Mortgage Pre Approval Paperwork Needed

Introduction to Mortgage Pre-Approval

When considering purchasing a home, one of the first steps potential buyers should take is to get pre-approved for a mortgage. This process involves submitting financial information to a lender, who then provides a pre-approval letter stating the amount they are willing to lend. The mortgage pre-approval process is crucial as it gives buyers an idea of how much they can afford and also makes their offer more attractive to sellers. To initiate this process, several documents are required. Understanding what paperwork is needed can help streamline the pre-approval process.

Required Paperwork for Mortgage Pre-Approval

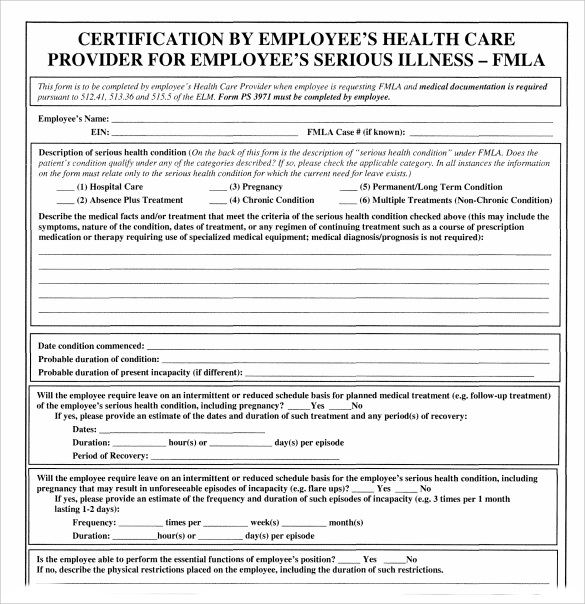

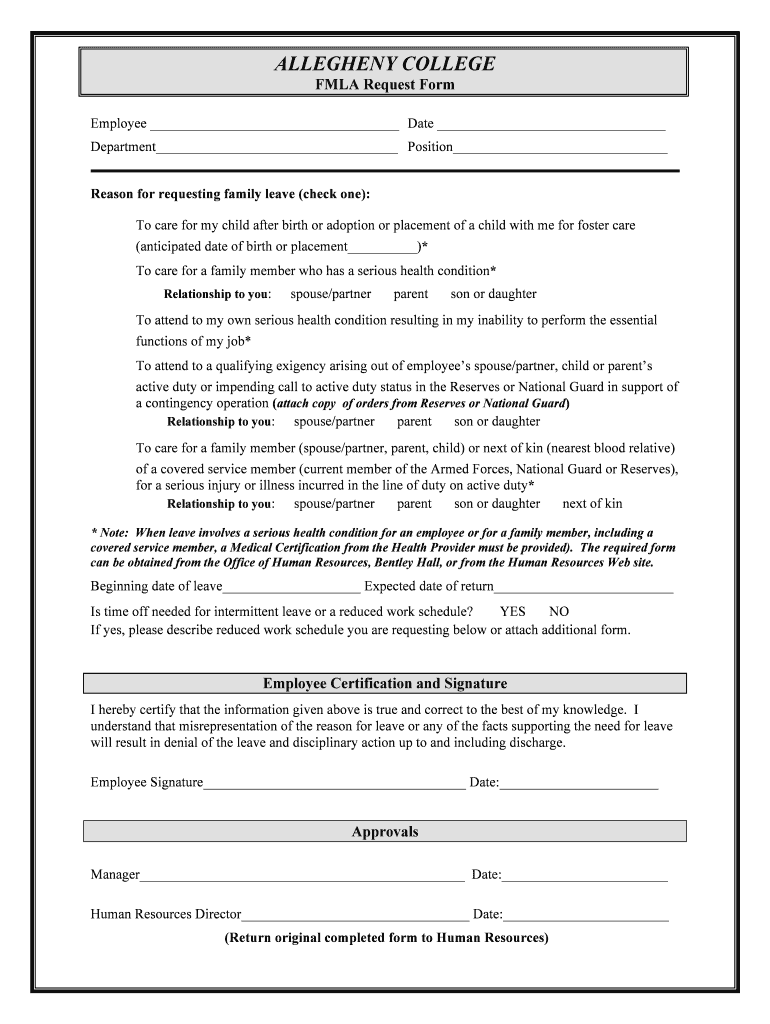

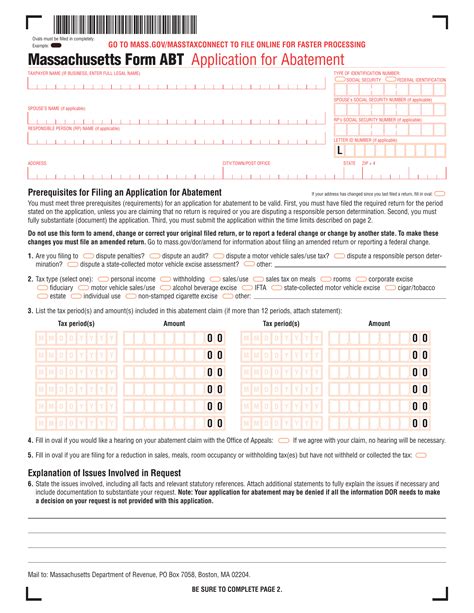

The mortgage pre-approval paperwork typically includes: - Identification Documents: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify identity. - Income Documents: Pay stubs, W-2 forms, and tax returns are required to assess income stability and capacity to repay the loan. - Employment Verification: Lenders may contact employers to confirm employment status and income details. - Bank Statements: Recent bank statements are needed to verify savings, investments, and other financial assets. - Credit Reports: Lenders will pull credit reports to evaluate credit history and score, which significantly influences the interest rate and loan terms. - Asset