Foreclosure Paperwork Example

Introduction to Foreclosure Paperwork

When a homeowner fails to make mortgage payments, the lender may initiate a foreclosure process to repossess the property. This process involves a series of complex and detailed paperwork. Understanding the different types of foreclosure paperwork is essential for homeowners, lenders, and investors. In this article, we will delve into the world of foreclosure paperwork, exploring the various documents involved, their purposes, and the overall process.

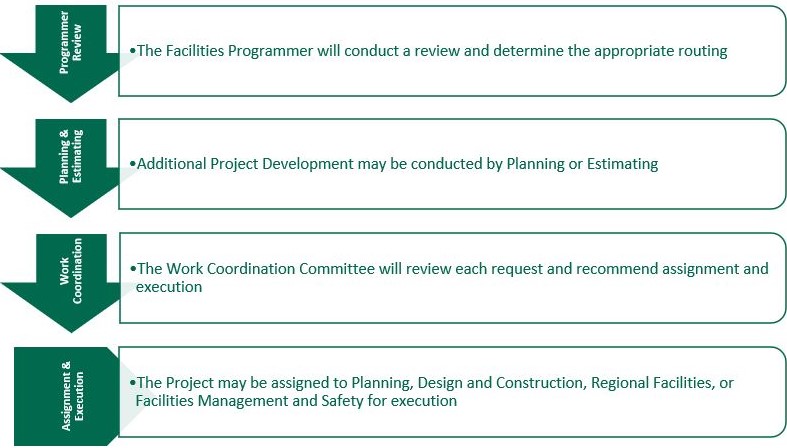

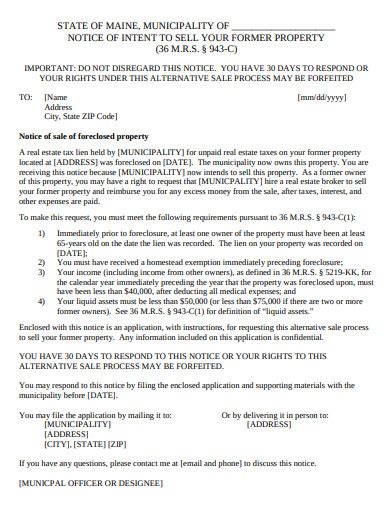

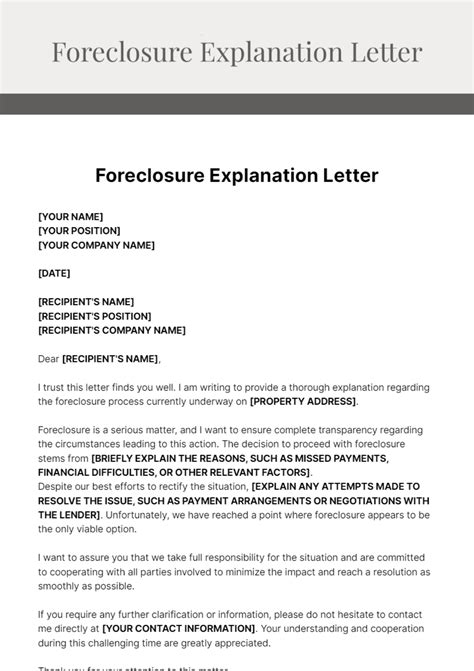

Types of Foreclosure Paperwork

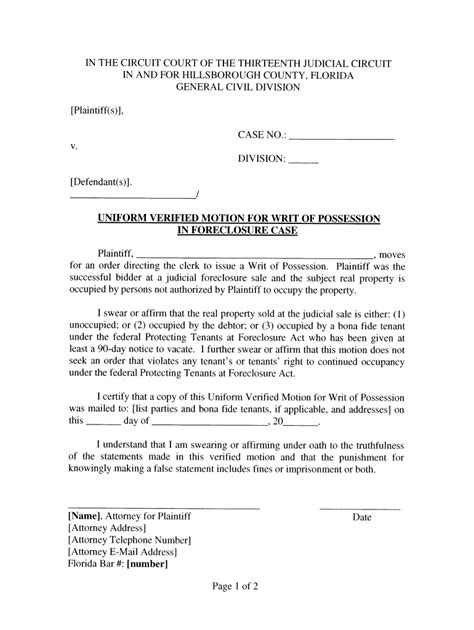

There are several types of foreclosure paperwork, each serving a specific purpose in the foreclosure process. Some of the most common documents include: * Notice of Default (NOD): This document is filed by the lender when the homeowner fails to make mortgage payments. It serves as a formal notice to the homeowner, stating that they are in default and providing a timeframe to cure the default. * Notice of Sale (NOS): If the homeowner fails to cure the default, the lender will file a Notice of Sale, which announces the upcoming foreclosure sale. * Foreclosure Deed: This document transfers ownership of the property from the homeowner to the lender