Paperwork

Handling Spouse Death Paperwork

Introduction to Handling Spouse Death Paperwork

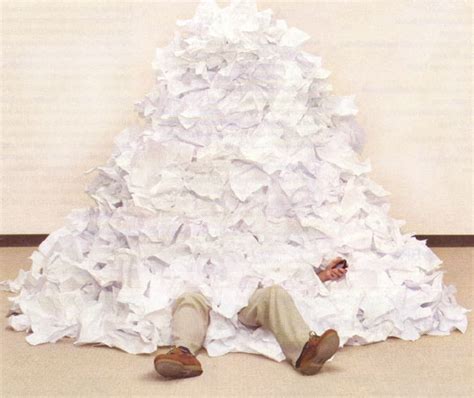

Losing a spouse is one of the most difficult experiences anyone can face. The emotional turmoil can be overwhelming, and on top of that, there’s the added burden of handling the paperwork and legal matters that follow. Navigating this complex process requires a clear understanding of what needs to be done and in what order. This guide aims to provide a step-by-step approach to managing the paperwork and legal aspects after the death of a spouse, helping to alleviate some of the stress during this challenging time.

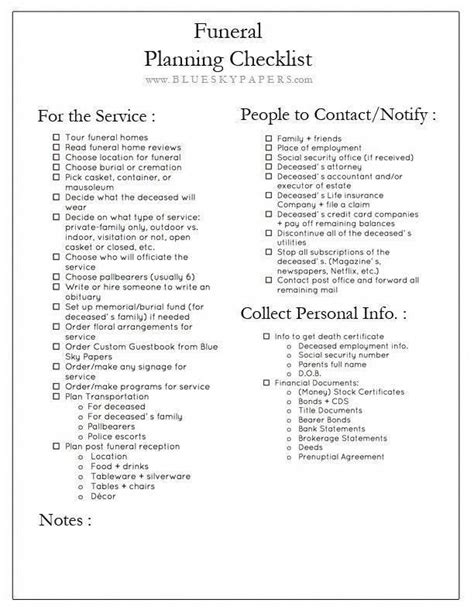

Immediate Actions

After the death of a spouse, there are several immediate actions that need to be taken. These include: - Notifying family and friends - Contacting the spouse’s employer (if applicable) - Informing the spouse’s insurance companies - Obtaining death certificates, which are crucial for various legal and administrative tasks These initial steps lay the groundwork for the more detailed paperwork and legal processes that follow.

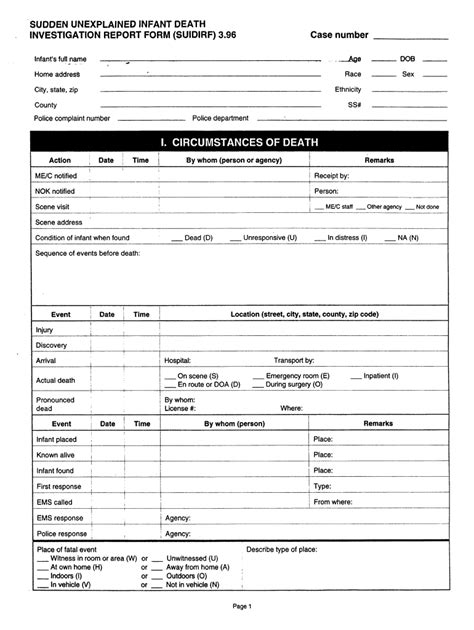

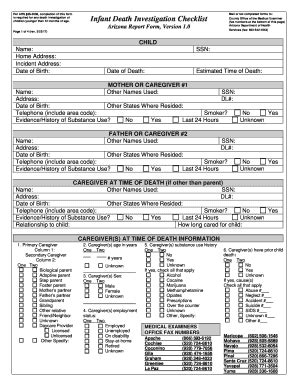

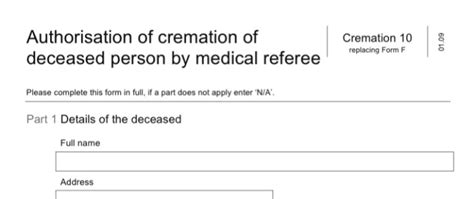

Obtaining Death Certificates

Death certificates are essential documents that serve as proof of death. They are required for a variety of purposes, including: - Notifying the Social Security Administration - Filing life insurance claims - Handling pension and retirement accounts - Transferring assets and property It’s recommended to obtain multiple copies of the death certificate, as each organization may require an original document.

