5 Tips Organize Bills

Introduction to Organizing Bills

Managing bills can be a daunting task, especially when you have multiple bills to pay each month. It’s easy to get overwhelmed and miss a payment, which can lead to late fees and damage to your credit score. However, with a few simple tips and tricks, you can stay on top of your bills and keep your finances in order. In this article, we’ll explore five tips to help you organize your bills and take control of your finances.

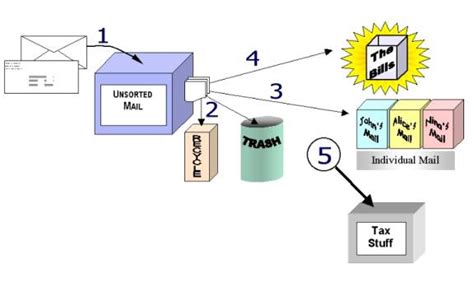

Tip 1: Create a Bill Calendar

A bill calendar is a great way to keep track of when your bills are due. You can use a physical calendar or create a digital one on your phone or computer. Write down the due date for each bill and set reminders for a few days before the payment is due. This will help you stay on track and ensure that you never miss a payment. You can also use color-coding to categorize your bills, such as using red for urgent bills and green for bills that are already paid.

Tip 2: Automate Your Payments

Automating your payments is a great way to ensure that you never miss a payment. You can set up automatic payments through your bank or the biller’s website. This way, the payment will be deducted from your account on the due date, and you won’t have to worry about forgetting to pay. Just make sure you have enough money in your account to cover the payment, or you may be charged overdraft fees.

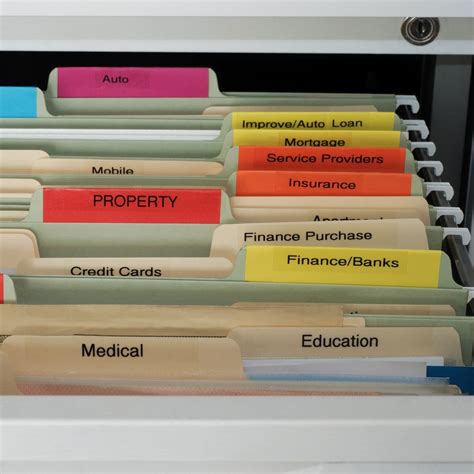

Tip 3: Prioritize Your Bills

Some bills are more important than others, and you should prioritize them accordingly. For example, your rent/mortgage and utility bills should be paid first, as they are essential for your daily living. You can use the following list to prioritize your bills: * Essential bills: rent/mortgage, utilities, food, and transportation * Important bills: credit cards, loans, and insurance * Non-essential bills: entertainment, hobbies, and travel

