Paperwork

7 Tax Papers Needed

Introduction to Tax Papers

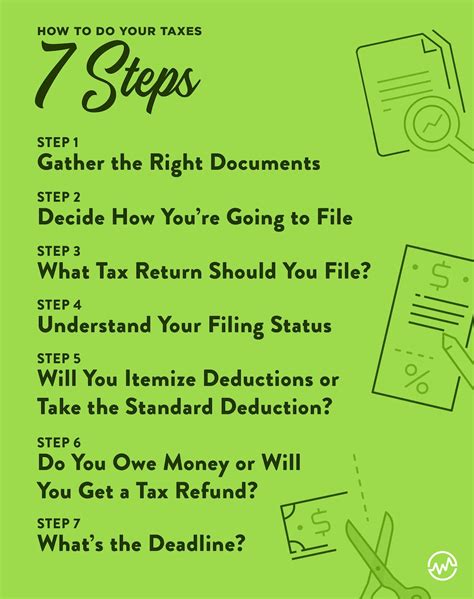

When it comes to filing taxes, having the right documents is crucial to ensure a smooth and accurate process. With the increasing complexity of tax laws and regulations, it’s essential to stay organized and have all the necessary papers in order. In this article, we will discuss the 7 tax papers needed to file your taxes efficiently.

Understanding the Importance of Tax Papers

Tax papers are documents that provide proof of income, expenses, and other relevant information required to file tax returns. These papers help the tax authority verify the accuracy of the tax returns and ensure that individuals and businesses are complying with tax laws. Without the necessary tax papers, individuals may face delays, penalties, or even audits.

The 7 Essential Tax Papers

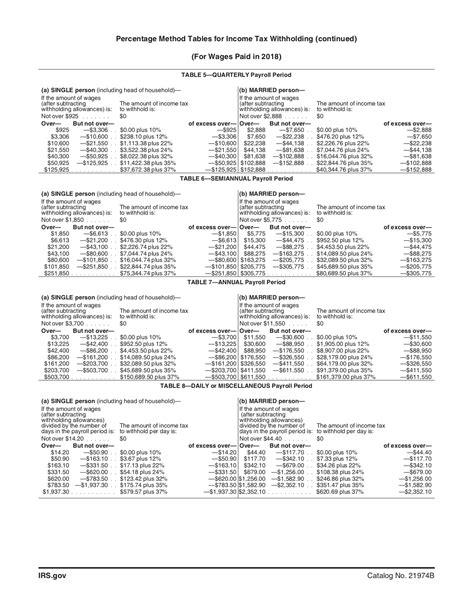

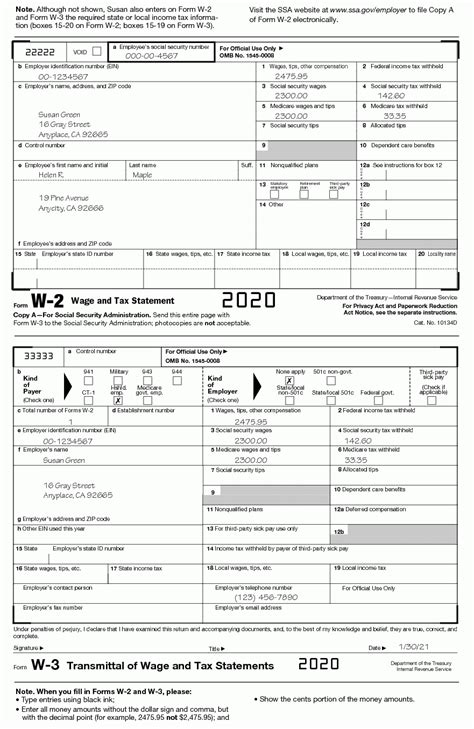

Here are the 7 tax papers needed to file your taxes: * Form W-2: This form shows your income and taxes withheld from your employer. * Form 1099: This form reports income from freelance work, dividends, and interest. * Schedule A: This form is used to itemize deductions, such as medical expenses and charitable donations. * Schedule B: This form reports interest and dividend income from investments. * Schedule C: This form is used to report income and expenses from self-employment or business activities. * Form 1098: This form reports mortgage interest and property taxes paid. * Form 5498: This form reports contributions to retirement accounts, such as IRAs and 401(k)s.

Additional Tax Papers You May Need

Depending on your individual circumstances, you may need additional tax papers, such as: * Form 1040: This is the standard form used for personal tax returns. * Form 8949: This form is used to report sales and other dispositions of capital assets. * Form 8829: This form is used to report expenses for a home office deduction. * Form 8863: This form is used to report education credits.

💡 Note: It's essential to keep all tax-related documents, including receipts, invoices, and bank statements, in case of an audit or if you need to verify information on your tax return.

Organizing Your Tax Papers

To ensure a smooth tax-filing process, it’s crucial to keep all tax papers organized and easily accessible. You can use a file folder or a digital tool to store and manage your tax documents. Make sure to keep your tax papers in a safe and secure location, such as a fireproof safe or a secure online storage service.

Tips for Filing Tax Papers

Here are some tips to keep in mind when filing your tax papers: * File electronically: Electronic filing is faster, more accurate, and more secure than paper filing. * Use tax software: Tax software can help you navigate the tax-filing process and ensure accuracy. * Keep receipts and records: Keep all receipts and records related to your tax return, in case of an audit or if you need to verify information. * Seek professional help: If you’re unsure about any aspect of the tax-filing process, consider seeking help from a tax professional.

Conclusion and Final Thoughts

In summary, having the right tax papers is essential to ensure a smooth and accurate tax-filing process. By understanding the importance of tax papers and keeping them organized, you can avoid delays, penalties, and audits. Remember to file electronically, use tax software, and keep receipts and records. If you’re unsure about any aspect of the tax-filing process, don’t hesitate to seek professional help. By following these tips and staying organized, you can navigate the tax-filing process with confidence and ensure a successful tax season.

What is the deadline for filing tax returns?

+

The deadline for filing tax returns is typically April 15th of each year, but it may vary depending on the tax authority and individual circumstances.

What happens if I miss the tax-filing deadline?

+

If you miss the tax-filing deadline, you may face penalties, interest, and even audits. It’s essential to file your tax return as soon as possible to avoid these consequences.

Can I file my tax return electronically?

+

Yes, you can file your tax return electronically using tax software or the tax authority’s website. Electronic filing is faster, more accurate, and more secure than paper filing.