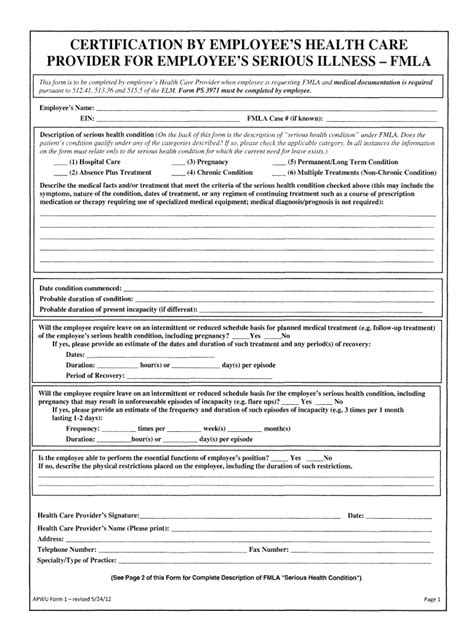

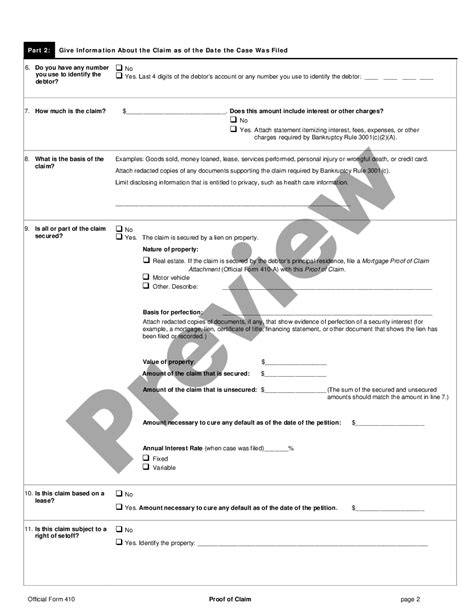

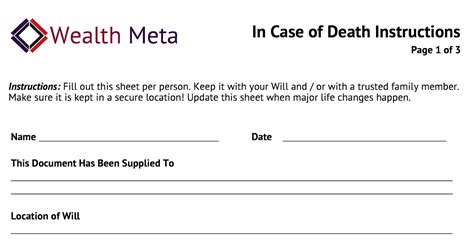

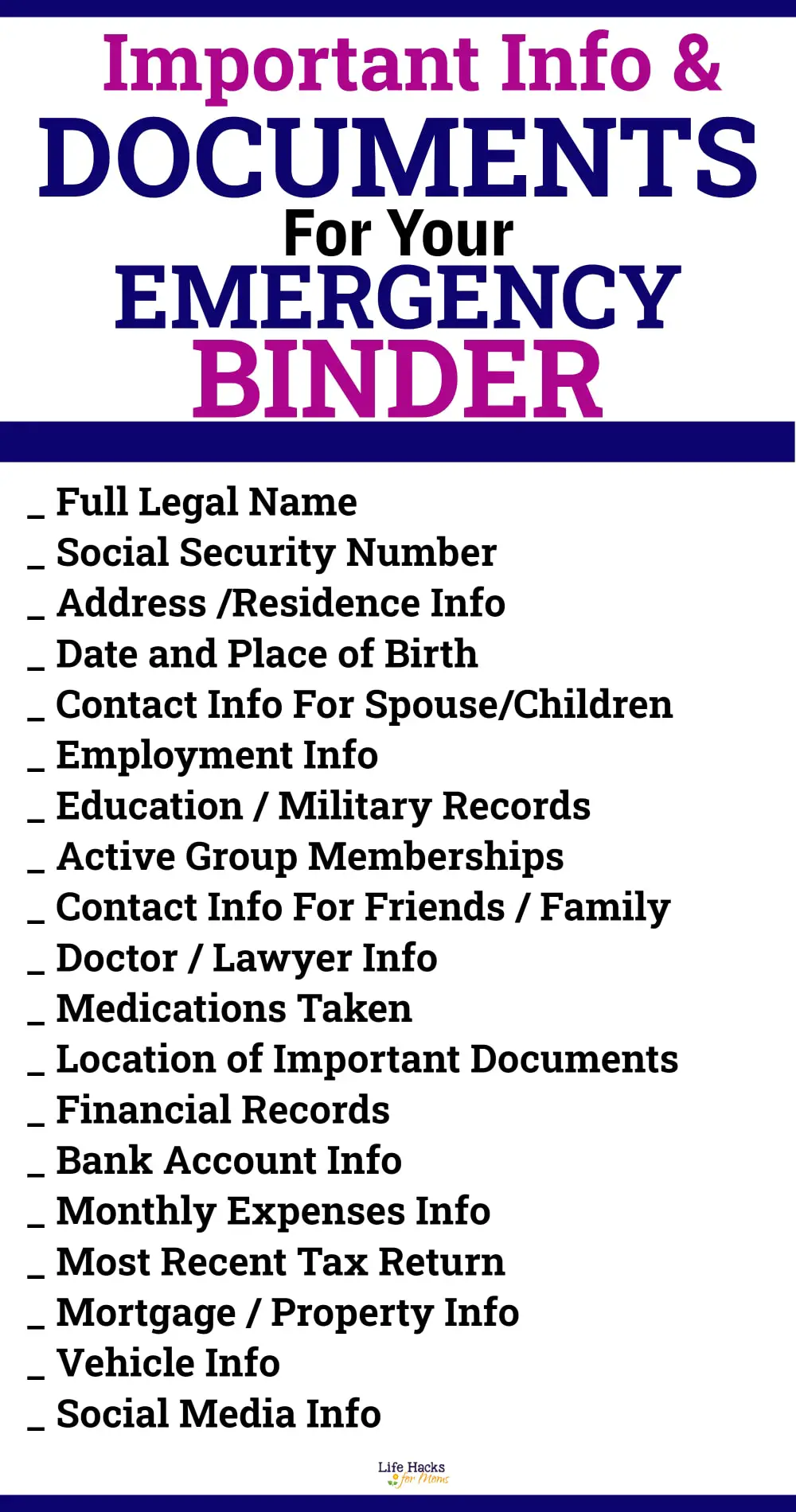

Legal and Financial Documentation

A significant part of handling spouse death paperwork involves dealing with legal and financial documents. This includes: - Will and Estate Planning: If the spouse had a will, it outlines how assets should be distributed. Without a will, the estate is distributed according to state laws. - Probate: The process by which the estate is settled under court supervision. - Tax Returns: Filing the spouse’s final tax return and potentially an estate tax return. - Bank and Investment Accounts: Notifying banks and investment companies to freeze accounts and begin the process of transferring assets according to the will or state laws.

Benefits and Insurance

Surviving spouses may be eligible for various benefits, including: - Social Security Benefits: Depending on the age and work history of the deceased and the survivor. - Life Insurance Policies: Filing claims for life insurance payouts. - Pension and Retirement Benefits: Understanding how these benefits are affected and what the survivor is entitled to. - Veterans Benefits (if applicable): The Department of Veterans Affairs offers several benefits to surviving spouses.

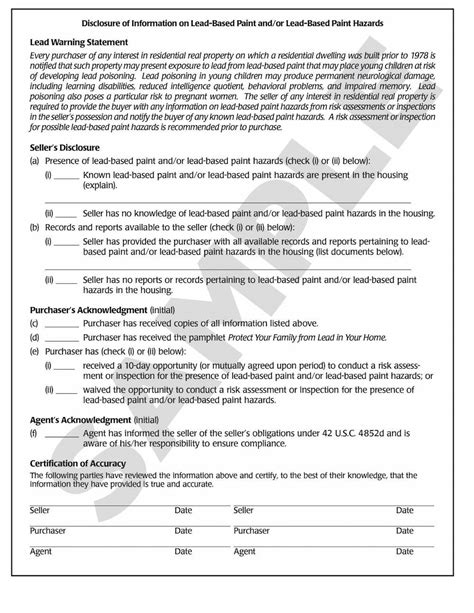

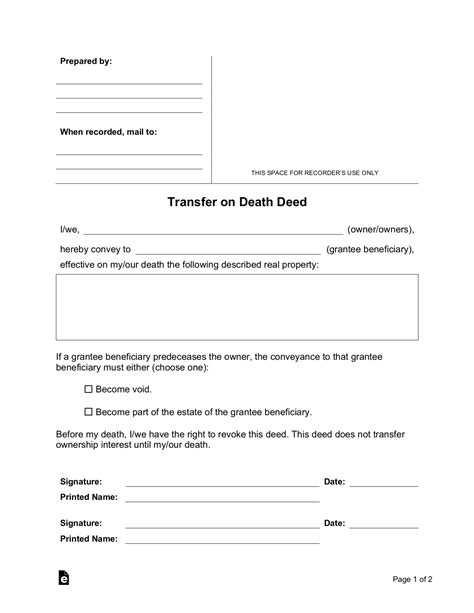

Asset Transfer and Estate Settlement

Transferring assets and settling the estate involves several steps, including: - Inventory of Assets: Listing all assets, including real estate, vehicles, personal property, and financial assets. - Appraisal of Assets: Determining the value of assets for tax and distribution purposes. - Distribution of Assets: According to the will or state intestacy laws. - Paying Debts and Taxes: Using estate assets to pay off debts and taxes before distribution.