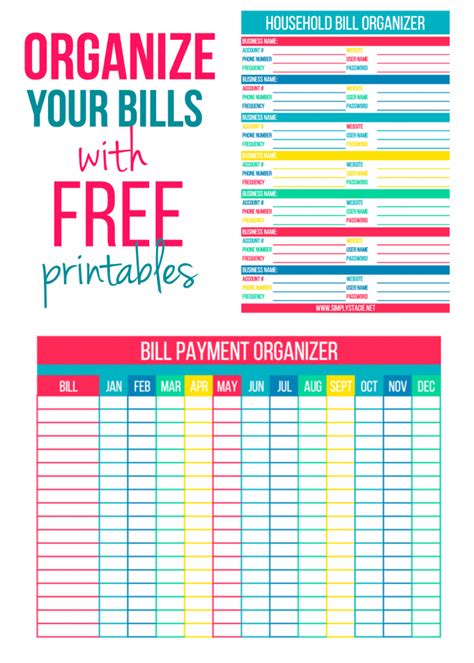

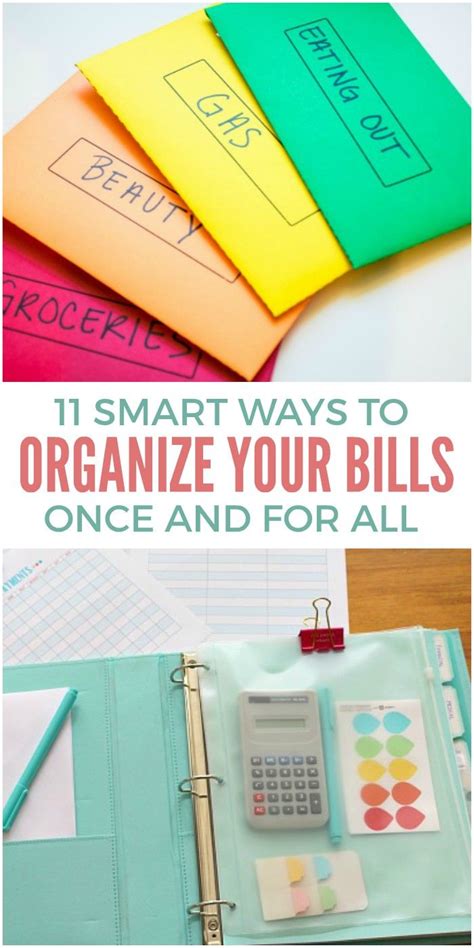

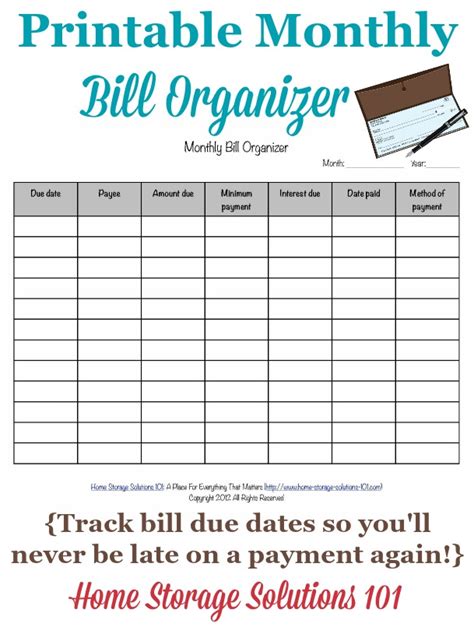

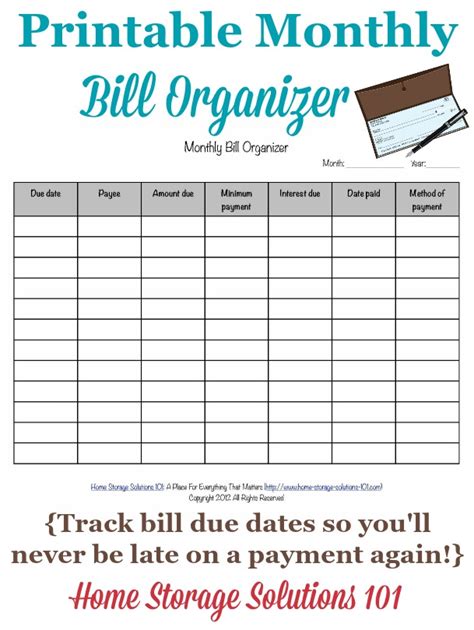

Tip 4: Use a Bill Tracker

A bill tracker is a great tool to help you stay organized and keep track of your bills. You can use a spreadsheet or a budgeting app to create a bill tracker. The tracker should include the following information: * Bill name * Due date * Payment amount * Payment status * Notes

Here is an example of what a bill tracker might look like:

| Bill Name | Due Date | Payment Amount | Payment Status | Notes |

|---|---|---|---|---|

| Electricity Bill | 15th of each month | 100</td> <td>Paid</td> <td>Auto-payment set up</td> </tr> <tr> <td>Water Bill</td> <td>20th of each month</td> <td>50 | Unpaid | Payment due soon |

Tip 5: Review and Adjust

Finally, it’s essential to review and adjust your bill organization system regularly. Check your bill calendar and tracker to ensure that you’re on track to pay all your bills on time. You can also use this opportunity to negotiate with service providers to lower your bills or cancel subscriptions that you no longer need.

💡 Note: Reviewing and adjusting your bill organization system regularly will help you stay on top of your finances and avoid any potential issues.

In summary, organizing your bills is a crucial step in managing your finances effectively. By creating a bill calendar, automating your payments, prioritizing your bills, using a bill tracker, and reviewing and adjusting your system regularly, you can stay on top of your bills and avoid any potential issues. Remember to always stay organized and review your finances regularly to ensure that you’re on the right track.

What is the best way to prioritize my bills?

+

The best way to prioritize your bills is to focus on essential bills first, such as rent/mortgage, utilities, food, and transportation. Then, prioritize important bills like credit cards, loans, and insurance. Finally, pay non-essential bills like entertainment, hobbies, and travel.

How can I avoid late fees and penalties?

+

To avoid late fees and penalties, make sure to pay your bills on time. Set reminders and automate your payments to ensure that you never miss a payment. You can also negotiate with service providers to waive late fees or penalties if you’ve missed a payment.

What is the best bill tracker to use?

+

The best bill tracker to use is one that is easy to use and understand. You can use a spreadsheet or a budgeting app to create a bill tracker. Some popular bill trackers include Mint, Personal Capital, and You Need a Budget (YNAB).