Paperwork

7 Tax Papers Needed

Introduction to Tax Preparation

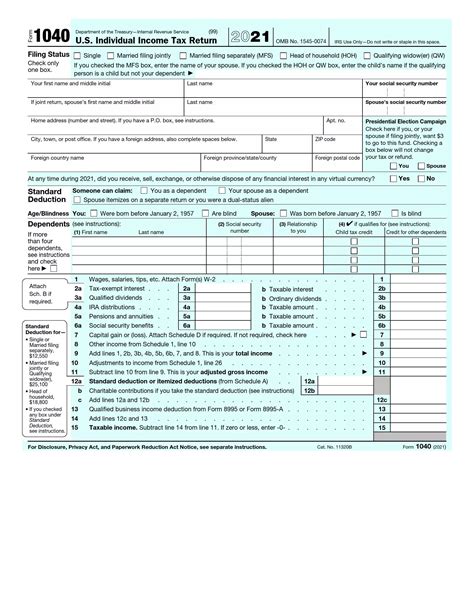

When it comes to preparing your taxes, having the right documents is crucial to ensure a smooth and accurate process. The tax preparation process can be overwhelming, especially for those who are new to filing taxes. To make this process easier, it’s essential to gather all the necessary tax papers beforehand. In this article, we will discuss the seven key tax papers that you need to have in order to file your taxes correctly.

Understanding the Importance of Tax Papers

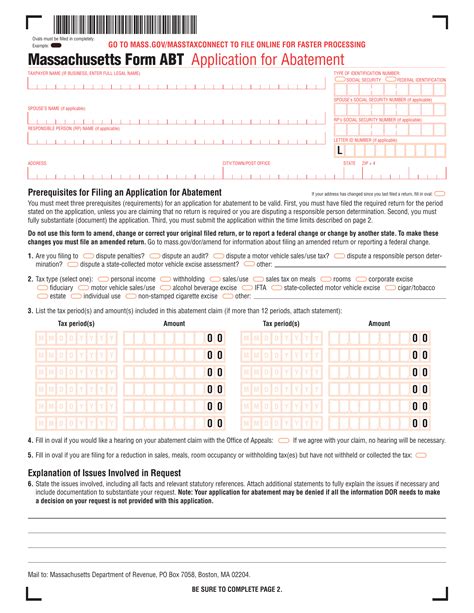

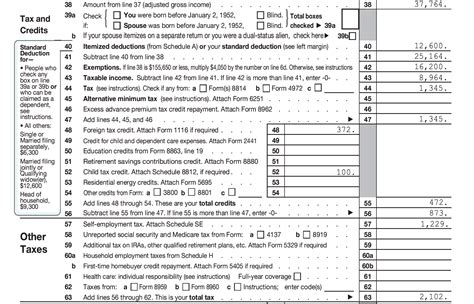

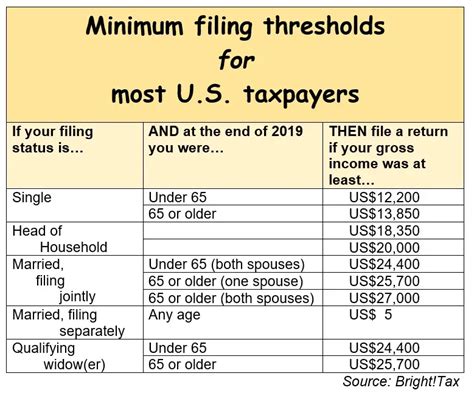

Tax papers are documents that contain information about your income, expenses, and other financial transactions that are relevant to your tax return. These documents are used to calculate your taxable income, deductions, and credits. Having all the necessary tax papers will help you to avoid errors and audits, and ensure that you receive the maximum refund you are eligible for. It’s also important to note that the type of tax papers you need may vary depending on your filing status, income sources, and other factors.

