SR22 Insurance Nebraska Forms

Understanding SR22 Insurance in Nebraska

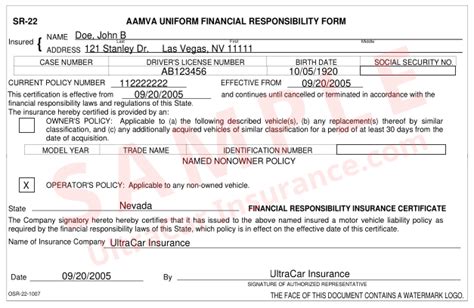

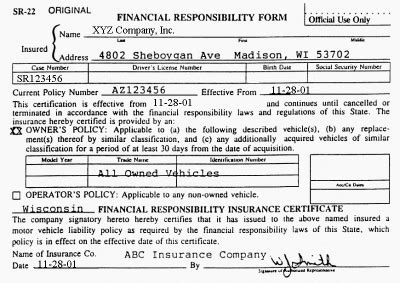

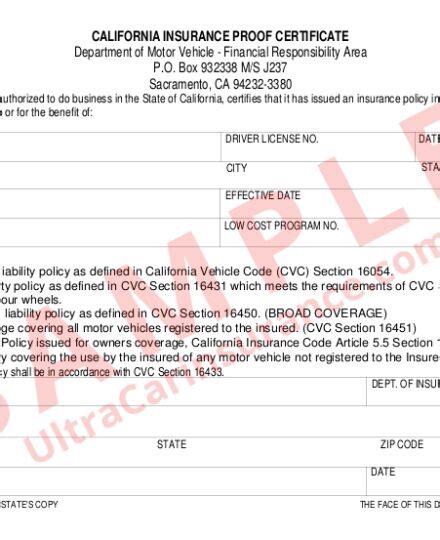

In the state of Nebraska, SR22 insurance is a type of car insurance that provides proof of financial responsibility to the Department of Motor Vehicles (DMV). This type of insurance is typically required for drivers who have been convicted of certain offenses, such as driving under the influence (DUI) or reckless driving. The SR22 form is a certificate of insurance that is filed with the state, demonstrating that the driver has the necessary insurance coverage to operate a vehicle.

Who Needs SR22 Insurance in Nebraska?

There are several situations in which a driver may be required to obtain SR22 insurance in Nebraska. These include: * Being convicted of a DUI or other serious driving offense * Accumulating too many points on their driver’s license * Causing an accident while driving without insurance * Having their driver’s license suspended or revoked * Being required to provide proof of financial responsibility by the court or DMV

How to Obtain SR22 Insurance in Nebraska

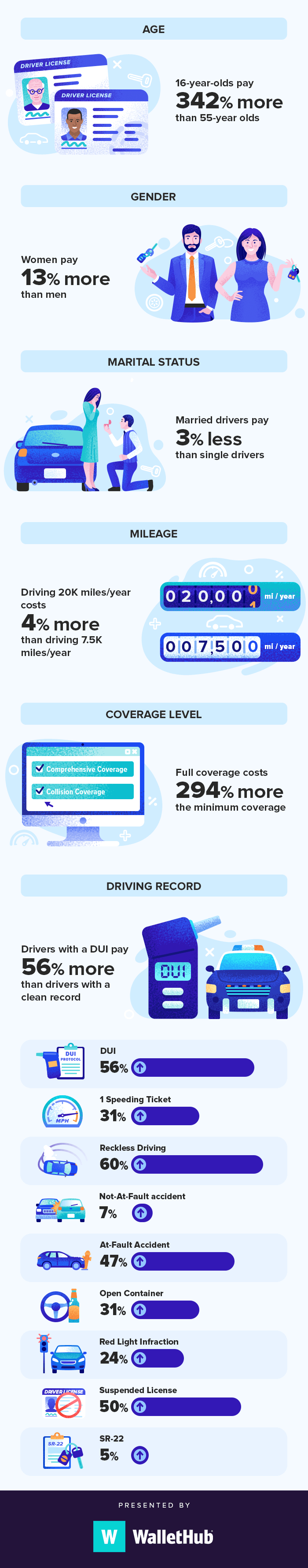

To obtain SR22 insurance in Nebraska, drivers will need to contact an insurance provider that offers this type of coverage. The insurance company will then file the SR22 form with the state, which will typically require a fee. The cost of SR22 insurance can vary depending on the insurance provider and the driver’s individual circumstances. Some of the factors that can affect the cost of SR22 insurance include: * The driver’s age and driving history * The type of vehicle being insured * The amount of coverage required * The insurance provider’s rates and fees

