Farm Exemption Paperwork Requirements

Introduction to Farm Exemption Paperwork Requirements

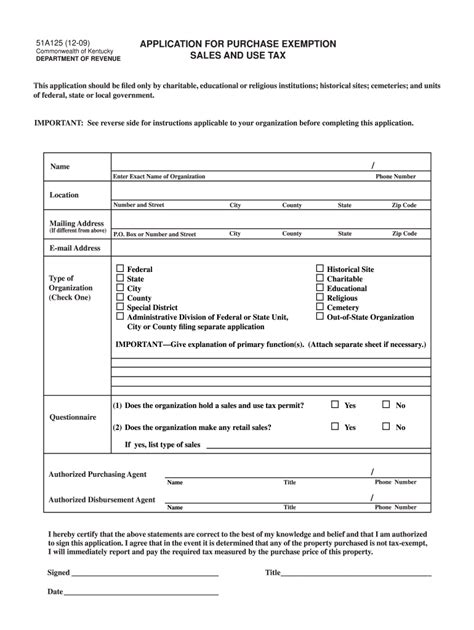

When it comes to taxation, farms and agricultural businesses are subject to various regulations and requirements. One of the key aspects of farm taxation is the exemption from certain taxes, which can help reduce the financial burden on farmers. However, to qualify for these exemptions, farmers must complete and submit the necessary paperwork. In this article, we will delve into the world of farm exemption paperwork requirements, exploring the various documents and forms that farmers need to complete to take advantage of these exemptions.

Types of Farm Exemptions

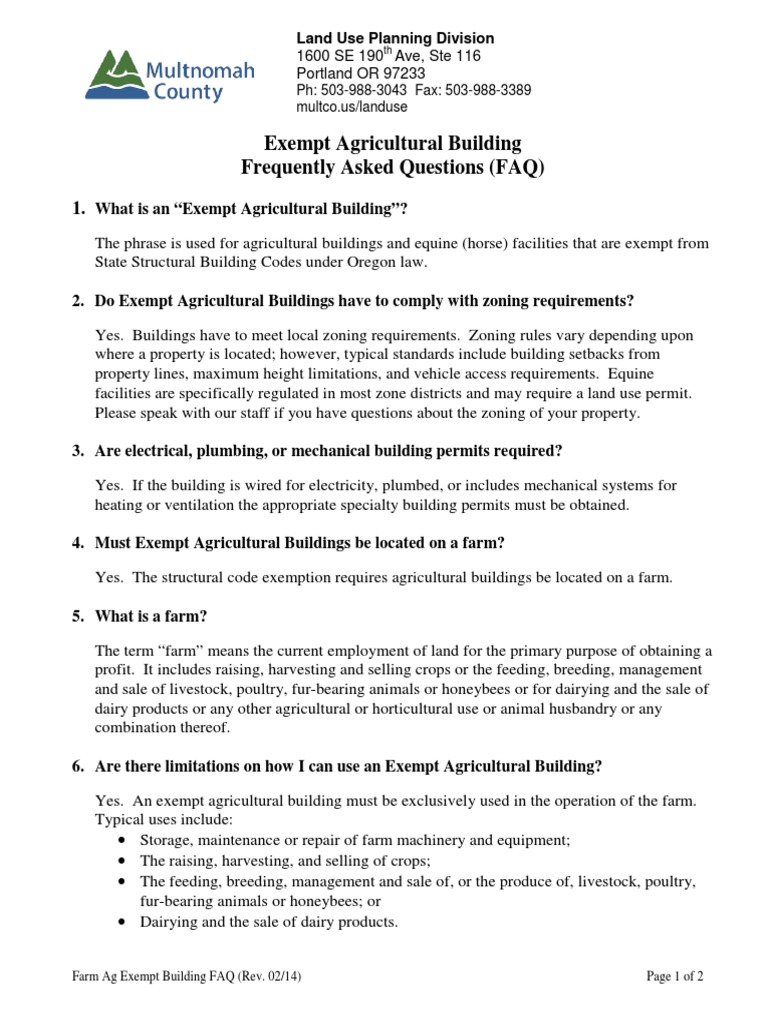

There are several types of farm exemptions available, including: * Sales tax exemptions: Many states offer sales tax exemptions on farm equipment, supplies, and other agricultural products. * Property tax exemptions: Some states provide property tax exemptions or reductions for farm land and buildings. * Income tax exemptions: Farmers may be eligible for income tax exemptions or deductions on certain types of farm income. To qualify for these exemptions, farmers must meet specific requirements and complete the necessary paperwork.

