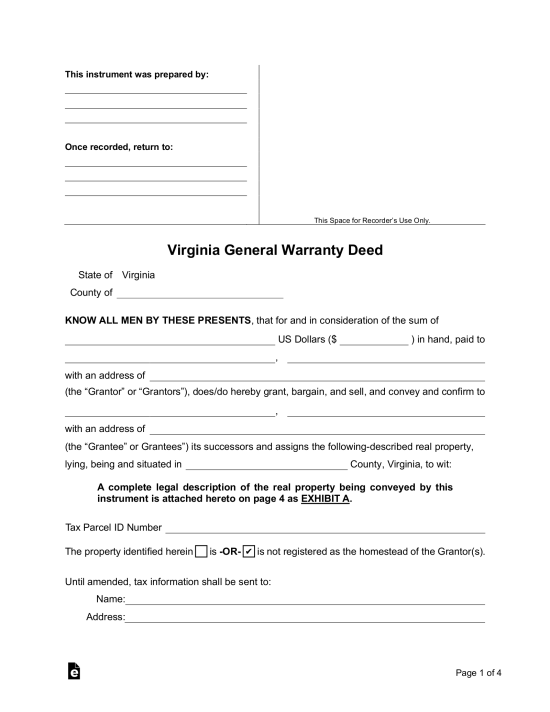

There are several types of gift deeds, including: * Quitclaim deed: A quitclaim deed is a type of gift deed that transfers the donor’s interest in a property, without making any warranties or guarantees about the title. * Warranty deed: A warranty deed is a type of gift deed that includes a warranty or guarantee about the title, providing greater protection for the donee. * Special warranty deed: A special warranty deed is a type of gift deed that includes a limited warranty or guarantee about the title, providing protection for the donee only against defects that arose during the donor’s ownership.

Benefits of Gift Deed Paperwork

Having the right gift deed paperwork in place can provide several benefits, including: * Avoiding disputes: A well-drafted gift deed can help to prevent misunderstandings and disputes that may arise in the future. * Minimizing tax implications: A gift deed can help to minimize the risk of tax implications and other financial consequences that may arise from the transfer of ownership. * Providing clarity: A gift deed can provide clarity and certainty about the transfer of ownership, helping to avoid confusion and misunderstandings.

📝 Note: It is essential to work with a lawyer or other qualified professional to ensure that the gift deed is properly drafted and executed, to avoid any potential legal issues or complications.

Common Mistakes to Avoid

When creating a gift deed, there are several common mistakes to avoid, including: * Failing to include necessary elements: A gift deed should include all the necessary elements, such as the names and addresses of the parties, a description of the property, and a statement indicating that the transfer is being made as a gift. * Not having the deed witnessed: The deed should be witnessed by at least two independent witnesses, to provide evidence of the signatures and the voluntary nature of the transfer. * Not recording the deed: The deed should be recorded with the relevant authorities, to provide public notice of the transfer of ownership.

Gift Deed Paperwork and Tax Implications

The tax implications of a gift deed can be complex and depend on a variety of factors, including the value of the property and the relationship between the donor and the donee. It is essential to consult with a tax professional to understand the potential tax implications of a gift deed and to ensure that the transfer is structured in a tax-efficient manner.

| Type of Gift Deed | Description |

|---|---|

| Quitclaim Deed | A type of gift deed that transfers the donor's interest in a property, without making any warranties or guarantees about the title. |

| Warranty Deed | A type of gift deed that includes a warranty or guarantee about the title, providing greater protection for the donee. |

| Special Warranty Deed | A type of gift deed that includes a limited warranty or guarantee about the title, providing protection for the donee only against defects that arose during the donor's ownership. |

As we can see, the world of legal gift deed paperwork is complex and nuanced, requiring careful attention to detail and a thorough understanding of the key elements and steps involved. By working with a lawyer or other qualified professional, individuals can ensure that their gift deed is properly drafted and executed, providing clarity and certainty about the transfer of ownership and minimizing the risk of tax implications and other financial consequences.

In summary, a gift deed is a legally binding document that serves as proof of the transfer of ownership of a property, and it is essential to have the right paperwork in place to avoid any potential disputes or legal issues. By understanding the importance of gift deed paperwork, the key elements that should be included, and the steps involved in creating a valid gift deed, individuals can ensure that their transfer of ownership is smooth and hassle-free.

What is a gift deed?

+

A gift deed is a type of legal document that is used to transfer ownership of a property from one person to another without any exchange of money or other compensation.

What are the key elements of a gift deed?

+

A gift deed typically includes the names and addresses of the donor and the donee, a detailed description of the property, a statement indicating that the transfer is being made as a gift, and the signatures of the parties involved.

What are the benefits of having a gift deed?

+

Having a gift deed can provide clarity and certainty about the transfer of ownership, help to avoid disputes and misunderstandings, and minimize the risk of tax implications and other financial consequences.