Start Non Profit Incorporation Paperwork

Introduction to Non-Profit Incorporation

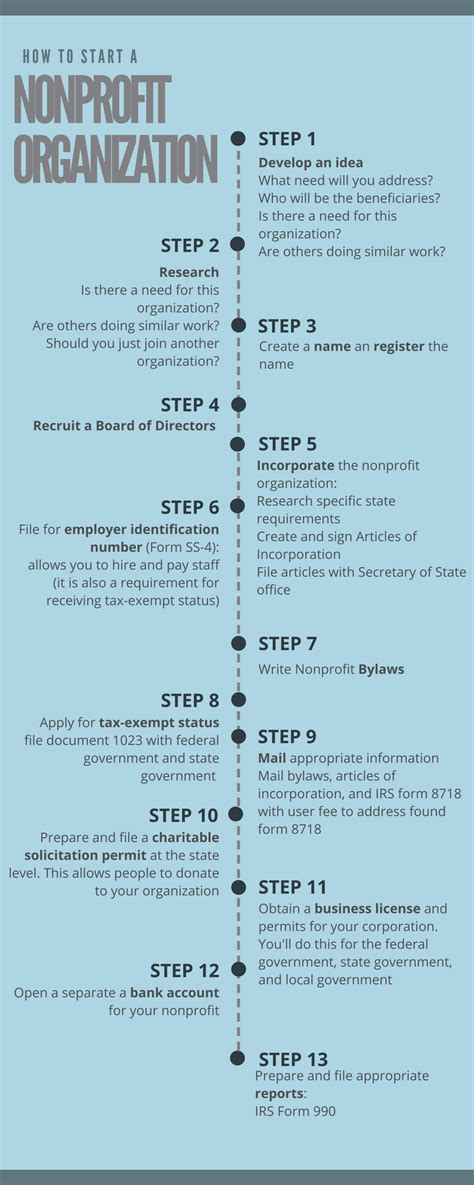

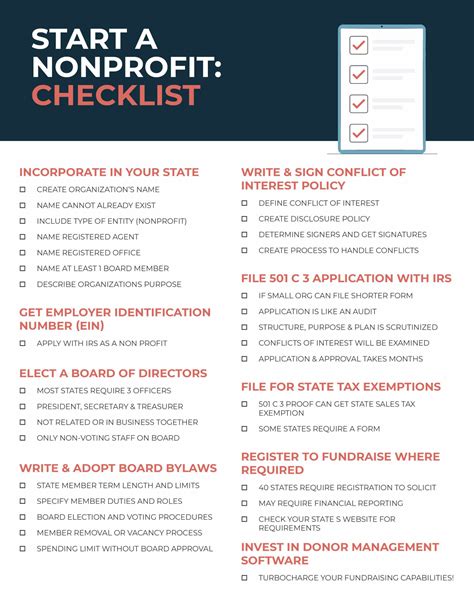

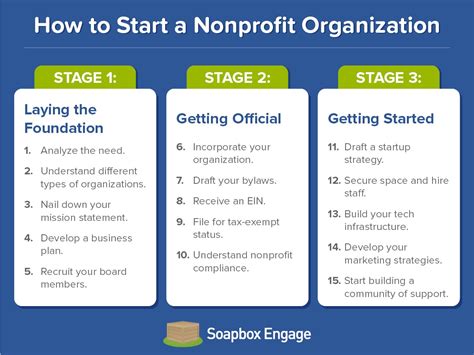

When starting a non-profit organization, one of the most crucial steps is incorporating the entity. This process involves filing paperwork with the state and obtaining tax-exempt status from the federal government. Incorporation provides a non-profit with limited liability protection, tax benefits, and increased credibility with donors and stakeholders. In this blog post, we will guide you through the non-profit incorporation paperwork process.

