Paperwork

Oregon Nonprofit Paperwork Requirements

Introduction to Oregon Nonprofit Paperwork Requirements

When starting a nonprofit organization in Oregon, it is essential to understand the various paperwork requirements that must be completed to ensure compliance with state and federal regulations. Nonprofit organizations play a vital role in addressing social, economic, and environmental issues, and proper registration and documentation are crucial for their success. In this article, we will guide you through the necessary paperwork requirements for Oregon nonprofits, including articles of incorporation, tax exemptions, and annual reporting.

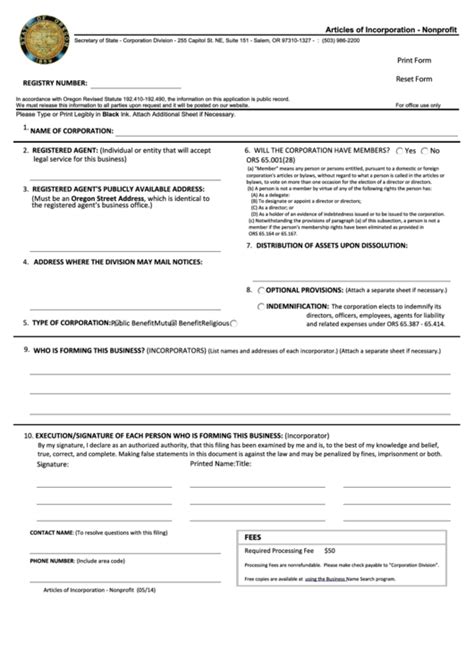

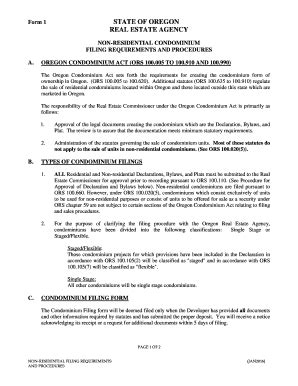

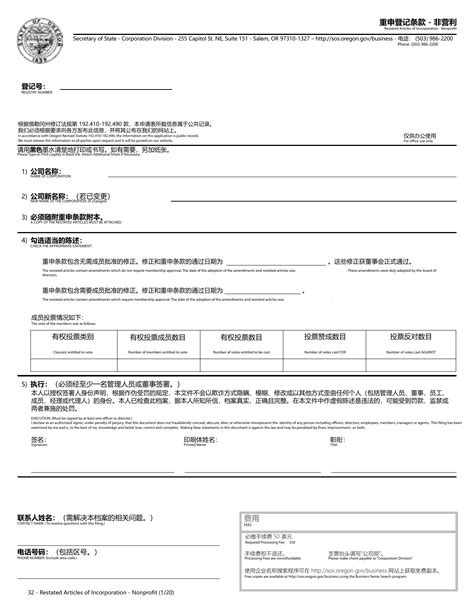

Articles of Incorporation

To form a nonprofit organization in Oregon, you must file articles of incorporation with the Oregon Secretary of State’s office. This document outlines the organization’s purpose, structure, and governance. The articles of incorporation must include:

- The organization’s name and address

- A statement of purpose, including the organization’s mission and goals

- The number and names of the initial directors

- The registered agent’s name and address

- A statement indicating that the organization is a nonprofit corporation

Tax Exemptions

Nonprofit organizations in Oregon are eligible for tax exemptions under Section 501©(3) of the Internal Revenue Code. To obtain tax-exempt status, you must file Form 1023 with the Internal Revenue Service (IRS). This application requires detailed information about your organization, including:

- Organizational structure and governance

- Financial information, including budget and funding sources

- Programs and services offered

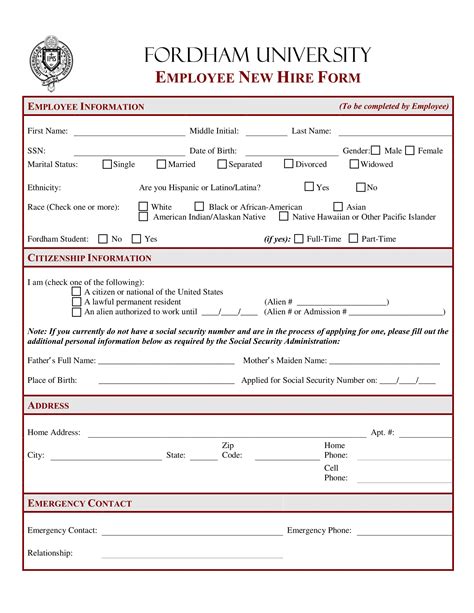

- Compensation and benefits for officers and employees

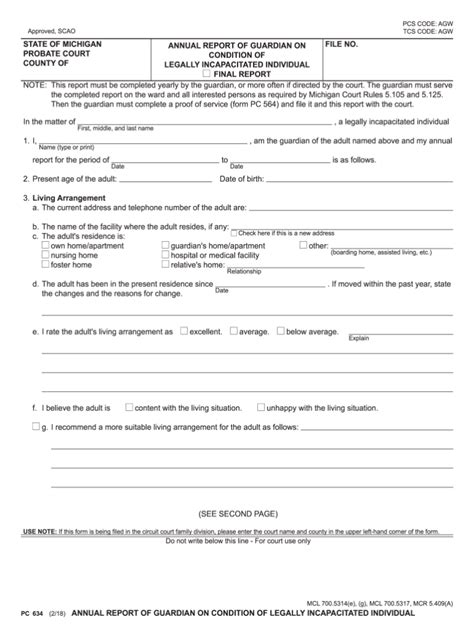

Annual Reporting

Once your nonprofit organization is registered and has obtained tax-exempt status, you must file annual reports with the Oregon Secretary of State’s office and the IRS. The annual report requires updates on:

