5 Tips Organize Finances

Introduction to Financial Organization

Organizing your finances is a crucial step towards achieving financial stability and security. It allows you to manage your money effectively, make informed decisions, and work towards your long-term financial goals. With a well-organized financial system, you can reduce stress, save time, and increase your overall sense of well-being. In this article, we will discuss five tips to help you organize your finances and take control of your financial future.

Tip 1: Track Your Expenses

The first step in organizing your finances is to track your expenses. This involves monitoring every single transaction you make, including small purchases like coffee or snacks. You can use a budgeting app, spreadsheet, or even just a notebook to record your expenses. By doing so, you’ll be able to identify areas where you can cut back and make adjustments to your spending habits. It’s essential to be honest and accurate when tracking your expenses, as this will help you create a realistic picture of your financial situation.

Tip 2: Create a Budget

Once you have a clear understanding of your expenses, it’s time to create a budget. A budget is a plan that outlines how you want to allocate your money towards different expenses, savings, and debt repayment. You can use the 50/30/20 rule as a guideline, where 50% of your income goes towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. Be sure to review and adjust your budget regularly to ensure it’s working for you.

Tip 3: Prioritize Needs Over Wants

It’s essential to prioritize needs over wants when organizing your finances. Needs include essential expenses like rent, utilities, and food, while wants include discretionary spending like dining out or entertainment. By prioritizing your needs, you’ll ensure that you’re taking care of the most critical aspects of your financial life. You can then allocate money towards your wants, but be sure to do so in moderation.

Tip 4: Manage Debt

Managing debt is a critical aspect of financial organization. If you have high-interest debt, such as credit card balances, it’s essential to create a plan to pay it off as quickly as possible. You can consider consolidating debt, negotiating with creditors, or using the snowball method to pay off debts one by one. Remember to always make timely payments and avoid accumulating new debt.

Tip 5: Build an Emergency Fund

Finally, it’s crucial to build an emergency fund to protect yourself against unexpected expenses or financial setbacks. Aim to save 3-6 months’ worth of living expenses in a easily accessible savings account. This fund will provide a cushion in case of emergencies, such as car repairs, medical bills, or losing your job. By having a safety net in place, you’ll reduce financial stress and be better equipped to handle unexpected expenses.

💡 Note: It's essential to review and adjust your financial plan regularly to ensure it's working for you. Consider consulting a financial advisor or using online resources to help you stay on track.

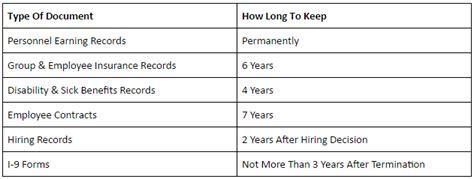

To further illustrate the importance of organizing your finances, consider the following table:

| Financial Goal | Importance | Timeframe |

|---|---|---|

| Emergency fund | High | Short-term |

| Debt repayment | Medium | Medium-term |

| Retirement savings | High | Long-term |

In summary, organizing your finances is a critical step towards achieving financial stability and security. By tracking your expenses, creating a budget, prioritizing needs over wants, managing debt, and building an emergency fund, you’ll be well on your way to taking control of your financial future. Remember to stay informed, adapt to changes, and continually work towards your long-term financial goals.

What is the best way to track expenses?

+

The best way to track expenses is to use a combination of methods, such as a budgeting app, spreadsheet, and cash tracking. Find a method that works for you and stick to it.

How do I create a budget that works for me?

+

To create a budget that works for you, start by tracking your expenses and identifying areas where you can cut back. Then, allocate your income towards necessary expenses, savings, and debt repayment. Review and adjust your budget regularly to ensure it’s working for you.

What is the importance of having an emergency fund?

+

Having an emergency fund is crucial to protect yourself against unexpected expenses or financial setbacks. It provides a cushion in case of emergencies, such as car repairs, medical bills, or losing your job. Aim to save 3-6 months’ worth of living expenses in a easily accessible savings account.