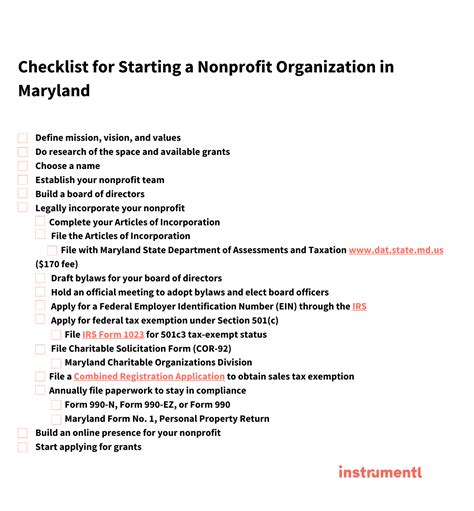

Step 1: Choose a Business Name

Before filing any paperwork, it’s essential to choose a unique and memorable business name for your non-profit. The name should reflect the organization’s mission and purpose. Make sure to check the availability of the name by searching the state’s business database and ensuring it’s not already in use. Additionally, consider registering a domain name and social media handles to match your business name.

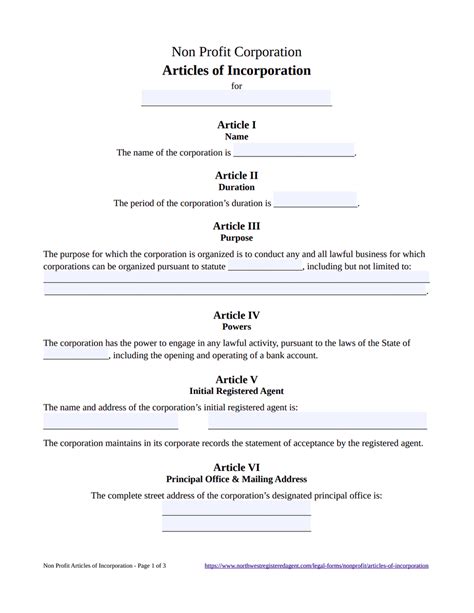

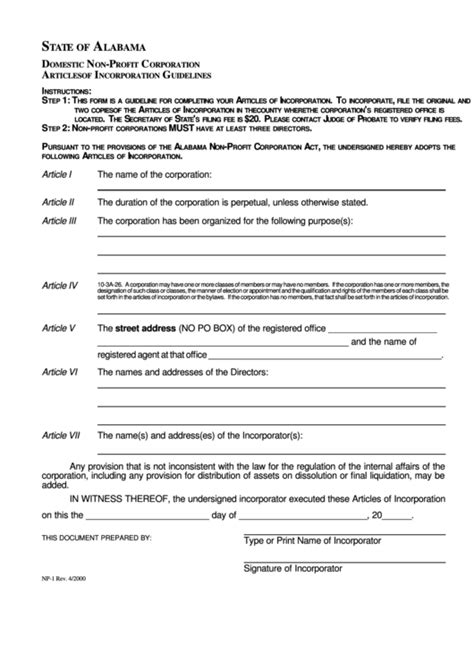

Step 2: File Articles of Incorporation

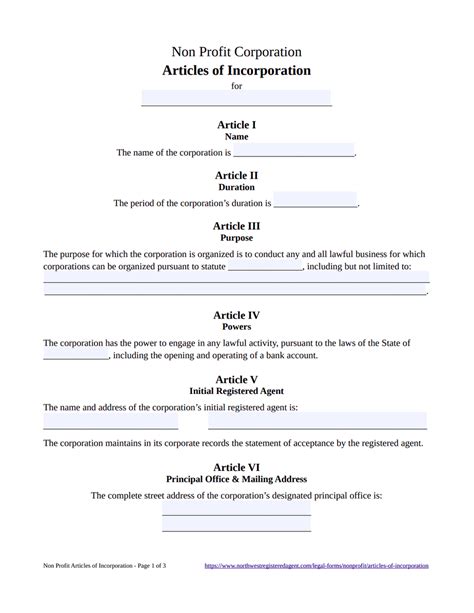

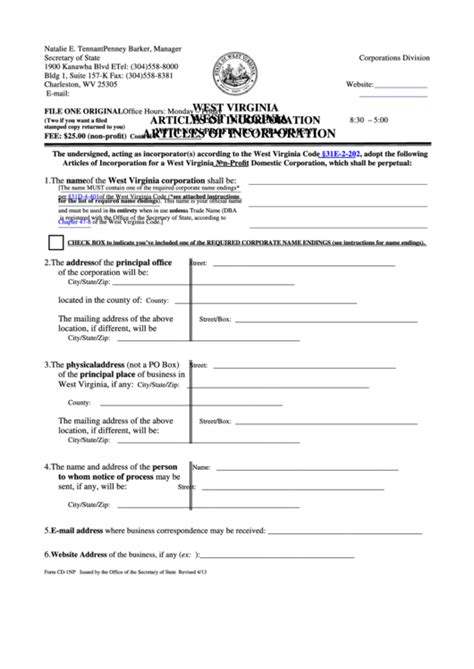

To incorporate a non-profit, you’ll need to file Articles of Incorporation with the state. This document typically includes:

- Business name and address

- Purpose and mission statement

- Names and addresses of directors and officers

- Registered agent information

Step 3: Obtain an Employer Identification Number (EIN)

An EIN is a unique nine-digit number assigned to your non-profit by the IRS. You’ll need an EIN to open a bank account, file tax returns, and apply for tax-exempt status. You can apply for an EIN online through the IRS website, and it’s usually issued immediately.

Step 4: Draft Bylaws

Bylaws are the internal rules and procedures that govern your non-profit’s operations. They should include information on:

- Membership and voting rights

- Meetings and notice requirements

- Officer and director roles and responsibilities

- Conflict of interest policies

Step 5: Apply for Tax-Exempt Status

To obtain tax-exempt status, you’ll need to file Form 1023 with the IRS. This form requires detailed information about your non-profit’s:

- Mission and purpose

- Structure and governance

- Financial projections and budget

- Activities and programs

| Form 1023 Filing Fee | Organization Size |

|---|---|

| $275 | Small organizations (annual gross receipts ≤ $50,000) |

| $600 | Medium organizations (annual gross receipts > $50,000 but ≤ $200,000) |

| $900 | Large organizations (annual gross receipts > $200,000) |