or a new buyer. * Affidavit of Foreclosure: This sworn statement is typically provided by the lender, outlining the facts surrounding the foreclosure, including the default and the sale of the property. * Foreclosure Judgment: In judicial foreclosure states, the court will issue a foreclosure judgment, which confirms the lender’s right to foreclose on the property.

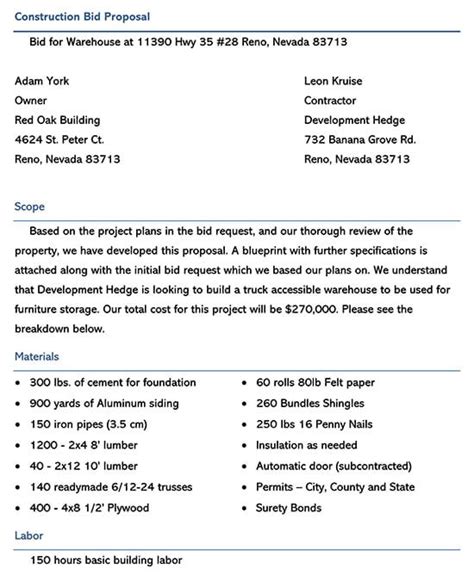

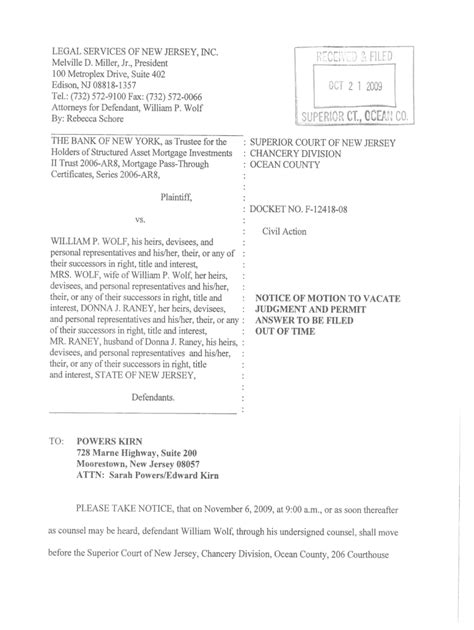

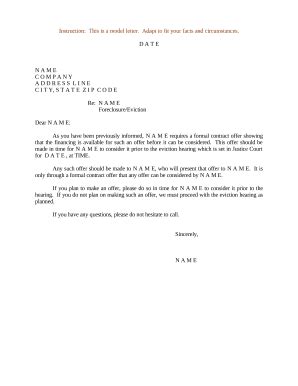

Example of Foreclosure Paperwork

To illustrate the foreclosure paperwork process, let’s consider an example. Suppose a homeowner, John, has failed to make mortgage payments on his property. The lender, XYZ Bank, decides to initiate foreclosure proceedings.

| Document | Purpose |

|---|---|

| Notice of Default (NOD) | Formal notice to the homeowner of default and opportunity to cure |

| Notice of Sale (NOS) | Announcement of upcoming foreclosure sale |

| Foreclosure Deed | Transfer of ownership from homeowner to lender or new buyer |

| Affidavit of Foreclosure | Sworn statement outlining facts surrounding foreclosure |

| Foreclosure Judgment | Court confirmation of lender’s right to foreclose |

In this example, XYZ Bank would file a Notice of Default, followed by a Notice of Sale, and ultimately a Foreclosure Deed, Affidavit of Foreclosure, and Foreclosure Judgment.

