7 Bills to Keep

Introduction to Bill Management

Managing bills is an essential aspect of personal finance and can significantly impact one’s credit score and financial stability. Keeping track of bills ensures that payments are made on time, avoiding late fees and potential damage to credit reports. In this article, we will explore seven key bills that individuals should prioritize to maintain a healthy financial profile.

Understanding the Importance of Bill Management

Effective bill management involves organizing and paying bills promptly. This practice helps in budgeting, as it ensures that all necessary expenses are accounted for, making it easier to allocate funds for other purposes such as savings and investments. Moreover, timely bill payments contribute to a good credit score, which is crucial for obtaining loans or credit cards at favorable interest rates.

The 7 Bills to Keep Track Of

Here are the seven bills that are essential to keep track of: - Rent/Mortgage: This is typically the largest monthly expense for most individuals. Whether you’re renting or paying a mortgage, this bill is crucial for maintaining a place to live. - Utilities: Bills for electricity, gas, water, and internet services are necessary for daily living. These can vary in cost depending on usage. - Car Loan/Lease: For those who own or lease a vehicle, this monthly payment is essential for maintaining ownership or the right to use the vehicle. - Credit Card Bills: Keeping credit card bills under control is vital. High balances can lead to significant interest charges and negatively impact credit scores. - Phone Bill: Whether it’s a mobile phone or a landline, this bill is necessary for communication. - Insurance Premiums: This includes health, life, and auto insurance premiums, which provide financial protection against unforeseen events. - Subscription Services: While not as critical as the others, keeping track of subscription services like streaming platforms, software, and gym memberships can help in managing monthly expenses effectively.