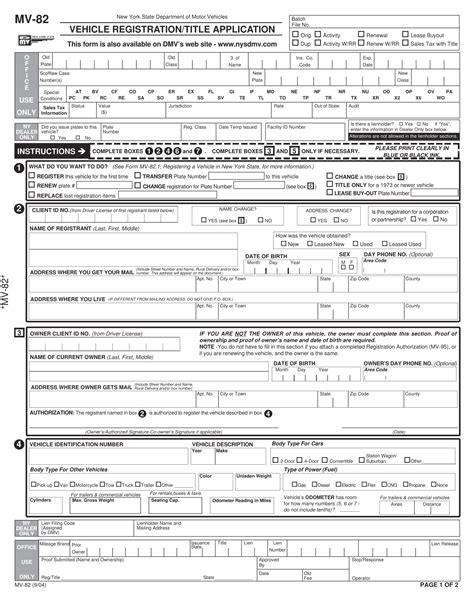

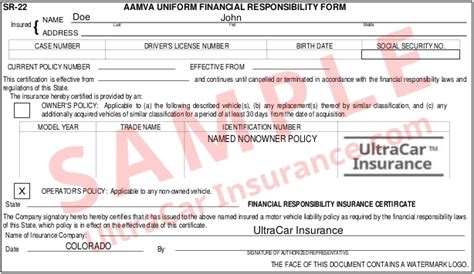

SR22 Insurance Forms and Requirements

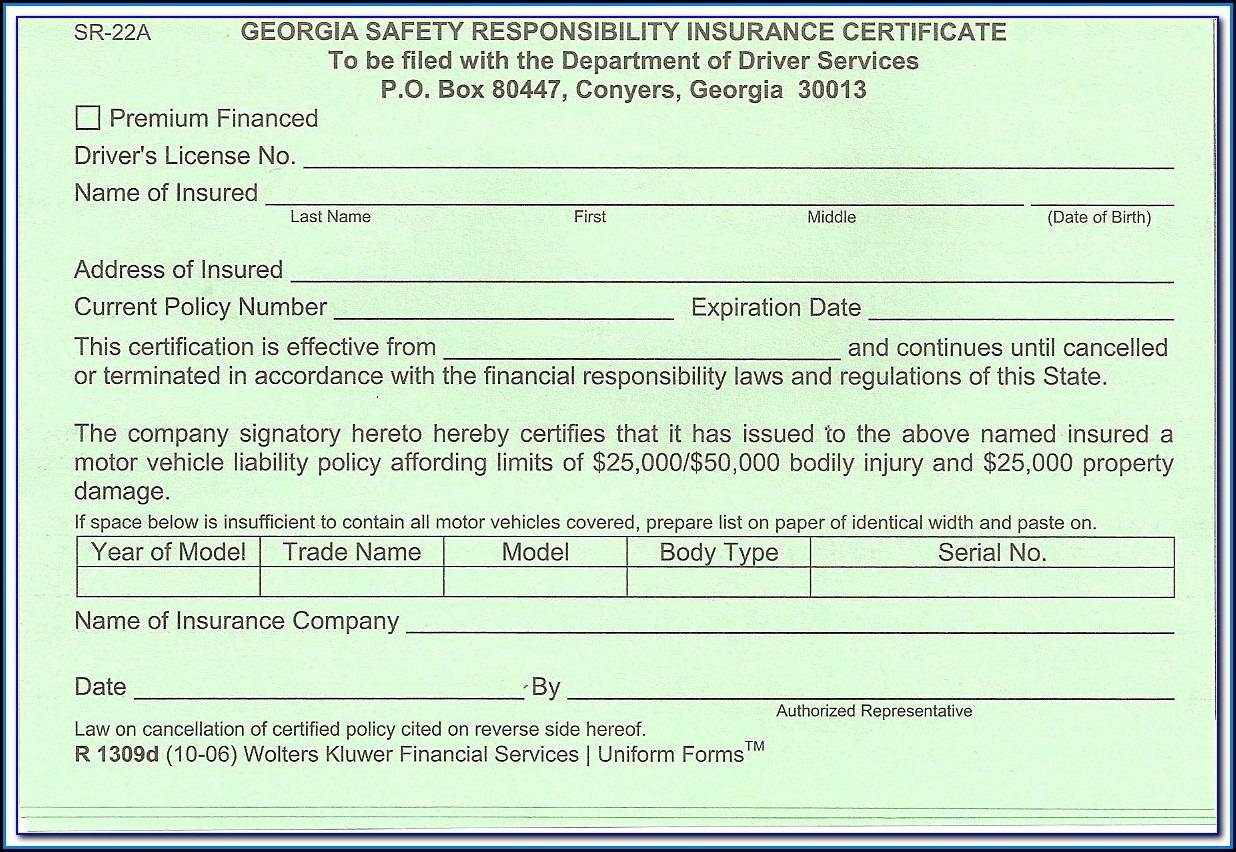

In Nebraska, the SR22 form is typically filed electronically with the state by the insurance provider. The form must include certain information, such as: * The driver’s name and address * The vehicle’s make, model, and year * The insurance policy number and coverage limits * The effective date of the policy The SR22 form must be filed with the state within a certain timeframe, usually 30 days, and must be maintained for a specified period, typically 3 years.

| Form | Description |

|---|---|

| SR22 | Certificate of insurance filed with the state |

| SR26 | Notification of cancellation or termination of SR22 insurance |

| SR22A | Non-owner SR22 insurance form |

📝 Note: Drivers who are required to obtain SR22 insurance in Nebraska should carefully review their policy and ensure that it meets the state's requirements.

Non-Owner SR22 Insurance in Nebraska

In some cases, drivers may be required to obtain non-owner SR22 insurance in Nebraska. This type of insurance provides coverage for drivers who do not own a vehicle, but still need to demonstrate proof of financial responsibility. Non-owner SR22 insurance can be more expensive than traditional SR22 insurance, and may have different requirements and restrictions.

Suspension and Revocation of SR22 Insurance

