Paperwork

5 NVA Paperwork Tips

Introduction to NVA Paperwork

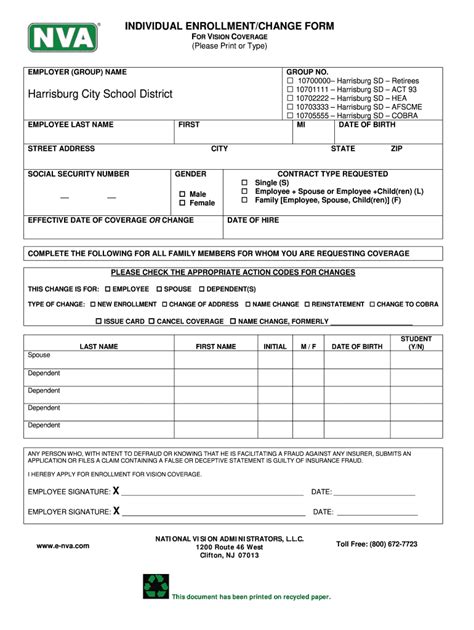

Dealing with paperwork can be a daunting task, especially when it comes to complex processes like those involved in the Nederlandse Vereniging van Accountants (NVA), or the Dutch Association of Accountants. For professionals and individuals interacting with this organization, understanding the intricacies of NVA paperwork is crucial. This article aims to provide insights and tips on navigating these processes efficiently.

Understanding NVA Requirements

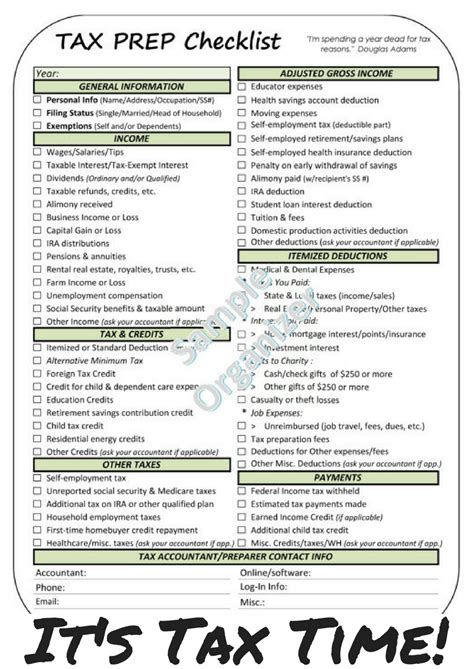

Before diving into the tips, it’s essential to understand what NVA paperwork entails. The NVA is responsible for overseeing the accounting profession in the Netherlands, ensuring that accountants meet certain standards and follow specific guidelines. This includes maintaining ethical standards, completing continuing professional development, and adhering to accounting and auditing standards. The paperwork involved can range from registration and membership applications to compliance reports and ethical conduct forms.