Documents: Documentation for any assets, such as retirement accounts, stocks, or bonds, may be required, especially if these assets will be used for the down payment or to demonstrate financial stability. - Debt Information: Details about existing debts, including credit card debt, student loans, and other financial obligations, are necessary to calculate the debt-to-income ratio.

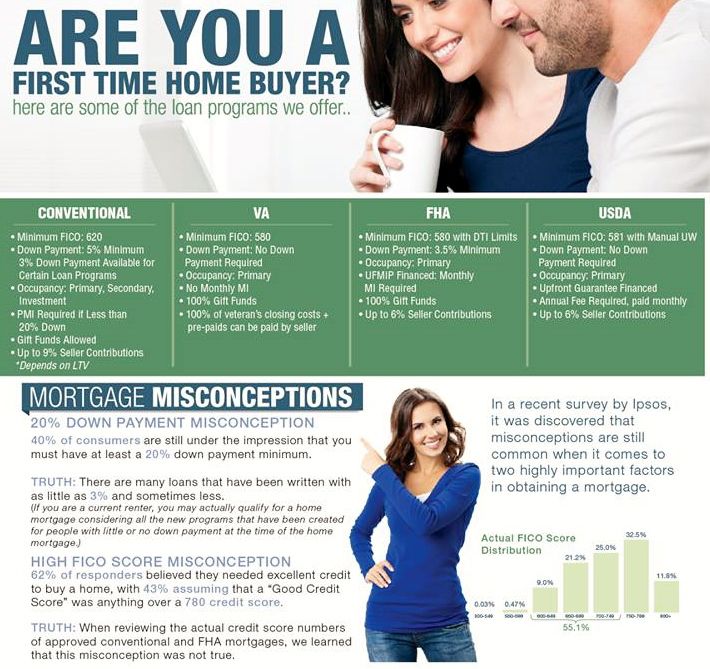

Importance of Credit Score in Mortgage Pre-Approval

A credit score plays a critical role in the mortgage pre-approval process. It not only affects the likelihood of being approved for a mortgage but also influences the interest rate offered by the lender. A higher credit score can lead to better loan terms, including lower interest rates and more favorable repayment conditions. Therefore, understanding and possibly improving one’s credit score before applying for pre-approval can be beneficial.

Steps to Improve Credit Score

To improve a credit score, consider the following steps: - Check Credit Reports: Ensure there are no errors on the credit report that could negatively affect the score. - Pay Bills on Time: Timely payment of bills is crucial for maintaining a good credit score. - Reduce Debt: Lowering debt, especially credit card debt, can significantly improve the credit utilization ratio and overall score. - Avoid New Credit Inquiries: Applying for multiple credit cards or loans in a short period can negatively impact the credit score.