Required Paperwork for Farm Exemptions

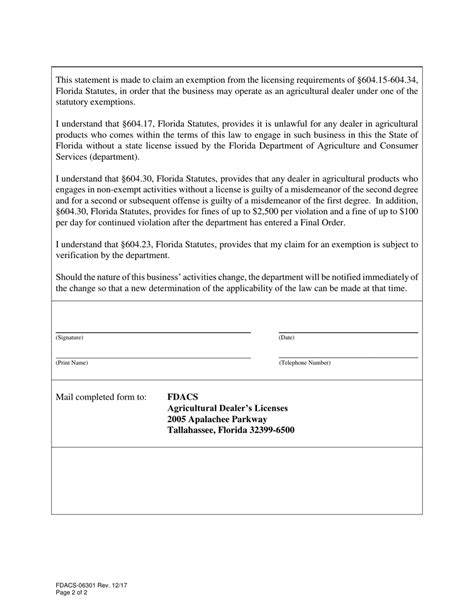

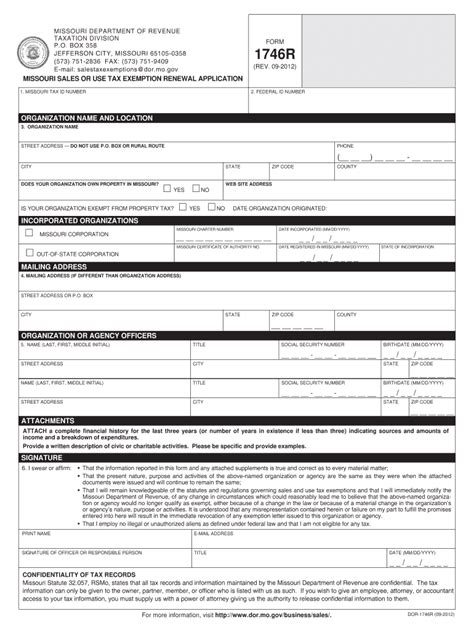

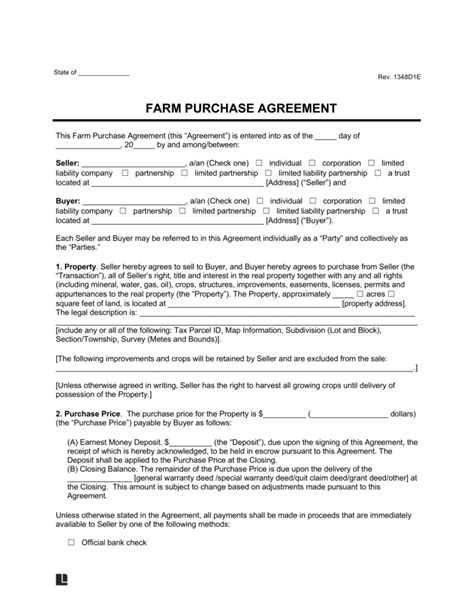

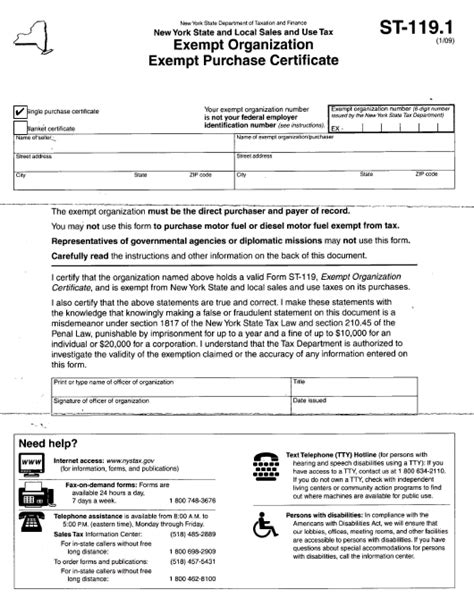

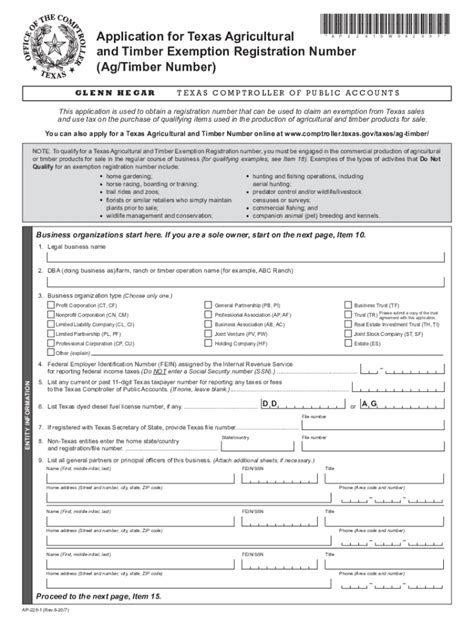

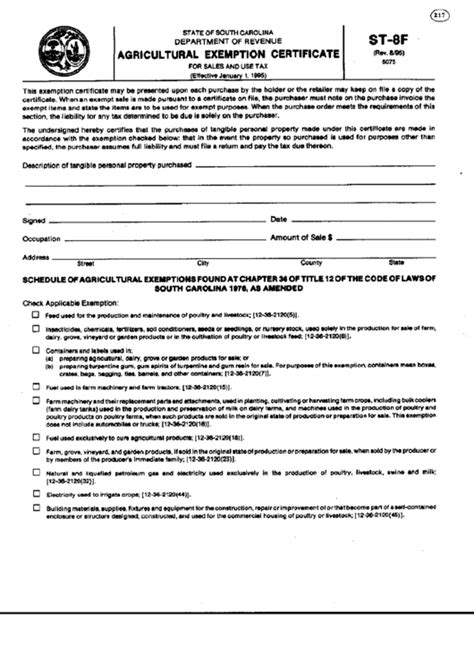

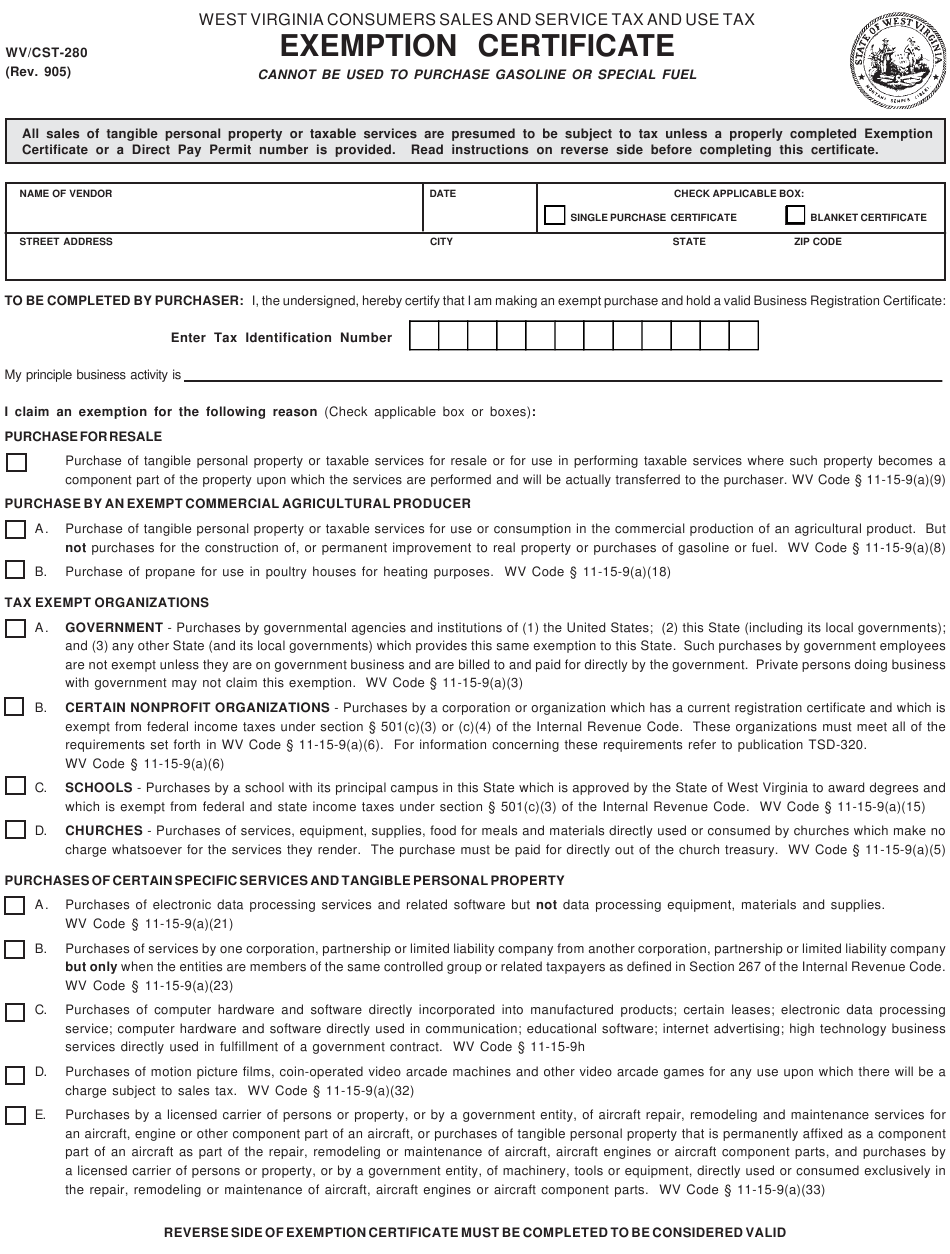

The specific paperwork required for farm exemptions varies depending on the state and type of exemption. However, some common documents and forms include: * Farm exemption certificates: These certificates are typically issued by the state department of agriculture or revenue department and certify that the farmer is eligible for the exemption. * Sales tax exemption forms: Farmers may need to complete sales tax exemption forms to purchase equipment and supplies tax-free. * Property tax exemption applications: Farmers must submit applications to their local assessor’s office to qualify for property tax exemptions. * Income tax returns: Farmers must complete and file income tax returns to claim income tax exemptions or deductions.

| Type of Exemption | Required Paperwork |

|---|---|

| Sales Tax Exemption | Farm exemption certificate, sales tax exemption form |

| Property Tax Exemption | Property tax exemption application, farm exemption certificate |

| Income Tax Exemption | Income tax return, farm exemption certificate |

Steps to Complete Farm Exemption Paperwork