Importance of Foreclosure Paperwork

Foreclosure paperwork plays a crucial role in the foreclosure process, as it provides a formal and public record of the proceedings. This documentation helps to: * Establish the lender’s right to foreclose * Notify the homeowner of the foreclosure proceedings * Transfer ownership of the property * Provide a clear and transparent record of the foreclosure process

Common Mistakes in Foreclosure Paperwork

Errors or omissions in foreclosure paperwork can lead to delays, disputes, or even the dismissal of the foreclosure case. Some common mistakes include: * Incomplete or inaccurate documentation * Failure to provide proper notice to the homeowner * Incorrect or missing signatures * Insufficient or inaccurate information

📝 Note: It is essential to ensure that all foreclosure paperwork is accurate, complete, and properly executed to avoid potential issues or disputes.

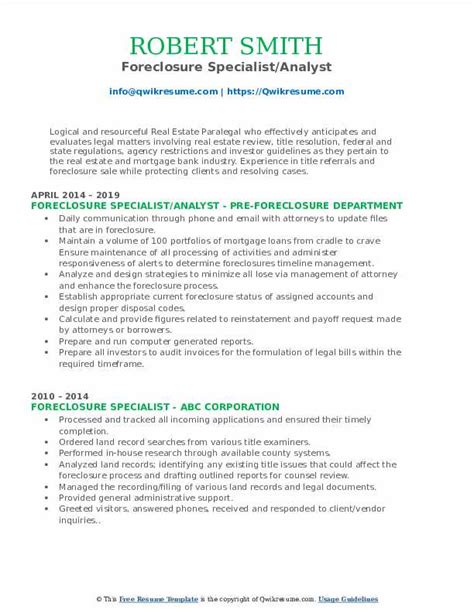

To avoid these mistakes, it is crucial to work with experienced professionals, such as attorneys or foreclosure specialists, who can guide you through the process and ensure that all necessary documentation is prepared and filed correctly.

Best Practices for Handling Foreclosure Paperwork

To ensure a smooth and efficient foreclosure process, it is essential to follow best practices when handling foreclosure paperwork. These include: * Verifying accuracy and completeness of documents * Providing proper notice to the homeowner * Maintaining a clear and transparent record of the foreclosure process * Seeking professional advice and guidance

By following these best practices and understanding the different types of foreclosure paperwork, you can navigate the foreclosure process with confidence and ensure that all necessary documentation is prepared and filed correctly.

In the end, foreclosure paperwork is a critical component of the foreclosure process, providing a formal and public record of the proceedings. By understanding the different types of documents involved and following best practices, you can ensure a smooth and efficient foreclosure process. The key takeaways from this discussion include the importance of accurate and complete documentation, proper notice to the homeowner, and maintaining a clear and transparent record of the foreclosure process. By keeping these points in mind, you can navigate the complex world of foreclosure paperwork with ease and confidence.

What is the purpose of a Notice of Default?

+

The Notice of Default serves as a formal notice to the homeowner, stating that they are in default and providing a timeframe to cure the default.

What is the difference between a judicial and non-judicial foreclosure?

+

A judicial foreclosure involves a court process, whereas a non-judicial foreclosure does not. The type of foreclosure process used depends on the state and local laws.

Can foreclosure paperwork be challenged or disputed?

+

Yes, foreclosure paperwork can be challenged or disputed. Homeowners or other parties may argue that the paperwork is incomplete, inaccurate, or improperly executed.