List Earnings for Children Paperwork Easily

Introduction to Earning Money as a Child

Earning money as a child can be an exciting and educational experience. It teaches responsibility, time management, and the value of money. Many children start earning money by doing chores, babysitting, or running small businesses like lemonade stands or pet sitting. However, when it comes to paperwork, it can become overwhelming, especially for minors. In this article, we will explore ways to make earnings for children paperwork easier.

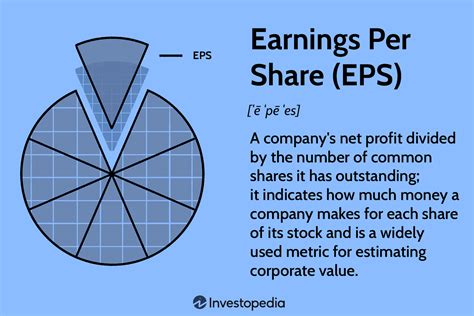

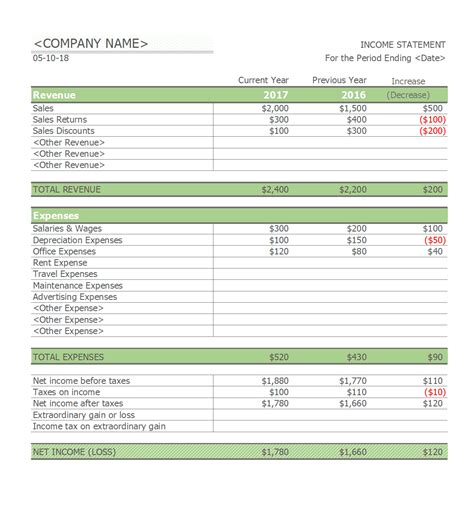

Understanding the Importance of Paperwork

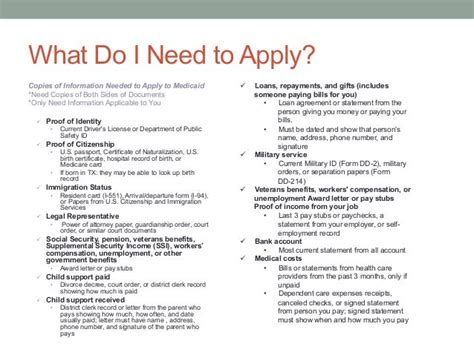

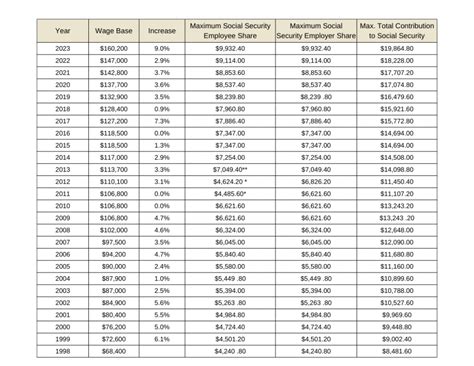

Paperwork is an essential part of any business or job, even for children. It helps keep track of earnings, expenses, and taxes. In the United States, for example, children under 18 who earn money from self-employment must file a tax return if their net earnings from self-employment are $400 or more. This is where accurate record-keeping comes into play. By keeping track of all transactions, children can easily fill out tax forms and other necessary documents.

Tools for Easy Paperwork

There are several tools that can make paperwork easier for children: * Spreadsheets: Google Sheets or Microsoft Excel can be used to create tables and track earnings and expenses. * Accounting software: Programs like QuickBooks or TurboTax can help with tax preparation and financial organization. * Mobile apps: Apps like Mint or Personal Capital can help track spending and create budgets. * Paper planners: For those who prefer a more traditional approach, paper planners can be used to record daily or weekly earnings and expenses.

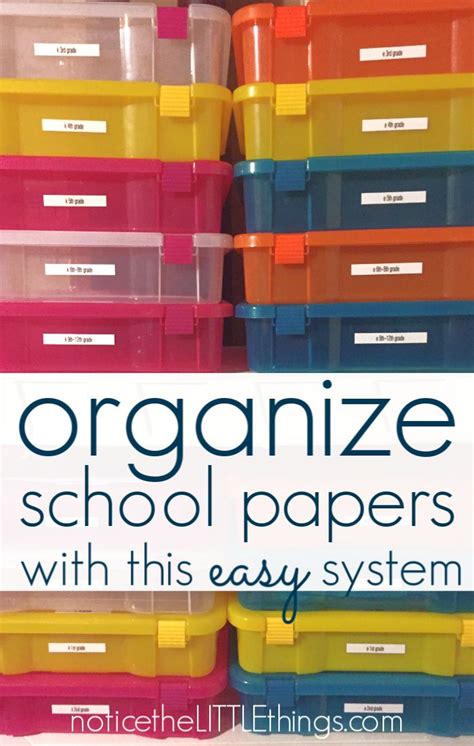

Steps to Simplify Paperwork

Here are some steps to simplify paperwork for children: * Create a system: Develop a system for organizing paperwork, such as a file folder or digital folder. * Set aside time: Designate a specific time each week to update records and organize paperwork. * Use templates: Use templates for invoices, receipts, and other documents to make paperwork easier and more efficient. * Seek help: If necessary, seek help from a parent, guardian, or accountant to ensure paperwork is accurate and complete.

Benefits of Easy Paperwork

Easy paperwork has several benefits for children, including: * Reduced stress: By keeping track of earnings and expenses, children can reduce stress and anxiety related to paperwork. * Increased organization: Easy paperwork helps children develop organizational skills, which can translate to other areas of life. * Improved financial literacy: By understanding how to manage paperwork, children can develop a better understanding of personal finance and money management. * Enhanced responsibility: Easy paperwork teaches children the importance of responsibility and accountability.

Common Challenges

Despite the benefits, there are common challenges that children may face when dealing with paperwork: * Lack of understanding: Children may not fully understand the importance of paperwork or how to complete it accurately. * Disorganization: Without a system, paperwork can become disorganized and overwhelming. * Procrastination: Children may put off paperwork, leading to missed deadlines and penalties. * Limited access to resources: Children may not have access to the necessary tools or resources to complete paperwork accurately.

📝 Note: It's essential for parents or guardians to provide guidance and support to help children overcome these challenges and develop good paperwork habits.

Conclusion and Final Thoughts

In summary, earning money as a child can be a valuable learning experience, but paperwork can be overwhelming. By using the right tools, creating a system, and seeking help when necessary, children can make paperwork easier and more efficient. It’s crucial for parents and guardians to provide support and guidance to help children develop good paperwork habits and a strong understanding of personal finance. By doing so, children can develop essential life skills that will benefit them in the long run.

What is the minimum age for a child to start earning money?

+

The minimum age for a child to start earning money varies depending on the country, state, or province. In the United States, for example, children as young as 13 can start working in non-agricultural jobs, while children under 13 can work in certain occupations such as babysitting or lawn care.

Do children need to pay taxes on their earnings?

+

Yes, children who earn money from self-employment or certain types of jobs may need to pay taxes on their earnings. In the United States, for example, children under 18 who earn money from self-employment must file a tax return if their net earnings from self-employment are $400 or more.

What are some ways children can earn money?

+

Children can earn money in various ways, such as doing chores, babysitting, pet sitting, running a lemonade stand, or starting a small business. They can also participate in online surveys, sell handmade products, or offer services such as lawn care or tutoring.