If a driver’s SR22 insurance is cancelled or terminated, the insurance provider will typically file an SR26 form with the state. This can result in the suspension or revocation of the driver’s license, and may require the driver to reinstate their SR22 insurance coverage. Drivers who are facing suspension or revocation of their SR22 insurance should contact their insurance provider and the DMV to determine the necessary steps to take.

Maintaining SR22 Insurance Coverage

To maintain SR22 insurance coverage in Nebraska, drivers will need to: * Pay their premiums on time * Keep their policy active and in force * Notify their insurance provider of any changes to their driving record or vehicle * File any required paperwork or forms with the state Failure to maintain SR22 insurance coverage can result in the suspension or revocation of the driver’s license, and may require the driver to reinstate their coverage.

In final consideration, obtaining and maintaining SR22 insurance in Nebraska requires careful attention to the state’s requirements and regulations. By understanding the SR22 insurance forms and requirements, drivers can ensure that they are in compliance with the law and maintain their driving privileges.

What is SR22 insurance in Nebraska?

+

SR22 insurance in Nebraska is a type of car insurance that provides proof of financial responsibility to the Department of Motor Vehicles (DMV).

Who needs SR22 insurance in Nebraska?

+

Drivers who have been convicted of certain offenses, such as DUI or reckless driving, or have had their driver’s license suspended or revoked, may be required to obtain SR22 insurance in Nebraska.

How long do I need to maintain SR22 insurance in Nebraska?

+

Typically, drivers are required to maintain SR22 insurance in Nebraska for 3 years, but this can vary depending on the individual circumstances.