Paperwork

Index Funds Investment Paperwork

Introduction to Index Funds

Index funds are a type of investment vehicle that allows individuals to invest in a diversified portfolio of stocks or bonds by tracking a specific market index, such as the S&P 500. This type of investment provides broad diversification and can be an effective way to gain exposure to various asset classes. Index funds are designed to mimic the performance of the underlying index, providing investors with a low-cost and efficient way to invest in the market. They are often considered a core holding in a portfolio, as they provide a stable foundation for long-term growth.

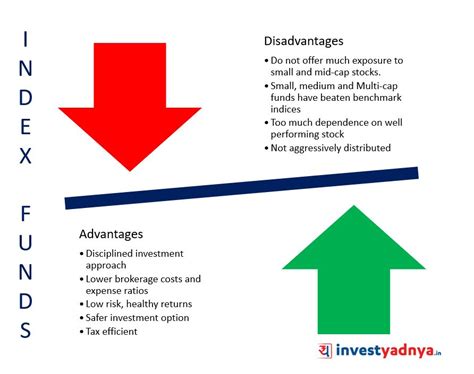

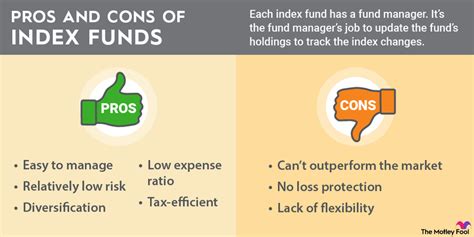

Benefits of Index Funds

There are several benefits to investing in index funds, including: * Diversification: Index funds provide instant diversification, as they hold a broad range of securities within the underlying index. * Low Costs: Index funds typically have lower fees compared to actively managed funds, as they do not require the same level of research and management. * Consistency: Index funds tend to be less volatile than individual stocks or actively managed funds, providing a more consistent return over the long term. * Flexibility: Index funds are available in a variety of asset classes, including stocks, bonds, and commodities, allowing investors to tailor their portfolio to their individual needs.

Investment Paperwork for Index Funds

When investing in index funds, there are several documents that investors should be familiar with. These include: * Prospectus: The prospectus is a detailed document that provides information about the index fund, including its investment objective, strategies, and risks. * Annual Report: The annual report provides an overview of the index fund’s performance over the past year, including its returns, expenses, and holdings. * Semiannual Report: The semiannual report provides an update on the index fund’s performance over the past six months, including its returns, expenses, and holdings. * Statement of Additional Information (SAI): The SAI provides supplemental information about the index fund, including its investment strategies, risks, and fees.

📝 Note: It's essential to carefully review these documents before investing in an index fund, as they provide important information about the fund's investment objectives, strategies, and risks.

Types of Index Funds

There are several types of index funds available, including: * Stock Index Funds: These funds track a specific stock market index, such as the S&P 500 or the Dow Jones Industrial Average. * Bond Index Funds: These funds track a specific bond market index, such as the Bloomberg Barclays U.S. Aggregate Bond Index. * Commodity Index Funds: These funds track a specific commodity index, such as the S&P GSCI Commodity Index. * International Index Funds: These funds track a specific international market index, such as the MSCI EAFE Index.

How to Invest in Index Funds

Investing in index funds is a relatively straightforward process. Here are the steps to follow: * Open a Brokerage Account: Investors need to open a brokerage account with a reputable online broker. * Choose an Index Fund: Investors should select an index fund that aligns with their investment objectives and risk tolerance. * Fund the Account: Investors need to deposit money into their brokerage account to purchase the index fund. * Monitor and Adjust: Investors should regularly monitor their portfolio and adjust their holdings as needed to ensure they remain aligned with their investment objectives.

| Index Fund | Underlying Index | Expense Ratio |

|---|---|---|

| Vanguard 500 Index Fund | S&P 500 | 0.04% |

| SPDR S&P 500 ETF Trust | S&P 500 | 0.09% |

| iShares Core U.S. Aggregate Bond ETF | Bloomberg Barclays U.S. Aggregate Bond Index | 0.04% |

Conclusion and Final Thoughts

In conclusion, index funds are a popular investment vehicle that provides broad diversification and can be an effective way to gain exposure to various asset classes. By understanding the benefits and types of index funds, as well as the investment paperwork involved, investors can make informed decisions about their investment portfolio. It’s essential to carefully review the prospectus, annual report, and other documents before investing in an index fund, as they provide important information about the fund’s investment objectives, strategies, and risks. With a solid understanding of index funds, investors can create a well-diversified portfolio that aligns with their investment objectives and risk tolerance.

What is an index fund?

+

An index fund is a type of investment vehicle that tracks a specific market index, such as the S&P 500, to provide broad diversification and potentially lower fees.

What are the benefits of investing in index funds?

+

The benefits of investing in index funds include diversification, low costs, consistency, and flexibility, making them a popular choice for investors.

How do I invest in an index fund?

+

To invest in an index fund, you need to open a brokerage account, choose an index fund that aligns with your investment objectives, fund the account, and monitor and adjust your portfolio as needed.