- Changes in the organization’s leadership or governance

- Financial information, including income and expenses

- Programs and services offered

- Compliance with state and federal regulations

Charitable Registration

If your nonprofit organization solicits donations or engages in fundraising activities, you must register with the Oregon Department of Justice’s Charitable Activities Section. This registration requires:

- A copy of your organization’s articles of incorporation and bylaws

- Financial information, including budget and funding sources

- Disclosure of fundraising activities and expenses

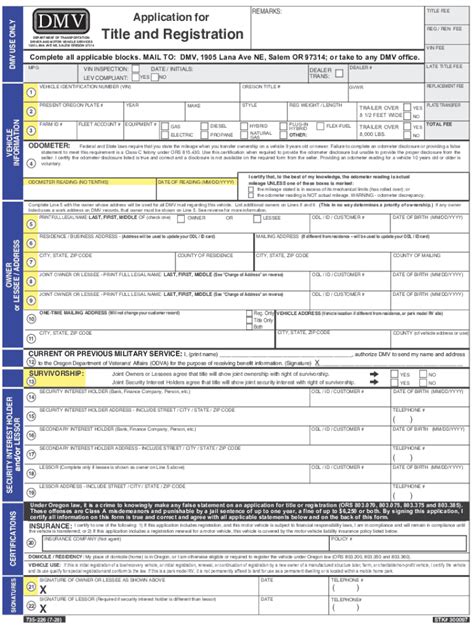

Other Paperwork Requirements

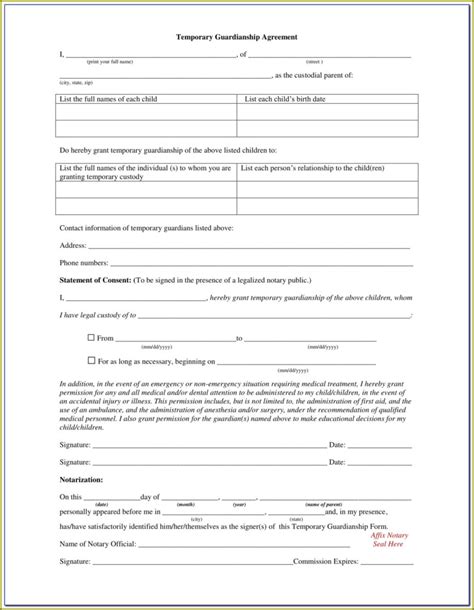

In addition to the above requirements, Oregon nonprofits may need to comply with other paperwork requirements, such as:

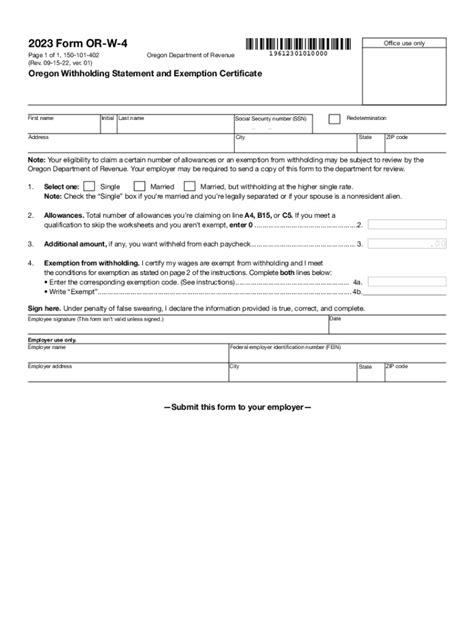

- Employment laws and regulations, including workers’ compensation and unemployment insurance

- Property tax exemptions, if your organization owns or leases property

- Business licenses and permits, depending on the type of activities your organization engages in

📝 Note: It is essential to keep accurate and detailed records of all paperwork and correspondence with state and federal agencies, as well as donors and stakeholders.

Conclusion and Final Thoughts

Starting a nonprofit organization in Oregon requires careful attention to paperwork requirements, including articles of incorporation, tax exemptions, annual reporting, and charitable registration. By understanding and complying with these requirements, your organization can ensure transparency, accountability, and success in its mission to serve the community. Remember to consult with experts and seek guidance when needed to navigate the complex regulatory landscape of nonprofit organizations in Oregon.

What is the purpose of filing articles of incorporation for a nonprofit organization in Oregon?

+

The purpose of filing articles of incorporation is to officially register the nonprofit organization with the Oregon Secretary of State’s office, outlining its purpose, structure, and governance.

How long does it take to obtain tax-exempt status from the IRS?

+

The IRS review process for tax-exempt status can take several months, so it is essential to submit your application well in advance of your organization’s planned activities.

What are the consequences of failing to file annual reports with the Oregon Secretary of State’s office and the IRS?

+

Failure to file annual reports can result in penalties, fines, and even loss of tax-exempt status.