To complete the necessary paperwork for farm exemptions, farmers should follow these steps: * Research the requirements: Familiarize yourself with the specific requirements for the exemption you are applying for. * Gather necessary documents: Collect all required documents, including farm exemption certificates, sales tax exemption forms, and property tax exemption applications. * Complete the forms accurately: Fill out the forms carefully and accurately, making sure to include all required information. * Submit the paperwork: Submit the completed paperwork to the relevant authorities, such as the state department of agriculture or local assessor’s office.

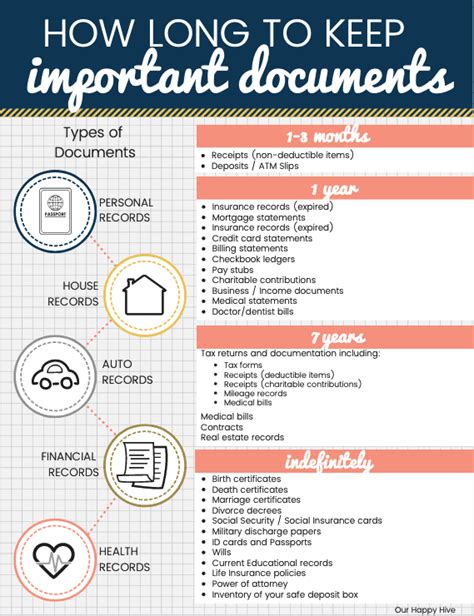

📝 Note: Farmers should keep accurate records of their exemption paperwork, including copies of submitted forms and certificates, in case of audits or other issues.

Benefits of Completing Farm Exemption Paperwork

Completing the necessary paperwork for farm exemptions can have several benefits, including: * Reduced tax liability: By taking advantage of exemptions, farmers can reduce their tax liability and save money. * Increased cash flow: With reduced tax liability, farmers can enjoy increased cash flow and improved financial stability. * Improved record-keeping: The process of completing exemption paperwork can help farmers develop better record-keeping habits, which can be beneficial for future tax planning and financial management.

Common Mistakes to Avoid

When completing farm exemption paperwork, farmers should avoid the following common mistakes: * Inaccurate or incomplete forms: Make sure to fill out forms carefully and accurately, including all required information. * Missing deadlines: Submit paperwork on time to avoid missing deadlines and losing exemption eligibility. * Insufficient documentation: Keep accurate records of exemption paperwork, including copies of submitted forms and certificates.

In the end, completing the necessary paperwork for farm exemptions is an essential step in taking advantage of these valuable tax savings opportunities. By understanding the requirements and following the steps outlined in this article, farmers can ensure they are in compliance with regulations and maximize their exemption benefits. The key to success lies in careful planning, accurate record-keeping, and timely submission of paperwork. With these best practices in mind, farmers can navigate the complex world of farm exemption paperwork with confidence and reap the rewards of reduced tax liability and improved financial stability.

What is the purpose of farm exemption paperwork?

+

The purpose of farm exemption paperwork is to certify that a farmer is eligible for certain tax exemptions, such as sales tax or property tax exemptions, and to provide the necessary documentation to support these exemptions.

What types of farm exemptions are available?

+

There are several types of farm exemptions available, including sales tax exemptions, property tax exemptions, and income tax exemptions. The specific types of exemptions available vary by state and location.

How do I complete farm exemption paperwork?

+

To complete farm exemption paperwork, farmers should research the requirements, gather necessary documents, complete the forms accurately, and submit the paperwork to the relevant authorities. It is also important to keep accurate records of exemption paperwork and to avoid common mistakes, such as inaccurate or incomplete forms and missing deadlines.