📝 Note: The IRS reviews Form 1023 applications carefully, and the process can take several months to a year or more to complete.

Step 6: Register with the State Charity Office

In addition to filing with the IRS, you may need to register your non-profit with the state charity office. This registration typically requires filing a Charitable Solicitations Registration form and paying a fee, which varies by state.

Step 7: Obtain Licenses and Permits

Depending on your non-profit’s activities and location, you may need to obtain licenses and permits from local, state, or federal authorities. These might include:

- Business licenses

- Zoning permits

- Health department permits

- Environmental permits

As you complete the non-profit incorporation paperwork, remember to stay organized, and don’t hesitate to seek professional advice if needed. The process can be complex, but with patience and attention to detail, you’ll be well on your way to establishing a successful and compliant non-profit organization.

To recap, the key steps in the non-profit incorporation paperwork process include choosing a business name, filing Articles of Incorporation, obtaining an EIN, drafting bylaws, applying for tax-exempt status, registering with the state charity office, and obtaining licenses and permits. By following these steps and seeking guidance when necessary, you’ll be able to establish a strong foundation for your non-profit and achieve your mission.

What is the difference between a non-profit and a for-profit organization?

+

A non-profit organization is established to serve a public benefit or charitable purpose, whereas a for-profit organization is designed to generate profits for its owners or shareholders.

How long does it take to obtain tax-exempt status?

+

The processing time for tax-exempt status can vary from several months to a year or more, depending on the complexity of the application and the workload of the IRS.

Do I need to hire an attorney to help with non-profit incorporation?

+

While it’s possible to complete the non-profit incorporation process without an attorney, it’s highly recommended to seek professional guidance to ensure compliance with all applicable laws and regulations.