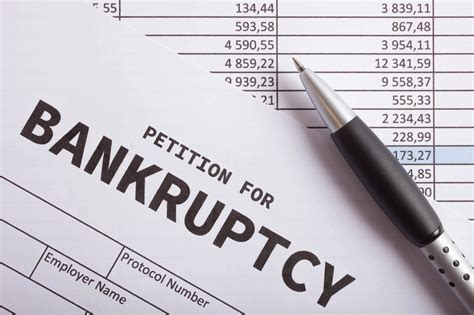

Bankruptcy Paperwork Requirements

Introduction to Bankruptcy Paperwork Requirements

Filing for bankruptcy is a complex process that involves a significant amount of paperwork. The requirements for bankruptcy paperwork can vary depending on the type of bankruptcy being filed, as well as the individual’s financial situation. In general, the paperwork required for bankruptcy includes financial statements, schedules, and other documents that provide a detailed picture of the individual’s or business’s financial situation. It is essential to understand the specific requirements for bankruptcy paperwork to ensure a smooth and successful filing process.

Types of Bankruptcy and Their Paperwork Requirements

There are several types of bankruptcy, each with its own set of paperwork requirements. The most common types of bankruptcy are Chapter 7 and Chapter 13. Chapter 7 bankruptcy, also known as liquidation bankruptcy, requires the debtor to surrender their non-exempt assets to a trustee, who then sells the assets and distributes the proceeds to creditors. Chapter 13 bankruptcy, also known as reorganization bankruptcy, allows the debtor to create a repayment plan to pay off a portion of their debts over time. The paperwork requirements for Chapter 7 and Chapter 13 bankruptcy are similar, but there are some key differences.

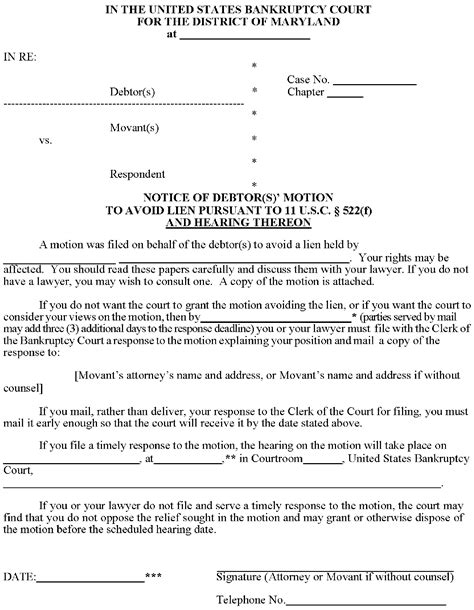

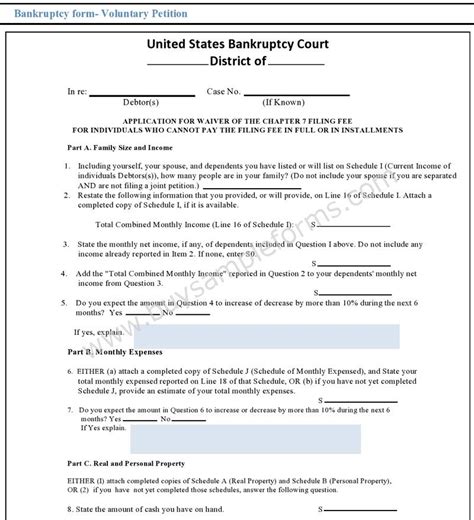

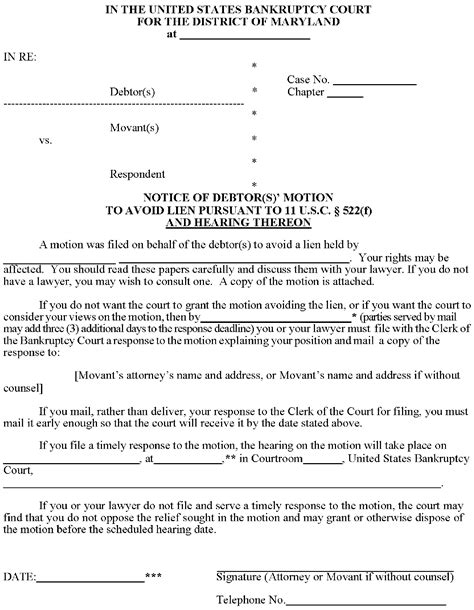

Voluntary Petition and Schedules

The first step in filing for bankruptcy is to submit a voluntary petition to the court. The petition must include the debtor’s name, address, and social security number, as well as a list of their creditors and the amount of debt owed to each creditor. In addition to the petition, the debtor must also submit several schedules that provide a detailed picture of their financial situation. These schedules include: * Schedule A/B: a list of the debtor’s real and personal property * Schedule C: a list of the debtor’s exemptions * Schedule D: a list of the debtor’s secured creditors * Schedule E/F: a list of the debtor’s unsecured creditors * Schedule G: a list of the debtor’s executory contracts and unexpired leases * Schedule H: a list of the debtor’s co-signers

Statement of Financial Affairs

In addition to the schedules, the debtor must also submit a statement of financial affairs that provides a detailed picture of their financial transactions over the past two years. This statement must include information about the debtor’s income, expenses, assets, and debts, as well as any financial transactions they have made, such as payments to creditors or transfers of assets.

