5 Discover Loan Papers

Understanding the Importance of Loan Papers

When it comes to loans, whether personal, mortgage, or business, having the right documentation is crucial. Loan papers, which include various documents and agreements, serve as the foundation of the loan process. These papers outline the terms, conditions, and responsibilities of both the lender and the borrower. In this article, we will delve into the world of loan papers, exploring their components, significance, and the steps involved in preparing and reviewing them.

Components of Loan Papers

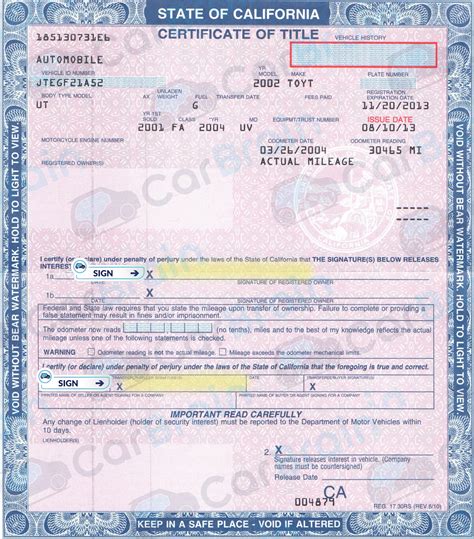

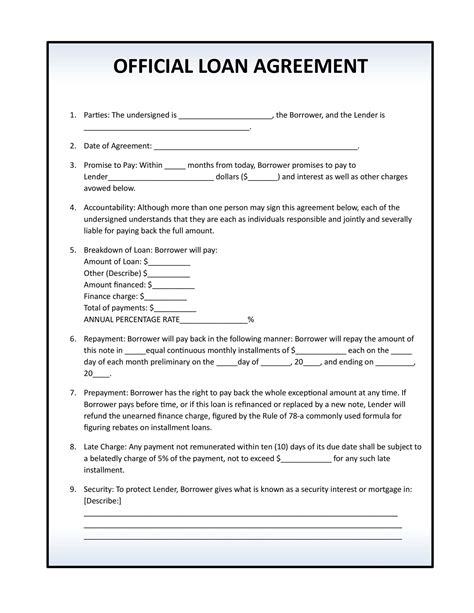

Loan papers typically consist of several key components, each designed to provide clarity and protection for both parties involved in the loan agreement. These components include: - Loan Agreement: This is the primary document that outlines the terms of the loan, including the amount borrowed, interest rate, repayment terms, and the duration of the loan. - Promissory Note: A promissory note is a promise to pay a certain amount of money, at a specified interest rate, within a specified timeframe. It is essentially an IOU that includes the borrower’s promise to repay the loan according to the terms agreed upon. - Security Agreement: If the loan is secured, this document describes the collateral (property, assets, etc.) that the borrower provides to guarantee repayment of the loan. It gives the lender the right to seize the collateral if the borrower defaults. - Mortgage or Deed of Trust: For mortgage loans, these documents transfer the legal title of a property to the lender as security for the loan. The specific document used varies by jurisdiction. - Guarantee Agreement: In cases where a third party guarantees the loan, this document outlines the responsibilities and obligations of the guarantor.

Significance of Loan Papers

The significance of loan papers cannot be overstated. They provide a clear understanding of the loan’s terms and conditions, protecting both the lender and the borrower. For lenders, these documents ensure that there is a legally binding agreement for repayment, including any collateral that can be seized in the event of default. For borrowers, loan papers serve as a contract that outlines their obligations, helping them understand exactly what they are committing to when they accept a loan.

Preparing and Reviewing Loan Papers

Preparing and reviewing loan papers is a critical step in the loan process. Here are some key points to consider: - Accuracy and Completeness: Ensure that all documents are accurate, complete, and signed by all necessary parties. - Legal Compliance: Verify that the loan papers comply with all relevant laws and regulations. - Understanding: It is crucial that both the lender and the borrower fully understand the terms and conditions outlined in the loan papers. - Negotiation: If necessary, negotiate the terms of the loan to ensure they are favorable and manageable for the borrower.

📝 Note: Borrowers should carefully review all loan documents before signing, seeking legal advice if they are unsure about any aspect of the agreement.

Types of Loans and Their Corresponding Papers

Different types of loans require different types of loan papers. For example: - Personal Loans: Typically involve a loan agreement and a promissory note. - Mortgage Loans: Involve a mortgage or deed of trust, along with other documents specific to real estate transactions. - Business Loans: May include security agreements, guarantee agreements, and detailed business plans in addition to the standard loan agreement and promissory note.

Best Practices for Managing Loan Papers

Effective management of loan papers is essential for both lenders and borrowers. Here are some best practices: - Keep Copies: Ensure that both parties have copies of all loan documents. - Organize: Keep loan papers organized and easily accessible. - Review Regularly: Regularly review loan papers to ensure compliance with the agreed terms and to identify any potential issues early.

Challenges and Considerations

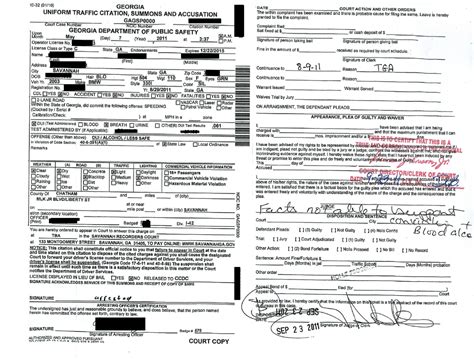

Despite their importance, managing loan papers can present several challenges, including ensuring compliance with changing regulations, maintaining accurate records, and dealing with disputes or defaults. It is essential to address these challenges proactively, potentially through legal counsel or financial advisors, to protect the interests of all parties involved.

Technological Advancements in Loan Documentation

The process of preparing, signing, and managing loan papers is increasingly being digitized, offering greater efficiency, security, and accessibility. Electronic signatures and digital document management systems are becoming more prevalent, reducing the need for physical storage and enhancing the speed of document exchange and review.

To summarize the key points of loan papers and their management, consider the following: - Loan papers are crucial for outlining the terms and conditions of a loan. - They protect both the lender and the borrower by providing a legally binding agreement. - Different types of loans require different documents. - Managing loan papers effectively is essential for compliance and preventing disputes.

What is the primary purpose of loan papers?

+

The primary purpose of loan papers is to outline the terms and conditions of a loan, providing a legally binding agreement between the lender and the borrower.

What are the key components of loan papers?

+

Key components include the loan agreement, promissory note, security agreement, and for mortgage loans, a mortgage or deed of trust.

Why is it important to carefully review loan papers before signing?

+

Reviewing loan papers carefully before signing is crucial to ensure that the borrower fully understands their obligations and the terms of the loan, helping to prevent potential disputes or issues.

In essence, loan papers are the backbone of any loan agreement, providing a clear, legally binding contract that outlines the responsibilities and obligations of both the lender and the borrower. By understanding the components, significance, and best practices for managing loan papers, individuals and businesses can navigate the loan process with confidence, protecting their interests and ensuring a successful financial transaction.