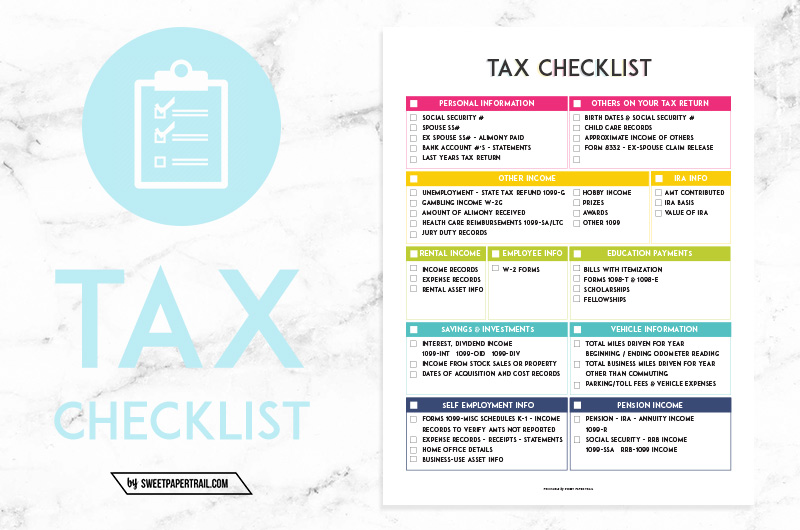

The 7 Essential Tax Papers

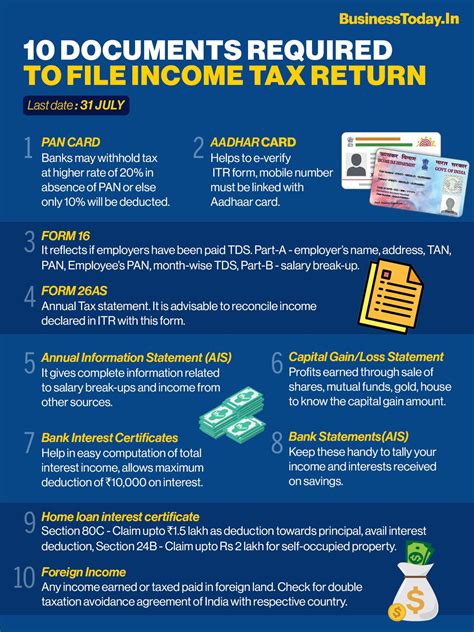

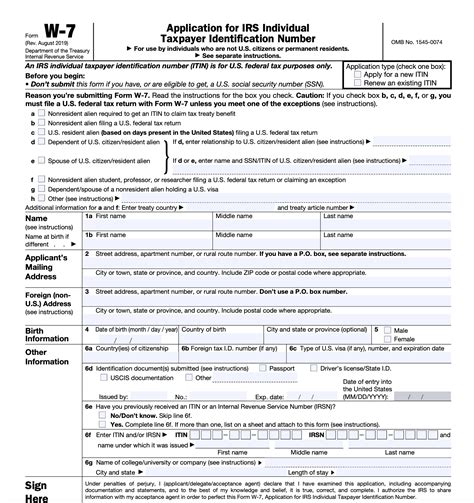

Here are the seven essential tax papers that you need to gather: * W-2 forms: These forms show your income and taxes withheld from your employer. * 1099 forms: These forms show income from freelance work, investments, and other sources. * Interest statements: These statements show the interest you earned from banks and other financial institutions. * Dividend statements: These statements show the dividends you received from investments. * Charitable donation receipts: These receipts show the amount you donated to charity. * Medical expense receipts: These receipts show the medical expenses you incurred during the year. * Business expense records: These records show the expenses related to your business, if you are self-employed.

Additional Tax Papers You May Need

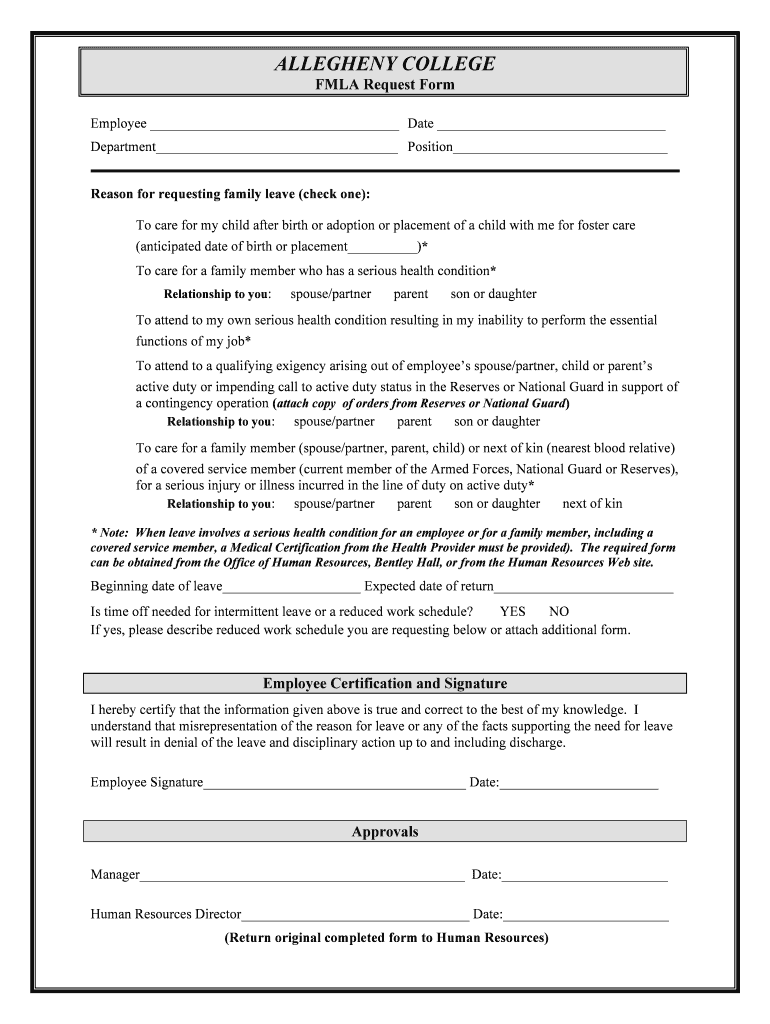

Depending on your situation, you may need to gather additional tax papers, such as: * Child care receipts: If you paid for child care services, you may be eligible for a credit. * Education expenses: If you paid for education expenses, you may be eligible for a credit or deduction. * Mortgage interest statements: If you own a home, you may be eligible for a mortgage interest deduction. * Property tax statements: If you own a home, you may be eligible for a property tax deduction.

Organizing Your Tax Papers

Once you have gathered all the necessary tax papers, it’s essential to organize them in a way that makes it easy to access and review the information. You can use a file folder or binder to keep all your tax papers in one place. Make sure to label each document and keep them in chronological order.

📝 Note: It's essential to keep your tax papers for at least three years in case of an audit.

Conclusion and Next Steps

In conclusion, gathering the right tax papers is essential to ensure a smooth and accurate tax preparation process. By having all the necessary documents, you can avoid errors and audits, and ensure that you receive the maximum refund you are eligible for. Once you have gathered all the necessary tax papers, you can start preparing your tax return. You can use tax software or consult a tax professional to help you with the process.

What is the deadline for filing taxes?

+

The deadline for filing taxes is typically April 15th of each year.

What happens if I don’t have all the necessary tax papers?

+

If you don’t have all the necessary tax papers, you may need to request an extension or amend your tax return later.

Can I file my taxes electronically?

+

Yes, you can file your taxes electronically using tax software or by consulting a tax professional.