5 Navr Paperwork Tips

Introduction to NAVR Paperwork

NAVR, or Notice of Assessment and Valuation Review, is a crucial document used in various administrative and legal contexts, particularly in real estate and property taxation. The process of handling NAVR paperwork can be complex and requires careful attention to detail to ensure compliance with regulations and to avoid potential disputes. In this article, we will delve into the world of NAVR paperwork, exploring its significance, the challenges associated with it, and most importantly, providing valuable tips to navigate through the process efficiently.

Understanding NAVR Paperwork

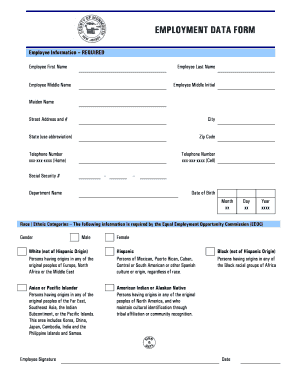

Before diving into the tips, it’s essential to have a solid understanding of what NAVR paperwork entails. NAVR documents are issued to inform property owners about the assessed value of their properties, which is a critical factor in determining property taxes. These documents are usually issued annually or whenever there is a significant change in the property’s value. The process involves a thorough assessment of the property, considering factors such as its location, size, condition, and comparable sales in the area.

Challenges in NAVR Paperwork

Handling NAVR paperwork can be challenging due to its complexity and the potential for errors. Some of the common challenges include: - Understanding the legal jargon: NAVR documents are filled with technical terms and legal language that can be confusing for those without a legal background. - Meeting deadlines: There are strict timelines for responding to NAVR notices, and missing these deadlines can result in unfavorable outcomes. - Gathering necessary documentation: The process requires collecting and submitting various documents to support the valuation review, which can be time-consuming and tedious.

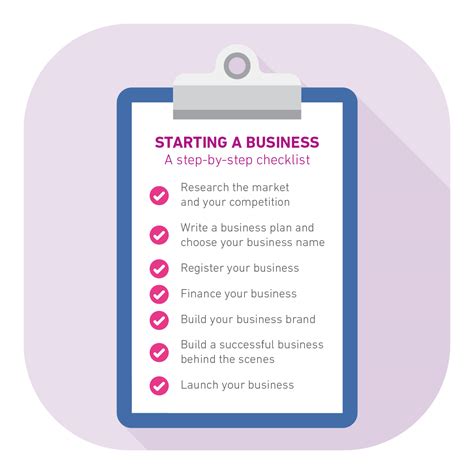

5 NAVR Paperwork Tips

To navigate through the NAVR paperwork process smoothly, consider the following tips:

Seek Professional Advice: Given the complexity of NAVR paperwork, it’s highly recommended to consult with a professional, such as a real estate attorney or a tax consultant. They can provide guidance tailored to your specific situation and help in making informed decisions.

Keep Detailed Records: Maintaining detailed and organized records of your property, including purchase documents, improvement receipts, and any communications with the assessment office, is crucial. These records can serve as valuable evidence in case of a dispute over the property’s valuation.

Understand the Appeal Process: If you disagree with the assessed value of your property, it’s essential to understand the appeal process. This includes knowing the deadlines, the required documentation, and the grounds for appeal. Timing is critical in these matters, as missing the appeal window can leave you with little recourse.

Stay Informed About Local Regulations: Property tax laws and regulations can vary significantly from one area to another. Staying updated on local ordinances and any changes to tax assessment procedures can help you anticipate and prepare for the NAVR process more effectively.

Review Your NAVR Notice Carefully: When you receive your NAVR notice, review it carefully for any errors or inaccuracies. Check the property description, assessed value, and tax amount to ensure they are correct. If you find any discrepancies, contact the assessment office immediately to rectify the situation.

📝 Note: Always keep a copy of your NAVR notice and any subsequent communications for your records.

Implementing the Tips

Implementing these tips requires a proactive approach. Start by educating yourself on the NAVR process and the specific requirements in your area. When you receive your NAVR notice, take immediate action to review it and seek professional advice if necessary. Keeping detailed records and staying informed about local regulations will also help in managing the NAVR paperwork efficiently.

| Tip | Description |

|---|---|

| Seek Professional Advice | Consult with a real estate attorney or tax consultant for personalized guidance. |

| Keep Detailed Records | Maintain organized records of your property documents and communications. |

| Understand the Appeal Process | Familiarize yourself with the deadlines, required documentation, and grounds for appeal. |

| Stay Informed About Local Regulations | Keep updated on local property tax laws and any changes to assessment procedures. |

| Review Your NAVR Notice Carefully | Check for errors or inaccuracies and contact the assessment office if issues are found. |

In essence, managing NAVR paperwork effectively is about being prepared, informed, and proactive. By following these tips and staying vigilant, property owners can ensure a smoother process and potentially avoid costly disputes over property valuations.

As we reflect on the key points discussed, it becomes clear that navigating the complexities of NAVR paperwork requires a combination of knowledge, organization, and timely action. By embracing these strategies, individuals can better position themselves to handle the challenges associated with NAVR documents, ultimately protecting their interests and ensuring compliance with regulatory requirements.

What is NAVR paperwork, and why is it important?

+

NAVR paperwork refers to the documents and process involved in the assessment and valuation review of properties for taxation purposes. It’s crucial for property owners as it determines their property tax liability.

How often is NAVR paperwork issued?

+

NAVR paperwork is typically issued annually, but it can also be issued whenever there’s a significant change in the property’s value, such as after major renovations or changes in the property’s use.

What should I do if I disagree with the assessed value of my property?

+

If you disagree with the assessed value, you should review the assessment notice carefully, gather evidence to support your claim, and follow the appeal process as outlined by the local assessment authority. It’s often beneficial to seek professional advice to ensure you’re taking the correct steps.