Emotional Support and Professional Guidance

Handling the death of a spouse is not just about paperwork; it’s also about navigating the emotional landscape of grief. Seeking support from family, friends, or professional counselors can be invaluable. Additionally, considering professional guidance from attorneys, financial advisors, and accountants can help manage the complex legal and financial aspects, ensuring that everything is handled correctly and efficiently.

💡 Note: It's crucial to keep all documents and correspondence related to the spouse's death and estate settlement organized, as these will be referenced frequently during the process.

Conclusion and Final Thoughts

Dealing with the aftermath of a spouse’s death is a daunting task, filled with emotional, legal, and financial challenges. By understanding the steps involved in handling the paperwork and legal matters, individuals can better navigate this difficult period. Remember, seeking help when needed, whether emotional support or professional advice, is a sign of strength, not weakness. It’s okay to not have all the answers, and there are resources available to guide you through this process.

What is the first step in handling spouse death paperwork?

+

The first step involves notifying immediate family and friends, followed by contacting relevant institutions such as the spouse’s employer, insurance companies, and obtaining death certificates.

How many death certificates should I obtain?

+

Are there any specific benefits I should look into as a surviving spouse?

+

Yes, depending on your situation, you may be eligible for Social Security benefits, life insurance payouts, pension and retirement benefits, and possibly veterans benefits if your spouse was a veteran.