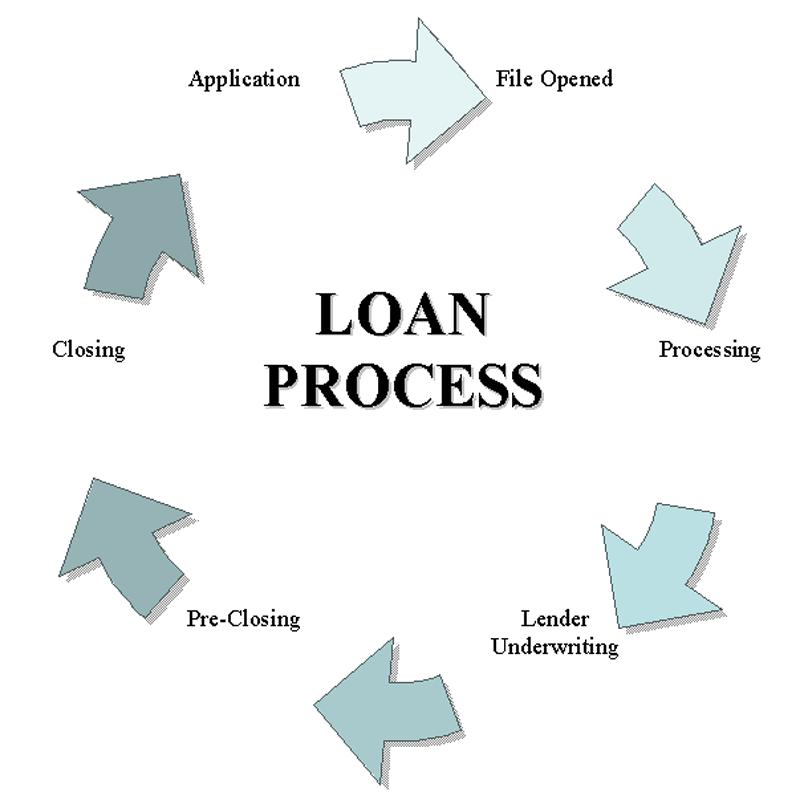

Mortgage Pre-Approval Process

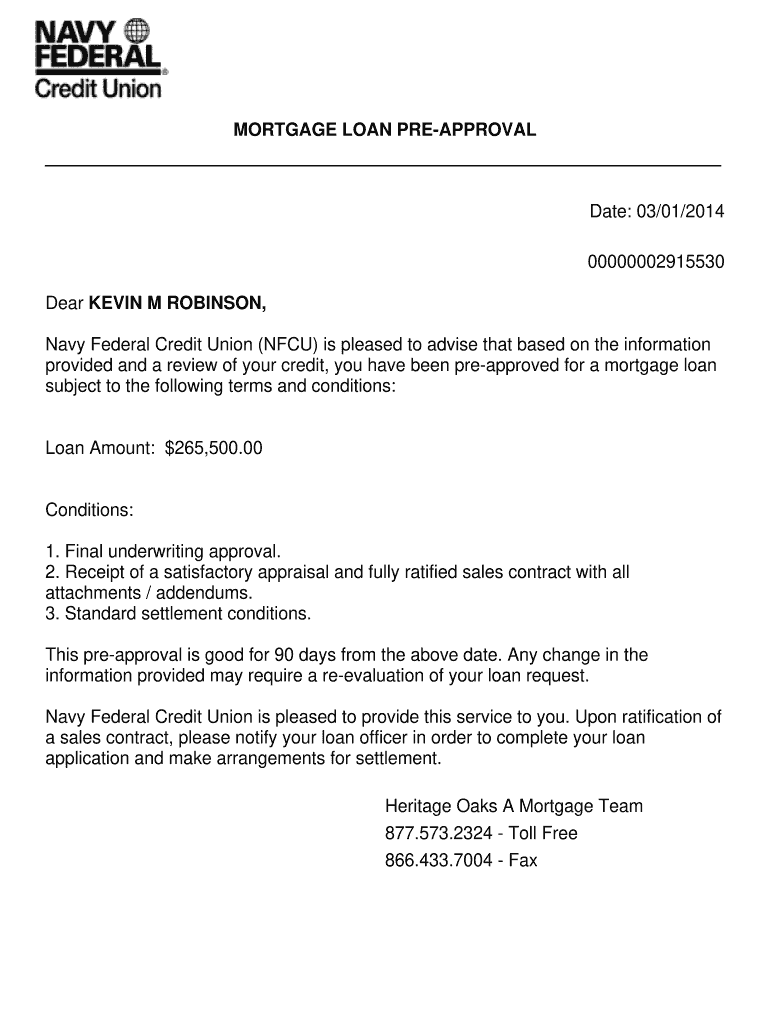

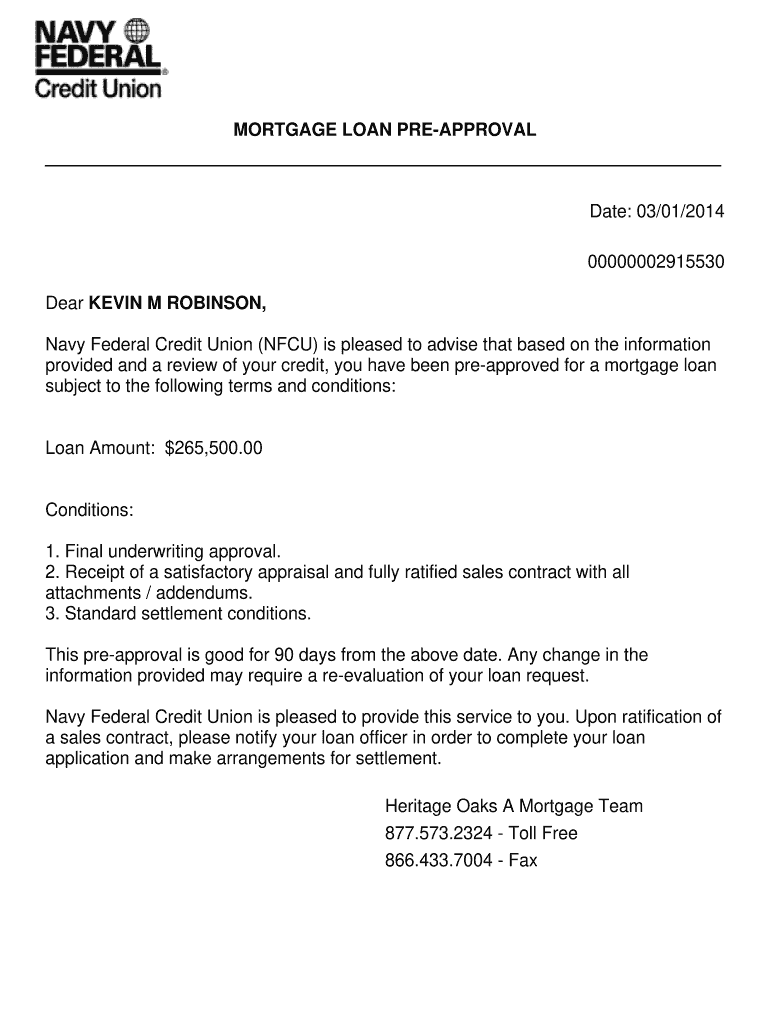

The mortgage pre-approval process typically involves the following steps: - Application: Submitting an application to the lender, which may be done online, over the phone, or in person. - Documentation: Providing the necessary paperwork as outlined above. - Review: The lender reviews the application and documentation. - Pre-Approval Letter: If approved, the lender issues a pre-approval letter stating the approved loan amount and any conditions.

📝 Note: The pre-approval letter is usually valid for a specific period, during which the buyer should find a property to purchase.

Benefits of Mortgage Pre-Approval

Getting pre-approved for a mortgage offers several benefits, including: - Clarifies Budget: Gives buyers a clear understanding of how much they can afford. - Strengthens Offer: A pre-approval letter makes the buyer’s offer more attractive to sellers. - Saves Time: Knowing exactly how much one can borrow streamlines the home search process.

Conclusion and Final Thoughts

In conclusion, the mortgage pre-approval process is a significant step for potential homebuyers. By understanding the required paperwork and the importance of credit scores, individuals can better prepare themselves for this process. Improving one’s financial situation and credit score before applying can lead to more favorable loan terms. Ultimately, getting pre-approved for a mortgage is a proactive step that sets the stage for a successful home buying experience.

What is the purpose of a pre-approval letter in the home buying process?

+

A pre-approval letter is provided by a lender to indicate the amount they are willing to lend to a buyer. It gives the buyer an idea of their budget and makes their offer more credible to sellers.

How long does the mortgage pre-approval process typically take?

+

The length of the pre-approval process can vary depending on the lender and the complexity of the buyer’s financial situation. However, it usually takes a few days to a week to receive a pre-approval letter after submitting the application and required documents.

Can I get pre-approved for a mortgage with bad credit?

+

While it may be more challenging, it is not impossible to get pre-approved for a mortgage with bad credit. Some lenders specialize in offering mortgages to individuals with lower credit scores, though the interest rates and terms may not be as favorable.