5 Ways MN Foreclosure

Understanding the Foreclosure Process in Minnesota

The state of Minnesota, like many others, has its own set of rules and regulations governing the foreclosure process. For homeowners facing financial difficulties, understanding these rules is crucial to navigating the challenges that come with potential foreclosure. In Minnesota, the foreclosure process can be either judicial or non-judicial, depending on the type of mortgage and the specific circumstances of the homeowner. Here, we will delve into the specifics of the Minnesota foreclosure process, highlighting five key aspects that homeowners and potential buyers should be aware of.

Key Aspects of Minnesota Foreclosure Laws

Before diving into the specifics, it’s essential to grasp the broader context of foreclosure laws in Minnesota. These laws are designed to protect both the homeowner and the lender, ensuring that the process is fair and transparent. Some key points to consider include: - The type of foreclosure process used (judicial or non-judicial) - The notice periods required before foreclosure can proceed - The rights of the homeowner to redeem the property - The potential for foreclosure by advertisement (a non-judicial process in Minnesota) - The impact of foreclosure on credit scores and future homeownership

1. Judicial Foreclosure Process

The judicial foreclosure process in Minnesota involves the court system. This process is typically used when the mortgage does not contain a power of sale clause, which allows the lender to sell the property without court intervention. The judicial process starts with the lender filing a lawsuit against the borrower, which leads to a court judgment. If the borrower loses the case, the court will order the sale of the property to satisfy the debt. This process can be lengthy and provides the homeowner with certain protections and opportunities to respond to the lawsuit.

2. Non-Judicial Foreclosure Process

In contrast, the non-judicial foreclosure process, also known as foreclosure by advertisement, is faster and does not involve the court system directly. This method is used when the mortgage contains a power of sale clause. The lender must follow specific procedures outlined in Minnesota statutes, including providing the homeowner with notice of default and intent to foreclose. The property is then sold at a public auction, with the proceeds going towards satisfying the mortgage debt. It’s crucial for homeowners to understand their rights and the timeline for this process, as it moves more quickly than the judicial route.

3. Redemption Period

One of the unique aspects of Minnesota foreclosure law is the redemption period. After the foreclosure sale, but before the lender can obtain title to the property, the homeowner has a certain period during which they can redeem the property by paying off the full amount of the debt, plus costs and fees. In Minnesota, this redemption period can be up to 6 months for certain types of properties, offering homeowners a last chance to save their homes.

4. Foreclosure Prevention Options

For homeowners facing foreclosure, there are several foreclosure prevention options worth exploring: - Loan Modification: Changing the terms of the loan to make payments more manageable. - Refinancing: Obtaining a new loan with better terms to replace the existing mortgage. - Selling the Property: Selling the home to pay off the mortgage debt. - Short Sale: Selling the property for less than the amount owed on the mortgage, with the lender’s agreement. - Deed in Lieu of Foreclosure: Transferring ownership of the property to the lender to avoid foreclosure.

5. Impact on Credit Scores

Finally, it’s essential to consider the impact of foreclosure on credit scores. Foreclosure can significantly lower a person’s credit score, affecting their ability to obtain credit or loans in the future. However, by understanding the foreclosure process and exploring all available options, homeowners can make informed decisions that minimize long-term financial damage. Rebuilding credit after foreclosure is possible, but it requires patience, consistent financial management, and a strategy to improve creditworthiness over time.

📝 Note: Homeowners in Minnesota should consult with a financial advisor or legal professional to understand their specific situation and the best course of action to avoid or navigate the foreclosure process.

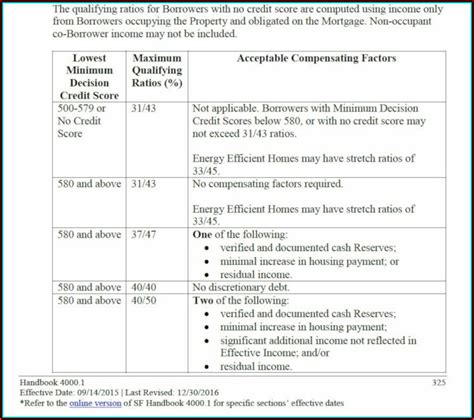

To further illustrate the foreclosure process and its implications, consider the following table outlining key differences between judicial and non-judicial foreclosure in Minnesota:

| Type of Foreclosure | Description | Notice Period | Redemption Period |

|---|---|---|---|

| Judicial Foreclosure | Involves the court system | Varies | Up to 6 months |

| Non-Judicial Foreclosure (Foreclosure by Advertisement) | Does not involve the court system, uses a power of sale clause | 6 weeks | Up to 6 months |

In summary, navigating the foreclosure process in Minnesota requires a thorough understanding of the state’s specific laws and regulations. By knowing the differences between judicial and non-judicial foreclosure, the rights of homeowners, and the potential impacts on credit scores, individuals can better protect their interests and make informed decisions about their financial futures.

What is the primary difference between judicial and non-judicial foreclosure in Minnesota?

+

The primary difference lies in the involvement of the court system. Judicial foreclosure involves the courts, while non-judicial foreclosure, or foreclosure by advertisement, does not and is facilitated through a power of sale clause in the mortgage.

How long does the redemption period last in Minnesota after a foreclosure sale?

+

The redemption period in Minnesota can last up to 6 months, during which the homeowner can redeem the property by paying off the debt, plus costs and fees.

What are some foreclosure prevention options available to homeowners in Minnesota?

+

Homeowners in Minnesota can explore options such as loan modification, refinancing, selling the property, short sale, or deed in lieu of foreclosure to prevent or mitigate the effects of foreclosure.