5 Tips for Handling NVA Paperwork

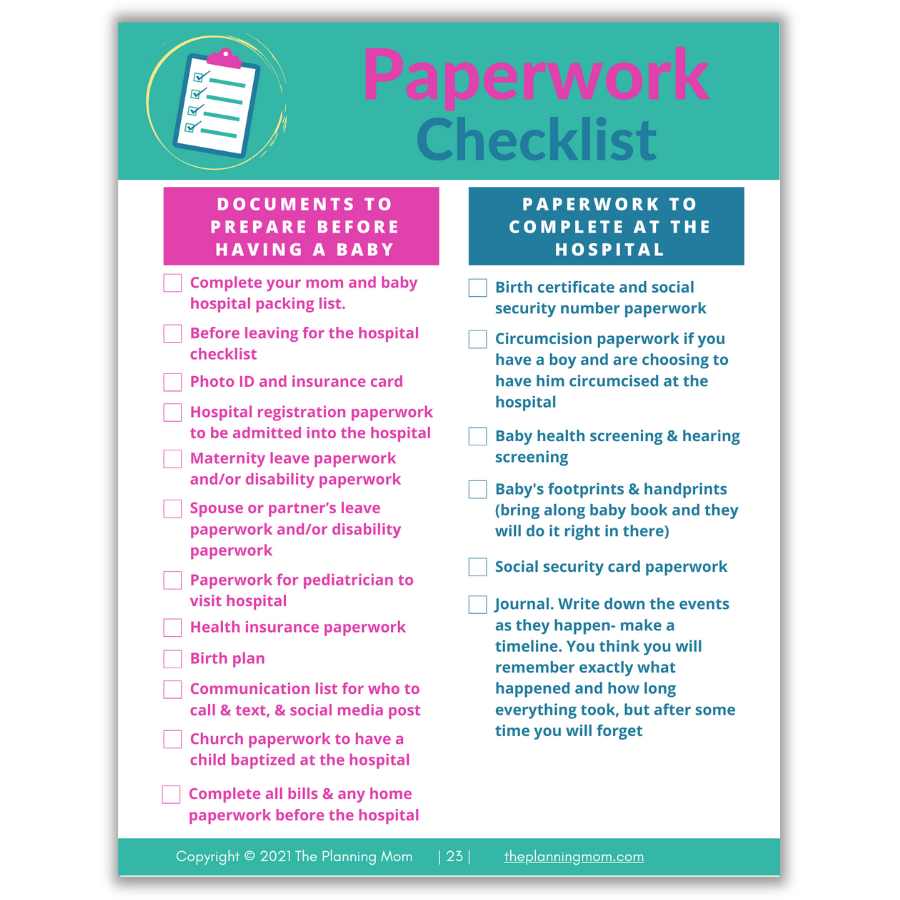

Given the complexity and importance of NVA paperwork, here are five tips to help individuals and professionals manage these tasks more effectively: - Stay Organized: Keeping all relevant documents and information in one place can significantly reduce the stress and time involved in completing NVA paperwork. Utilizing digital tools for organization can also help in quickly locating specific documents when needed. - Understand the Requirements: Each piece of paperwork has specific requirements that must be met. Taking the time to thoroughly read through the instructions and understanding what is being asked can prevent errors and the need for resubmission. - Plan Ahead: NVA paperwork often comes with deadlines. Creating a timeline for when applications or reports are due can help ensure that everything is submitted on time, avoiding any potential penalties or delays. - Seek Professional Help When Needed: For complex paperwork or when uncertainty arises, it may be beneficial to seek help from a professional, such as an accountant or legal advisor who is familiar with NVA processes. - Double-Check Submissions: Before submitting any paperwork, it’s crucial to double-check that all information is accurate and complete. This can prevent delays and additional work in the long run.

Common Challenges and Solutions

Despite the best preparations, challenges can arise when dealing with NVA paperwork. Some common issues include misunderstanding the requirements, missing deadlines, or encountering technical difficulties with online submission platforms. Solutions to these challenges often involve seeking clarification from NVA support services, planning well in advance to meet deadlines, and utilizing reliable technology for submissions.

Importance of Compliance

Compliance with NVA regulations and standards is not just about completing paperwork correctly; it’s also about maintaining professional integrity and contributing to the trust and reliability of the accounting profession as a whole. By taking the time to understand and adhere to these standards, professionals can ensure their work meets the highest levels of quality and ethics.

💡 Note: Always refer to the latest guidelines and regulations provided by the NVA, as these can change over time.

Utilizing Digital Tools for Efficiency

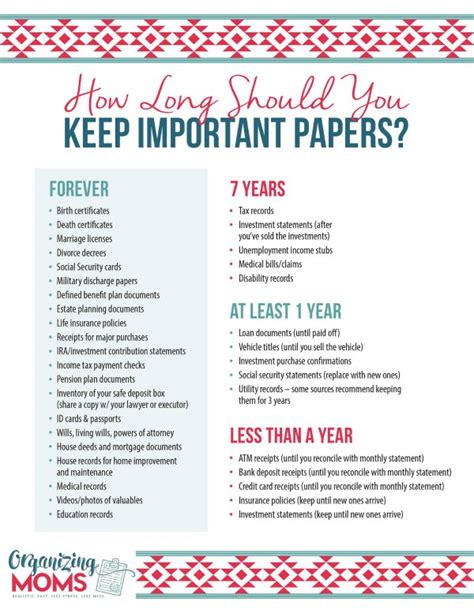

In today’s digital age, leveraging technology can significantly streamline the process of handling NVA paperwork. From digital storage solutions for keeping documents organized to online platforms for submitting applications and reports, there are numerous tools available that can enhance efficiency and reduce the administrative burden.

Conclusion and Future Directions

In conclusion, managing NVA paperwork effectively requires a combination of understanding, organization, and proactive planning. By following the tips outlined above and staying informed about the latest developments and requirements, professionals can navigate these processes with greater ease and confidence. As the accounting profession continues to evolve, embracing digital solutions and maintaining a commitment to ethical standards will be key to success.

What is the primary purpose of the NVA?

+

The primary purpose of the NVA is to oversee the accounting profession in the Netherlands, ensuring that accountants meet certain standards and follow specific guidelines.

How can I stay updated on the latest NVA requirements and changes?

+

You can stay updated by regularly visiting the NVA’s official website, subscribing to their newsletters, or following their social media channels.

What are the consequences of not complying with NVA regulations?

+

The consequences can range from penalties and fines to loss of professional certification or membership. It’s essential to comply with all regulations to maintain professional integrity and avoid these consequences.