Means Test

If the debtor is filing for Chapter 7 bankruptcy, they must also submit a means test to determine whether they are eligible for Chapter 7 bankruptcy. The means test calculates the debtor’s disposable income and compares it to the median income for their state. If the debtor’s disposable income is above the median income, they may not be eligible for Chapter 7 bankruptcy and may need to file for Chapter 13 bankruptcy instead.

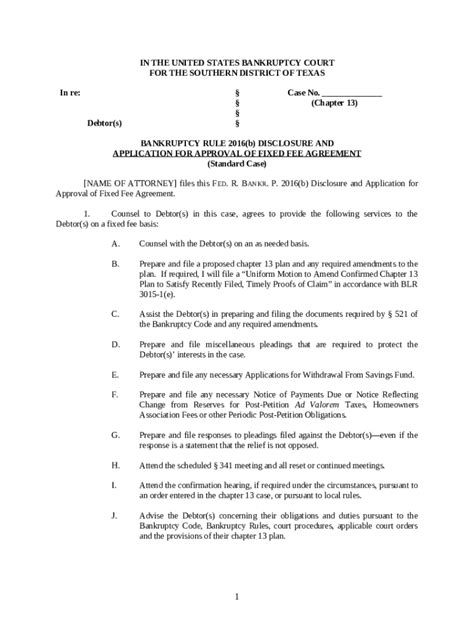

Plan and Disclosure Statement

If the debtor is filing for Chapter 13 bankruptcy, they must submit a plan that outlines how they intend to repay their debts over time. The plan must include information about the debtor’s income, expenses, and debt payments, as well as a detailed schedule of payments. In addition to the plan, the debtor must also submit a disclosure statement that provides a detailed picture of their financial situation and explains how the plan will be implemented.

| Document | Description |

|---|---|

| Voluntary Petition | The initial document filed with the court to begin the bankruptcy process |

| Schedules | Documents that provide a detailed picture of the debtor's financial situation |

| Statement of Financial Affairs | A document that provides a detailed picture of the debtor's financial transactions over the past two years |

| Means Test | A test used to determine whether the debtor is eligible for Chapter 7 bankruptcy |

| Plan | A document that outlines how the debtor intends to repay their debts over time |

| Disclosure Statement | A document that provides a detailed picture of the debtor's financial situation and explains how the plan will be implemented |

📝 Note: The specific paperwork requirements for bankruptcy can vary depending on the individual's financial situation and the type of bankruptcy being filed. It is essential to consult with a bankruptcy attorney to ensure that all necessary paperwork is completed accurately and submitted on time.

In summary, the paperwork requirements for bankruptcy are complex and can vary depending on the type of bankruptcy being filed. It is essential to understand the specific requirements for bankruptcy paperwork to ensure a smooth and successful filing process. By submitting the required documents, including the voluntary petition, schedules, statement of financial affairs, means test, plan, and disclosure statement, debtors can take the first step towards financial recovery.

What is the first step in filing for bankruptcy?

+

The first step in filing for bankruptcy is to submit a voluntary petition to the court. The petition must include the debtor's name, address, and social security number, as well as a list of their creditors and the amount of debt owed to each creditor.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy, also known as liquidation bankruptcy, requires the debtor to surrender their non-exempt assets to a trustee, who then sells the assets and distributes the proceeds to creditors. Chapter 13 bankruptcy, also known as reorganization bankruptcy, allows the debtor to create a repayment plan to pay off a portion of their debts over time.

What is the means test and how is it used in bankruptcy?

+

The means test is a test used to determine whether the debtor is eligible for Chapter 7 bankruptcy. The test calculates the debtor's disposable income and compares it to the median income for their state. If the debtor's disposable income is above the median income, they may not be eligible for Chapter 7 bankruptcy and may need to file for Chapter 13 bankruptcy instead.

The process of filing for bankruptcy can be complex and overwhelming, but by understanding the paperwork requirements and seeking the advice of a bankruptcy attorney, individuals can take the first step towards financial recovery. It is essential to approach the process with caution and carefully consider all options before making a decision. By doing so, individuals can ensure that they are making the best decision for their financial situation and can move forward with confidence.