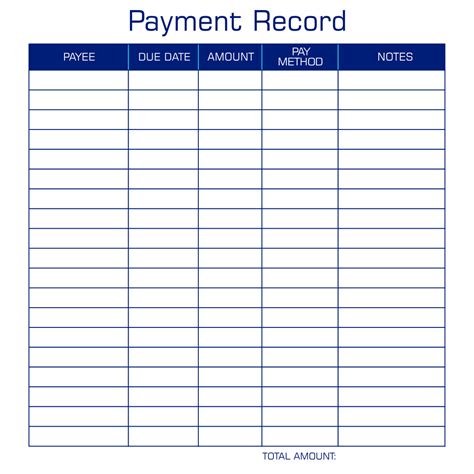

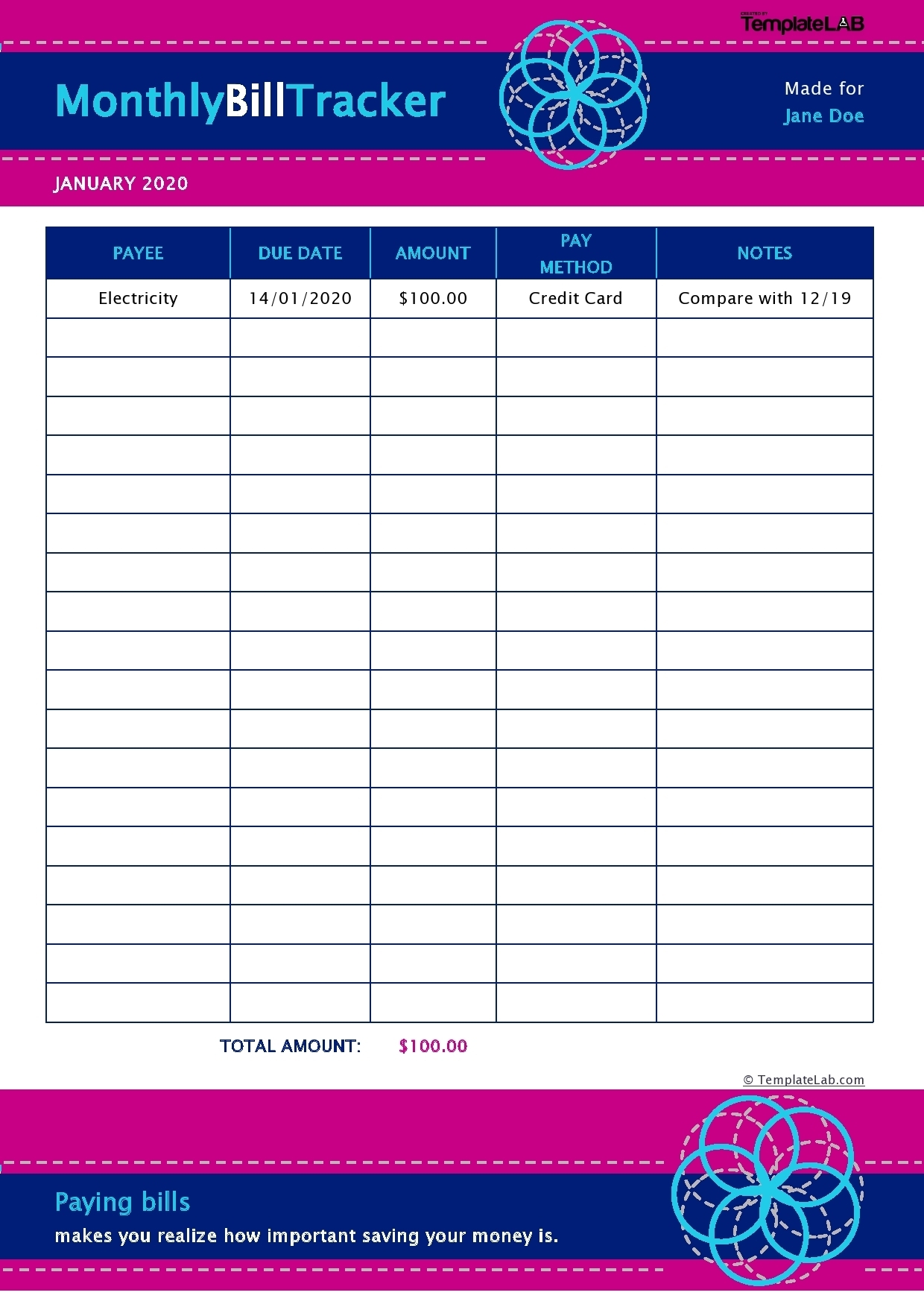

Tools for Managing Bills

There are several tools and strategies available to help manage these bills effectively: - Spreadsheets: Creating a spreadsheet to track due dates and amounts can be an effective way to visualize monthly expenses. - Budgeting Apps: Apps like Mint, You Need a Budget (YNAB), and Personal Capital offer comprehensive bill tracking and budgeting features. - Automatic Payments: Setting up automatic payments for bills can ensure that payments are made on time, reducing the risk of late fees and negative impacts on credit scores. - Calendar Reminders: Setting reminders on calendars, either digital or physical, can provide an additional layer of assurance that bills are not forgotten.

Benefits of Effective Bill Management

Effective management of these seven bills offers several benefits, including: - Improved Credit Score: Timely payments reflect positively on credit reports. - Reduced Stress: Knowing that all bills are paid on time can reduce financial stress. - Better Budgeting: Understanding monthly expenses helps in creating a more accurate and manageable budget. - Financial Stability: It contributes to overall financial stability, allowing for more freedom in making financial decisions.

📝 Note: Regularly reviewing and adjusting budget allocations as financial situations change is crucial for maintaining financial health.

Overcoming Challenges in Bill Management

Despite the importance of bill management, individuals may face challenges such as forgetting due dates or insufficient funds. To overcome these, implementing a system of reminders and regularly reviewing financial budgets can help. Additionally, communicating with service providers to negotiate payment plans or due dates can provide temporary relief during difficult financial periods.

Conclusion and Future Financial Planning

In summary, managing the seven identified bills effectively is key to maintaining a healthy financial profile. By understanding the importance of each bill, utilizing tools for management, and overcoming potential challenges, individuals can ensure their financial stability and security. As financial situations evolve, so too should strategies for bill management, always aiming for timely payments, reduced debt, and a clear path to long-term financial goals.

What are the most common bills that people forget to pay?

+

The most common bills that people forget to pay include credit card bills, utility bills, and subscription services, primarily due to their variable nature or the ease of overlooking them among other expenses.

How can I ensure I never miss a bill payment?

+

To ensure you never miss a bill payment, consider setting up automatic payments for all your bills. Additionally, keeping a calendar specifically for bill due dates and setting reminders can provide an extra layer of security against missed payments.

What happens if I miss a bill payment?

+

Missing a bill payment can result in late fees, negative impacts on your credit score, and in severe cases, termination of services. It’s essential to communicate with the service provider as soon as possible to negotiate a payment plan or temporary waiver of late fees.